£3 Billion Slash To SSE Spending Plan: Responding To Economic Headwinds

Table of Contents

The Impact of Economic Headwinds on SSE's Investment Strategy

The UK's current economic climate is undeniably challenging. Businesses across all sectors are grappling with rising inflation, squeezing profit margins and hindering investment. For energy companies like SSE, the situation is particularly acute. The cost of securing funding has increased dramatically due to higher interest rates, making it more expensive to finance large-scale projects. This directly impacts SSE's ability to invest in crucial areas like renewable energy development and network infrastructure upgrades.

The impact on SSE's ambitious plans is substantial. The company's commitment to transitioning to a low-carbon energy future is being tested by the current economic realities. The increased costs associated with developing renewable energy sources are a major factor.

- Rising material costs: The price increases for materials like steel, copper, and concrete significantly inflate project budgets.

- Increased borrowing costs: Higher interest rates make it significantly more expensive to borrow the capital needed for large-scale infrastructure projects.

- Supply chain disruptions: Ongoing global supply chain issues add delays and increase costs further.

- Reduced consumer demand: The cost-of-living crisis is impacting consumer demand, potentially affecting the returns on investment in new energy generation and distribution infrastructure.

Specific Areas Affected by the £3 Billion Reduction

The £3 billion reduction in SSE's spending plan is not evenly distributed. Certain projects and areas of the business will feel the impact more acutely than others. While precise details may remain undisclosed for competitive reasons, it's likely that:

- Renewable energy projects: New wind farm constructions and other renewable energy projects are likely to experience delays or even cancellations. This might include specific projects like [insert specific example of a delayed or cancelled project if available, e.g., the planned expansion of the Viking wind farm].

- Network infrastructure improvements: Upgrades to the UK's electricity grid are crucial for integrating renewable energy sources. However, cutbacks could lead to delays in essential upgrades in critical locations, potentially affecting grid stability and the integration of renewable energy sources. [Insert specific location or project examples if available].

- R&D initiatives: Research and development into new energy technologies might also see reduced funding, potentially hindering long-term innovation.

- Customer service investments: Investment in improved customer service infrastructure and digital tools might be scaled back, potentially impacting customer experience.

The announcement also raises concerns about job security. While SSE has not yet confirmed any major job losses, the reduction in spending could indirectly lead to redundancies through project cancellations and a slowdown in hiring.

SSE's Response and Future Outlook

SSE's official statement regarding the spending cuts acknowledges the challenging economic climate and highlights the need for a revised investment strategy. The company is focusing on cost-cutting measures, restructuring projects to prioritize the most essential initiatives, and concentrating on core business areas to maintain financial stability.

- Cost-cutting measures: This likely includes streamlining operations, renegotiating contracts, and possibly reducing non-essential expenditure.

- Restructuring of projects: Projects are likely being reviewed for feasibility and economic viability, with some being delayed or scaled back.

- Focus on core business areas: SSE may be concentrating its resources on its most profitable and essential operations.

- Revised investment timeline: The company will likely adjust its investment plans to reflect the reduced budget and economic uncertainties.

The long-term implications for SSE's growth and market position remain uncertain. The ability to successfully navigate this period of economic hardship will significantly impact its future competitiveness. The effect on energy prices and the UK's overall energy security is another crucial aspect that requires close monitoring.

Wider Implications for the UK Energy Sector

SSE's decision to slash its spending plan has significant implications for the wider UK energy sector. Other energy companies are likely to face similar pressures, potentially leading to widespread cutbacks in investment. This could significantly impact the UK's ambitious energy transition goals.

- Impact on renewable energy deployment: Delays in renewable energy projects could slow down the UK's progress toward its net-zero targets.

- Potential delays in energy infrastructure upgrades: Delays in grid modernization could hinder the integration of renewable energy sources and compromise energy security.

- Implications for the UK's climate change commitments: Reduced investment in green energy technologies could make it more challenging to meet the UK's climate change commitments.

- Competitiveness of the UK energy market: The slowdown in investment could impact the UK's competitiveness in the global green energy market.

Conclusion: Understanding the £3 Billion SSE Spending Cut and its Long-Term Effects

The £3 billion reduction in SSE's spending plan is a stark indication of the significant challenges facing the UK energy sector. Soaring inflation, increased borrowing costs, and supply chain disruptions have forced the company to reassess its investment strategy. The impact will be felt across various areas, from renewable energy projects to grid upgrades, potentially leading to delays and impacting the UK's energy transition goals. The long-term effects on SSE's growth, the wider energy sector, and the UK's climate commitments remain to be seen. Staying informed about further developments in SSE's spending plan and the UK energy market is crucial. Subscribe to our newsletter or follow us on social media to stay updated on the latest news regarding SSE investment strategy and the UK energy sector investment landscape.

