40% Up In 2025: Analyzing Palantir Stock's Potential For Growth

Table of Contents

Palantir's Current Market Position and Competitive Advantages

Palantir Technologies is a prominent player in the big data analytics and government contracting sectors. Its business model centers around providing proprietary platforms, Gotham and Foundry, that enable organizations to integrate, analyze, and act upon vast amounts of data. These platforms are particularly useful for complex, data-intensive tasks, providing a significant competitive advantage.

- Market leadership in specific niches: Palantir holds a strong position in government intelligence and defense contracting, leveraging its expertise in data security and sophisticated analytics. Its success in these sectors has established a reputation for reliability and performance with high-security clients.

- Strong government contracts and partnerships: Government contracts form a substantial portion of Palantir's revenue, providing a stable and recurring income stream. These partnerships often lead to further developments and iterations of its platforms, enhancing its technology and market standing.

- Technological innovation and platform differentiation: Palantir's proprietary platforms, Gotham and Foundry, are highly sophisticated and difficult to replicate, creating substantial barriers to entry for competitors. Continuous innovation in artificial intelligence (AI), machine learning (ML), and data visualization further strengthens its competitive edge.

- Barriers to entry for competitors: The high cost of developing comparable platforms, coupled with the need for specialized expertise in data integration and analysis, creates significant barriers for potential competitors. Palantir's established client relationships and brand recognition add to these barriers.

Growth Drivers: Factors Contributing to Potential 40% Increase

Several factors could contribute to a significant increase in Palantir's stock price. The rising demand for big data analytics and AI solutions across diverse industries is a key driver.

- Expansion into commercial markets (healthcare, finance, etc.): Palantir is actively expanding its commercial client base, targeting sectors like healthcare, finance, and energy. This diversification reduces reliance on government contracts and opens access to larger markets with substantial growth potential.

- Growing government spending on data analytics and cybersecurity: Increased global emphasis on national security and cybersecurity is driving robust government spending on data analytics solutions, benefiting Palantir significantly. This ongoing demand fuels their contracts and future revenue.

- Successful implementation of new technologies (e.g., AI, machine learning): Palantir's continuous investment in AI and ML enhances its platform capabilities, attracting new clients and expanding its product offerings. These advancements enhance its value proposition in a competitive market.

- Strategic alliances and partnerships driving revenue growth: Collaborations with other technology companies and strategic partnerships enable Palantir to expand its reach and access new markets more efficiently. These alliances amplify its resources and market penetration.

Potential Risks and Challenges to Palantir's Growth

Despite the promising outlook, several risks could hinder Palantir's growth trajectory. These need careful consideration for a balanced assessment.

- Increased competition in the big data analytics market: The big data analytics market is becoming increasingly competitive, with established tech giants and emerging startups vying for market share. This intense competition could pressure margins and growth.

- Dependence on government contracts: While providing stability, a heavy reliance on government contracts exposes Palantir to potential changes in government spending and priorities. Budget cuts or shifts in policy could impact revenue.

- Economic uncertainty and its impact on spending: Economic downturns can lead to reduced spending on technology and software, impacting Palantir's revenue growth, especially in the commercial sector.

- Potential for regulatory scrutiny and compliance issues: As a provider of data analytics solutions for government and commercial clients, Palantir is subject to regulatory scrutiny and compliance requirements. Failure to meet these standards could lead to legal challenges or financial penalties.

Financial Analysis: Evaluating Palantir's Financial Performance and Projections

Analyzing Palantir's recent financial performance is crucial in assessing its growth potential. While revenue has been growing, profitability remains a key focus.

- Revenue growth trends and forecasts: Examining Palantir's historical revenue growth and comparing it to analyst forecasts provides a clearer picture of its future financial trajectory. Consistent growth is a positive sign, while deceleration could indicate challenges.

- Profitability margins and projections: Tracking Palantir's profit margins and comparing them to industry benchmarks helps evaluate its efficiency and profitability. Improving margins are essential for sustainable growth.

- Valuation compared to industry peers: Comparing Palantir's valuation metrics (like P/E ratio) to those of its competitors provides insight into whether it's overvalued or undervalued. A fair valuation is critical for investment decisions.

- Analyst ratings and price targets: Reviewing analyst ratings and price targets gives a sense of market sentiment and expectations for future price movements. While not a definitive prediction, it provides valuable context.

Conclusion: Investing in Palantir's Future: A 40% Growth Potential?

Analyzing Palantir's potential for a 40% stock increase by 2025 requires a balanced perspective. While significant growth drivers exist, including strong market positioning, technological innovation, and expansion into new markets, potential risks like increased competition and economic uncertainty need careful consideration. The company's financial performance and future projections will be critical factors determining the realization of this ambitious goal.

While a 40% increase in Palantir stock by 2025 is a possibility, thorough due diligence is crucial. Further research into Palantir's financial performance and the broader market conditions is essential before making any investment decisions related to Palantir stock. Remember to consult with a financial advisor before making any investment choices.

