$150 Million For Credit Suisse Whistleblowers: Details Of The Settlement

Table of Contents

The Allegations: Unveiling the Misconduct at Credit Suisse

The $150 million settlement stems from serious allegations of fraudulent activity and systemic failures within Credit Suisse. Understanding the nature of these allegations is crucial to grasping the significance of this whistleblower case.

Specific Claims of Fraudulent Activity

The alleged fraudulent activities at Credit Suisse spanned several years and involved various forms of misconduct. While the specifics of some allegations remain confidential due to the settlement agreement, publicly available information suggests a pattern of:

- Money Laundering: Allegations involve facilitating the movement of illicit funds through the bank's systems, potentially violating anti-money laundering regulations.

- Tax Evasion: Claims suggest assisting clients in evading taxes through complex financial transactions and offshore accounts.

- Securities Fraud: Allegations include misleading investors through the misrepresentation of financial products or the manipulation of market prices.

The alleged misconduct impacted numerous clients and potentially destabilized financial markets, highlighting the systemic risk posed by such activities. The timeframe of the alleged activities is currently under investigation, though the settlement suggests a period extending over several years.

Internal Failures and Lack of Oversight

The scale of the alleged misconduct points to significant failures within Credit Suisse's internal control systems and compliance programs. These failures allowed the alleged fraudulent activities to persist undetected for an extended period. Specifically, allegations include:

- Inadequate Risk Management: A lack of robust risk assessment and mitigation strategies allowed fraudulent activities to flourish.

- Weak Compliance Programs: Insufficient oversight and enforcement of internal policies and regulations facilitated the alleged misconduct.

- Ineffective Internal Audit Functions: Failures in internal audit processes failed to identify and report the alleged wrongdoing.

These regulatory shortcomings, combined with internal failures, created an environment conducive to the alleged misconduct and underscore the importance of robust internal controls and effective regulatory oversight in the financial sector.

The Whistleblowers: Their Roles and Contributions

The $150 million settlement wouldn't have been possible without the courage and dedication of the whistleblowers involved. Their actions played a critical role in bringing the alleged misconduct to light.

Identifying the Key Players

While the identities of all whistleblowers involved may not be publicly disclosed due to confidentiality agreements, their roles within Credit Suisse varied, ranging from junior employees to senior management. Their motivations for coming forward likely included a sense of ethical responsibility, concern for the integrity of the financial system, and a desire to hold the institution accountable for its actions.

The Evidence Provided

The whistleblowers provided substantial evidence to support their allegations. This evidence likely included internal documents, emails, financial records, and potentially witness testimonies. The quality and quantity of this evidence played a pivotal role in securing the settlement and demonstrating the credibility of their claims. Their persistence and courage in the face of potential professional and personal risks are commendable.

The Settlement: Terms and Implications

The $150 million settlement represents a significant financial commitment from Credit Suisse to resolve the allegations. The implications of this settlement extend far beyond the immediate financial impact.

Breakdown of the $150 Million

The exact distribution of the $150 million among the whistleblowers and legal fees remains largely confidential. However, the size of the settlement reflects the seriousness of the allegations and the strength of the evidence provided. Details of the settlement agreement itself, including any confidentiality clauses, are likely protected by non-disclosure agreements.

Regulatory Impact and Future Implications

The settlement carries significant implications for Credit Suisse, the broader financial industry, and future whistleblower protections. It is likely to:

- Increase regulatory scrutiny of Credit Suisse's operations and internal controls.

- Encourage other potential whistleblowers to come forward with information about misconduct within financial institutions.

- Lead to increased emphasis on strengthening corporate governance and compliance practices throughout the financial sector.

- Potentially impact investor confidence in Credit Suisse and the broader market.

While Credit Suisse may face further regulatory investigations and potential fines, the settlement itself points to a need for systemic change within the financial industry.

Conclusion

The $150 million Credit Suisse whistleblower settlement underscores the vital role whistleblowers play in uncovering financial fraud and promoting ethical conduct within corporations. The allegations of widespread misconduct, the whistleblowers' crucial roles in bringing these issues to light, the substantial financial settlement, and its implications for regulatory oversight all demonstrate the significant consequences of failing to maintain strong internal controls and ethical practices. If you have information regarding potential financial wrongdoing, consider reporting it through appropriate channels. Learn more about whistleblower protections and how to report potential misconduct securely and confidentially. Understanding the details of this significant Credit Suisse whistleblower settlement can help protect your rights and contribute to a more transparent and accountable financial industry.

