30% Drop For Palantir: Investment Opportunity Or Warning Sign?

Table of Contents

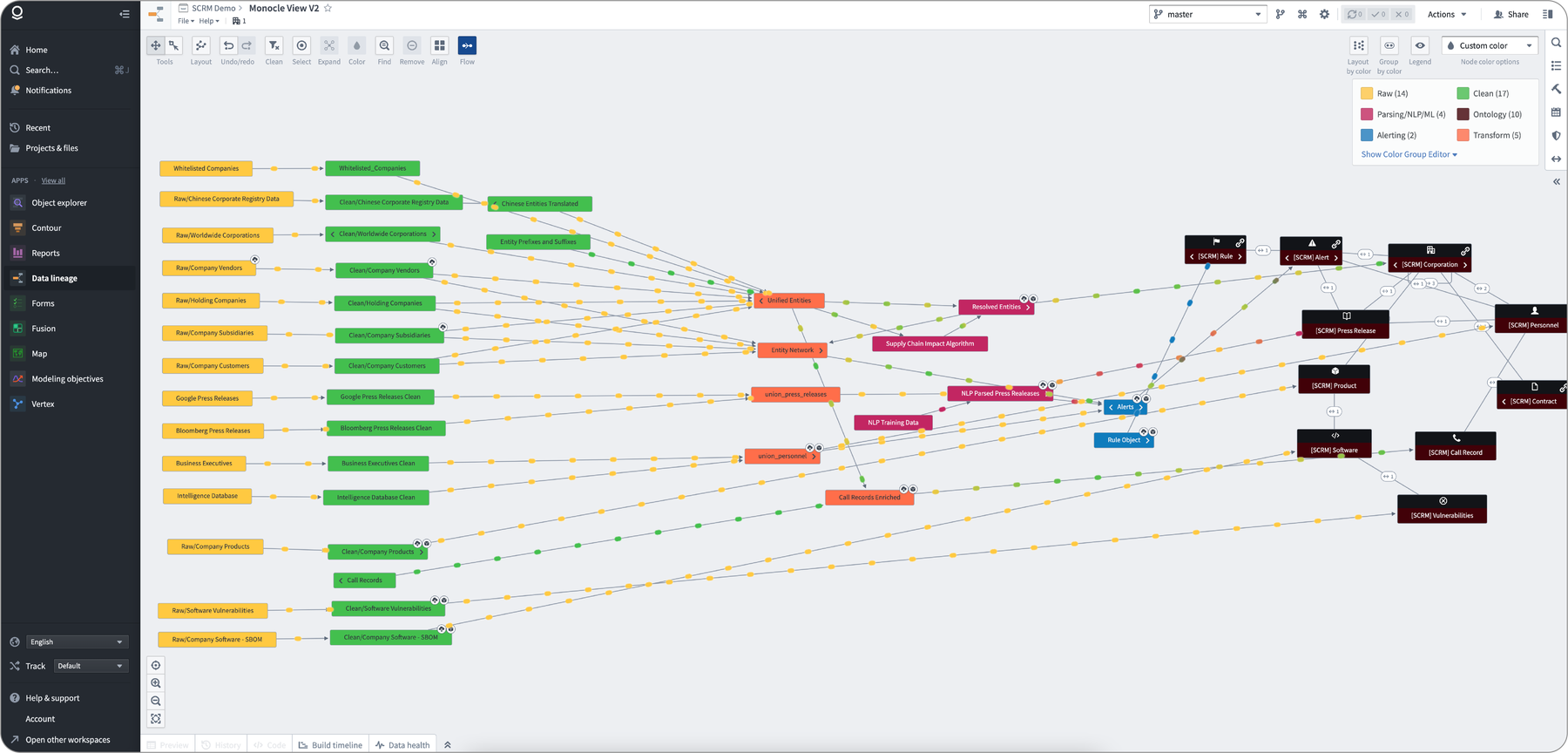

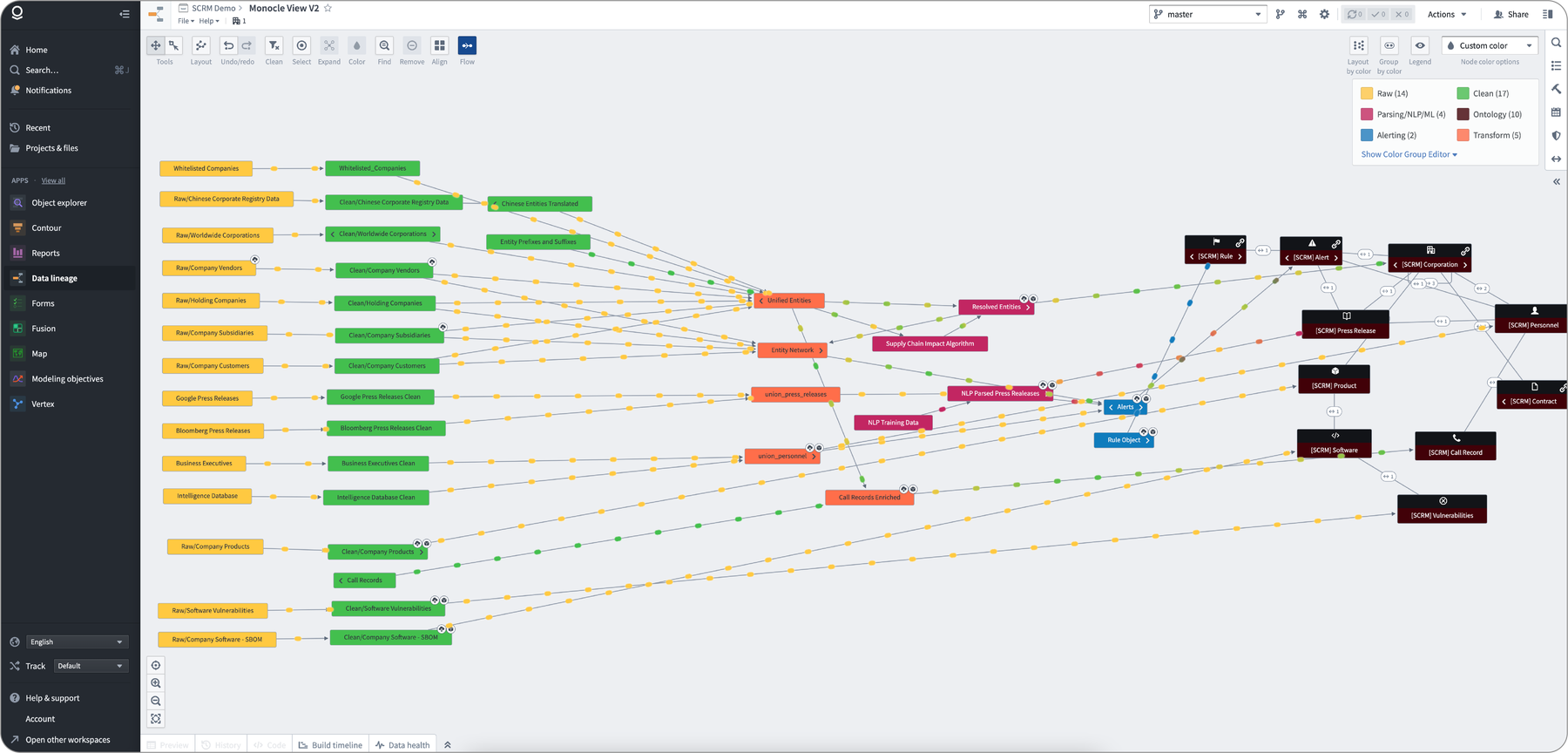

Analyzing the 30% Palantir Stock Decline

Potential Causes of the Drop

Several factors likely contributed to the recent Palantir stock decline. Understanding these is key to assessing the investment opportunity.

