110% Potential: Why Billionaires Are Betting Big On This BlackRock ETF

Table of Contents

H2: The Allure of Passive Investing

High-net-worth individuals, including billionaires, are increasingly drawn to passive investment strategies, particularly Exchange-Traded Funds (ETFs), for several key reasons:

-

Lower Management Fees: ETFs typically boast significantly lower expense ratios compared to actively managed funds. This translates to greater returns for investors over the long term. The cost savings can be substantial, especially for large investment portfolios.

-

Diversification: ETFs offer instant diversification across a broad market segment or sector. This significantly reduces portfolio risk compared to investing in individual stocks or bonds. Diversification is a cornerstone of any robust investment strategy.

-

Tax Efficiency: ETFs generally offer better tax efficiency than actively managed funds. Lower trading frequency and specific tax structures contribute to minimizing capital gains taxes.

-

Ease of Access and Simple Trading: ETFs trade like individual stocks on major exchanges, providing ease of access and simple trading mechanisms. This liquidity is particularly attractive to sophisticated investors who might need to adjust their portfolios quickly.

BlackRock, a leading global asset manager, has a strong reputation for managing highly successful and diverse ETFs. Their expertise in indexing and portfolio construction contributes to the confidence billionaires place in their offerings.

H2: Understanding the Specific BlackRock ETF

This analysis focuses on the iShares Core S&P 500 ETF (IVV), a popular BlackRock ETF. IVV tracks the S&P 500 index, providing broad exposure to the 500 largest publicly traded companies in the U.S.

-

Underlying Assets: IVV's underlying assets are the 500 companies that comprise the S&P 500 index, offering exposure to a wide range of sectors and industries.

-

Performance History: IVV has consistently mirrored the performance of the S&P 500, providing investors with exposure to the growth of the U.S. economy. (Insert data on historical performance, citing sources.)

-

Expense Ratio: IVV maintains a very low expense ratio (insert current expense ratio), making it a cost-effective way to gain broad market exposure.

The attractiveness of IVV to billionaires lies in its ability to provide consistent, market-rate returns with minimal management fees and a proven track record. The S&P 500's long-term growth potential remains compelling for long-term investors.

H2: Billionaire Investment Strategies & Due Diligence

High-net-worth individuals employ sophisticated investment strategies emphasizing long-term growth, risk mitigation, and thorough due diligence.

-

Long-Term Growth: Billionaires typically prioritize long-term growth over short-term gains. ETFs like IVV, which track established indices, align with this focus.

-

Diversification and Risk Mitigation: Diversification is paramount in their strategies. IVV's broad market exposure significantly reduces portfolio-specific risk.

-

Thorough Due Diligence: Billionaires conduct extensive research before making investment decisions. The established track record and transparency of IVV contribute to its appeal.

The choice of IVV reflects a preference for proven, low-cost, and diversified investment vehicles.

H2: Market Trends and Future Potential

Several market trends support the continued strong performance of IVV:

-

Economic Growth: Sustained U.S. economic growth (cite relevant data) is expected to drive the performance of the S&P 500, positively impacting IVV.

-

Technological Innovation: The continued innovation within technology and other high-growth sectors within the S&P 500 fuels future potential.

-

Expert Predictions: Many market analysts predict continued growth in the U.S. stock market, making IVV an attractive investment (cite expert opinions and forecasts, with links to sources).

While future performance is never guaranteed, the underlying economic fundamentals and growth potential of the U.S. market suggest continued strength for IVV.

H2: Risks and Considerations

Investing in any ETF, including IVV, carries inherent risks:

-

Market Volatility: The stock market is subject to volatility. IVV will experience fluctuations along with the overall S&P 500.

-

Geopolitical Risks: Global events and geopolitical instability can negatively impact market performance.

-

Regulatory Changes: Changes in regulations can affect the ETF's performance.

It is crucial to understand these risks before investing. Consult with a financial advisor to determine the suitability of IVV for your individual investment goals.

3. Conclusion

Billionaires are betting big on BlackRock ETFs like IVV due to their low-cost structure, inherent diversification, and alignment with long-term investment strategies focused on the U.S. market's growth potential. While risks exist, the long-term potential, coupled with robust due diligence, explains the significant investment.

Learn more about this high-potential BlackRock ETF and how it can fit into your investment portfolio. Research the IVV today! [Link to iShares Core S&P 500 ETF information] Remember, this is not financial advice; conduct your own thorough research before making any investment decisions.

