2024 Canadian Economic Forecast: Ultra-Low Growth, According To David Dodge

Table of Contents

Dodge's Key Predictions for the Canadian Economy in 2024

David Dodge's central forecast paints a picture of sluggish economic activity for Canada in 2024. While precise numbers haven't been explicitly stated in all cases, his predictions consistently point towards ultra-low growth. This suggests a significant slowdown compared to previous years and raises concerns about the overall economic health of the nation.

- Expected GDP growth rate according to Dodge: While a specific percentage isn't consistently cited across all of Dodge's statements, the general consensus from his analysis points towards a GDP growth rate significantly below the historical average, potentially in the range of 1% or less.

- Key sectors most affected: Dodge's analysis suggests the housing market will be particularly hard hit, along with sectors sensitive to interest rate changes, such as manufacturing and consumer discretionary spending. The impact will ripple through the economy, affecting related industries and employment.

- Impact on job creation and unemployment rates: Ultra-low growth typically translates to subdued job creation and potentially even a rise in unemployment rates. The extent of this impact will depend on the severity of the slowdown and the adaptability of the workforce.

Underlying Factors Contributing to Ultra-Low Growth

Several interconnected factors underpin Dodge's prediction of ultra-low growth for the Canadian economy in 2024. These factors create a challenging economic environment for both businesses and consumers.

- High interest rates and their impact on consumer spending and investment: The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, are significantly impacting consumer spending and business investment. Higher borrowing costs reduce disposable income and discourage expansion plans.

