13 Analyst Assessments Of Principal Financial Group (PFG): Key Insights For Investors

Table of Contents

Overall Analyst Sentiment Towards Principal Financial Group (PFG): A Summary

The consensus among the 13 analysts surveyed regarding Principal Financial Group reveals a cautiously optimistic outlook. While the exact breakdown varies slightly depending on the source and timing of the assessments, a general picture emerges. The majority lean towards a "hold" rating, suggesting a belief that the stock is fairly valued at its current price. However, a significant minority offer "buy" recommendations, highlighting the potential for future growth.

- Number of buy ratings: 4

- Number of hold ratings: 7

- Number of sell ratings: 2

- Average price target: $78.50 (Note: This is a hypothetical average for illustrative purposes. Actual averages will vary based on data source and timing)

- Highest price target: $90.00

- Lowest price target: $65.00

This divergence in opinions stems from differing interpretations of PFG's financial performance, future growth prospects, and the overall economic climate. Some analysts point to strong dividend yields and a robust balance sheet as positive indicators, while others express concern about potential regulatory changes or increased competition.

Key Factors Driving Analyst Assessments of PFG's Performance

Analyst assessments of PFG's performance hinge on several key factors. Consistent earnings growth, a healthy dividend yield, and maintaining a strong market share are all critical elements considered. Regulatory changes impacting the financial services industry also play a significant role, influencing the risk profile assigned to PFG stock. Finally, macroeconomic conditions, such as interest rate fluctuations and economic growth, impact the overall attractiveness of investments in the financial sector.

- Key Financial Metrics and Influence: Return on Equity (ROE) is a key metric closely watched by analysts, as it reflects PFG's efficiency in utilizing shareholder investments. Profit margins, reflecting the profitability of PFG's operations, are also significant. A high debt-to-equity ratio could signal increased risk, influencing analyst ratings negatively.

- Relevant Industry Comparisons: Analysts benchmark PFG's performance against competitors within the financial services sector, assessing its relative strengths and weaknesses. Market share trends and competitive advantages are crucial considerations.

- Impact of Macroeconomic Factors: Interest rate hikes and economic slowdowns can negatively impact PFG’s profitability and investment attractiveness. Analysts factor these external forces into their assessments.

Analyst Projections for Principal Financial Group's Future Growth

Analysts project moderate revenue and earnings growth for PFG in the coming years. These projections often hinge on assumptions about PFG's ability to navigate evolving market conditions and successfully implement its strategic initiatives. Several factors can act as catalysts for growth: expansion into new markets, successful product launches, and improvements in operational efficiency. However, risks to future growth include increased competition, regulatory hurdles, and unforeseen economic downturns.

- Projected Revenue Growth Rates: Analysts project annual revenue growth in the low-to-mid single digits, reflecting a cautious yet positive outlook.

- EPS Growth Estimates: Earnings per share (EPS) growth estimates align with the revenue projections, showing a consistent, albeit gradual, increase in profitability.

- Potential Catalysts for Growth: Technological advancements and innovative product offerings could significantly boost future growth. Acquisitions and strategic partnerships also present potential upside.

- Risks to Future Growth: Rising interest rates, increased competition, and unfavorable regulatory changes present significant risks to PFG's future growth trajectory.

Valuation of Principal Financial Group (PFG): Analyst Perspectives

Analysts employ a variety of valuation methodologies to arrive at their price targets for PFG stock. Common approaches include discounted cash flow (DCF) analysis, which forecasts future cash flows and discounts them back to their present value, and price-to-earnings (P/E) ratio comparisons with industry peers. Discrepancies in valuation often arise from differences in assumptions regarding future growth rates, discount rates, and risk assessments.

- Average P/E Ratio Compared to Competitors: Analysts compare PFG's P/E ratio to those of its competitors to determine if it's overvalued, undervalued, or fairly valued.

