500-Point Sensex Gain: Detailed Market Analysis & Top Performers

Table of Contents

Macroeconomic Factors Fueling the 500-Point Sensex Rally

Several macroeconomic factors contributed to this impressive 500-point Sensex gain. Understanding these underlying currents is crucial for interpreting the market's overall health and potential future movements.

Positive Global Sentiment

Positive global economic indicators played a significant role. Improved US economic data, coupled with easing trade tensions, boosted investor confidence worldwide. This positive global sentiment spilled over into the Indian market, attracting significant foreign investment.

- Examples of positive global news: Strong US employment figures, positive manufacturing data from key global economies, and reduced trade uncertainties.

- Impact on investor confidence: Increased risk appetite among global investors leading to higher demand for emerging market assets, including Indian equities.

- Foreign Institutional Investor (FII) inflows: Substantial FII inflows were observed, injecting liquidity into the Indian stock market and fueling the Sensex rally.

Domestic Economic Indicators

Strong domestic economic indicators further amplified the positive market sentiment. Positive GDP growth figures and encouraging inflation data signaled a healthy and growing Indian economy, reinforcing investor confidence.

- Specific data points: Stronger-than-expected GDP growth, easing inflation rates, and positive consumer spending data.

- Influence on market sentiment: Positive economic indicators boosted investor optimism, leading to increased buying pressure and driving the Sensex higher.

- Effect on investor behavior: Investors reacted positively, increasing their investment in various sectors, thereby contributing to the 500-point jump.

Government Policies and Initiatives

Recent government policies and announcements also played a crucial part in boosting market sentiment. Positive reforms and supportive initiatives created a favorable environment for businesses and investments, further propelling the Sensex's upward trajectory.

- Examples of supportive government policies: Relaxation of certain regulations, infrastructure development initiatives, and tax benefits for specific sectors.

- Their effect on specific sectors: These policies had a particularly positive impact on sectors such as infrastructure, manufacturing, and renewable energy.

- Resulting investor response: Investors reacted favorably, increasing their exposure to these sectors, thereby contributing to the overall market strength.

Sectoral Performance: Identifying the Top Contributors to the 500-Point Sensex Gain

The 500-point Sensex gain wasn't driven by a single sector but a confluence of strong performances across various segments. Let's delve into the key contributors.

IT Sector's Strong Performance

The IT sector emerged as a major driver of the Sensex rally. Strong quarterly earnings, coupled with increased demand for IT services globally, propelled several IT giants to record highs.

- Key drivers of IT sector growth: Increased outsourcing from global companies, strong deal wins, and positive outlook for the future.

- Specific companies that saw significant gains: Leading IT companies experienced substantial increases in their stock prices, contributing significantly to the Sensex's surge. (Specific company examples would be inserted here in a real-time article.)

- Reasons for their growth: A combination of strong order books, robust revenue growth, and increased profitability fueled this remarkable performance.

Banking and Finance Sector's Contribution

The banking and finance sector also played a significant role in the 500-point Sensex gain. Positive credit growth, coupled with improved asset quality, boosted investor confidence in this crucial sector.

- Factors contributing to growth in this sector: Improved economic activity leading to higher credit demand, positive regulatory changes, and efficient management of Non-Performing Assets (NPAs).

- Leading companies: Major public and private sector banks saw notable gains, contributing significantly to the market's overall strength. (Specific company examples would be inserted here in a real-time article.)

- Impact on the overall market: The strength of the banking sector often acts as a barometer for the overall health of the economy, and its positive performance greatly influenced the Sensex's upward trajectory.

Other High-Performing Sectors

Other sectors, such as FMCG (Fast-Moving Consumer Goods), Pharma, and Auto, also contributed significantly to the Sensex increase. Strong consumer demand and positive industry-specific trends boosted their performance.

- Key factors influencing these sectors' performance: Strong consumer demand, favorable regulatory environments, and positive industry outlook.

- Top performers: Several leading companies within these sectors recorded substantial gains. (Specific company examples would be inserted here in a real-time article.)

- Their overall contribution: The collective positive performance of these sectors further amplified the positive momentum in the market.