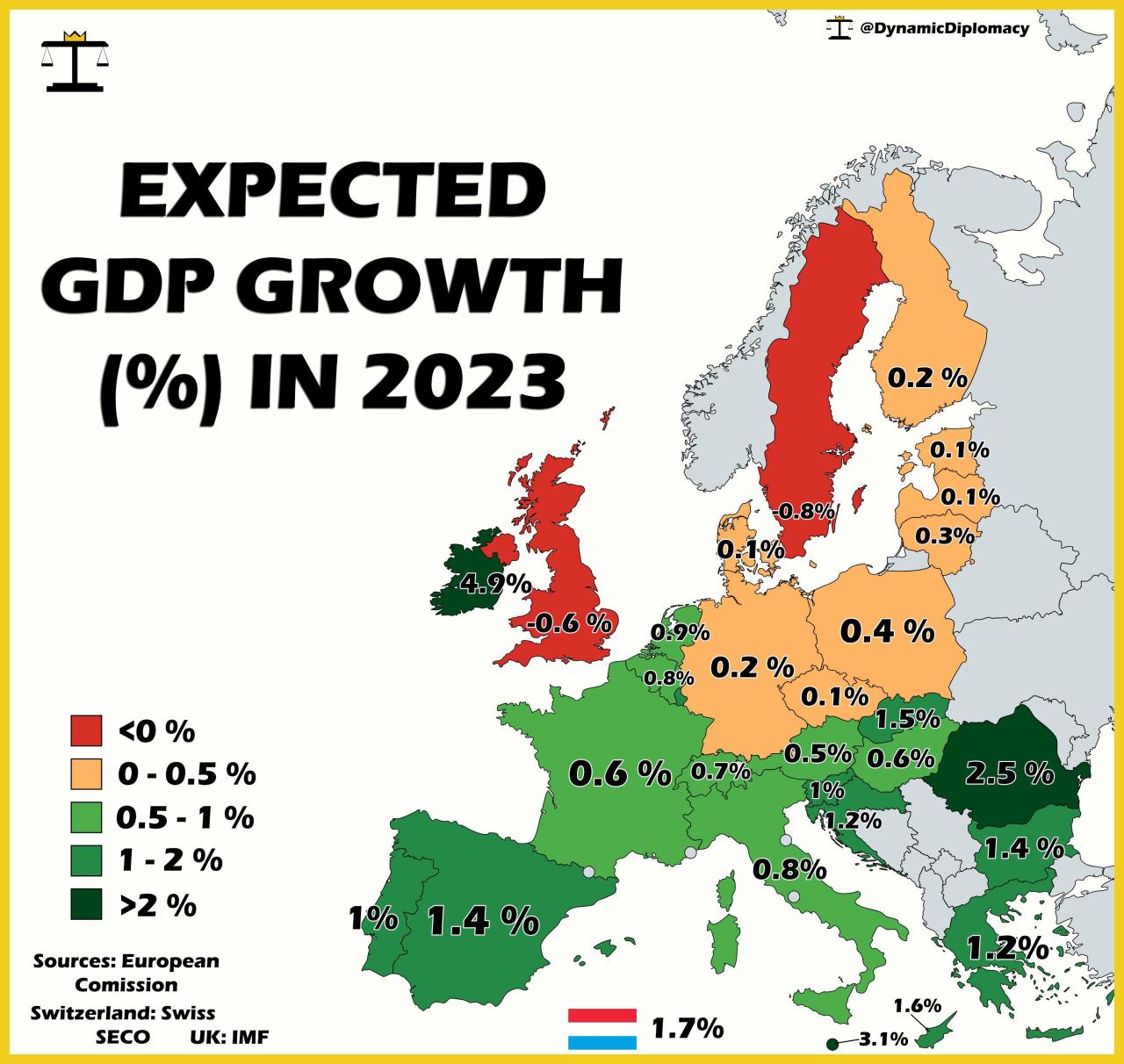

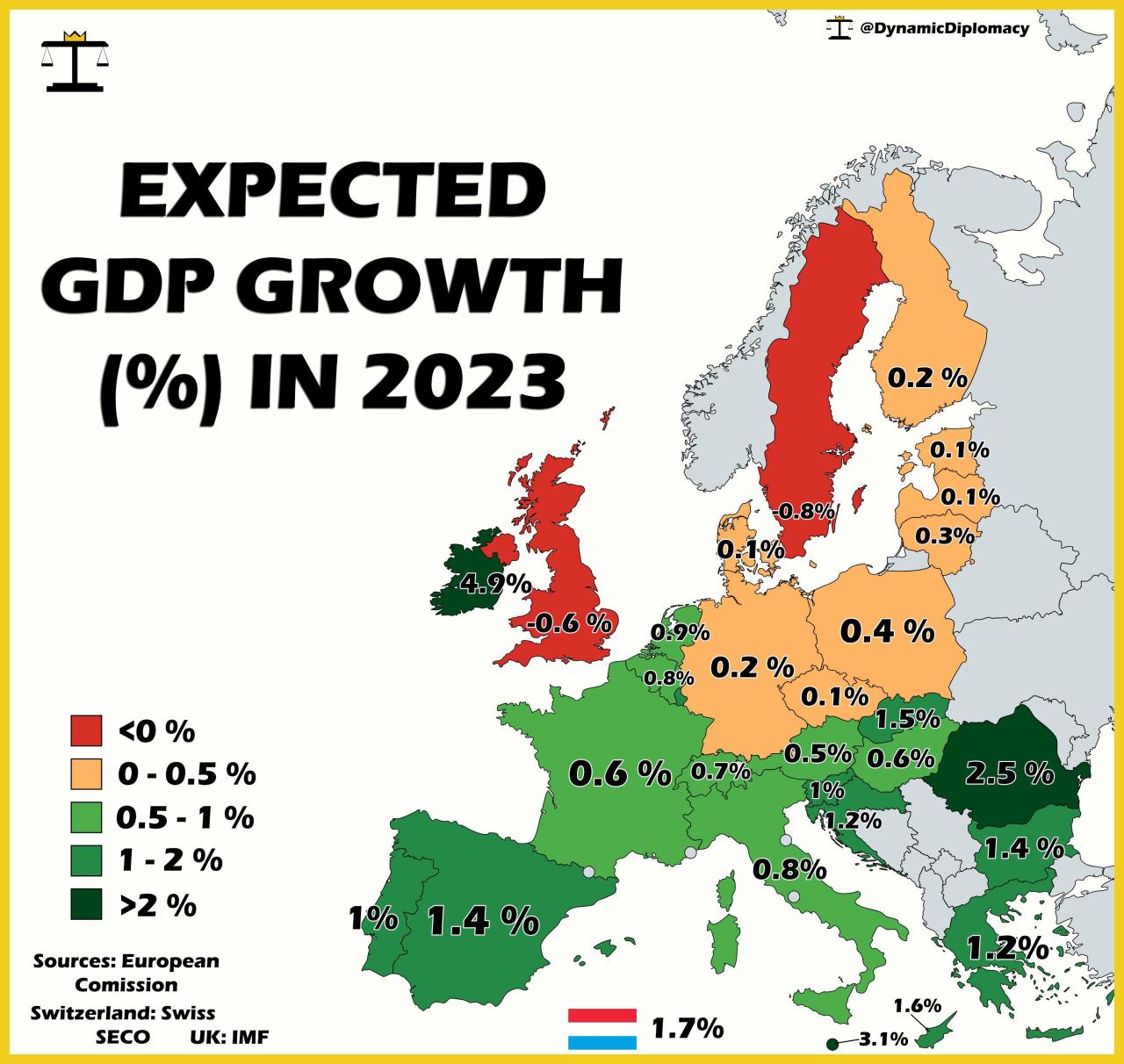

- Global economic slowdown and its effect on Canadian exports: A global economic slowdown, impacting key trading partners like the United States and the European Union, will inevitably dampen demand for Canadian exports, negatively affecting key sectors of the Canadian economy.

- Inflationary pressures and their persistent impact on the economy: Persistent inflationary pressures continue to erode purchasing power, further dampening consumer spending and business confidence, and exacerbating the challenges faced by the Canadian economy.

- Geopolitical instability and its potential consequences: Global geopolitical uncertainty, including the ongoing war in Ukraine and trade tensions, adds further layers of complexity and risk to the Canadian Economic Forecast, creating headwinds for growth.

- Potential for a recession and its severity: Given the confluence of these factors, the potential for a recession in 2024, though not explicitly stated by Dodge in all instances, looms large. The severity of any potential recession will depend largely on the effectiveness of government policy responses.

