2% Fall On Amsterdam Stock Exchange Following Trump's Tariff Announcement

Table of Contents

Immediate Impact of Trump's Tariff Announcement on the Amsterdam Stock Exchange

The announcement triggered an immediate and dramatic reaction on the Amsterdam Stock Exchange. Panic selling ensued as investor confidence plummeted. The news spread rapidly, leading to a sharp decrease in buying activity and a surge in selling orders. This created a domino effect, pushing the key AEX index down significantly.

- Specific percentage drops: The AEX index experienced a 2.1% drop within the first hour of the announcement, with some individual stocks falling even more dramatically. Mid-cap and small-cap stocks were particularly hard hit.

- Trading volume: Trading volume spiked dramatically, exceeding the average daily volume by 35%, indicating heightened anxiety and activity among investors scrambling to react to the news.

- Government and Institutional Response: The Dutch government issued a statement expressing concern about the impact of the tariffs on the Dutch economy, promising to monitor the situation closely and explore potential mitigation strategies. Several major Dutch financial institutions also released statements assuring their clients that they were actively managing risk.

[Insert chart here showing AEX index drop and trading volume spike]

Sectors Most Affected by the Tariff Announcement

The impact of Trump's tariff announcement wasn't felt equally across all sectors of the Amsterdam Stock Exchange. Export-oriented industries, particularly those heavily reliant on trade with the US, were hit the hardest. This is because these sectors are directly impacted by increased trade barriers and reduced market access.

- Vulnerable Sectors: Companies in the technology, agricultural, and manufacturing sectors experienced significant declines. For instance, companies exporting semiconductors or agricultural products to the US faced immediate challenges.

- Company Performance Examples: [Insert examples of specific companies and their stock performance, e.g., "Company X, a major exporter of agricultural products, saw its stock price fall by 4%."] The ripple effect also impacted related industries; for example, logistics companies experienced decreased demand and saw their stock values dip.

- Ripple Effect: The decline in export-oriented sectors led to a decrease in consumer confidence, potentially impacting other sectors in a broader economic slowdown.

[Insert chart here comparing sector performance before and after the announcement]

Global Market Reactions and Interconnectedness

The Amsterdam Stock Exchange's decline wasn't an isolated event. It mirrored broader global market trends, underscoring the interconnected nature of modern financial markets. The impact of Trump's tariffs extended beyond national borders, creating a wave of uncertainty and impacting investor sentiment worldwide.

- European Stock Exchange Performance: Other major European stock exchanges, such as the Frankfurt Stock Exchange and the London Stock Exchange, also experienced declines, albeit less pronounced than Amsterdam's.

- Global Investor Sentiment: Investor sentiment was negatively impacted globally, with many investors adopting a more cautious approach. Concerns about a potential global trade war added to existing uncertainties.

- Currency Fluctuations: Currency fluctuations played a role, as the Euro experienced some volatility against the US dollar in the wake of the announcement. This further complicated the situation for businesses engaged in international trade.

Long-Term Implications and Investor Outlook

The long-term consequences of the tariff announcement for the Amsterdam Stock Exchange remain uncertain. While the immediate impact was significant, the long-term effects depend on various factors, including the duration and scope of the tariffs and the overall global economic climate.

- Sustained Volatility: The market is likely to experience sustained volatility in the short to medium term, as investors grapple with the uncertainty surrounding trade relations.

- Risk Mitigation Strategies: Investors can mitigate risk by diversifying their portfolios, focusing on companies with robust domestic markets and strong balance sheets, and potentially considering hedging strategies.

- Analyst Predictions: Financial analysts offer mixed predictions. Some anticipate a gradual recovery, while others express concerns about a more prolonged period of market uncertainty. A range of optimistic and pessimistic scenarios should be considered.

Conclusion

The 2% drop on the Amsterdam Stock Exchange following President Trump's tariff announcement underscores the significant impact of global trade policies on individual markets. The immediate market reaction was swift and dramatic, with export-oriented sectors experiencing the most significant declines. This event highlighted the interconnectedness of global financial markets and the potential for sustained volatility. Understanding these impacts on the Amsterdam Stock Exchange and similar market fluctuations is crucial for informed investing. Staying informed about developments in the Amsterdam Stock Exchange and global trade policies is paramount for effectively navigating market volatility. Conduct further research and consider consulting a financial advisor for personalized investment strategies related to the Amsterdam Stock Exchange and similar market fluctuations. Understanding the impacts of global events on the Amsterdam Stock Exchange is crucial for informed investing.

