30-Year Treasury Yield Hits 5%: Implications For The 'Sell America' Narrative

Table of Contents

The Significance of the 5% 30-Year Treasury Yield

A 5% 30-year Treasury yield represents a notable shift in the bond market, carrying significant weight for investors and policymakers alike. Let's explore its impact on key areas:

Impact on Inflation Expectations

A 5% yield often reflects heightened inflation expectations or anxieties about future inflation. This directly impacts the attractiveness of US Treasuries as an inflation hedge.

- Higher yields as inflation compensation: The market attempts to compensate for the anticipated erosion of purchasing power through higher yields. Investors demand a higher return to offset the risk of inflation diminishing the real value of their investment.

- Portfolio reallocation: Investors may reassess their inflation-hedging strategies and adjust their portfolio allocations accordingly. This might involve shifting towards assets that historically perform well during inflationary periods, such as commodities or real estate.

- Federal Reserve's influence: The Federal Reserve's monetary policy response will play a crucial role in determining future yield movements. Further interest rate hikes could push yields even higher, while a pause or reversal could lead to a decline.

Attractiveness of US Debt for Foreign Investors

Higher yields can make US debt more attractive to foreign investors, potentially counteracting some of the "Sell America" sentiment.

- Increased foreign demand: The allure of higher returns can draw capital inflows from overseas, strengthening the US dollar.

- Strong dollar implications: A stronger dollar, however, can negatively impact US exports, potentially hindering economic growth.

- Geopolitical and economic uncertainty: Global economic uncertainty and geopolitical risks can significantly influence foreign investment decisions. These factors can outweigh the appeal of higher yields.

The "Sell America" Narrative: Deconstructing the Thesis

The "Sell America" narrative reflects a pessimistic outlook on US assets, driven by several factors. Let's examine these concerns:

Underlying Factors Driving the Narrative

Several factors contribute to the "Sell America" narrative:

- Rising US debt levels: Concerns about the sustainability of the US national debt contribute to investor apprehension. High debt levels can lead to credit rating downgrades and increased borrowing costs.

- Political instability: Political polarization and uncertainty can erode investor confidence, making US assets less appealing.

- Global economic competition: The rise of other major economies presents increased competition for global investment, potentially diverting capital away from the US.

How Rising Yields Challenge the Narrative

The increase in the 30-year Treasury yield directly challenges certain aspects of the "Sell America" narrative:

- Attracting capital flows: Higher yields attract capital flows into the US, weakening the "Sell America" argument. This influx of capital can support the dollar and potentially stabilize the market.

- Increased confidence (to some extent): The higher yields, to a degree, suggest increased confidence in the long-term stability of the US economy, at least amongst a segment of investors.

- Short-term vs. long-term trend: It's critical to determine whether the rise in yields is a temporary phenomenon or a longer-term trend reflecting underlying economic strength or weakness.

Investment Implications and Strategic Responses

The rising 30-year Treasury yield presents both opportunities and risks across different asset classes.

Opportunities and Risks for Investors

The shift in yields impacts various asset classes:

- Opportunities: Higher yields can create opportunities for fixed-income investors seeking higher returns. However, rising rates can also impact stock valuations.

- Risks: Rising interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth. This can lead to decreased corporate earnings and lower stock prices.

- Portfolio diversification: Diversifying investments across various asset classes remains crucial to mitigate potential downside risks.

Re-evaluating Investment Strategies

The new yield environment demands a re-evaluation of investment strategies:

- Careful analysis: Thorough analysis is vital before making any investment decisions. Consider factors like risk tolerance, investment horizon, and economic outlook.

- Risk tolerance and investment goals: Strategies should align with individual risk tolerance and long-term investment goals.

- Professional financial advice: Seeking professional financial advice is recommended for personalized guidance.

Conclusion

The 30-year Treasury yield reaching 5% significantly impacts the prevailing "Sell America" narrative. Concerns about US debt and political uncertainty persist, but higher yields offer counterarguments by potentially attracting foreign investment and bolstering the dollar. Understanding the interplay between rising yields and the "Sell America" narrative is crucial for informed investment choices. Staying informed about the evolving 30-year Treasury yield and its broader economic implications is vital for effectively managing your investment portfolio and navigating the complexities of the global market. Consider seeking professional financial advice to tailor your investment strategy to the current 30-year Treasury yield environment.

Featured Posts

-

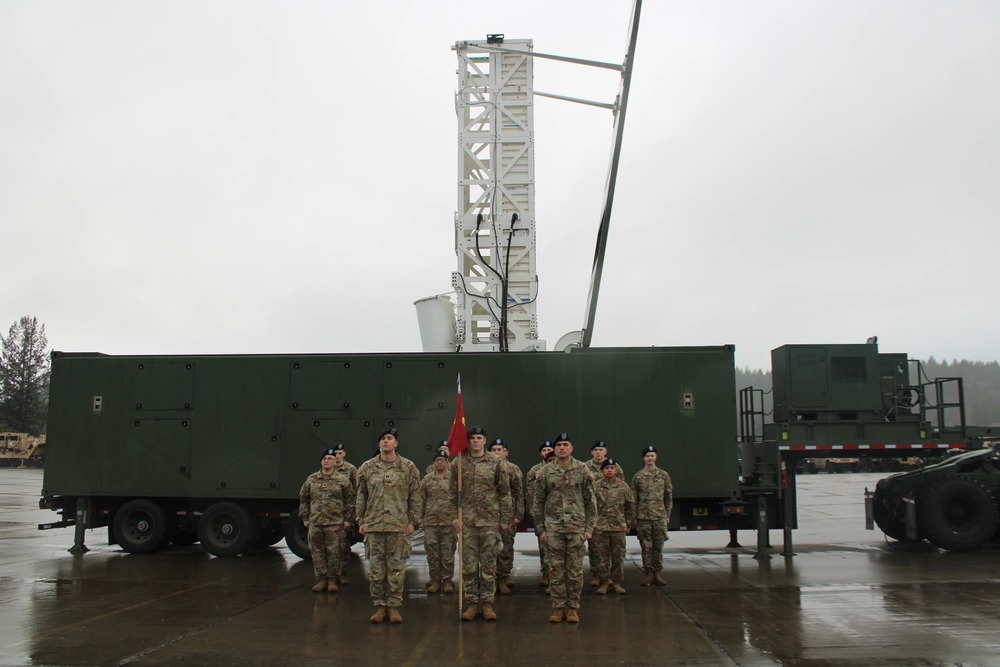

Regional Stability At Stake Chinas Plea Regarding Phls Typhon Missiles

May 20, 2025

Regional Stability At Stake Chinas Plea Regarding Phls Typhon Missiles

May 20, 2025 -

Two Supreme Court Justices Alito And Roberts Influence After Two Decades

May 20, 2025

Two Supreme Court Justices Alito And Roberts Influence After Two Decades

May 20, 2025 -

Ryanair Faces Tariff War Headwinds Announces Share Repurchase Plan

May 20, 2025

Ryanair Faces Tariff War Headwinds Announces Share Repurchase Plan

May 20, 2025 -

Fa Cup Rashfords Two Goals Secure Manchester United Victory Against Aston Villa

May 20, 2025

Fa Cup Rashfords Two Goals Secure Manchester United Victory Against Aston Villa

May 20, 2025 -

Lewis Hamiltonin Ja Ferrarin Yhteistyoe Mikae Meni Pieleen

May 20, 2025

Lewis Hamiltonin Ja Ferrarin Yhteistyoe Mikae Meni Pieleen

May 20, 2025