5 Essential Do's And Don'ts To Secure A Private Credit Role

Table of Contents

Do's to Secure Your Dream Private Credit Position

1. Craft a Stellar Private Credit Resume & Cover Letter

Your resume and cover letter are your first impression – make it count! In the competitive world of private credit, a well-crafted application is paramount.

- Highlight relevant experience: Focus on specific achievements demonstrating your skills in deal sourcing, underwriting, due diligence, portfolio management, and financial modeling within private credit. Don't just list your responsibilities; showcase your impact.

- Quantify your accomplishments: Use numbers to showcase your success. Instead of saying "managed a portfolio," say "managed a $50 million portfolio of leveraged loans, achieving a 12% annualized return." Quantifiable results demonstrate your value.

- Tailor your resume and cover letter: Generic applications won't cut it. Customize each application to the specific job description, demonstrating your understanding of the role and the firm's investment strategy. Research the firm thoroughly; understanding their portfolio and recent deals shows genuine interest.

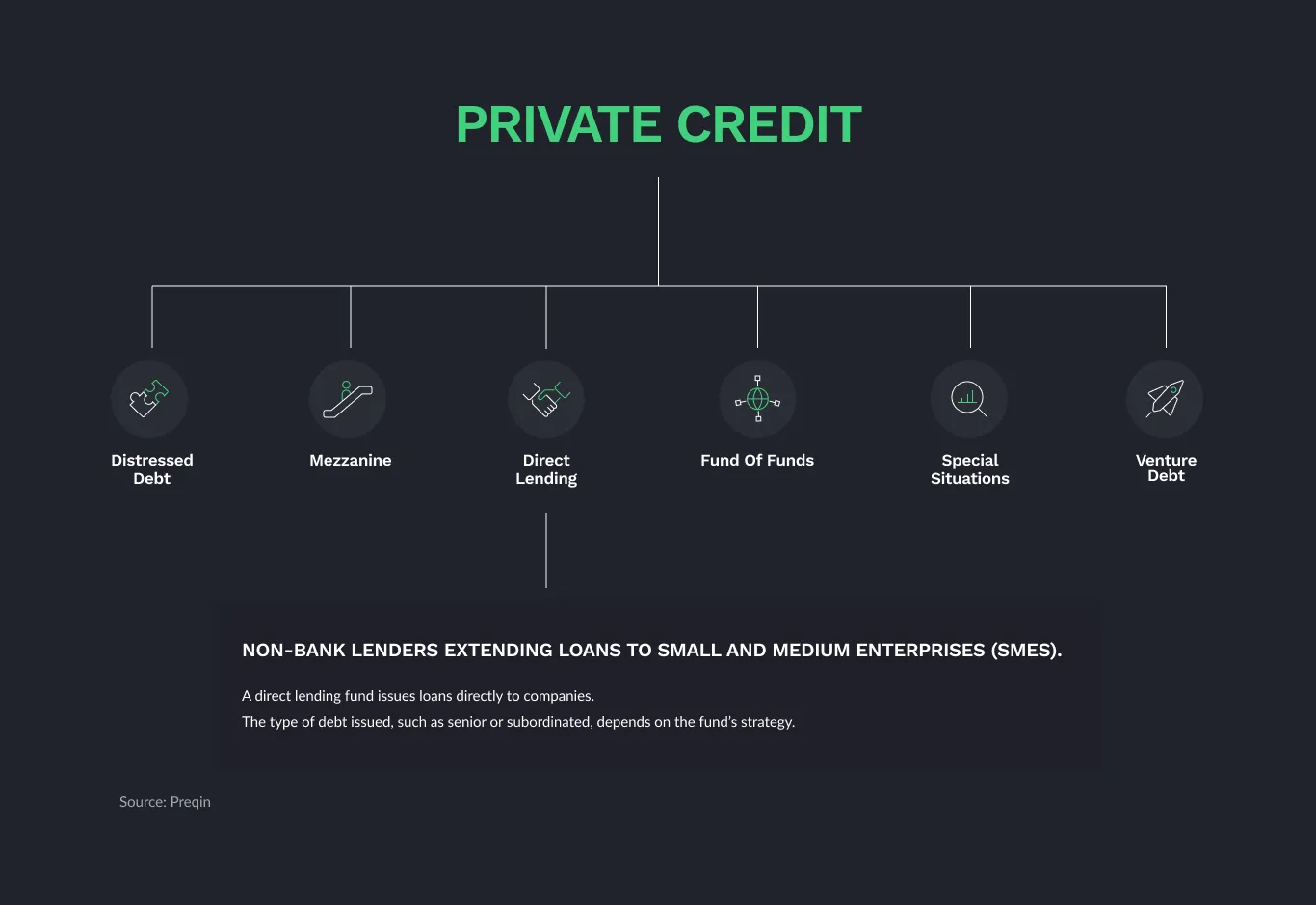

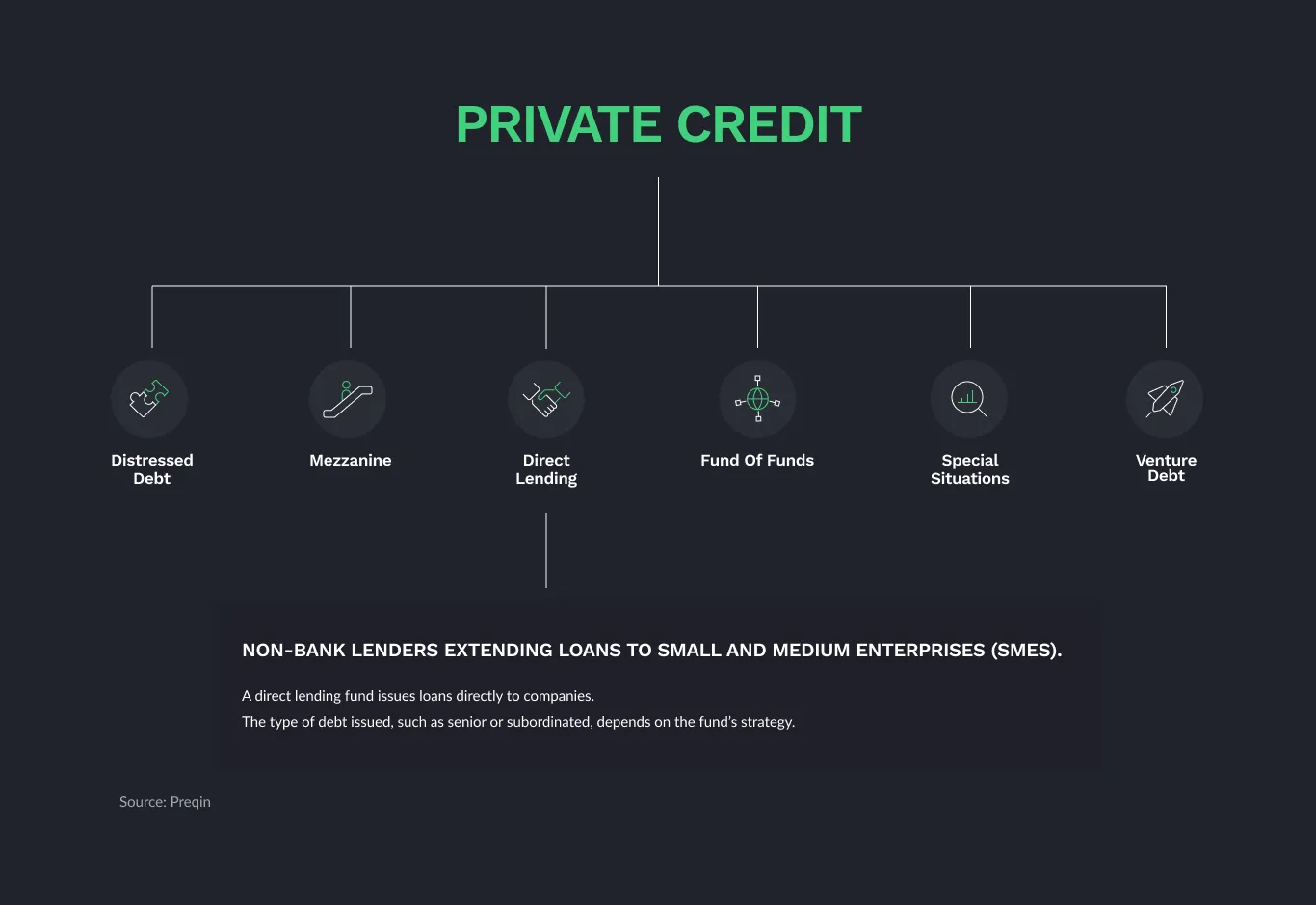

- Keywords are key: Incorporate relevant keywords throughout your resume and cover letter. Think private credit, leveraged loans, direct lending, structured credit, distressed debt, mezzanine financing, fund management, credit analysis, and portfolio management. Use these terms naturally, avoiding keyword stuffing.

