5 Key Actions To Secure A Role In The Booming Private Credit Sector

Table of Contents

Develop Specialized Skills and Knowledge

The private credit sector demands a specialized skill set. To stand out, you need to demonstrate proficiency in several key areas.

Mastering Financial Modeling

Advanced financial modeling is crucial for success in private credit. You'll be analyzing complex financial statements and projecting future cash flows. Proficiency in these areas is essential:

- Proficiency in Excel/VBA: Mastering Excel, particularly VBA (Visual Basic for Applications), is paramount for efficient data manipulation and model building.

- Experience with specialized financial modeling software: Familiarity with software like Argus, DealCloud, or other industry-standard tools is highly advantageous.

- Understanding of discounted cash flow analysis (DCF): DCF is a cornerstone of private credit valuation, so a deep understanding is critical.

- LBO modeling: Leveraged buyout (LBO) modeling is frequently used in private credit transactions, so expertise in this area is highly valued.

Understanding Credit Analysis

In-depth knowledge of credit analysis techniques is paramount. You must be able to accurately assess risk and understand various debt structures. Key areas include:

- Experience with credit scoring models: Familiarity with different credit scoring models will help you assess the creditworthiness of borrowers.

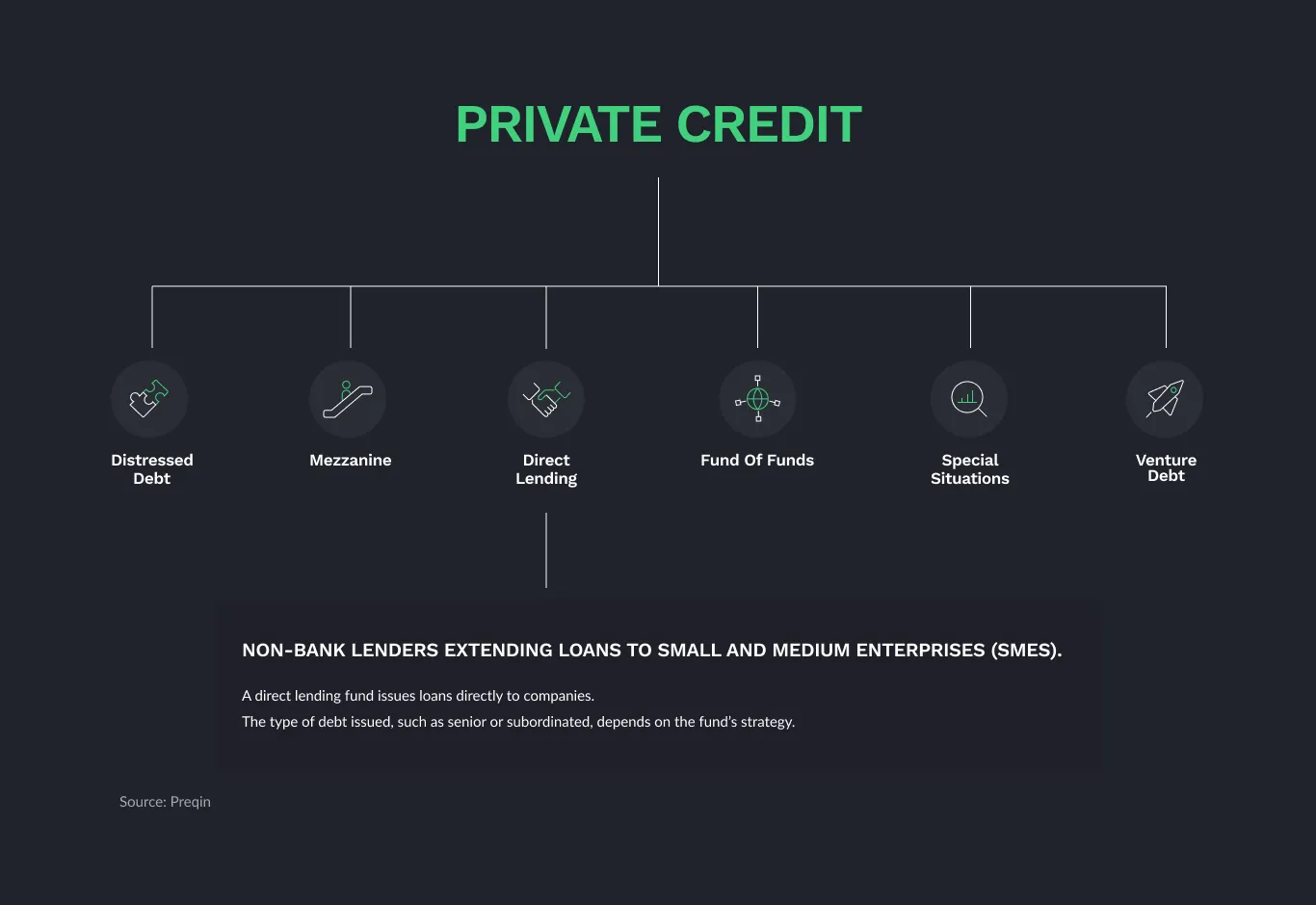

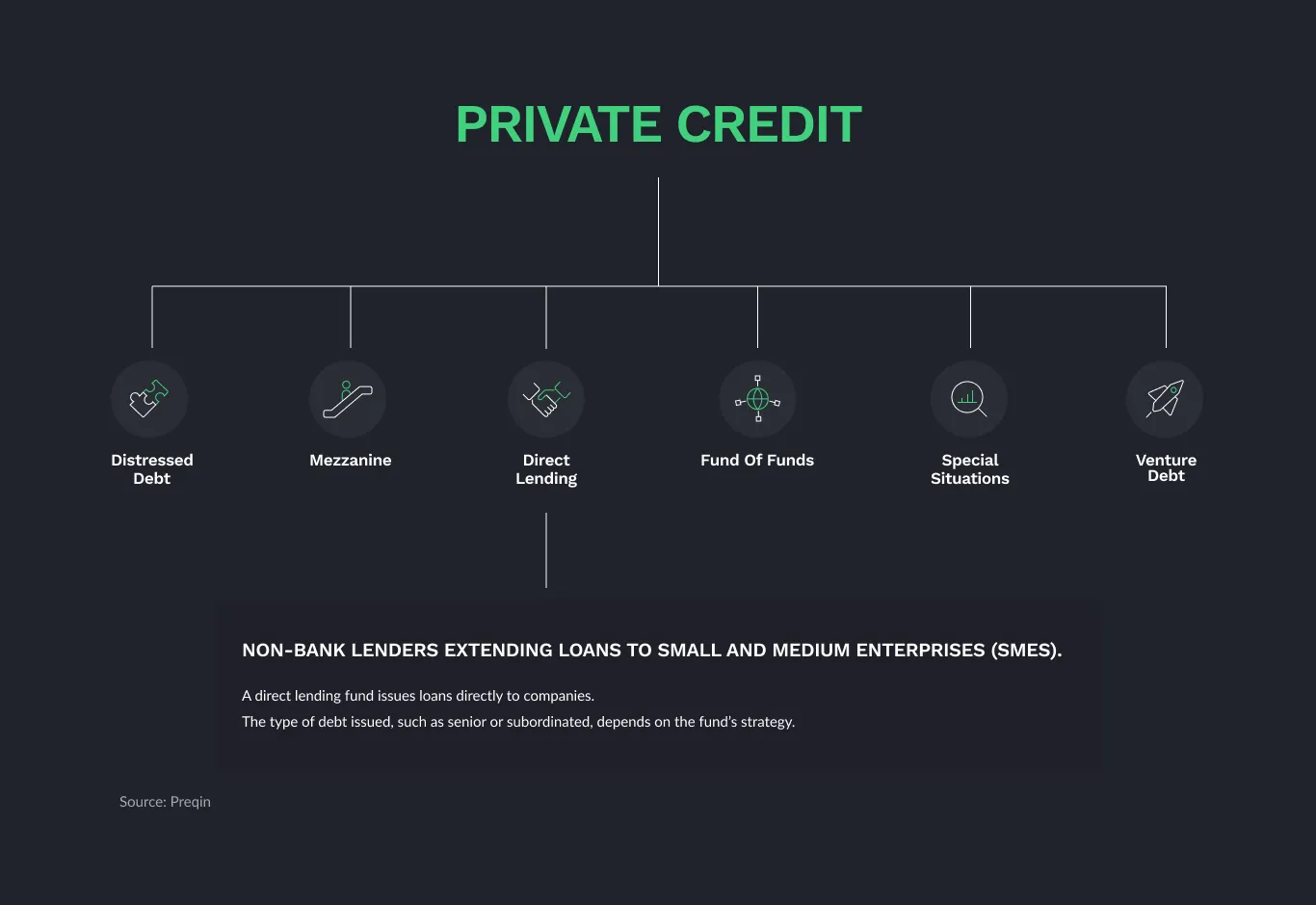

- Understanding of different debt structures (senior, subordinated, mezzanine): A solid grasp of the nuances of different debt structures is essential.

- Familiarity with industry-specific credit metrics: Understanding key performance indicators (KPIs) specific to different industries is vital for effective credit assessment.

Legal and Regulatory Compliance

The private credit market is heavily regulated. Understanding the legal and regulatory landscape is not just important—it's essential. This includes:

- Familiarity with relevant laws and regulations: Stay updated on relevant laws and regulations, including those related to KYC/AML (Know Your Customer/Anti-Money Laundering).

- Understanding of KYC/AML procedures: Thorough knowledge of KYC/AML procedures is crucial for compliance and risk mitigation.

- Experience with due diligence processes: Experience conducting thorough due diligence is essential to assess the risks associated with potential investments.

Network Strategically Within the Private Credit Industry

Building a strong network is crucial in the private credit sector. Leverage every opportunity to connect with professionals in the field.