Featured Posts

-

Eleven Injured One Killed In Myrtle Beach Police Shooting Sled Investigation Underway

May 25, 2025

Eleven Injured One Killed In Myrtle Beach Police Shooting Sled Investigation Underway

May 25, 2025 -

Lvmh Shares Plunge 8 2 Q1 Sales Disappoint

May 25, 2025

Lvmh Shares Plunge 8 2 Q1 Sales Disappoint

May 25, 2025 -

Apple Stock Key Levels And Q2 Earnings Report

May 25, 2025

Apple Stock Key Levels And Q2 Earnings Report

May 25, 2025 -

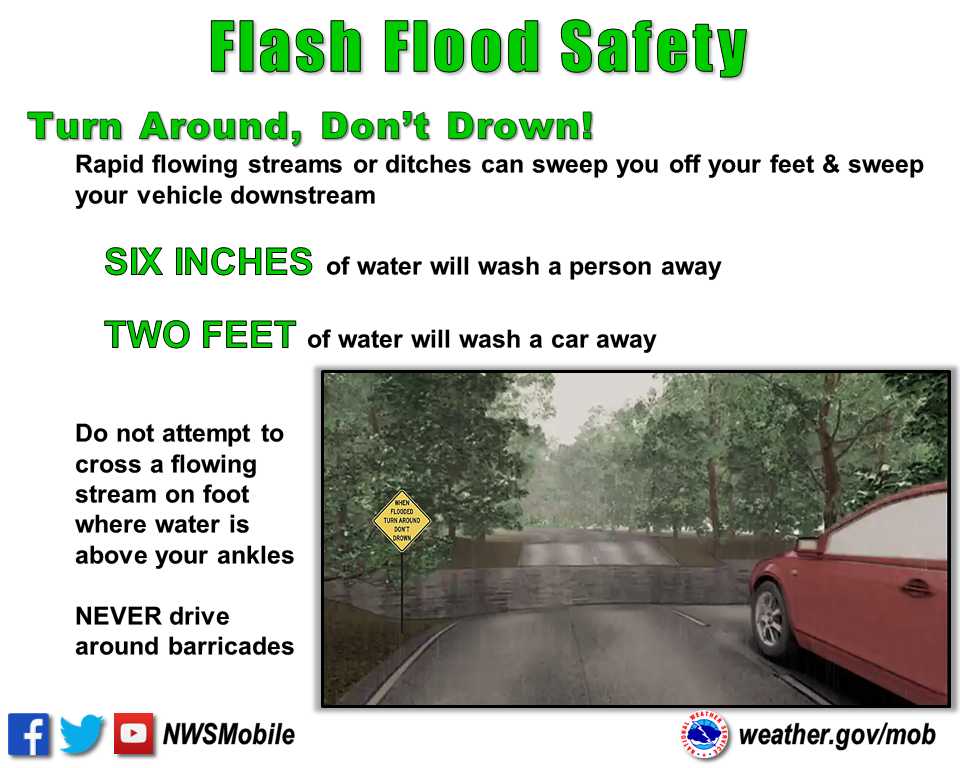

Severe Weather Awareness Week Day 5 Flood Safety Tips And Preparedness

May 25, 2025

Severe Weather Awareness Week Day 5 Flood Safety Tips And Preparedness

May 25, 2025 -

Imcd N V Annual General Meeting All Resolutions Passed

May 25, 2025

Imcd N V Annual General Meeting All Resolutions Passed

May 25, 2025

Latest Posts

-

George L Russell Jr Maryland Legal Giant And Progressive Icon Passes Away

May 25, 2025

George L Russell Jr Maryland Legal Giant And Progressive Icon Passes Away

May 25, 2025 -

Claire Williams Handling Of George Russell A Retrospective

May 25, 2025

Claire Williams Handling Of George Russell A Retrospective

May 25, 2025 -

1 5m Debt Paid George Russells Financial Situation And Future With Mercedes

May 25, 2025

1 5m Debt Paid George Russells Financial Situation And Future With Mercedes

May 25, 2025 -

George Russells 1 5m Debt Repayment A Sign Of Things To Come At Mercedes

May 25, 2025

George Russells 1 5m Debt Repayment A Sign Of Things To Come At Mercedes

May 25, 2025 -

Mercedes F1 Toto Wolff Offers Further Insight Into George Russells Contract

May 25, 2025

Mercedes F1 Toto Wolff Offers Further Insight Into George Russells Contract

May 25, 2025