$10.5 Million Fine For Resorts World Casino In Las Vegas: Money Laundering Case

Table of Contents

The Allegations: Unpacking the Resorts World Casino Las Vegas Fine

The hefty $10.5 million Resorts World Casino Las Vegas fine stems from accusations of violating the Bank Secrecy Act (BSA), a federal law designed to combat money laundering. The Financial Crimes Enforcement Network (FinCEN) investigation likely focused on several key areas of non-compliance:

-

Insufficient AML Compliance Program: Investigators likely uncovered significant weaknesses in Resorts World Casino Las Vegas' internal controls. This could include inadequate employee training on identifying suspicious activities, insufficient monitoring of high-value transactions, and a lack of robust customer due diligence procedures—all crucial elements of a comprehensive AML program. Failure to implement and maintain these safeguards directly contributed to the substantial fine.

-

Suspicious Activity Reporting (SAR) Failures: Casinos are mandated to file SARs with FinCEN when they detect suspicious transactions that might signal money laundering. The investigation likely uncovered instances where Resorts World Casino Las Vegas either failed to file SARs when required or filed them incompletely and inadequately, hindering the ability of authorities to effectively investigate potential illegal activities.

-

Structuring Transactions: The investigation may have revealed evidence of customers structuring transactions—breaking down large sums of money into smaller amounts to avoid detection—a classic money laundering tactic. The casino's failure to identify and report such activity contributed to the severity of the penalty.

-

Lack of Due Diligence on High-Risk Customers: Casinos are expected to perform thorough due diligence on high-risk customers. This includes verifying identities, monitoring transaction patterns, and scrutinizing individuals with known ties to criminal activities. The investigation probably found that Resorts World Casino Las Vegas failed to meet these requirements.

Impact on Resorts World Casino Las Vegas and its Brand Reputation

The $10.5 million fine is not just a financial blow; it significantly impacts Resorts World Casino Las Vegas' reputation and future operations.

-

Erosion of Customer Trust: The negative publicity surrounding the money laundering allegations directly erodes public trust. Customers may be hesitant to gamble at a casino perceived as lax in its security measures and AML compliance. This could lead to a decline in revenue and market share.

-

Increased Regulatory Scrutiny: Expect increased scrutiny from regulatory bodies, including more frequent audits and stricter enforcement of AML regulations. This added oversight will place additional financial and operational burdens on the casino.

-

Potential Legal Ramifications: While the fine might conclude the immediate regulatory action, further legal challenges or investigations from other agencies cannot be ruled out. This prolonged uncertainty creates further risk and instability for the casino.

Broader Implications for the Las Vegas Casino Industry and Beyond

The Resorts World Casino Las Vegas case serves as a stark warning for the entire casino industry, highlighting the need for comprehensive AML compliance.

-

Increased Emphasis on AML Training: Casinos across the board will likely enhance their AML training programs, equipping employees with the skills and knowledge to effectively identify and report suspicious activity. This includes updated training materials and regular refresher courses.

-

Improved Technology Adoption: The adoption of advanced technology, including AI-powered transaction monitoring systems, will accelerate to improve the efficiency and accuracy of AML compliance efforts. These systems can detect subtle patterns and anomalies that might evade human detection.

-

Strengthened Regulatory Oversight: Expect a more robust regulatory environment with stricter enforcement and potentially harsher penalties for AML non-compliance. This will require casinos to continuously upgrade their AML programs to stay compliant.

Conclusion: Learning from the Resorts World Casino Las Vegas Fine

The $10.5 million Resorts World Casino Las Vegas fine demonstrates the severe financial and reputational consequences of failing to uphold AML regulations. This case underlines the paramount importance of proactive and comprehensive AML compliance programs for all casinos. To prevent similar penalties, casinos must prioritize employee training, invest in advanced technologies, and meticulously follow customer due diligence procedures. Avoiding a future Resorts World Casino Las Vegas Fine-sized penalty requires a commitment to robust AML compliance. Proactive measures are crucial for maintaining a strong reputation and ensuring the long-term sustainability of the business. Learn more about AML best practices to protect your casino from similar financial and reputational risks.