Featured Posts

-

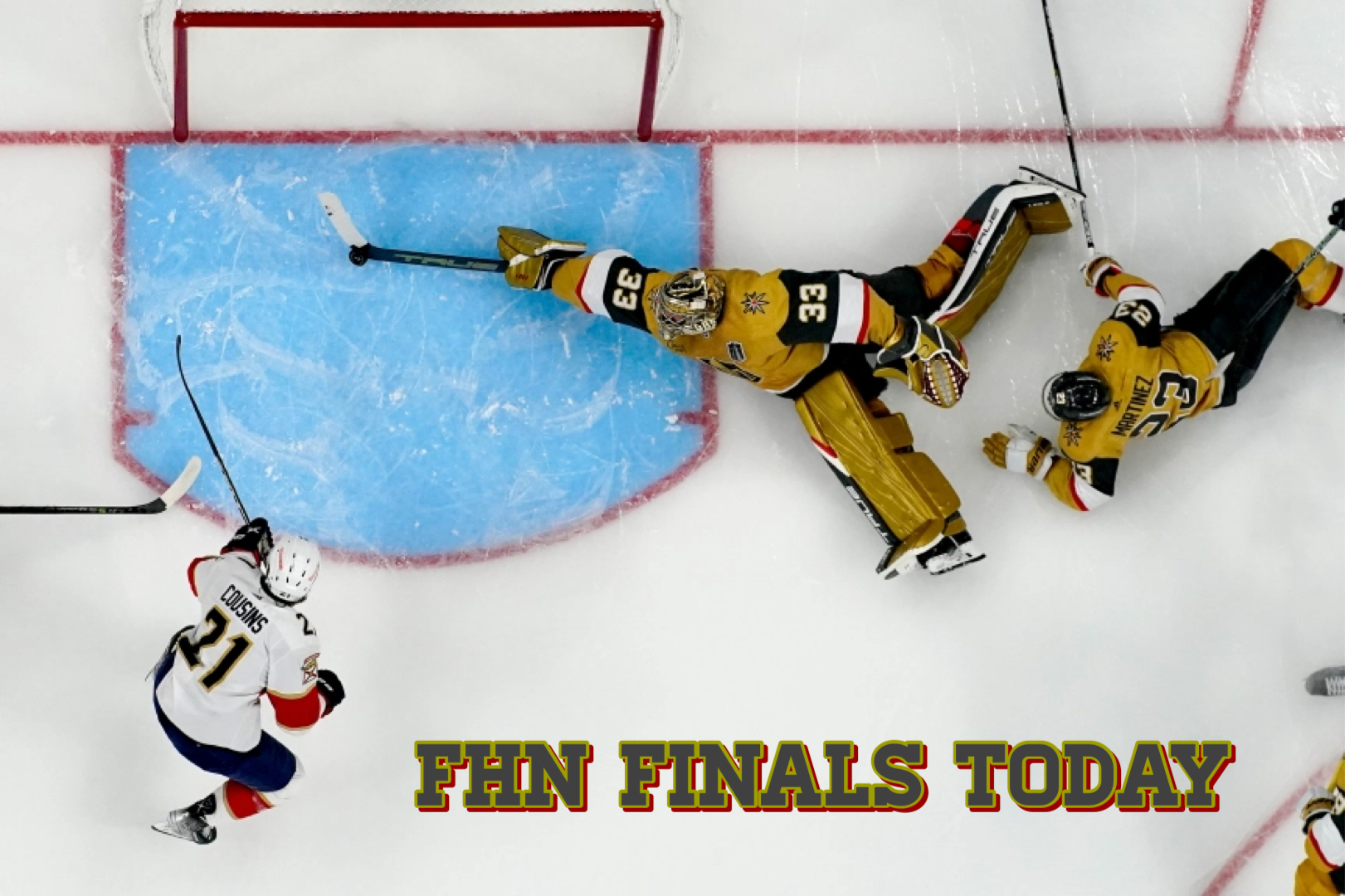

Adin Hill Leads Vegas Golden Knights To 4 0 Victory Over Columbus Blue Jackets

May 09, 2025

Adin Hill Leads Vegas Golden Knights To 4 0 Victory Over Columbus Blue Jackets

May 09, 2025 -

Exclusive Nottingham Attack Survivor Shares Her Story For The First Time

May 09, 2025

Exclusive Nottingham Attack Survivor Shares Her Story For The First Time

May 09, 2025 -

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh I Barselona Protiv Intera

May 09, 2025

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh I Barselona Protiv Intera

May 09, 2025 -

Bayern Munich Vs Inter Milan Who Will Win A Detailed Prediction

May 09, 2025

Bayern Munich Vs Inter Milan Who Will Win A Detailed Prediction

May 09, 2025 -

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Screening

May 09, 2025

Melanie Griffith And Siblings Support Dakota Johnson At Materialist Screening

May 09, 2025

Latest Posts

-

Mezhdunarodnaya Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 09, 2025

Mezhdunarodnaya Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 09, 2025 -

Pakistan Economic Crisis Imf Reviews 1 3 Billion Aid Amidst Geopolitical Tensions

May 09, 2025

Pakistan Economic Crisis Imf Reviews 1 3 Billion Aid Amidst Geopolitical Tensions

May 09, 2025 -

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025 -

Klyuchevoe Soglashenie Frantsiya I Polsha Podpisyvayut Dogovor Analiz Ot Unian

May 09, 2025

Klyuchevoe Soglashenie Frantsiya I Polsha Podpisyvayut Dogovor Analiz Ot Unian

May 09, 2025 -

Firstpost Imfs Decision On Pakistans 1 3 Billion Loan Package

May 09, 2025

Firstpost Imfs Decision On Pakistans 1 3 Billion Loan Package

May 09, 2025