14%+ Shopify Stock Increase Following Nasdaq 100 Announcement

Table of Contents

The Nasdaq 100 Inclusion: A Catalyst for Growth

Inclusion in the Nasdaq 100 is a landmark achievement for any company. It signifies a significant level of market maturity, financial stability, and growth potential. For Shopify, this inclusion was more than just recognition; it became a powerful engine for further growth.

The Nasdaq 100's influence stems from its composition: it comprises 100 of the largest non-financial companies listed on the Nasdaq Stock Market. This means inclusion attracts significant attention from institutional investors – large investment firms, pension funds, and mutual funds – who often track the index for investment opportunities. This influx of institutional investment translates to:

- Increased market capitalization: Inclusion boosts the company's overall valuation.

- Enhanced brand reputation and credibility: Being part of the Nasdaq 100 lends significant credibility and enhances Shopify's reputation amongst investors and consumers alike.

- Improved access to capital: Companies listed in the Nasdaq 100 typically find it easier to raise capital through further offerings.

- Potential for higher valuation: The increased investor interest often leads to a higher stock valuation over time.

- Attracting passive investment funds: Many passively managed investment funds track the Nasdaq 100, leading to automatic buying of Shopify stock. This represents a significant source of consistent demand.

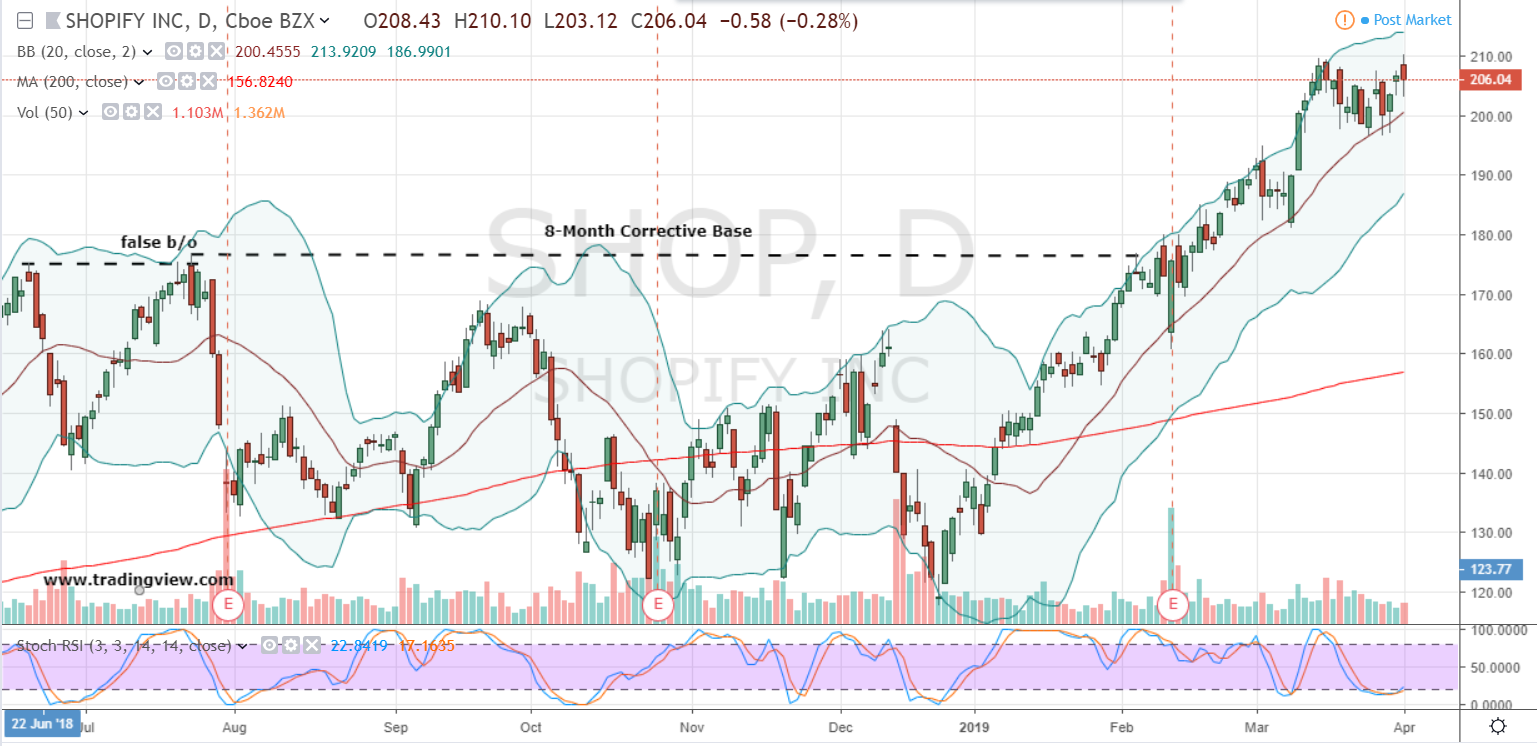

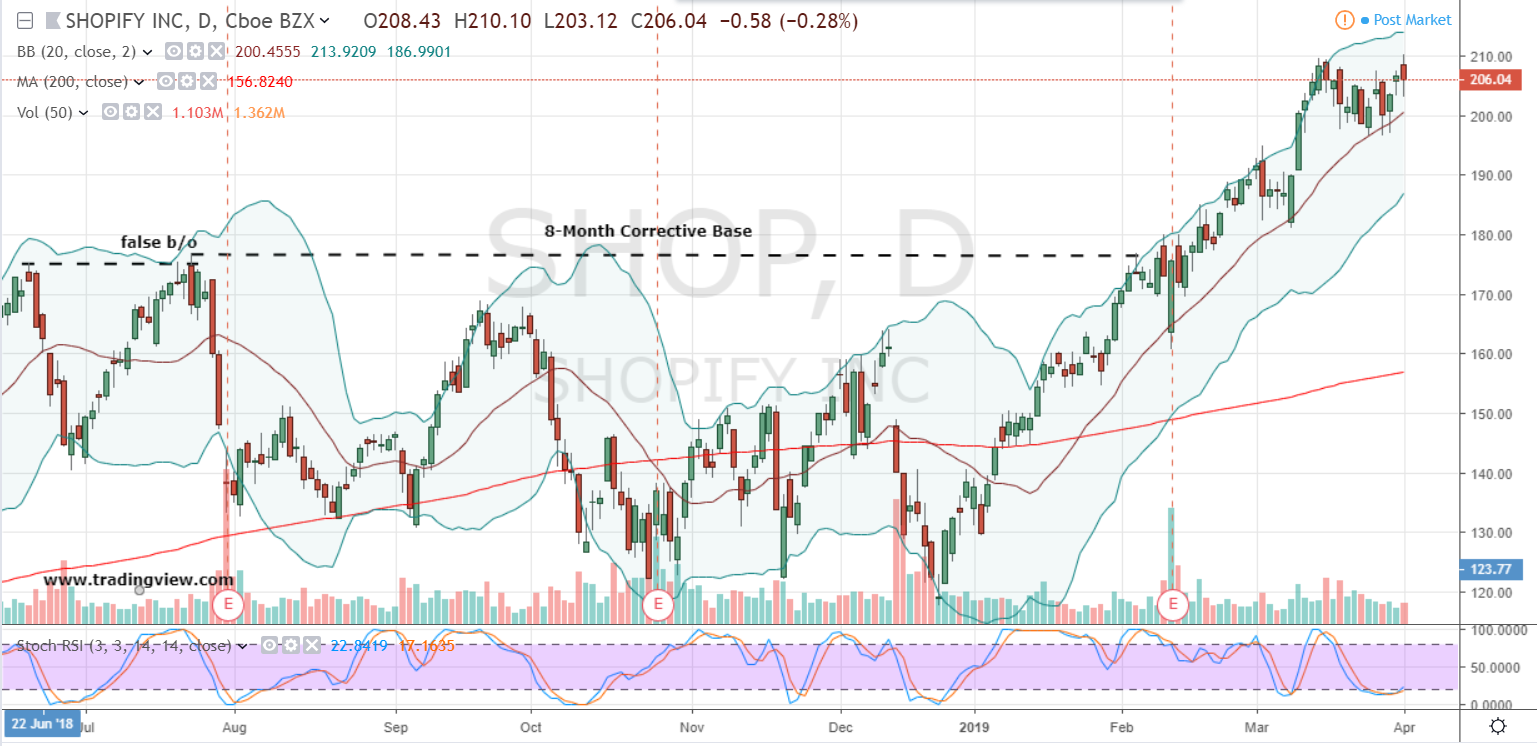

Market Reaction and Investor Sentiment

The market reacted swiftly and positively to the Nasdaq 100 announcement. The immediate impact was a sharp increase in Shopify's stock price and trading volume. This positive market response reflected the overwhelmingly positive investor sentiment towards the company.