-

Broader Market Downturn: The tech sector, particularly growth stocks like Palantir, has been significantly impacted by recent market volatility. Rising interest rates and fears of a recession have led to a widespread sell-off in growth stocks, dragging down even strong performers like Palantir. This broader market trend in tech stocks must be considered.

-

Concerns about Palantir's Revenue Growth and Profitability: While Palantir has demonstrated significant revenue growth, concerns remain about its path to profitability. Investors are scrutinizing the company's ability to consistently deliver on its financial projections and achieve sustainable profitability. Analyzing Palantir's quarterly earnings reports is vital for understanding these concerns. Look for data on revenue growth rates, operating margins, and net income.

-

Increased Competition in the Data Analytics Sector: The data analytics market is highly competitive, with established players and emerging startups vying for market share. Increased competition can pressure pricing and margins, impacting Palantir's financial performance. Understanding Palantir's competitive advantages and its strategies to maintain a strong market position is essential.

-

Impact of Geopolitical Instability: Palantir's business significantly relies on government contracts, particularly in the US. Geopolitical uncertainty and shifts in government priorities can affect the timing and size of these contracts, influencing the company’s revenue stream and impacting investor sentiment. Tracking geopolitical events and their potential influence on government spending is crucial for assessing Palantir’s stock.

-

Specific News or Events: Negative news or announcements directly related to Palantir can trigger significant selling pressure. For instance, a missed earnings target, a loss of a major contract, or a negative regulatory development could all contribute to a stock price decline. Staying updated on Palantir-related news from reputable financial sources is therefore important.

-

Bullet Points:

- Check Palantir's investor relations page for official financial statements and press releases. [Link to Palantir Investor Relations]

- Compare Palantir's performance against its competitors such as Snowflake, Databricks, and Tableau. [Links to competitor financial reports]

- Monitor major financial news outlets for up-to-date information and analysis of Palantir's stock performance. [Links to reputable financial news sources]

Examining Palantir's Financial Performance

Analyzing Palantir's recent financial reports (quarterly and annual) is essential to evaluate its financial health and assess the long-term viability of the company. Key metrics to examine include:

-

Revenue Growth: Examine the trend in revenue growth over time to assess the company's ability to expand its business and penetrate new markets.

-

Operating Margins: Analyze the operating margins to evaluate the company's profitability and efficiency. Improving margins suggest increasing operational strength and may influence future Palantir stock prices.

-

Debt Levels: Assess the company's debt levels and its ability to manage its financial obligations. High debt levels can be a risk factor and influence investor decisions.

-

Bullet Points:

- Compare Palantir's key financial metrics to its competitors to assess its relative performance and standing within the industry.

- Use charts and graphs to visualize the trends in Palantir's financial data to better understand its financial health.

- Look for signs of improvement or deterioration in Palantir’s financial position in recent reports.

Evaluating the Investment Opportunity

Risk Assessment

Investing in Palantir, like any stock, involves risks. Key risks to consider include:

-

Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. Changes in government policy or budget cuts could negatively impact the company's financial performance.

-

Technological Advancements and Competition: The data analytics industry is constantly evolving. Rapid technological advancements and intense competition could render Palantir's technologies obsolete or less competitive over time.

-

Bullet Points:

- Consider the possibility of further price drops in the Palantir stock price before investing.

- Assess your own risk tolerance before making any investment decision related to Palantir stock.

- Diversify your investment portfolio to minimize the impact of potential losses on your overall investment.

Potential for Growth

Despite the risks, Palantir possesses significant potential for long-term growth:

-

Innovative Technologies: Palantir offers cutting-edge data analytics and artificial intelligence technologies that are in high demand across various industries.

-

Market Position: The company holds a strong position in the government and commercial sectors, giving it a solid foundation for future expansion.

-

Expansion into New Markets: Palantir has opportunities to expand into new markets and applications for its technologies, further driving future growth and increasing its potential value.

