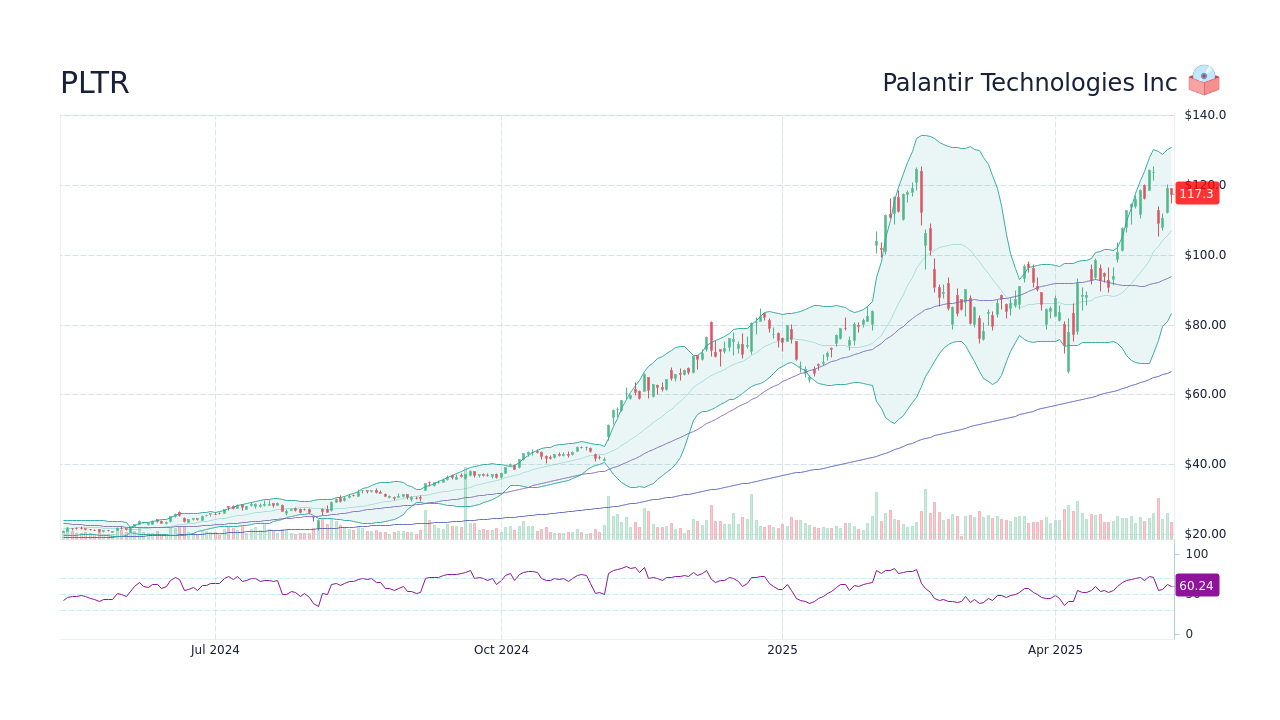

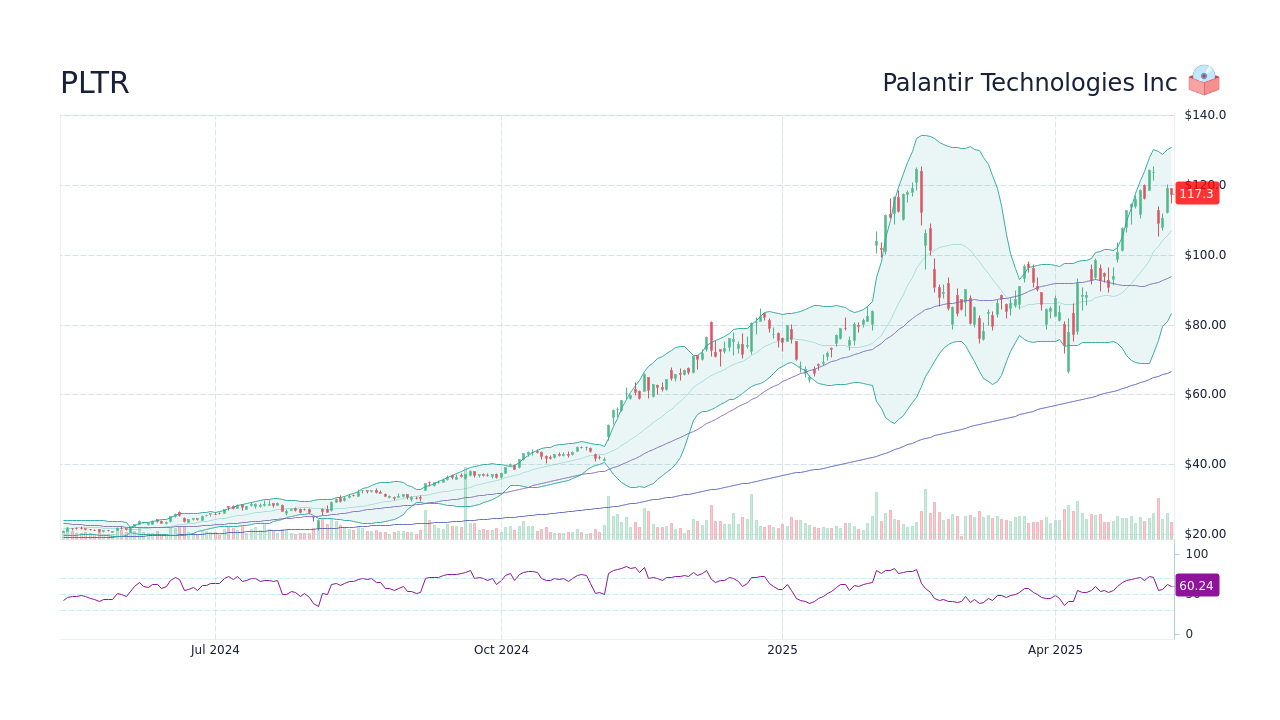

40% Palantir Stock Growth By 2025: A Realistic Investment Opportunity?

Table of Contents

Palantir's Current Market Position and Growth Potential

Analyzing Palantir's Revenue Streams and Recent Performance

Palantir's revenue is driven primarily by two segments: government contracts and commercial partnerships. Recent financial reports reveal a steady, albeit sometimes uneven, growth trajectory. Analyzing these reports is crucial for understanding the potential for Palantir stock growth.

- Government Contracts: A significant portion of Palantir's revenue comes from government contracts, particularly within the defense and intelligence sectors. These contracts often involve long-term partnerships and provide a stable revenue stream. Keywords like "government contracts Palantir" and "defense contracts" are vital to understanding this aspect of Palantir revenue.

- Commercial Partnerships: Palantir is expanding its commercial offerings, targeting various sectors like finance, healthcare, and energy. The success of these partnerships is a key factor influencing future Palantir revenue. The keyword "Palantir revenue" is relevant here, as is exploring the company's market share within the big data analytics market.

- Market Share and Competition: While Palantir holds a strong position in the big data analytics space, competition is fierce. Companies like AWS, Google Cloud, and Microsoft Azure offer competing solutions. Understanding Palantir's competitive advantage and market share is essential to predicting future Palantir stock growth.

Technological Innovation and Future Product Roadmap

Palantir's continued success hinges on its ability to innovate and adapt to evolving market demands. Its flagship product, Palantir Foundry, a powerful data integration platform, plays a key role.

- Palantir Foundry: This platform enables organizations to integrate and analyze vast datasets, unlocking valuable insights. Its widespread adoption is crucial for sustained Palantir stock growth. The keyword "Palantir Foundry" directly relates to its core product and future potential.

- AI and Palantir: The increasing incorporation of Artificial Intelligence (AI) into Palantir's offerings is another significant driver for future growth. Using keywords such as "AI Palantir" allows us to target searches focused on the AI aspect of the company's potential.

- Future Product Roadmap: Palantir's consistent investment in research and development suggests a promising product pipeline. Analyzing their future product roadmap and potential market impact is vital in assessing Palantir stock growth potential.

