400% XRP Price Jump: Is This Cryptocurrency A Smart Investment?

Table of Contents

Analyzing the 400% XRP Price Surge

Several factors could be contributing to this significant increase in XRP's value. Understanding these factors is crucial for assessing the long-term prospects of this cryptocurrency.

Factors Contributing to the Increase

- Positive Ripple Legal News: The ongoing legal battle between Ripple and the SEC has significantly impacted XRP's price. Positive developments in the case, such as favorable court rulings or settlements, could trigger substantial price increases. Recent judicial interpretations suggesting a more favorable outcome for Ripple have buoyed investor confidence.

- Increased XRP Trading Volume: A sharp rise in XRP trading volume often precedes and accompanies price increases. This suggests growing market interest and potentially increased demand. Analyzing trading volume data on major exchanges can provide valuable insights into the strength and sustainability of the price surge.

- Broader Crypto Market Trends: The overall cryptocurrency market's performance plays a vital role. A broader crypto market rally, driven by factors such as increased institutional adoption or positive regulatory news, often lifts the prices of individual cryptocurrencies like XRP.

- Positive Regulatory Developments: Increasing regulatory clarity regarding cryptocurrencies in key markets could stimulate investment and increase demand for XRP, leading to a price jump. Positive regulatory signals globally can significantly impact investor sentiment.

Is This a Sustainable Trend or a Short-Term Pump?

The cryptocurrency market is notoriously volatile. While the 400% XRP price jump is impressive, its sustainability remains questionable. Historical XRP price charts show periods of significant price volatility, with sharp increases often followed by equally dramatic corrections. Therefore, it's crucial to consider the possibility of a market correction. Predicting future price movements is challenging, but analyzing historical trends and market sentiment provides valuable context for making informed decisions. Understanding concepts like "XRP volatility" and "crypto price prediction" is essential for navigating this volatile landscape.

Ripple's Legal Battle and its Impact on XRP

The legal dispute between Ripple Labs and the Securities and Exchange Commission (SEC) has profoundly impacted XRP's price. The outcome of this lawsuit carries significant implications for the future of XRP.

The SEC Lawsuit and its Resolution

The SEC lawsuit alleges that Ripple sold XRP as an unregistered security. A positive resolution for Ripple could significantly boost investor confidence and drive up XRP's price. Conversely, an unfavorable ruling could lead to a substantial price drop. Understanding the nuances of "SEC vs Ripple" and the potential "Ripple lawsuit outcome" is crucial for anyone considering investing in XRP.

Ripple's Technological Advancements and Partnerships

Ripple continues to develop its technology and forge strategic partnerships. These developments can positively influence XRP's adoption and price. Key innovations like On-Demand Liquidity (ODL) are streamlining cross-border payments, expanding XRP's use case and potentially driving future price appreciation. Staying informed about "Ripple technology" and "Ripple partnerships" is crucial for assessing its long-term viability.

Assessing XRP as an Investment

Investing in XRP, like any cryptocurrency, involves significant risk. While the potential for high returns exists, investors need to carefully weigh the risks before committing their capital.

Risk and Reward Analysis

Cryptocurrency investments are inherently high-risk. XRP's price can fluctuate dramatically, and investors could lose a substantial portion of their investment. A well-diversified investment portfolio and a thorough understanding of "XRP investment risk" are essential for mitigating potential losses. This investment strategy should align with your risk tolerance and financial goals.

Comparing XRP to Other Cryptocurrencies

XRP's performance should be compared to other major cryptocurrencies like Bitcoin and Ethereum. Analyzing "XRP vs Bitcoin" and "XRP vs Ethereum" helps contextualize its growth potential and relative risk. Considering factors such as market capitalization, adoption rate, and technological advancements provides a more comprehensive view of XRP's place in the cryptocurrency landscape.