- Proofread meticulously: Typos and grammatical errors are unprofessional and can instantly disqualify you. Have a friend or colleague review your application before submitting it.

2. Network Strategically Within the Private Credit Industry

Networking is crucial in the private credit industry. Building relationships can open doors to opportunities you wouldn't find elsewhere.

- Attend industry conferences and events: These events offer excellent networking opportunities. Engage in conversations, exchange business cards, and follow up afterward.

- Leverage LinkedIn: Optimize your LinkedIn profile with relevant keywords and connect with recruiters and professionals in private credit. Engage with their posts and participate in industry discussions.

- Informational interviews: Reach out to individuals working in private credit for informational interviews. This allows you to learn more about the industry, gain insights, and build relationships.

- Build relationships: Networking isn't a one-time event. Nurture your network; consistent engagement builds stronger relationships that can lead to opportunities.

3. Master the Art of Private Credit Interviewing

The interview is your chance to shine and demonstrate your skills and knowledge. Preparation is key.

- Prepare for technical questions: Brush up on financial modeling, valuation techniques (DCF, LBO, etc.), credit analysis (including covenant analysis and credit metrics), and current industry trends. Be ready to discuss specific deals you've worked on.

- Practice behavioral questions: Prepare examples showcasing your problem-solving skills, teamwork abilities, and experience handling challenging situations using the STAR method (Situation, Task, Action, Result).

- Research the firm thoroughly: Demonstrate your understanding of their investment strategy, portfolio composition (e.g., focus on specific sectors or asset classes), and recent deals.

- Ask insightful questions: Prepare thoughtful questions that show your genuine interest and engagement. This demonstrates your proactive nature and initiative.

- Practice your delivery: Confidence and clarity in communication are vital. Practice your answers beforehand to ensure a smooth and professional delivery.

Don'ts to Avoid When Pursuing a Private Credit Role

1. Don't Neglect the Fundamentals of Finance

A strong foundation in finance is non-negotiable.

- Lack of core finance knowledge is a major red flag: Ensure a solid understanding of accounting principles, financial statement analysis, valuation methodologies, and corporate finance.

- Continuously update your skills: The private credit industry is dynamic. Stay current on new trends, regulations, and technologies through continuous learning and professional development.

2. Don't Underestimate the Importance of Due Diligence

Thorough research is essential at every stage of the application process.

- Thoroughly research the firm and the role before applying or attending an interview: Understand their investment mandate, target sectors, and recent transactions.

- Avoid generic applications: Tailor your resume and cover letter to each specific role, highlighting the skills and experience most relevant to the position.

3. Don't Be Afraid to Highlight Your Strengths & Unique Skills

What makes you stand out from other candidates?

- Showcase your experience in areas like deal structuring, portfolio management, or specialized industry knowledge: Highlight any niche expertise that sets you apart.

- Emphasize your unique selling propositions: What are your key strengths and accomplishments? What makes you a valuable asset to a private credit firm?

Conclusion

Securing a private credit role requires dedication and a strategic approach. By following these five essential do's and don'ts – from crafting a compelling resume to mastering the interview process and networking effectively – you'll significantly improve your chances of landing your dream private credit position. Remember to consistently refine your skills, network strategically, and highlight your unique value proposition. Don't delay; start applying these strategies today to advance your career in the competitive world of private credit.

Featured Posts

-

Aryn Sabalenka Claims 19th Career Title In Miami

May 13, 2025

Aryn Sabalenka Claims 19th Career Title In Miami

May 13, 2025 -

Open Ai And Chat Gpt The Ftc Investigation And Its Potential Impact

May 13, 2025

Open Ai And Chat Gpt The Ftc Investigation And Its Potential Impact

May 13, 2025 -

Byd Targets Brazil The Shift In Global Ev Leadership From Ford

May 13, 2025

Byd Targets Brazil The Shift In Global Ev Leadership From Ford

May 13, 2025 -

The Good Fight Season 2 Episode 18 Elsbeths Showdown With Judge Crawford

May 13, 2025

The Good Fight Season 2 Episode 18 Elsbeths Showdown With Judge Crawford

May 13, 2025 -

Aryna Sabalenkas Miami Open Victory 19th Career Title

May 13, 2025

Aryna Sabalenkas Miami Open Victory 19th Career Title

May 13, 2025