Featured Posts

-

Maneskins Damiano David Next Summer A Contemplative Solo Debut

May 18, 2025

Maneskins Damiano David Next Summer A Contemplative Solo Debut

May 18, 2025 -

Las Vegas Sands Abandons Nassau Coliseum Casino Project

May 18, 2025

Las Vegas Sands Abandons Nassau Coliseum Casino Project

May 18, 2025 -

Delhi And Mumbai Pet Owners Rejoice Uber Now Offers Pet Friendly Rides

May 18, 2025

Delhi And Mumbai Pet Owners Rejoice Uber Now Offers Pet Friendly Rides

May 18, 2025 -

Daily Lotto Results Tuesday 22 April 2025

May 18, 2025

Daily Lotto Results Tuesday 22 April 2025

May 18, 2025 -

Snl I Komiki Apeikonisi Toy Ilon Mask Apo Ton Maik Magiers Ipa

May 18, 2025

Snl I Komiki Apeikonisi Toy Ilon Mask Apo Ton Maik Magiers Ipa

May 18, 2025

Latest Posts

-

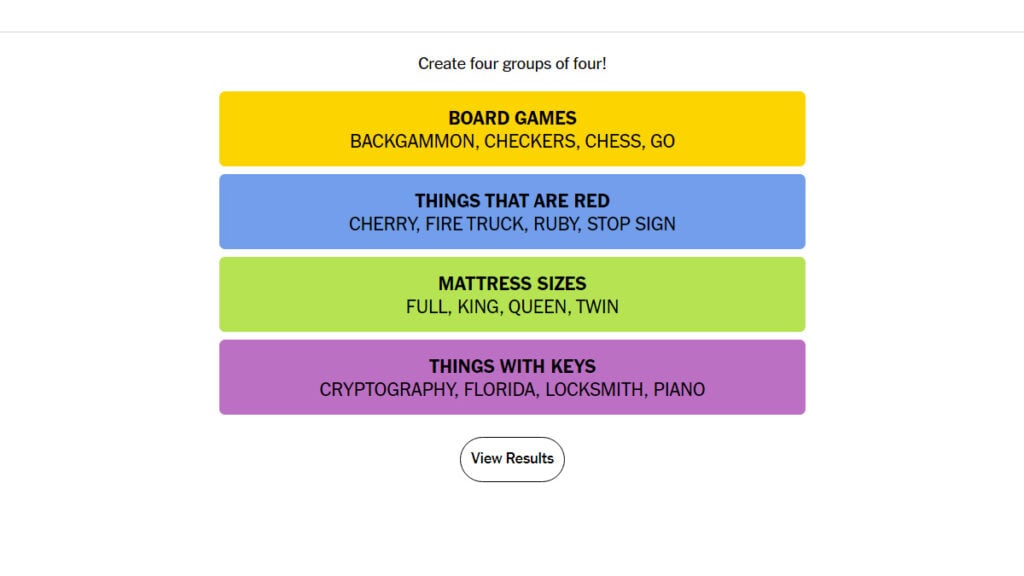

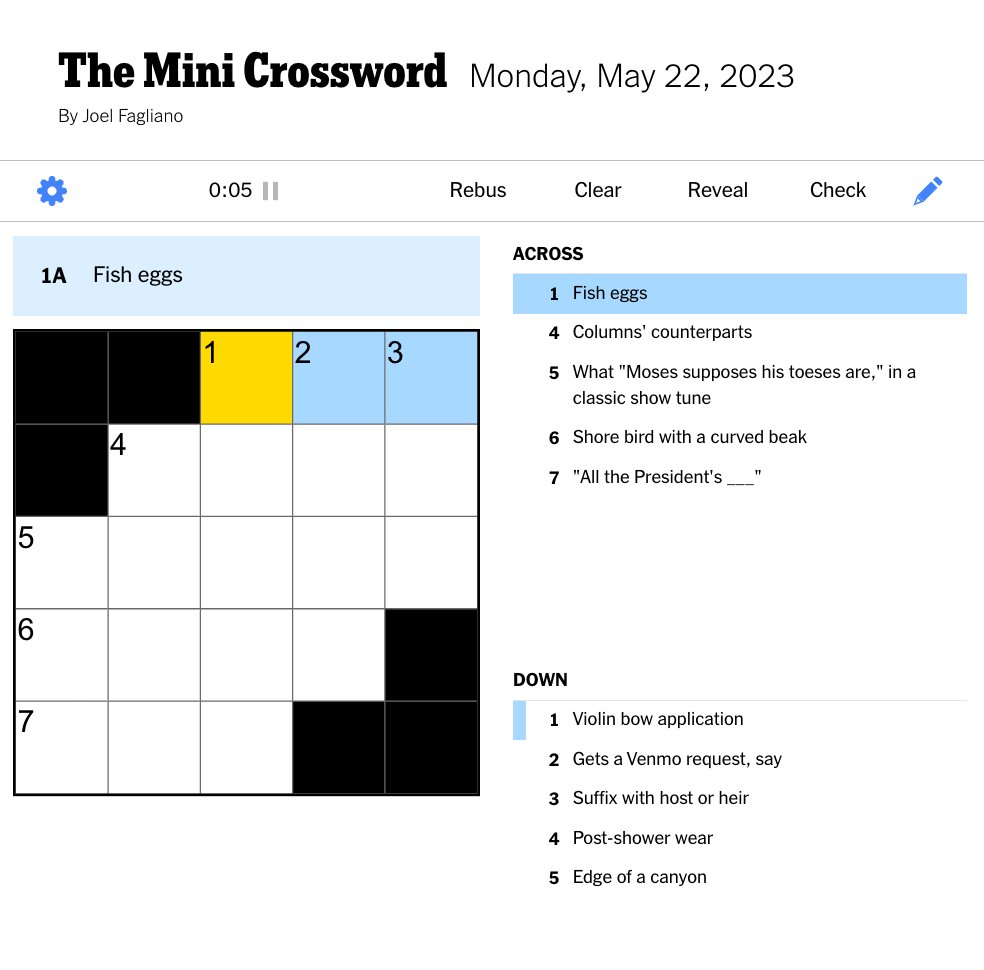

Nyt Mini Crossword April 18 2025 Answers And Helpful Hints

May 18, 2025

Nyt Mini Crossword April 18 2025 Answers And Helpful Hints

May 18, 2025 -

Nyt Mini Crossword Solutions March 24 2025 Puzzle

May 18, 2025

Nyt Mini Crossword Solutions March 24 2025 Puzzle

May 18, 2025 -

Solve The Nyt Mini Crossword Answers And Hints April 18 2025

May 18, 2025

Solve The Nyt Mini Crossword Answers And Hints April 18 2025

May 18, 2025 -

March 24 2025 Nyt Mini Crossword Solutions And Clues

May 18, 2025

March 24 2025 Nyt Mini Crossword Solutions And Clues

May 18, 2025 -

Sunday May 11 Nyt Mini Crossword Clues Hints And Solutions

May 18, 2025

Sunday May 11 Nyt Mini Crossword Clues Hints And Solutions

May 18, 2025