Conclusion

The 400% XRP price jump is a significant event, driven by a combination of factors including legal developments, market sentiment, and technological advancements. However, the cryptocurrency market's inherent volatility makes predicting future price movements challenging. While the potential rewards are substantial, the risks are equally significant. Before investing in XRP, conduct thorough research, understand the risks, and diversify your portfolio. Remember, the recent XRP price jump doesn't guarantee future success. Always exercise caution and seek professional financial advice before making any investment decisions related to the XRP price jump and other cryptocurrencies.

Featured Posts

-

0 0

May 07, 2025

0 0

May 07, 2025 -

Jenna Ortegas Exit From Scream 7 The Real Reason Revealed

May 07, 2025

Jenna Ortegas Exit From Scream 7 The Real Reason Revealed

May 07, 2025 -

Check The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 07, 2025

Check The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 07, 2025 -

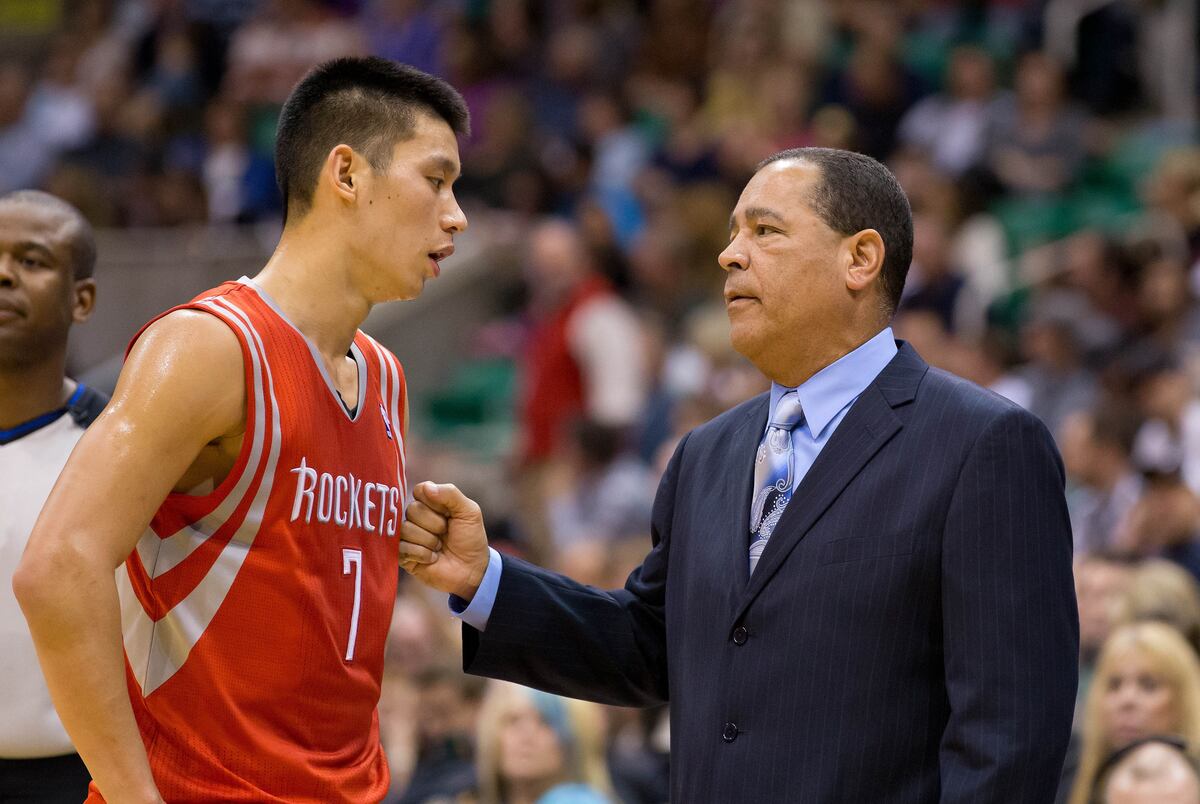

Jazz Vs Rockets Conley And Edwards To Carry The Load Without Gobert

May 07, 2025

Jazz Vs Rockets Conley And Edwards To Carry The Load Without Gobert

May 07, 2025 -

Ai 20

May 07, 2025

Ai 20

May 07, 2025