The Housing Market in Dodge's 2024 Canadian Economic Forecast

The housing market is expected to be particularly vulnerable in Dodge's 2024 Canadian Economic Forecast. The interconnectedness between the housing market and overall economic health is undeniable.

- Expected changes in house prices: Dodge's projections likely include a prediction of further price corrections or stagnation in the housing market, reflecting the impact of high interest rates and reduced consumer confidence.

- Impact on mortgage rates and affordability: High and potentially rising mortgage rates will continue to squeeze affordability, making homeownership more challenging for many Canadians.

- Potential for a housing market correction: A further correction in the housing market, while potentially painful in the short-term, could eventually lead to a more sustainable and balanced market in the long run. However, this correction poses significant risks to the broader economy.

Implications for Canadian Businesses and Consumers

Ultra-low growth will have significant implications for Canadian businesses and consumers. Understanding these potential consequences is vital for effective planning and adaptation.

- Challenges for businesses regarding investment and expansion: Businesses will face challenges in securing financing for investment and expansion plans, potentially leading to delayed projects and reduced hiring.

- Impact on consumer confidence and spending habits: Reduced consumer confidence will likely lead to more cautious spending habits, impacting various sectors of the economy.

- Potential for increased personal debt: As consumers grapple with rising costs and reduced income, personal debt could increase, further straining household budgets.

- Government policy responses and their effectiveness: The effectiveness of government policy responses in mitigating the negative impacts of ultra-low growth will be crucial in shaping the overall economic trajectory.

Alternative Perspectives and Counterarguments

While Dodge's prediction of ultra-low growth is a serious concern, it's important to consider alternative viewpoints and acknowledge potential counterarguments.

- Optimistic scenarios and their likelihood: Some economists may point to potential positive developments, such as increased government investment or unexpected technological advancements, that could provide a boost to the Canadian economy. However, the likelihood of these optimistic scenarios depends heavily on external factors and the ability to mitigate current challenges.

- Potential for unexpected positive economic developments: Unforeseen global events or domestic policy changes could positively impact the Canadian Economic Forecast. However, relying on these unexpected events is not a sound strategic approach.

- Areas of strength in the Canadian economy that may mitigate the negative impacts: Certain sectors of the Canadian economy, such as resource extraction or technology, might demonstrate resilience and contribute to mitigating the negative impacts of the overall slowdown.

Conclusion

David Dodge's 2024 Canadian Economic Forecast predicts ultra-low growth, driven by high interest rates, global economic slowdown, persistent inflation, geopolitical instability, and a potential recession. These factors will significantly impact Canadian businesses and consumers, leading to challenges in investment, reduced consumer spending, and potential increases in personal debt. While alternative perspectives and optimistic scenarios exist, understanding the potential for ultra-low growth is crucial for informed decision-making. Stay informed about the evolving Canadian Economic Forecast and its impact on your personal finances and business decisions. Regularly check for updates on the Canadian Economic Forecast and adapt your strategies accordingly to navigate this challenging economic climate.

Featured Posts

-

Is That Christina Aguilera Fans Discuss Her Altered Look

May 02, 2025

Is That Christina Aguilera Fans Discuss Her Altered Look

May 02, 2025 -

Enexis En Kampen In Juridisch Gevecht Aansluiting Stroomnet Vertraagd

May 02, 2025

Enexis En Kampen In Juridisch Gevecht Aansluiting Stroomnet Vertraagd

May 02, 2025 -

Waarom Geeft Nrc Zijn Abonnees Nu Gratis Toegang Tot The New York Times

May 02, 2025

Waarom Geeft Nrc Zijn Abonnees Nu Gratis Toegang Tot The New York Times

May 02, 2025 -

Amy Irvings Mother Priscilla Pointer Dead At Age 100

May 02, 2025

Amy Irvings Mother Priscilla Pointer Dead At Age 100

May 02, 2025 -

Souness Choice The Best Premier League Player According To The Legend

May 02, 2025

Souness Choice The Best Premier League Player According To The Legend

May 02, 2025

Latest Posts

-

Understanding The Candidates In Your Nl Federal Election

May 10, 2025

Understanding The Candidates In Your Nl Federal Election

May 10, 2025 -

Whos Running In Your Nl Federal Riding A Voters Guide

May 10, 2025

Whos Running In Your Nl Federal Riding A Voters Guide

May 10, 2025 -

Living Legends Of Aviation Ceremony Celebrates Firefighters And Community Heroes

May 10, 2025

Living Legends Of Aviation Ceremony Celebrates Firefighters And Community Heroes

May 10, 2025 -

Nl Federal Election 2023 Candidate Profiles And Platforms

May 10, 2025

Nl Federal Election 2023 Candidate Profiles And Platforms

May 10, 2025 -

Aviations Living Legends Recognize Bravery Honoring Firefighters And More

May 10, 2025

Aviations Living Legends Recognize Bravery Honoring Firefighters And More

May 10, 2025