Featured Posts

-

Two Hat Tricks For Hertl As Golden Knights Beat Red Wings

May 09, 2025

Two Hat Tricks For Hertl As Golden Knights Beat Red Wings

May 09, 2025 -

Broad Street Diners Demise Hyatt Hotel Construction To Begin

May 09, 2025

Broad Street Diners Demise Hyatt Hotel Construction To Begin

May 09, 2025 -

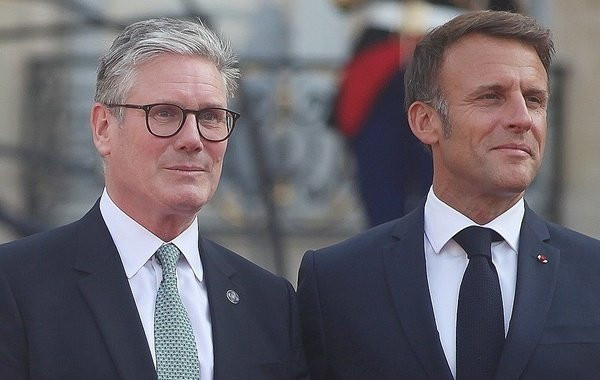

Starmer Makron Merts I Tusk Propustyat Parad V Kieve 9 Maya

May 09, 2025

Starmer Makron Merts I Tusk Propustyat Parad V Kieve 9 Maya

May 09, 2025 -

Best Elizabeth Arden Skincare Products At Walmart Prices

May 09, 2025

Best Elizabeth Arden Skincare Products At Walmart Prices

May 09, 2025 -

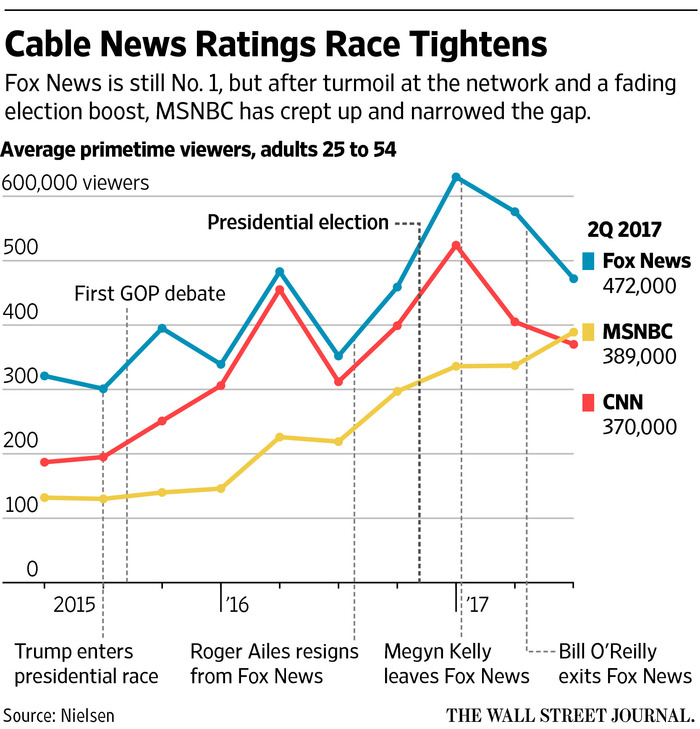

Aoc Vs Fox News A Clash Over Trumps Legacy

May 09, 2025

Aoc Vs Fox News A Clash Over Trumps Legacy

May 09, 2025

Latest Posts

-

