30% Drop For Palantir: Time To Buy Or Sell?

Table of Contents

Palantir Technologies (PLTR) has experienced a significant 30% drop in its stock price, leaving investors scrambling to understand the implications and decide on their next move. This dramatic decline raises crucial questions: Is this a buying opportunity, a signal to sell, or simply a temporary setback? This article delves into the factors contributing to the Palantir price drop, analyzing the situation to help you make an informed decision about your Palantir investment.

Understanding the 30% Palantir Stock Price Decline

Market Sentiment and Investor Fear

The recent 30% drop in Palantir stock price isn't happening in a vacuum. Broader market conditions significantly impact growth stocks like Palantir. The current economic climate is characterized by:

- A broader tech sector downturn: Many technology companies, particularly those reliant on future growth projections, have seen significant valuation corrections. This overall negative sentiment spills over into individual stocks like PLTR.

- Rising interest rates: Increased interest rates make borrowing more expensive, impacting company expansion plans and reducing investor appetite for growth stocks with high valuations but potentially lower near-term profits.

- Inflation concerns: Persistent inflation erodes purchasing power and increases uncertainty, prompting investors to shift towards more conservative investments. This flight to safety often negatively affects riskier assets like Palantir stock.

These factors, reported extensively in publications like the Wall Street Journal and Financial Times, contribute to a general atmosphere of investor fear, impacting sentiment towards PLTR and other growth stocks.

Palantir's Recent Financial Performance and Guidance

Palantir's recent financial performance and guidance also play a crucial role in its stock price fluctuations. While the company has shown consistent revenue growth, certain key metrics warrant close examination:

- Revenue Growth: While revenue has generally increased, the rate of growth may have fallen short of market expectations, leading to sell-offs.

- Operating Income and Profit Margins: Analyzing the company's operating income and profit margins helps to understand its profitability and sustainability. Any significant deviation from projections can influence investor confidence.

- Cash Flow: A strong cash flow is essential for a company's long-term health. Analyzing cash flow trends provides insights into Palantir's financial stability and future potential.

Discrepancies between Palantir's actual financial performance and market expectations often lead to significant price volatility. Investors closely scrutinize earnings reports for any signs of slowing growth or unmet targets, which can trigger sell-offs.

Geopolitical Factors and Their Impact on Palantir

Geopolitical events significantly influence Palantir's performance, especially given its dependence on government contracts. The ongoing war in Ukraine and broader global instability create uncertainty:

- Government Contracts: Geopolitical instability can impact the awarding and timing of government contracts, a significant revenue stream for Palantir. Delays or cancellations can negatively affect investor confidence.

- International Operations: Palantir operates globally, making it susceptible to disruptions caused by geopolitical tensions. Sanctions, trade wars, or other conflicts can affect business operations and revenue.

Understanding the potential long-term implications of these geopolitical factors is crucial for assessing the future prospects of PLTR stock.

Analyzing the Potential for Future Growth of Palantir Stock

Palantir's Long-Term Growth Strategy and Market Position

Despite the recent setbacks, Palantir's long-term growth strategy remains a key factor in evaluating its investment potential. The company is focusing on:

- AI and Big Data Analytics: Palantir's expertise in AI and big data analytics positions it favorably in a rapidly growing market. This focus allows them to offer advanced solutions to various sectors.

- Strategic Partnerships and Acquisitions: Strategic partnerships and acquisitions can expand Palantir's market reach and technological capabilities, bolstering future growth.

- Expanding into New Markets: Diversification into new markets reduces dependence on any single sector, enhancing resilience and growth prospects.

Palantir's competitive advantages in data analytics and its potential to capture market share in emerging sectors contribute to its long-term growth potential.

Assessing the Risk-Reward Ratio for Investing in Palantir

Investing in Palantir involves inherent risks that must be carefully considered:

- Stock Volatility: PLTR is known for its significant price volatility, making it a higher-risk investment.

- Competition: The data analytics market is competitive, with established players and emerging startups vying for market share.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts, creating vulnerability to changes in government spending or policy.

Weighing the potential rewards of future growth against these risks is crucial in determining the risk-reward ratio for potential investors. A thorough analysis of these factors is essential before making any investment decision.

Expert Opinions and Analyst Recommendations on Palantir Stock

Summarize key findings and recommendations from reputable financial analysts

Several financial analysts offer varying perspectives on Palantir's future. Some analysts maintain a bullish outlook, citing Palantir's technological advantages and long-term growth potential. Their reports often include target prices significantly higher than the current market price, suggesting a potential upside for investors. You can find these reports on reputable financial news websites and analyst platforms. Conversely, other analysts express caution, highlighting the risks associated with the stock's volatility and dependence on government contracts. These bearish forecasts may include lower target prices or even "sell" recommendations.

Diverse perspectives on the future of Palantir

It's crucial to review a variety of opinions to form a comprehensive understanding of the investment landscape. Remember that analyst predictions are not guarantees, and the actual performance of Palantir stock may differ from any forecast.