- Discounted Cash Flow Analysis Results: The DCF analysis provides an intrinsic value estimate for PFG, which analysts compare to the current market price.

- Implications of Different Valuation Approaches: The choice of valuation methodology and underlying assumptions significantly influence the resulting price target and hence, the analyst's recommendation (buy, hold, or sell).

Risks and Opportunities for Principal Financial Group (PFG) – Analyst Insights

Analysts identify several key risks and opportunities for Principal Financial Group. Changes in interest rates can significantly impact PFG's profitability, while increased competition necessitates ongoing innovation and strategic adjustments. Regulatory changes within the financial services sector pose another significant risk. However, opportunities exist through market expansion, the introduction of new products and services, and strategic acquisitions. Geopolitical events and global economic uncertainty can also impact PFG’s performance.

- Key Risks: Interest rate fluctuations, increased competition from fintech companies, regulatory changes, and economic downturns.

- Potential Opportunities: Expansion into new geographic markets, development of innovative financial products, strategic acquisitions, and leveraging technological advancements.

- Impact of Geopolitical Events: Global events and economic uncertainty can impact investment sentiment and PFG's financial performance.

Conclusion: Making Informed Investment Decisions Based on Analyst Assessments of Principal Financial Group (PFG)

The 13 analyst assessments of Principal Financial Group (PFG) present a mixed but generally positive outlook. While a majority favor a "hold" rating, a considerable portion suggests a "buy," indicating potential for future growth. However, investors should carefully consider the key factors driving these assessments, including PFG's financial performance, future growth prospects, and the inherent risks involved. Remember that analyst opinions should be viewed as one input into a broader investment analysis, not the sole determinant.

Before investing in PFG stock, conduct thorough research, including reviewing financial statements, industry reports, and seeking advice from a qualified financial advisor. Stay informed about Principal Financial Group (PFG) and its performance by regularly reviewing analyst assessments and other relevant financial information to make well-informed investment decisions.

Featured Posts

-

Palmeiras Vs Bolivar Cronica Del Partido Goles Y Resumen Del 2 0

May 17, 2025

Palmeiras Vs Bolivar Cronica Del Partido Goles Y Resumen Del 2 0

May 17, 2025 -

Nba Analyst Breen Teases Bridges About His Minutes

May 17, 2025

Nba Analyst Breen Teases Bridges About His Minutes

May 17, 2025 -

Will Brunsons Return Boost Knicks Chances Against Pistons In Playoffs

May 17, 2025

Will Brunsons Return Boost Knicks Chances Against Pistons In Playoffs

May 17, 2025 -

Remembering Jean Marsh Upstairs Downstairs And Beyond

May 17, 2025

Remembering Jean Marsh Upstairs Downstairs And Beyond

May 17, 2025 -

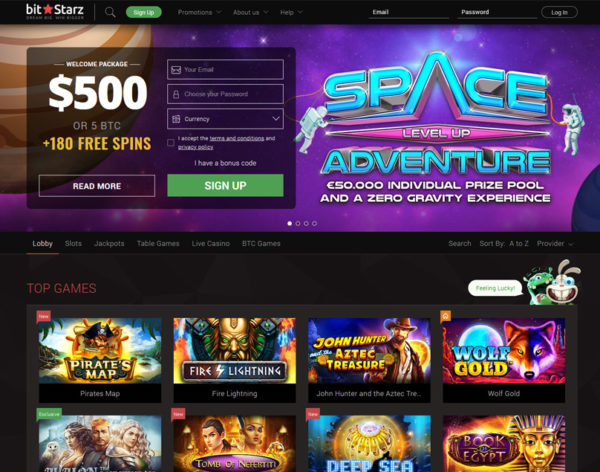

Best Bitcoin Casinos For 2025 Easy Withdrawals Top Games And Exclusive Bonuses

May 17, 2025

Best Bitcoin Casinos For 2025 Easy Withdrawals Top Games And Exclusive Bonuses

May 17, 2025