2025 Presidential Politics A Case Study Of The Trump Administration Day 109

May 10, 2025

2025 Presidential Politics A Case Study Of The Trump Administration Day 109

May 10, 2025 -

The Impact Of High Potentials Season 1 Finale On Abc

May 10, 2025

The Impact Of High Potentials Season 1 Finale On Abc

May 10, 2025 -

Day 109 Retrospective On The Trump Administrations Actions On May 8th 2025

May 10, 2025

Day 109 Retrospective On The Trump Administrations Actions On May 8th 2025

May 10, 2025 -

Analyzing The Trump Presidency A Focus On Day 109 May 8th 2025

May 10, 2025

Analyzing The Trump Presidency A Focus On Day 109 May 8th 2025

May 10, 2025 -

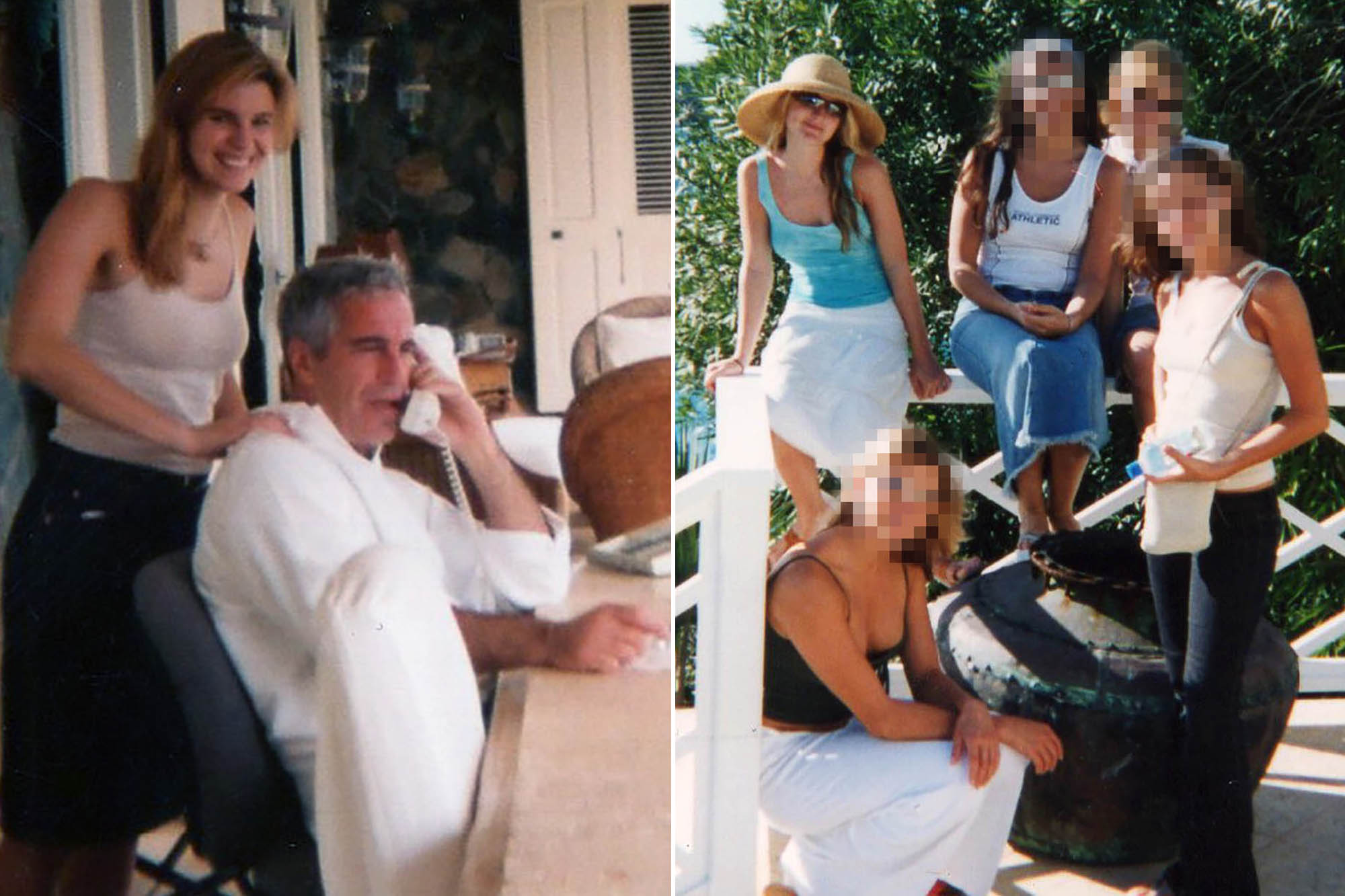

The Jeffrey Epstein Case Public Opinion On Ag Pam Bondis Decision To Release Files

May 10, 2025

The Jeffrey Epstein Case Public Opinion On Ag Pam Bondis Decision To Release Files

May 10, 2025