10% Tariff Baseline: Trump's Conditions For Avoiding Increased Import Duties

Table of Contents

The Initial Implementation of the 10% Tariff Baseline

The 10% tariff baseline emerged as a key component of Trump's trade war, largely driven by concerns over unfair trade practices and intellectual property theft. These initial tariffs, often referred to as Section 301 tariffs, were imposed under the guise of national security and aimed to pressure trading partners into making significant trade concessions. The initial implementation targeted a wide range of goods from several countries.

- Targeted Goods: The 10% tariff initially affected a broad spectrum of goods, including steel, aluminum, and various consumer products. Specific goods and the extent of the impact varied by country.

- Targeted Countries: Major economies like China, the European Union, and others were affected by the initial wave of import tariffs. The list of targeted countries was subject to change based on ongoing trade negotiations.

- Exemptions and Exclusions: While many goods were subject to the 10% tariff, certain exemptions and exclusions were granted based on specific circumstances or industry lobbying efforts. These exceptions often highlighted the complexities and political influence within tariff imposition.

Conditions for Avoiding Increased Import Duties

The Trump administration made it clear that the 10% tariff baseline was not set in stone. Countries could avoid further escalation of import duties by meeting specific conditions, putting significant pressure on their economic policies and trade practices.

- Trade Negotiations: Successful trade negotiations were central to avoiding higher tariffs. This often involved bilateral agreements, addressing specific concerns such as trade imbalances, intellectual property rights, and market access.

- Structural Reforms: Some countries faced pressure to implement significant structural reforms, such as addressing state-owned enterprises, subsidies, and other practices deemed unfair by the US administration.

- Intellectual Property Protection Agreements: Strengthened intellectual property protection was another condition frequently emphasized. This included stricter enforcement mechanisms and greater protection for US companies operating in foreign markets.

These conditions were not easily met and often led to intense diplomatic and economic pressure on affected countries. The process highlighted the complex interplay between trade policy and broader geopolitical considerations.

The Impact of the 10% Tariff Baseline on Different Industries

The 10% tariff baseline had a profound and varied impact across different industries. Some sectors benefited from increased domestic demand and protection, while others faced significant challenges due to higher input costs and reduced competitiveness.

- Agriculture: Some agricultural products faced tariff increases, leading to challenges for exporters. Conversely, some domestic farmers experienced increased demand due to reduced imports.

- Manufacturing: The manufacturing sector experienced a mixed impact, with some sub-sectors facing higher input costs while others benefited from reduced foreign competition. Supply chain disruptions became a prominent concern.

- Technology: The technology industry felt significant pressure, particularly companies relying on imported components or operating in global supply chains. The increased costs affected consumer prices and competitiveness.

- Consumer Prices: The tariffs led to an increase in prices for many imported goods, negatively impacting consumers. Businesses also faced higher input costs, potentially impacting their profitability and pricing strategies.

The ripple effects on consumers and businesses underscore the interconnected nature of global trade and the significant ramifications of even seemingly small adjustments to import tariffs.

Long-Term Consequences and Legacy of the 10% Tariff Baseline

The long-term consequences of the 10% tariff baseline are still being assessed. The policy significantly altered trade relationships, leading to both intensified protectionism and attempts to diversify trade partners.

- Trade Relationships: The tariffs strained relationships with many key trading partners, leading to retaliatory measures and escalating tensions.

- Global Trade: The trade policy had broader implications for global trade patterns, promoting a more fragmented and less predictable system.

- Economic Consequences: The overall economic consequences remain a subject of debate, with economists differing in their assessments of the costs and benefits.

- Trade Policy Legacy: The 10% tariff baseline remains a significant case study in the complexities and consequences of unilateral trade policy.

The ongoing debate surrounding the effectiveness of this approach highlights the ongoing need for a comprehensive understanding of its impact on global trade.

