5 Reasons For Today's Significant Increase In Sensex And Nifty 50

Table of Contents

Today witnessed a significant upward swing in the Indian stock market, with both the Sensex and Nifty 50 indices experiencing substantial gains. This unexpected market surge has left many investors wondering about the underlying factors driving this impressive market rally. This article delves into five key reasons contributing to today's remarkable increase in Sensex and Nifty 50 values, offering insights into the forces shaping the Indian stock market.

Positive Global Cues

Positive developments in global markets significantly influence the performance of the Indian stock market. Stronger-than-expected economic data or positive announcements from major global companies can create a ripple effect, boosting investor confidence and driving up stock prices. This positive sentiment often translates into increased foreign institutional investor (FII) inflow, further fueling the market rally.

- Improved economic indicators in major global economies: Positive data from the US, Europe, and other key markets often sets a positive tone for global markets, impacting investor sentiment towards emerging markets like India.

- Increased foreign institutional investor (FII) inflow: FIIs play a crucial role in the Indian stock market. Their increased investment, driven by positive global cues, directly impacts stock prices and market indices like the Sensex and Nifty 50.

- Positive global sentiment towards emerging markets: A bullish global outlook often favors emerging markets, leading to increased capital flows into countries like India, further boosting market performance.

- Stable geopolitical environment: A relatively stable geopolitical landscape reduces uncertainty, encouraging investor confidence and promoting market growth.

Strong Domestic Economic Data

Positive domestic economic data plays a crucial role in driving up the Sensex and Nifty 50. Robust GDP growth, coupled with a decrease in inflation, instills investor optimism and encourages investment in the Indian stock market. Stronger-than-expected economic indicators demonstrate the health and potential of the Indian economy, leading to increased stock valuations.

- Robust GDP growth figures: Recent releases of higher-than-expected GDP growth figures indicate a healthy and expanding Indian economy, attracting both domestic and foreign investment.

- Lower-than-anticipated inflation rates: Controlled inflation creates a stable economic environment, encouraging investors to invest in stocks and contributing to the market surge.

- Positive manufacturing and services PMI data: Positive Purchasing Managers' Index (PMI) data reflects growth in key economic sectors, highlighting the strength of the Indian economy.

- Increased consumer spending and confidence: Rising consumer spending indicates a healthy economy and strong consumer demand, boosting investor confidence and leading to market growth.

Positive Corporate Earnings

Strong corporate earnings reports from major listed companies are a significant driver of market growth. Better-than-expected quarterly results, coupled with upward revisions in profit forecasts, demonstrate the financial health and future growth potential of companies, making their stocks more attractive to investors. This leads to increased buying pressure and drives up stock prices, contributing to the overall market surge.

- Better-than-expected quarterly earnings from key sectors: Strong performance across various sectors boosts overall market sentiment and attracts investment.

- Upward revisions in profit forecasts by leading companies: Positive future guidance from leading companies reassures investors about the long-term prospects of the market.

- Positive outlook for future growth in various sectors: A positive outlook across sectors increases investor confidence and boosts investment activity.

- Strong balance sheets and improved financial health of companies: Healthy company financials are a key driver of investor confidence and stock valuation.

Sector-Specific Growth Drivers

Sometimes, market surges are driven by exceptionally strong performance in specific sectors. This could be due to technological advancements, government policy changes, or other industry-specific events. For instance, a surge in the IT sector due to increased global demand or a boom in the renewable energy sector due to government incentives can significantly impact the overall market indices like the Sensex and Nifty 50.

- Strong performance in specific sectors: Exceptional growth in sectors like IT, pharmaceuticals, or fast-moving consumer goods (FMCG) can significantly boost overall market performance.

- Government policies supporting particular industries: Government initiatives and policy changes aimed at boosting specific industries can lead to increased investment and growth in those sectors.

- Technological breakthroughs driving innovation and growth: Technological advancements often lead to the emergence of new industries and increased growth in existing ones, impacting market performance.

- Increased investment in infrastructure projects: Government investment in infrastructure projects can create significant opportunities and growth in related sectors.

Short Covering and Speculative Trading

Short covering (when investors who bet against the market buy back stocks to limit losses) and increased speculative trading can contribute to sudden price increases and amplify market movements. Increased retail investor participation and volatility can lead to rapid price swings, contributing to the overall market surge.

- Significant short covering observed in certain stocks: Investors who bet against the market are forced to buy back stocks to limit their losses, driving up prices.

- Increased retail investor participation and trading activity: Increased participation from retail investors can boost trading volumes and lead to rapid price increases.

- Speculative buying contributing to the price increase: Speculative buying, driven by market sentiment and anticipation of further price increases, can amplify market movements.

- Market volatility leading to sudden price swings: Market volatility can create rapid price fluctuations, contributing to the overall market surge.

Conclusion

Today's significant increase in the Sensex and Nifty 50 is a result of a confluence of factors, including positive global cues, strong domestic economic data, impressive corporate earnings, sector-specific growth drivers, and short covering. Understanding these drivers is crucial for investors to make informed decisions and navigate the complexities of the Indian stock market. To stay updated on the latest market trends and the factors influencing Sensex and Nifty 50 movements, regularly check reputable financial news sources and consider consulting with a financial advisor. Keep a close watch on the Sensex and Nifty 50 for future market insights and to capitalize on potential investment opportunities.

