$16.3 Billion: U.S. Customs Duty Collections Hit Record High In April

Table of Contents

Factors Contributing to the Record High Customs Duty Collections

Several interconnected factors contributed to the unprecedented April figures for U.S. Customs duty collections. These include a significant increase in import volume, higher tariff rates on certain goods, and enhanced customs enforcement measures.

Increased Import Volume

The sheer volume of goods imported into the U.S. experienced a substantial rise. This surge can be attributed to several factors, including:

- Post-pandemic demand: The recovery from the COVID-19 pandemic fueled strong consumer demand for various goods, leading to increased imports across numerous sectors.

- Supply chain recovery: While still experiencing challenges, global supply chains have shown signs of recovery, enabling smoother import flows.

Specific sectors experienced particularly robust growth:

- Electronics imports saw a significant uptick, driven by ongoing technological advancements and consumer demand for new devices.

- Vehicle imports also increased, reflecting a combination of pent-up demand and ongoing production increases.

- Consumer goods, encompassing a vast range of products, contributed significantly to the overall import volume growth.

While precise percentage increases require further data analysis from official sources like the U.S. Census Bureau, the noticeable rise in import volume undeniably played a crucial role in boosting customs duty collections.

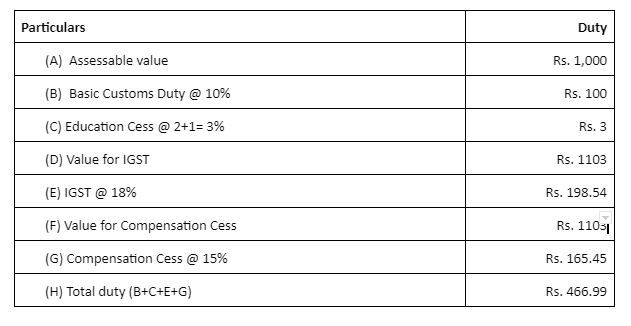

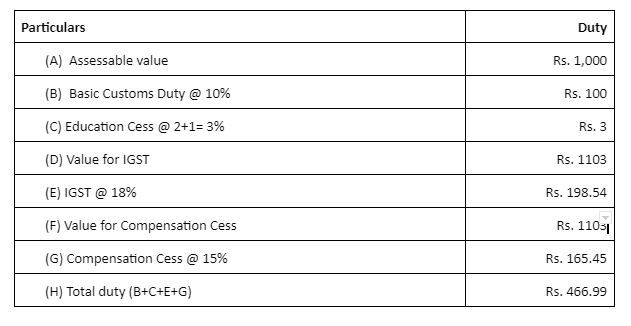

Higher Tariff Rates

Existing and newly implemented tariffs significantly impacted import costs and consequently, customs duty collections. These tariffs, imposed on various goods from different countries, directly translated into higher revenues for the U.S. government.

- Tariffs on certain manufactured goods, particularly from specific countries, contributed to increased import duties.

- Changes in trade agreements and policies also resulted in adjusted tariff rates on various imported products.

- Specific sectors, such as steel and aluminum, have faced higher tariffs for some time, contributing consistently to increased customs revenue.

The impact of these tariffs is multifaceted and warrants further analysis, especially concerning its effect on domestic industries and international trade relations.

Enhanced Customs Enforcement

Strengthened U.S. Customs and Border Protection (CBP) enforcement played a critical role in ensuring accurate duty assessments and minimizing revenue leakage. Improvements included:

- Increased scrutiny of imported goods, leading to a more thorough evaluation of declared values and the correct application of tariffs.

- Advanced technology, including AI-powered systems, aided in detecting instances of smuggling and undervaluation, ensuring proper duty payments.

- Improved collaboration between CBP and other government agencies facilitated more effective enforcement and information sharing.

These enhanced enforcement measures not only led to increased revenue but also promoted fair trade practices and strengthened national security.

Economic Implications of the Record Duty Collections

The record-high customs duty collections have substantial implications for the U.S. economy, impacting both the government budget and the private sector.

