20 Million XRP Purchased: Whale Activity Sparks Ripple Price Speculation

Table of Contents

The Significance of the 20 Million XRP Purchase

The acquisition of 20 million XRP by a single entity, often referred to as a "whale," is a noteworthy event in the cryptocurrency market. Understanding the implications requires examining several key aspects.

Identifying the Whale

Pinpointing the exact identity of the whale behind this massive XRP purchase presents a significant challenge. Tracking large cryptocurrency transactions relies heavily on on-chain analysis, which examines the public blockchain ledger. However, this method has its limitations.

- Anonymity Techniques: Whales often employ techniques to mask their identity, such as using mixers or multiple wallets to break down the transaction trail.

- Attribution Difficulty: Definitively attributing transactions to specific entities, especially large ones, is incredibly difficult due to the pseudonymous nature of many cryptocurrencies.

- Coordinated Buying: The possibility of coordinated buying by multiple entities working together to conceal their collective impact cannot be ruled out.

Impact on XRP Supply

A 20 million XRP purchase represents a significant chunk of the overall circulating supply, though the exact percentage varies depending on the total circulating supply at the time of the transaction. This large purchase can influence several key market dynamics.

- Supply Reduction: While not drastically altering the overall supply, the removal of 20 million XRP from the readily available supply can potentially tighten liquidity.

- Price Manipulation Potential: Large purchases can create upward price pressure, and whales might use this strategy to manipulate the market to their advantage. Conversely, large sells can trigger price drops.

- Order Book Impact: Such a significant buy order can significantly alter the order book, potentially depleting available sell-side liquidity and causing price spikes.

Possible Motivations Behind the Purchase

Several factors might have motivated this substantial XRP investment. Understanding these potential motivations is key to interpreting the market implications.

- Belief in Ripple's Success: The whale might have a strong belief in Ripple's long-term success and the potential for future price appreciation of XRP.

- Anticipation of Regulatory Clarity: Positive regulatory news concerning Ripple's ongoing legal battle with the SEC could trigger a significant price surge, making accumulation ahead of such news highly lucrative.

- Strategic Accumulation: The purchase might be part of a larger accumulation strategy, aiming to amass a substantial holding of XRP before a projected price increase.

- Market Manipulation: While less likely, the possibility of market manipulation to artificially inflate the price cannot be entirely discounted.

Ripple Price Speculation and Market Reaction

The 20 million XRP purchase immediately triggered significant market reaction and fueled intense price speculation.

Immediate Price Impact

The news of the large XRP purchase likely caused a ripple effect (pun intended) in the market, leading to an immediate price increase. (Insert chart/graph showing price movement here, if available).

- Percentage Price Change: The exact percentage increase would depend on the timeframe and overall market conditions at the time of the purchase.

- Trading Volume Surge: Increased trading volume often accompanies significant price movements, reflecting heightened investor interest.

- Comparison to Previous Movements: This event could be compared to previous instances of significant whale activity to assess its relative impact.

Analyst Predictions and Opinions

Cryptocurrency analysts and experts have offered varied opinions on the future price of XRP following this event.

- Bullish Predictions: Some analysts might see this as a bullish signal, suggesting increased confidence in XRP's future.

- Bearish Predictions: Others could view it as a potential manipulation tactic and warn against the risks of investing in XRP.

- Neutral Perspectives: Some might maintain a neutral stance, highlighting the inherent volatility of the cryptocurrency market.

- Analyst References: (Include links to reputable analysts’ reports and articles here).

Social Media Sentiment and Community Reaction

Social media platforms like Twitter and Reddit witnessed a flurry of activity surrounding the news.

- Bullish/Bearish Sentiment: The overall sentiment could range from bullish excitement to bearish concerns, depending on individual interpretations of the event.

- Community Engagement: Significant discussions and debates would be expected within the XRP community, showcasing the event's impact.

- Misinformation Potential: It is crucial to be cautious of misinformation and rely on verified sources for accurate information.

The Broader Context: Ripple's Legal Battles and Future Outlook

Understanding the broader context of Ripple's legal battles and future prospects is crucial for analyzing the implications of this XRP purchase.

The SEC Lawsuit

The ongoing legal battle between Ripple and the SEC significantly influences XRP's price.

- Lawsuit Status: (Provide a brief summary of the current status of the lawsuit).

- Potential Outcomes: Different outcomes could drastically impact investor sentiment and XRP's price.

- Investor Confidence: The lawsuit's uncertainty creates volatility and affects investor confidence.

Ripple's Technological Advancements and Partnerships

Ripple continues to develop its technology and forge partnerships, aiming to expand the adoption of XRP.

- New Products/Services: (Highlight Ripple's recent technological advancements).

- Financial Institution Partnerships: (Mention key partnerships with financial institutions that support XRP).

- XRP Adoption: (Discuss the increasing adoption of XRP in cross-border payments).

Long-Term Price Projections

Predicting XRP's long-term price remains challenging, dependent on several intertwined factors.

- Price Increase Catalysts: Positive regulatory outcomes, increased adoption, and further technological advancements could fuel price increases.

- Risks and Challenges: Continued regulatory uncertainty and competition from other cryptocurrencies represent ongoing challenges.

- Realistic Price Targets: (Mention reasonable price target ranges, referencing reputable analysts' projections, if available).