Featured Posts

-

Wynne Evans Health New Update Following Serious Illness

May 09, 2025

Wynne Evans Health New Update Following Serious Illness

May 09, 2025 -

Dijon Violences Conjugales Le Boxeur Bilel Latreche Devant Le Tribunal En Aout

May 09, 2025

Dijon Violences Conjugales Le Boxeur Bilel Latreche Devant Le Tribunal En Aout

May 09, 2025 -

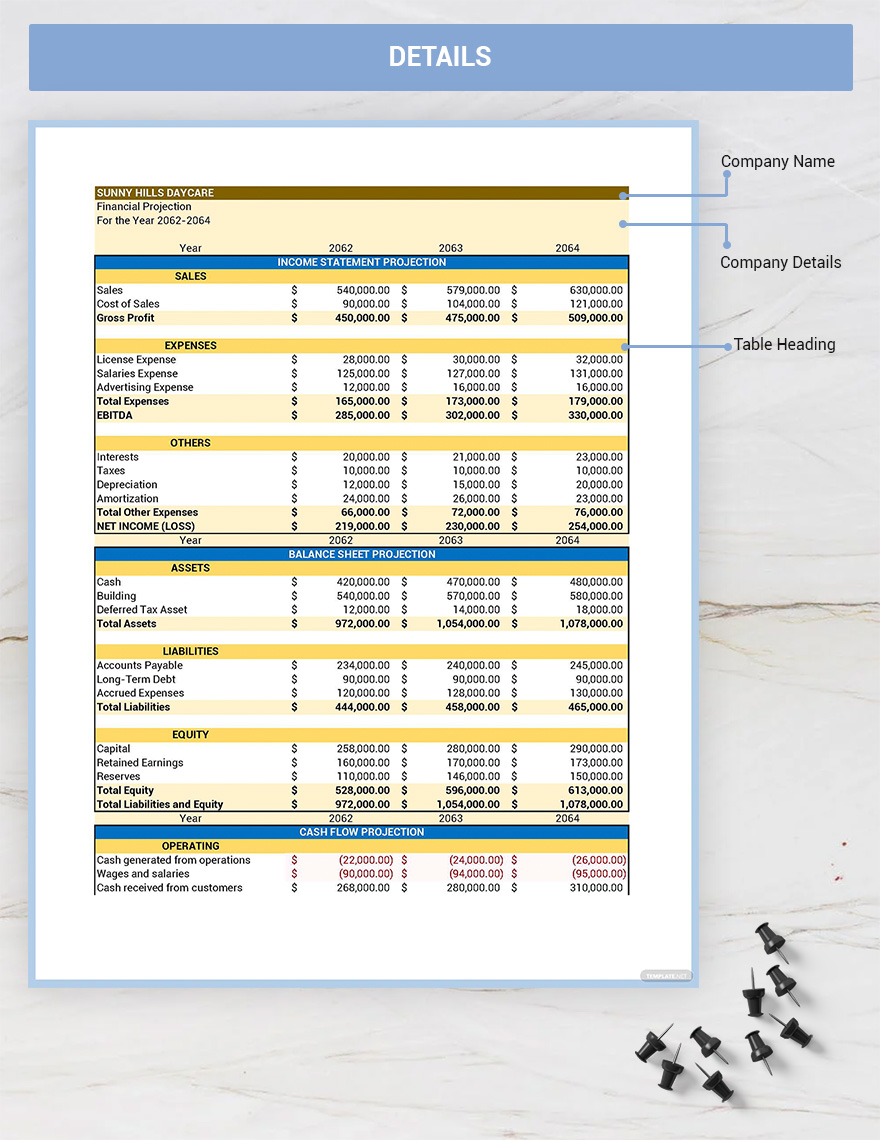

From 3 000 Babysitting Bill To 3 600 Daycare A Financial Nightmare

May 09, 2025

From 3 000 Babysitting Bill To 3 600 Daycare A Financial Nightmare

May 09, 2025 -

Brekelmans India Strategie Behoud Van Samenwerking

May 09, 2025

Brekelmans India Strategie Behoud Van Samenwerking

May 09, 2025 -

Should You Buy Palantir Stock Now After Its 40 Projected Growth In 2025

May 09, 2025

Should You Buy Palantir Stock Now After Its 40 Projected Growth In 2025

May 09, 2025

Latest Posts

-

Justice Sought After Brutal Racist Murder Of Family Member

May 10, 2025

Justice Sought After Brutal Racist Murder Of Family Member

May 10, 2025 -

Nonbinary Activists Untimely Passing A Loss For The Community

May 10, 2025

Nonbinary Activists Untimely Passing A Loss For The Community

May 10, 2025 -

Supporting Transgender Individuals Practical Allyship On International Transgender Day

May 10, 2025

Supporting Transgender Individuals Practical Allyship On International Transgender Day

May 10, 2025 -

The Aftermath Of A Racist Killing A Familys Journey

May 10, 2025

The Aftermath Of A Racist Killing A Familys Journey

May 10, 2025 -

Death Of A Pioneer Remembering Americas First Nonbinary Individual

May 10, 2025

Death Of A Pioneer Remembering Americas First Nonbinary Individual

May 10, 2025