Market Factors Influencing Palantir Stock Growth

Geopolitical Landscape and its Impact on Palantir's Government Contracts

The geopolitical landscape significantly impacts Palantir's government contracts. Increased government spending on defense and intelligence directly benefits Palantir.

- Government Spending: Fluctuations in government spending on national security directly affect the demand for Palantir's services. Tracking government spending and budget allocations is crucial for projecting Palantir stock growth. Keywords like "government spending" are essential in this context.

- Geopolitical Risk: Global instability and conflicts can lead to increased demand for Palantir's analytical capabilities, boosting revenue. However, geopolitical uncertainty also presents risks, impacting investor confidence. "Geopolitical risk" is a relevant keyword to consider.

Overall Economic Conditions and Investor Sentiment

Macroeconomic factors like inflation and interest rates significantly influence investor sentiment and stock prices.

- Market Volatility: Economic uncertainty can lead to market volatility, affecting investor confidence in tech stocks like Palantir. Understanding market trends and investor sentiment is critical for accurately predicting Palantir stock growth. The keyword "market volatility" highlights the risk factors.

- Economic Outlook: A positive economic outlook generally fuels investor confidence, potentially boosting Palantir's stock price. Conversely, a negative outlook could lead to a decline. Analyzing the overall economic outlook is crucial. The keyword "economic outlook" is relevant here.

Risk Assessment and Potential Downsides

Competition and Market Saturation

The big data analytics market is highly competitive. Palantir faces competition from established tech giants and emerging players.

- Palantir Competitors: Analyzing the strengths and weaknesses of Palantir compared to its competitors is vital. Identifying Palantir's competitive advantage is key to assessing its long-term viability and potential for Palantir stock growth. The keyword "Palantir competitors" is important for understanding the competitive landscape.

- Market Saturation: The risk of market saturation exists, particularly if competitors develop comparable solutions at lower costs. Analyzing market trends and the potential for saturation is crucial in risk assessment.

Financial Risks and Uncertainties

Palantir's financial performance and future prospects involve inherent uncertainties.

- Palantir Financial Performance: Analyzing key financial metrics like profitability, debt levels, and cash flow is essential for assessing financial health and risk. Using keywords like "Palantir financial performance" allows for a targeted approach.

- Profitability: Palantir's ability to consistently generate profits is a key factor influencing investor confidence. Analyzing profitability trends and projections is crucial.

Conclusion

Predicting a 40% Palantir stock growth by 2025 is ambitious. While Palantir possesses strong technological capabilities and enjoys a significant market position, substantial risks remain. The company's reliance on government contracts, the competitive landscape, and macroeconomic uncertainties all need to be considered. A thorough risk-reward analysis is essential before investing in Palantir stock. While the potential for Palantir stock growth is significant, careful consideration of the factors outlined above, along with independent research and consultation with a financial advisor, are crucial before making any investment decisions. Conduct your own thorough due diligence before investing in Palantir stock growth.

Featured Posts

-

Bbc Strictly Come Dancing Wynne Evans Addresses Return Speculation

May 10, 2025

Bbc Strictly Come Dancing Wynne Evans Addresses Return Speculation

May 10, 2025 -

Dakota Johnson And Melanie Griffith A Mother Daughter Day Out In Spring Fashion

May 10, 2025

Dakota Johnson And Melanie Griffith A Mother Daughter Day Out In Spring Fashion

May 10, 2025 -

Jeanine Pirros North Idaho Visit Dates Location And Details

May 10, 2025

Jeanine Pirros North Idaho Visit Dates Location And Details

May 10, 2025 -

Zayava Stivena Kinga Chi Ye Mask Ta Tramp Zradnikami

May 10, 2025

Zayava Stivena Kinga Chi Ye Mask Ta Tramp Zradnikami

May 10, 2025 -

Why This Michigan City Ranks Among The Best College Towns In The Us

May 10, 2025

Why This Michigan City Ranks Among The Best College Towns In The Us

May 10, 2025