Conclusion

The recent purchase of 20 million XRP by a cryptocurrency whale has significantly impacted market sentiment and sparked considerable speculation regarding the future price of XRP. While the event's exact impact remains uncertain, it underlines the volatility inherent in the cryptocurrency market and highlights the importance of understanding whale activity. The ongoing Ripple-SEC lawsuit and Ripple's future technological advancements will continue to shape XRP's trajectory.

Call to Action: Stay informed about the latest developments in the XRP market. Continue to research the impact of whale activity and other relevant factors affecting the XRP price. Follow reputable sources for accurate information and make informed decisions regarding your XRP investments. Remember to always conduct thorough due diligence before investing in any cryptocurrency, including Ripple's XRP.

Featured Posts

-

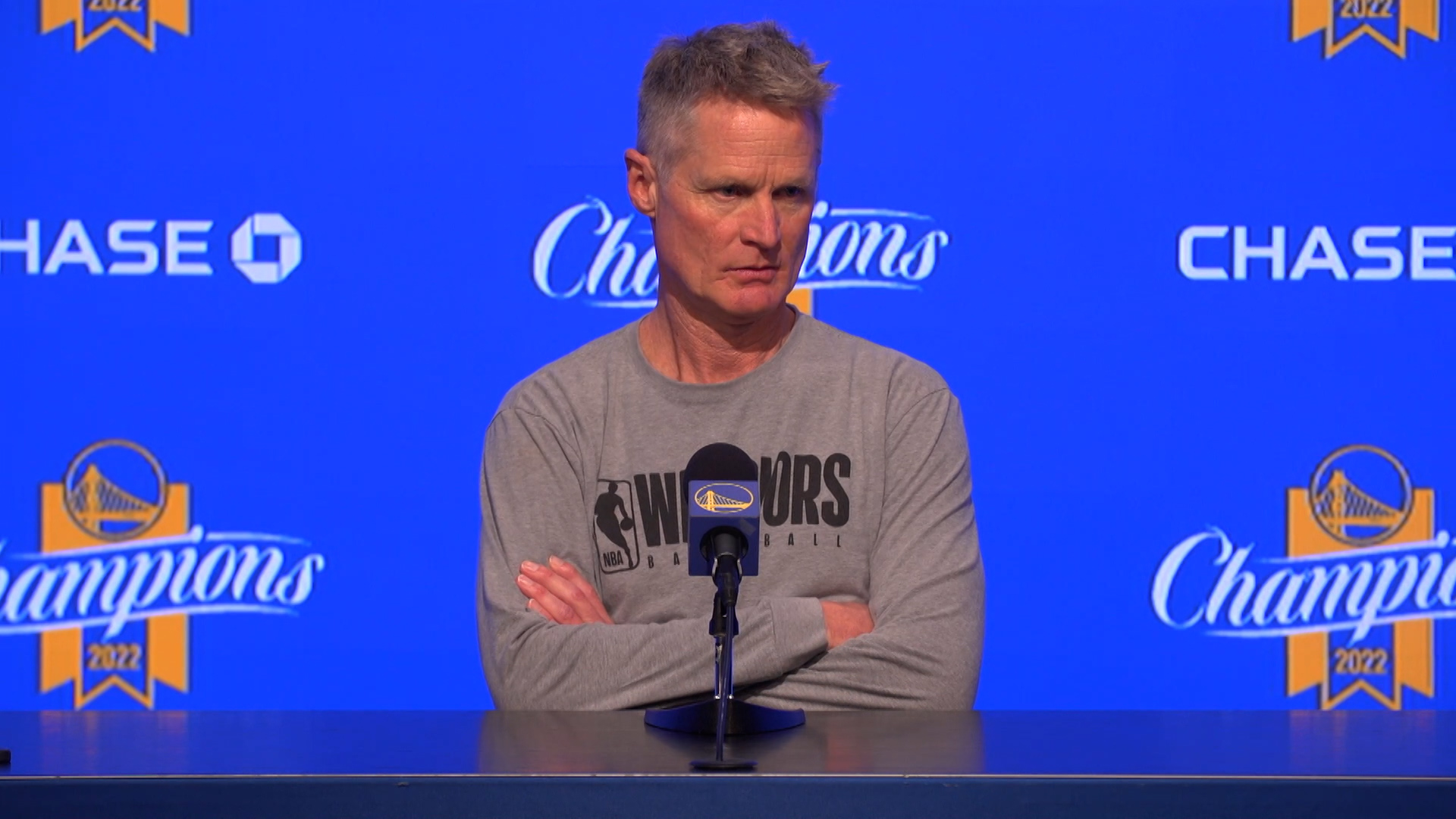

Steve Kerr Remains Optimistic About Stephen Currys Speedy Recovery

May 07, 2025

Steve Kerr Remains Optimistic About Stephen Currys Speedy Recovery

May 07, 2025 -

Pedro Pascal And Bella Ramsey Hint At Intense Drama In The Last Of Us Part Ii Trailer

May 07, 2025

Pedro Pascal And Bella Ramsey Hint At Intense Drama In The Last Of Us Part Ii Trailer

May 07, 2025 -

Steelers Omar Khan Discusses George Pickens Potential

May 07, 2025

Steelers Omar Khan Discusses George Pickens Potential

May 07, 2025 -

From Celtics Battles To Cavaliers Success Key Lessons Learned

May 07, 2025

From Celtics Battles To Cavaliers Success Key Lessons Learned

May 07, 2025 -

La Palisades Fire A List Of Celebrities Affected By Home Losses

May 07, 2025

La Palisades Fire A List Of Celebrities Affected By Home Losses

May 07, 2025