Conclusion: Navigating the Complexities of the 10% Tariff Baseline

The 10% tariff baseline implemented under Trump's trade policies represented a significant shift in global trade dynamics. Its impact was multifaceted, varying across industries and leading to lasting consequences for trade relationships and global trade patterns. Understanding the conditions set by the Trump administration to avoid higher import duties—including trade negotiations, structural reforms, and intellectual property agreements—is crucial to navigating this complex landscape. The lasting effects on consumer prices, business operations, and international relations are substantial and warrant further examination. To stay informed about future tariff adjustments and fully understand the implications of the 10% tariff baseline, explore reputable resources on international trade and trade policy. Learn more about avoiding increased import duties and the ongoing challenges of navigating the intricacies of global trade.

Featured Posts

-

Veniturile Lui Sylvester Stallone Din Filmele Rocky

May 11, 2025

Veniturile Lui Sylvester Stallone Din Filmele Rocky

May 11, 2025 -

Medieval Book Cover Unveiling Merlin And Arthurs Hidden Tale

May 11, 2025

Medieval Book Cover Unveiling Merlin And Arthurs Hidden Tale

May 11, 2025 -

Who Could Be The Next Pope Potential Candidates And Predictions

May 11, 2025

Who Could Be The Next Pope Potential Candidates And Predictions

May 11, 2025 -

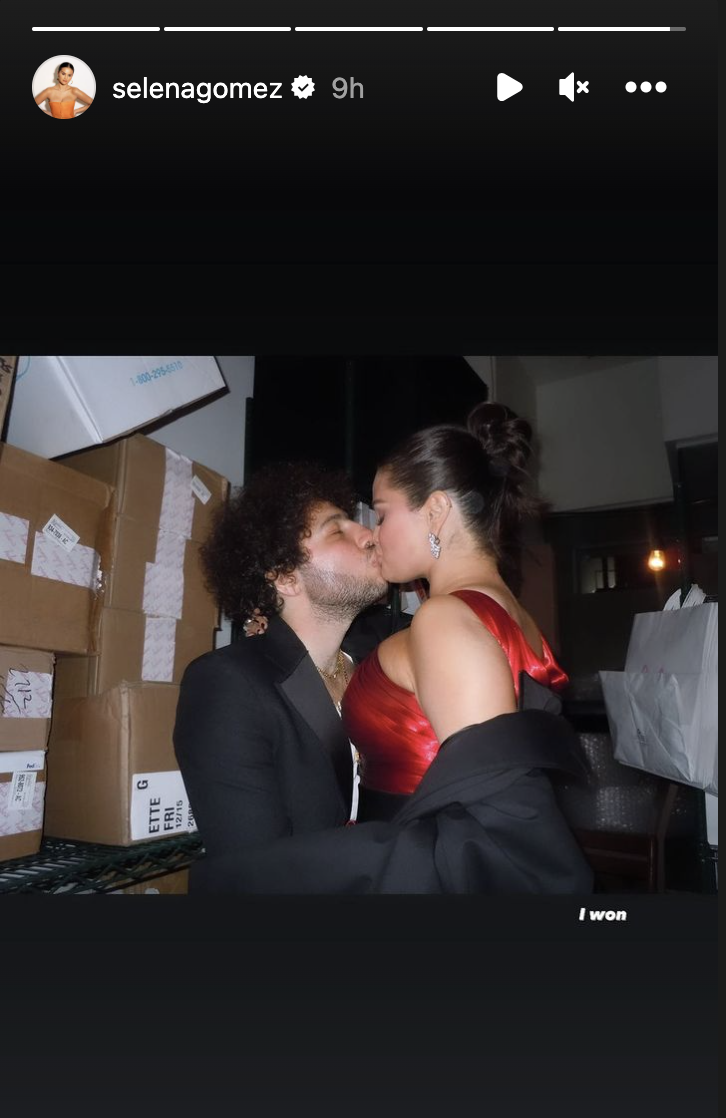

Selena Gomez Sells Benny Blanco Dedication Ring For A Mere 12

May 11, 2025

Selena Gomez Sells Benny Blanco Dedication Ring For A Mere 12

May 11, 2025 -

Robert F Smith Grand Slam Track Miami Meet Viewing Guide

May 11, 2025

Robert F Smith Grand Slam Track Miami Meet Viewing Guide

May 11, 2025