Conclusion

The 30% drop in Palantir's stock price presents a complex investment scenario. While the current market conditions and recent financial performance raise concerns, Palantir's long-term growth strategy and technological capabilities offer potential upside. Investors must carefully weigh the risks associated with the stock's volatility and dependence on government contracts against the potential rewards of long-term growth in the data analytics market. Remember to conduct thorough due diligence, considering your own risk tolerance and financial goals, before making any investment decisions. Consult with a financial advisor for personalized guidance. Make an informed decision about your Palantir investment today.

Featured Posts

-

The Whats App Spyware Case Metas 168 Million Defeat And What It Means

May 10, 2025

The Whats App Spyware Case Metas 168 Million Defeat And What It Means

May 10, 2025 -

Ajaxs Brobbey A Powerful Force In The Europa League

May 10, 2025

Ajaxs Brobbey A Powerful Force In The Europa League

May 10, 2025 -

Zolotaya Malina Dakota Dzhonson I Samye Provalnye Filmy Goda

May 10, 2025

Zolotaya Malina Dakota Dzhonson I Samye Provalnye Filmy Goda

May 10, 2025 -

Jessica Tarlov And Jeanine Pirro Clash Over Canada Trade Dispute

May 10, 2025

Jessica Tarlov And Jeanine Pirro Clash Over Canada Trade Dispute

May 10, 2025 -

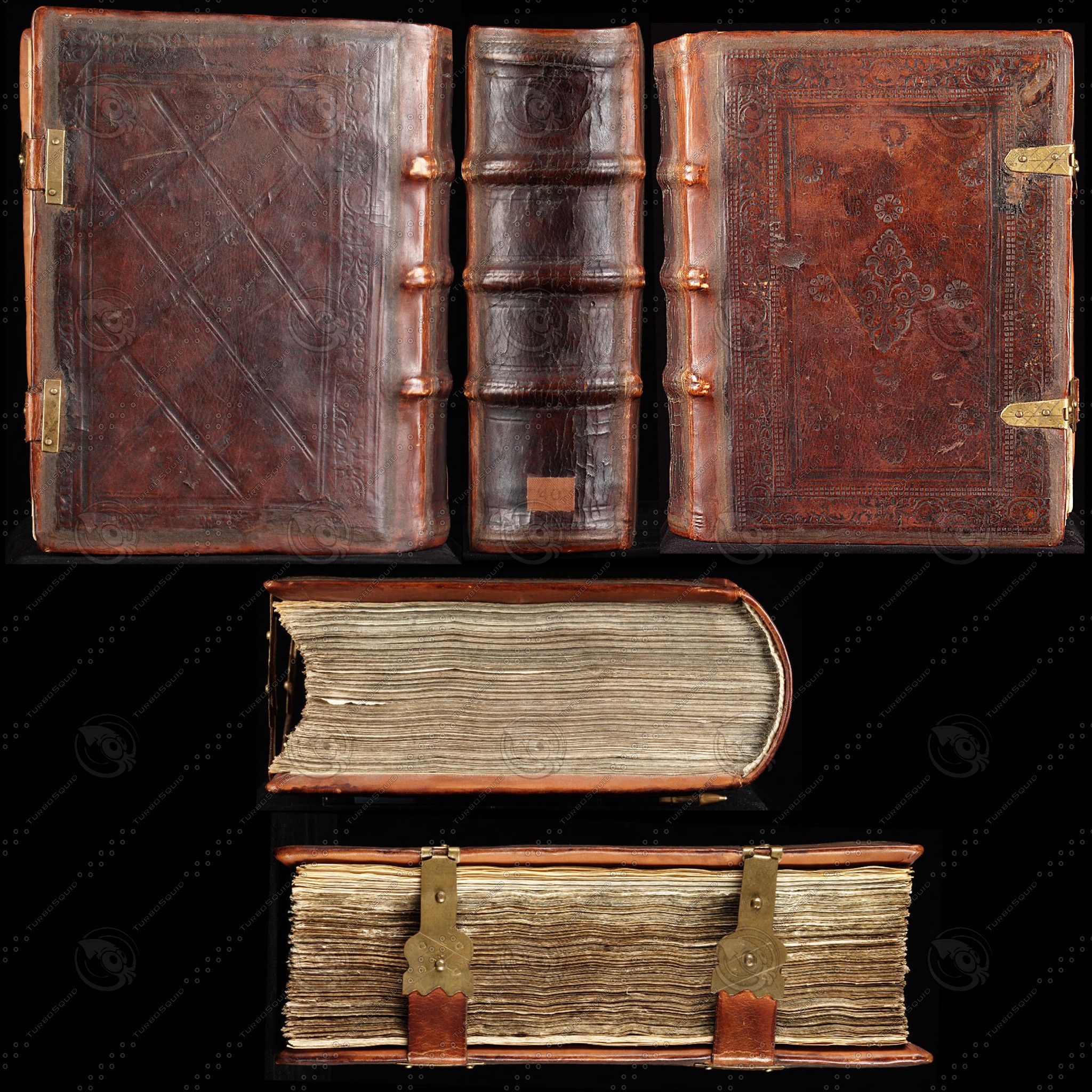

A Medieval Book Covers Hidden Story Merlin And King Arthurs Tale

May 10, 2025

A Medieval Book Covers Hidden Story Merlin And King Arthurs Tale

May 10, 2025