Attend Industry Events

Networking events are invaluable for connecting with potential employers and learning about new opportunities.

- Examples of relevant conferences and events: Research and attend conferences like the Private Equity International (PEI) events, SuperReturn conferences, and industry-specific workshops.

- Tips for effective networking at industry gatherings: Prepare talking points, actively listen, exchange business cards, and follow up after the event.

Leverage LinkedIn

LinkedIn is a powerful tool for connecting with professionals in the private credit sector.

- Strategies for optimizing your LinkedIn profile: Create a professional profile that highlights your skills and experience, including keywords relevant to private credit.

- Examples of relevant LinkedIn groups and hashtags to follow: Join relevant groups and follow industry influencers to stay informed and expand your network.

Informational Interviews

Informational interviews are a great way to learn more about the industry and build relationships.

- Tips for conducting successful informational interviews: Prepare thoughtful questions, be respectful of the interviewer's time, and send a thank-you note afterward.

- Preparing questions: Research the interviewer and their firm beforehand to formulate relevant and insightful questions.

- Following up: Send a thank-you note after the interview and maintain contact.

Tailor Your Resume and Cover Letter to Private Credit Roles

Your resume and cover letter are your first impression. Make them count!

Highlight Relevant Experience

Emphasize the skills and experiences most relevant to private credit roles.

- Examples of keywords and phrases to use: Use keywords like "financial modeling," "credit analysis," "due diligence," "LBO," and "private debt."

- Tailoring your resume to specific job descriptions: Carefully review each job description and tailor your resume to match the specific requirements and keywords.

Quantify Your Achievements

Use metrics to demonstrate your impact in previous roles.

- Examples of quantifiable achievements in previous roles: Quantify your accomplishments using numbers and data, showcasing your contributions.

- Using metrics to highlight success: Instead of stating "improved efficiency," say "Improved efficiency by 15% by implementing X strategy."

Showcase Your Passion for Private Credit

Demonstrate your genuine interest in the private credit sector.

- Highlighting relevant coursework, volunteer work, or personal projects: Showcase your commitment through related coursework, volunteer experiences, or personal projects.

Gain Practical Experience Through Internships or Entry-Level Positions

Practical experience is invaluable. Seek out opportunities to gain hands-on experience.

Seek Internships

Internships provide invaluable experience and networking opportunities.

- Resources for finding internships: Utilize online job boards, university career services, and networking contacts.

- Tips for securing an internship: Craft a strong resume and cover letter, prepare for interviews, and network effectively.

Consider Entry-Level Roles

Entry-level positions in related fields can provide a pathway to a private credit career.

- Examples of entry-level roles that can lead to a career in private credit: Consider roles in financial analysis, accounting, or credit risk management.

Volunteer Work

Volunteer work can provide valuable skills and networking opportunities.

- Examples of relevant volunteer organizations: Consider organizations focused on financial literacy or community development.

Develop a Strong Understanding of Market Trends

Stay informed about the ever-evolving private credit landscape.

Stay Updated on Industry News

Regularly read industry publications and follow market trends.

- Examples of relevant publications, websites, and news sources: Follow reputable financial news sources, industry publications, and blogs specializing in private credit.

Understand Economic Cycles

Grasp the impact of economic cycles on the private credit market.

- Key economic indicators to monitor: Monitor key economic indicators like interest rates, inflation, and GDP growth.

- Understanding the relationship between economic conditions and private credit investment: Learn how economic conditions influence investment strategies and risk assessments in the private credit sector.

Follow Key Players

Keep an eye on major players and their activities in the private credit sector.

- Examples of significant players in the market: Research and follow prominent private credit firms, institutional investors, and industry leaders.

Conclusion

Securing a role in the competitive private credit sector requires a multifaceted approach. By developing specialized skills, networking strategically, tailoring your application materials, gaining practical experience, and understanding market trends, you significantly increase your chances of success. The demand within the private credit sector is high, and with dedicated effort, you can carve out a rewarding career. Start building your career in the lucrative private credit sector today by applying these five key actions!

Featured Posts

-

Eala Eyes Successful French Open Campaign

May 25, 2025

Eala Eyes Successful French Open Campaign

May 25, 2025 -

Philips Agm A Recap Of Key Discussions And Resolutions

May 25, 2025

Philips Agm A Recap Of Key Discussions And Resolutions

May 25, 2025 -

B C Billionaire Targets Hudsons Bay Leases For Shopping Mall Expansion

May 25, 2025

B C Billionaire Targets Hudsons Bay Leases For Shopping Mall Expansion

May 25, 2025 -

Claim Your Bbc Radio 1 Big Weekend 2025 Tickets Now Full Line Up Confirmed

May 25, 2025

Claim Your Bbc Radio 1 Big Weekend 2025 Tickets Now Full Line Up Confirmed

May 25, 2025 -

Analyse Snelle Marktdraai Europese Aandelen Toekomstige Trends

May 25, 2025

Analyse Snelle Marktdraai Europese Aandelen Toekomstige Trends

May 25, 2025