Top Performing Stocks: Unveiling the Market Leaders Behind the 500-Point Surge

The 500-point Sensex gain was fueled by several standout performers. The following table highlights some of the top-performing stocks (Note: This section requires real-time data. Replace the placeholders with actual data):

| Company Name | Percentage Gain | Reasons for Gain |

|---|---|---|

| [Company Name 1] | [Percentage] | [Reason 1, e.g., Strong Q3 earnings, positive management outlook] |

| [Company Name 2] | [Percentage] | [Reason 2, e.g., New product launch, increased market share] |

| [Company Name 3] | [Percentage] | [Reason 3, e.g., Acquisition, successful strategic partnership] |

| [Company Name 4] | [Percentage] | [Reason 4, e.g., Positive industry trends, favorable government policies] |

| [Company Name 5] | [Percentage] | [Reason 5, e.g., Strong export demand, expansion into new markets] |

Conclusion

The remarkable 500-point Sensex gain reflects a confluence of positive macroeconomic factors, strong sectoral performance, and stellar individual stock performances. Understanding these underlying drivers is crucial for investors seeking to navigate the Indian stock market effectively. While this surge presents an optimistic outlook, it's essential to conduct thorough research and consider risk factors before making investment decisions. Stay informed about future market movements and continue analyzing the Sensex performance to capitalize on opportunities and mitigate potential risks. Remember to consult with a financial advisor before making any investment decisions based on this analysis of the 500-point Sensex gain.

Featured Posts

-

Aviations Living Legends Recognize Bravery Honoring Firefighters And More

May 10, 2025

Aviations Living Legends Recognize Bravery Honoring Firefighters And More

May 10, 2025 -

Resultat National 2 Dijon Concarneau 0 1 28eme Journee

May 10, 2025

Resultat National 2 Dijon Concarneau 0 1 28eme Journee

May 10, 2025 -

Hundreds In Caravans Is This Uk City Becoming A Ghetto

May 10, 2025

Hundreds In Caravans Is This Uk City Becoming A Ghetto

May 10, 2025 -

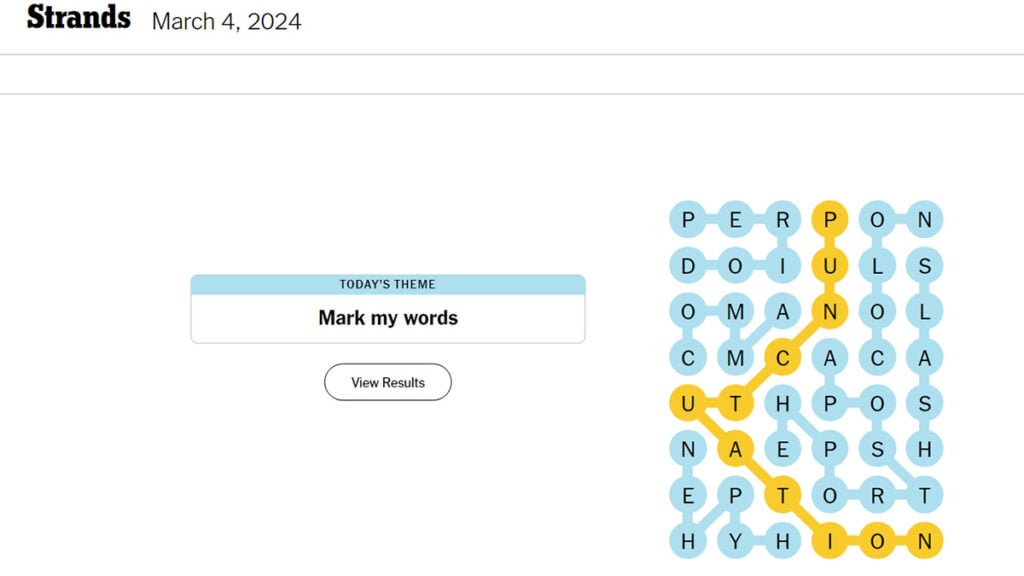

Nyt Strands April 12th 2024 Solutions Game 405

May 10, 2025

Nyt Strands April 12th 2024 Solutions Game 405

May 10, 2025 -

Uk Tightens Visa Rules Amid Concerns Over Overstays Nigerians Affected

May 10, 2025

Uk Tightens Visa Rules Amid Concerns Over Overstays Nigerians Affected

May 10, 2025