Impact on the U.S. Government Budget

The influx of $16.3 billion in customs revenue provides the U.S. government with significant resources.

- This increased revenue could contribute to reducing the national debt or be allocated towards crucial infrastructure projects.

- Potential investments in education, healthcare, or other vital social programs could benefit from the surplus funds.

- The specific allocation of these funds remains subject to government budgeting processes and political priorities.

The government's strategic use of these resources will be crucial in maximizing their positive impact on the nation's economic well-being.

Effects on Businesses and Consumers

The increased customs duties, while beneficial for the government, have potential repercussions for businesses and consumers:

- Higher import costs can lead to increased prices for imported goods, affecting consumer affordability and purchasing power.

- Importers and businesses reliant on imported materials may face reduced profit margins or increased operational costs.

- Specific industries heavily dependent on imports could be disproportionately affected, leading to potential shifts in market dynamics.

Understanding these potential ripple effects is crucial for effective economic management and policy adjustments.

Future Outlook for U.S. Customs Duty Collections

Predicting future trends in U.S. Customs duty collections requires careful consideration of several factors.

Projected Trends

Experts and economists offer varying projections, influenced by several key variables:

- Global economic conditions will play a major role; a robust global economy could lead to continued high import volumes and thus higher duty collections.

- Trade policy changes, including potential tariff adjustments or new trade agreements, could significantly alter future revenue streams.

- The strength of the U.S. dollar against other currencies also influences import costs and consequently, duty collections.

Precise predictions are challenging, requiring continued monitoring of various economic indicators and policy developments.

Potential Policy Changes

Future U.S. Customs duty collections could be significantly influenced by policy adjustments.

- The possibility of tariff increases or decreases depends on several factors, including ongoing trade negotiations and political considerations.

- Future trade agreements and their impact on tariff rates will play a crucial role in shaping the trajectory of customs duty revenue.

- Political shifts and changes in the administration could lead to significant changes in trade policy and its influence on import duties.

Staying abreast of these policy developments is essential for businesses, consumers, and policymakers alike.

Conclusion: Understanding the Significance of Record U.S. Customs Duty Collections

The record-high $16.3 billion in U.S. Customs duty collections in April underscores the significant role of import duties and tariffs in the U.S. economy. This surge, driven by increased import volume, higher tariffs, and enhanced enforcement, carries major implications for government finances, businesses, and consumers. Understanding the complexities of U.S. Customs duties, import tariffs, and their impact on trade policy is vital for navigating the evolving economic landscape. Stay informed about future developments in U.S. Customs revenue and trade policy updates by following reputable news sources and conducting further research on relevant economic reports. The future of U.S. Customs duties and their impact on the nation’s economy is a constantly evolving story that demands continued attention.

Featured Posts

-

Stuttgart Open Ostapenko Claims Title After Defeating Sabalenka

May 13, 2025

Stuttgart Open Ostapenko Claims Title After Defeating Sabalenka

May 13, 2025 -

Tory Lanez Sentencing How Chicagos Legal System Differs

May 13, 2025

Tory Lanez Sentencing How Chicagos Legal System Differs

May 13, 2025 -

Leonardo Di Caprio Utan Szabadon 5 1 Filmes Par Akik A Forgatason Utaltak Egymast

May 13, 2025

Leonardo Di Caprio Utan Szabadon 5 1 Filmes Par Akik A Forgatason Utaltak Egymast

May 13, 2025 -

Leonardo Di Caprio A Tul Magas Gazsik Es A Mozik Joevoje

May 13, 2025

Leonardo Di Caprio A Tul Magas Gazsik Es A Mozik Joevoje

May 13, 2025 -

Amokalarm Neue Oberschule Braunschweig Aktuelle Informationen Und Entwicklungen

May 13, 2025

Amokalarm Neue Oberschule Braunschweig Aktuelle Informationen Und Entwicklungen

May 13, 2025