-

Bullet Points:

- Research Palantir's new product offerings and partnerships for potential growth catalysts.

- Analyze the size and growth potential of the data analytics market to assess Palantir's future prospects.

- Consider the potential for Palantir to disrupt other industries using its technology.

Comparing Palantir to Competitors

Understanding Palantir's competitive landscape is critical for making an informed investment decision. Compare Palantir to competitors such as Snowflake, Databricks, and others based on:

-

Market Share: Analyze the market share held by Palantir and its competitors.

-

Growth Potential: Evaluate the growth potential of each company and its competitive advantages.

-

Financial Performance: Compare key financial metrics such as revenue growth, profitability, and debt levels.

-

Bullet Points:

- Use comparative analysis tools to assess Palantir’s competitive position.

- Identify any significant competitive advantages or disadvantages held by Palantir.

- Assess the overall industry outlook and growth potential.

Conclusion

The 30% drop in Palantir stock presents a complex investment scenario. While the broader market downturn, concerns about profitability, and increased competition pose significant risks, Palantir's innovative technologies, strong market position, and potential for expansion into new markets offer a counterbalance. Before making any decisions regarding your Palantir investment or other investments in similar tech stocks, a thorough assessment of your risk tolerance, comprehensive due diligence, and further research into Palantir's financials and the broader market conditions are crucial. Only then can you determine whether this significant drop in Palantir stock presents a genuine investment opportunity or a warning sign.

Featured Posts

-

Kiev 9 Maya Starmer Makron Merts I Tusk Ne Primut Uchastie V Meropriyatiyakh

May 09, 2025

Kiev 9 Maya Starmer Makron Merts I Tusk Ne Primut Uchastie V Meropriyatiyakh

May 09, 2025 -

Who Is Casey Means Trumps Pick For Surgeon General Explained

May 09, 2025

Who Is Casey Means Trumps Pick For Surgeon General Explained

May 09, 2025 -

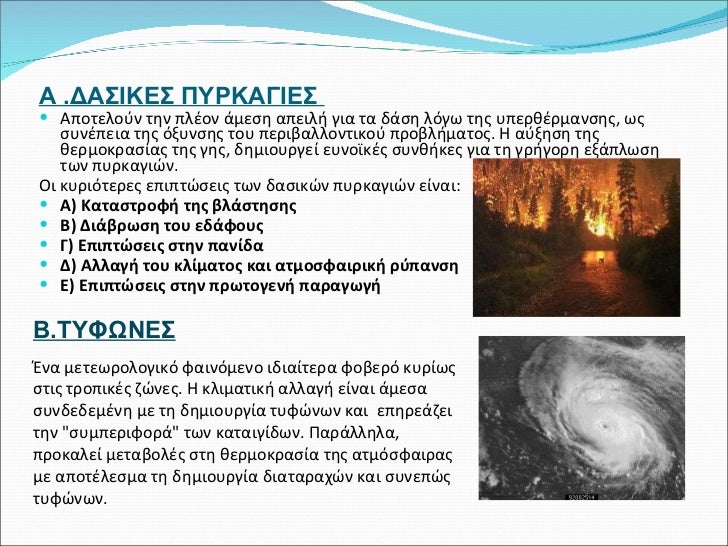

I Epidrasi Tis Klimatikis Allagis Sta Xionoskepi Imalaia

May 09, 2025

I Epidrasi Tis Klimatikis Allagis Sta Xionoskepi Imalaia

May 09, 2025 -

Edmontons Nordic Spa Dreams Closer To Reality Council Approves Rezoning

May 09, 2025

Edmontons Nordic Spa Dreams Closer To Reality Council Approves Rezoning

May 09, 2025 -

Bundesliga Preview Bayern Munichs Tough Test Against Eintracht Frankfurt

May 09, 2025

Bundesliga Preview Bayern Munichs Tough Test Against Eintracht Frankfurt

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025