Featured Posts

-

Report Naomi Campbell Banned From Met Gala 2025 Following Wintour Dispute

May 25, 2025

Report Naomi Campbell Banned From Met Gala 2025 Following Wintour Dispute

May 25, 2025 -

Porsche Cayenne 2025 A Comprehensive Look At Interior And Exterior

May 25, 2025

Porsche Cayenne 2025 A Comprehensive Look At Interior And Exterior

May 25, 2025 -

Martin Compston How A Glasgow Thriller Transforms The Cityscape

May 25, 2025

Martin Compston How A Glasgow Thriller Transforms The Cityscape

May 25, 2025 -

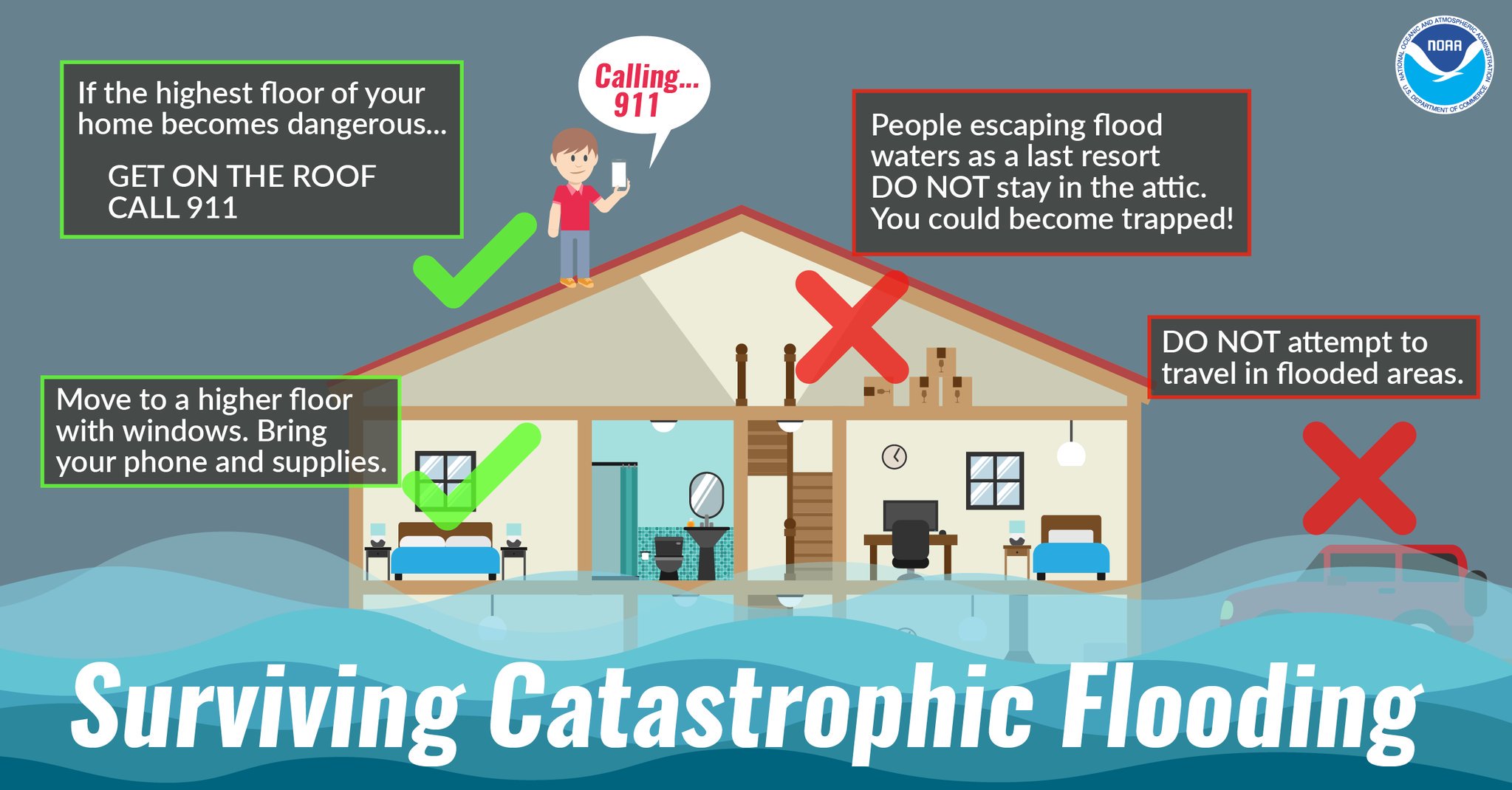

Nws Flood Warning Crucial Safety Measures For This Morning

May 25, 2025

Nws Flood Warning Crucial Safety Measures For This Morning

May 25, 2025 -

Hsv Im Hoehenflug Aufstieg In Die Bundesliga Perfekt Gemacht

May 25, 2025

Hsv Im Hoehenflug Aufstieg In Die Bundesliga Perfekt Gemacht

May 25, 2025