Several factors contributed to this enthusiastic response:

- Sharp increase in trading volume: The news fueled a considerable increase in trading activity, as investors rushed to buy Shopify stock.

- Positive media coverage: Widespread positive media coverage amplified the news, influencing public perception and further increasing investor interest.

- Upward revisions of price targets: Financial analysts responded by upgrading their price targets for Shopify stock, reflecting their increased confidence in the company's future performance.

- Increased interest from retail investors: The news also sparked interest from retail investors, further contributing to the increased trading volume and price appreciation.

Shopify's Performance and Future Outlook

Shopify's recent financial performance has been robust, exhibiting strong revenue growth and expanding market share in the rapidly growing e-commerce sector. The company's strategic focus on innovation, particularly in areas like e-commerce technology and solutions, has cemented its position as a market leader.

Key factors contributing to Shopify's success and sustainability include:

- Strong revenue growth and expanding market share: Shopify continues to demonstrate strong financial performance, indicating significant market penetration and growth potential.

- Innovation in e-commerce technology and solutions: Shopify's commitment to innovation ensures it remains at the forefront of the e-commerce industry.

- Successful diversification into new markets and verticals: Shopify's expansion into new markets and verticals diversifies revenue streams and mitigates risks.

- Robust merchant base and customer loyalty: Shopify boasts a large and loyal merchant base, providing a solid foundation for future growth.

- Potential for further expansion and acquisitions: Shopify is well-positioned to pursue further expansion through organic growth and strategic acquisitions.

Risks and Considerations for Shopify Investors

While the outlook for Shopify is largely positive, investors should consider potential risks and challenges:

- Competition from other e-commerce platforms: Shopify faces intense competition from established players and emerging competitors.

- Economic downturns and changes in consumer spending: Economic uncertainty can impact consumer spending and negatively affect Shopify's performance.

- Dependence on specific market segments or geographic regions: Over-reliance on particular segments or regions can expose Shopify to increased vulnerability.

- Regulatory changes affecting the e-commerce industry: Changes in regulations can impact Shopify's operations and profitability.

- Potential for unexpected negative news or setbacks: As with any publicly traded company, unforeseen events can negatively impact Shopify's stock price.

Conclusion: Investing in the Post-Nasdaq 100 Shopify Stock Surge

The recent 14%+ surge in Shopify stock price is largely attributable to its inclusion in the Nasdaq 100, attracting increased institutional investment and enhancing investor sentiment. While this signifies a positive outlook, potential investors should conduct thorough due diligence, carefully weighing the positive aspects discussed alongside the inherent risks of any stock market investment. The Nasdaq 100 inclusion strengthens Shopify's position, but market volatility remains a factor.

Learn more about Shopify stock, analyze Shopify's investment potential, and consider adding Shopify to your portfolio after conducting comprehensive research and understanding your own risk tolerance. Remember, responsible investing practices and thorough due diligence are crucial before making any investment decisions related to Shopify stock price or the Nasdaq 100.

Featured Posts

-

Dubai Open Sabalenka Upsets Paolini Claims Victory

May 14, 2025

Dubai Open Sabalenka Upsets Paolini Claims Victory

May 14, 2025 -

Watch Wrestle Mania Iii Live This Sunday On Wwe Vault

May 14, 2025

Watch Wrestle Mania Iii Live This Sunday On Wwe Vault

May 14, 2025 -

Aldi Issues Recall For Shredded Cheese Due To Steel Contamination

May 14, 2025

Aldi Issues Recall For Shredded Cheese Due To Steel Contamination

May 14, 2025 -

Nominations Societe Generale Alexis Kohler Devient Vice President Executif

May 14, 2025

Nominations Societe Generale Alexis Kohler Devient Vice President Executif

May 14, 2025 -

The Voice Season 27 Episode 3 Recap Adam Levines Return To Form

May 14, 2025

The Voice Season 27 Episode 3 Recap Adam Levines Return To Form

May 14, 2025