Featured Posts

-

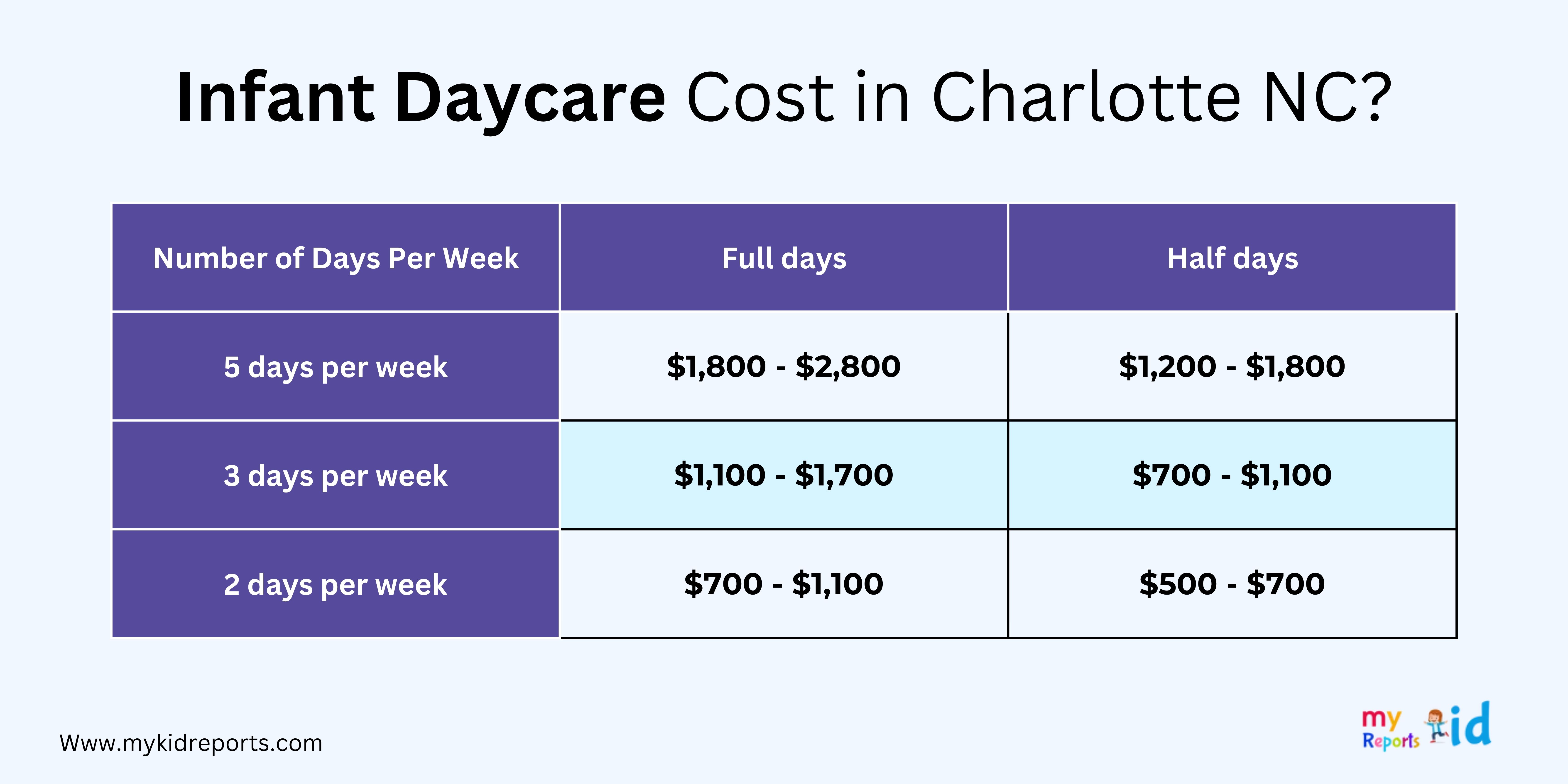

Expensive Babysitting Costs Father 3 000 Then 3 600 In Daycare Fees

May 09, 2025

Expensive Babysitting Costs Father 3 000 Then 3 600 In Daycare Fees

May 09, 2025 -

Bitcoin Madenciligi Gelecegi Ve Sonu

May 09, 2025

Bitcoin Madenciligi Gelecegi Ve Sonu

May 09, 2025 -

High Potential Season 1 When Morgan Wasnt So Smart

May 09, 2025

High Potential Season 1 When Morgan Wasnt So Smart

May 09, 2025 -

Analyzing The Potential Success Or Failure Of The Monkey In 2025

May 09, 2025

Analyzing The Potential Success Or Failure Of The Monkey In 2025

May 09, 2025 -

Trumps Tariffs Mark Warner Explains The Presidents Strategy

May 09, 2025

Trumps Tariffs Mark Warner Explains The Presidents Strategy

May 09, 2025

Latest Posts

-

From Wolves Reject To European Champion His Journey To The Top

May 09, 2025

From Wolves Reject To European Champion His Journey To The Top

May 09, 2025 -

Mdkhnw Krt Alqdm Asmae Lamet Athrt Altdkhyn Ela Msyrtha

May 09, 2025

Mdkhnw Krt Alqdm Asmae Lamet Athrt Altdkhyn Ela Msyrtha

May 09, 2025 -

Ashhr Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn

May 09, 2025

Ashhr Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn

May 09, 2025 -

West Hams Financial Future A 25m Gap And Potential Solutions

May 09, 2025

West Hams Financial Future A 25m Gap And Potential Solutions

May 09, 2025 -

Ashhr Njwm Krt Alqdm Almdkhnyn Hqayq Sadmt

May 09, 2025

Ashhr Njwm Krt Alqdm Almdkhnyn Hqayq Sadmt

May 09, 2025