8% Stock Market Jump On Euronext Amsterdam: Trump's Tariff Impact

Table of Contents

Understanding the 8% Surge on Euronext Amsterdam

The 8% jump on Euronext Amsterdam, occurring within [specify timeframe, e.g., a single trading day or a specific period], was a remarkable event. This significant increase wasn't evenly distributed; certain sectors experienced far more dramatic gains than others. Before the surge, the market had been [describe market conditions – e.g., experiencing moderate growth, showing signs of stagnation, or recovering from a downturn]. This sudden shift highlights the inherent volatility of the market and the need to understand the driving forces behind such fluctuations.

- Key Index Performance: [Example: The AEX index increased by 8.2%, while the AMX index saw a 7.9% rise.]

- Trading Volume: Trading volume increased by [percentage] compared to the average daily volume during the preceding [time period]. This suggests heightened investor activity.

- Unusual Market Activity: [Example: A significant increase in short covering was observed, indicating a potential shift in investor sentiment.]

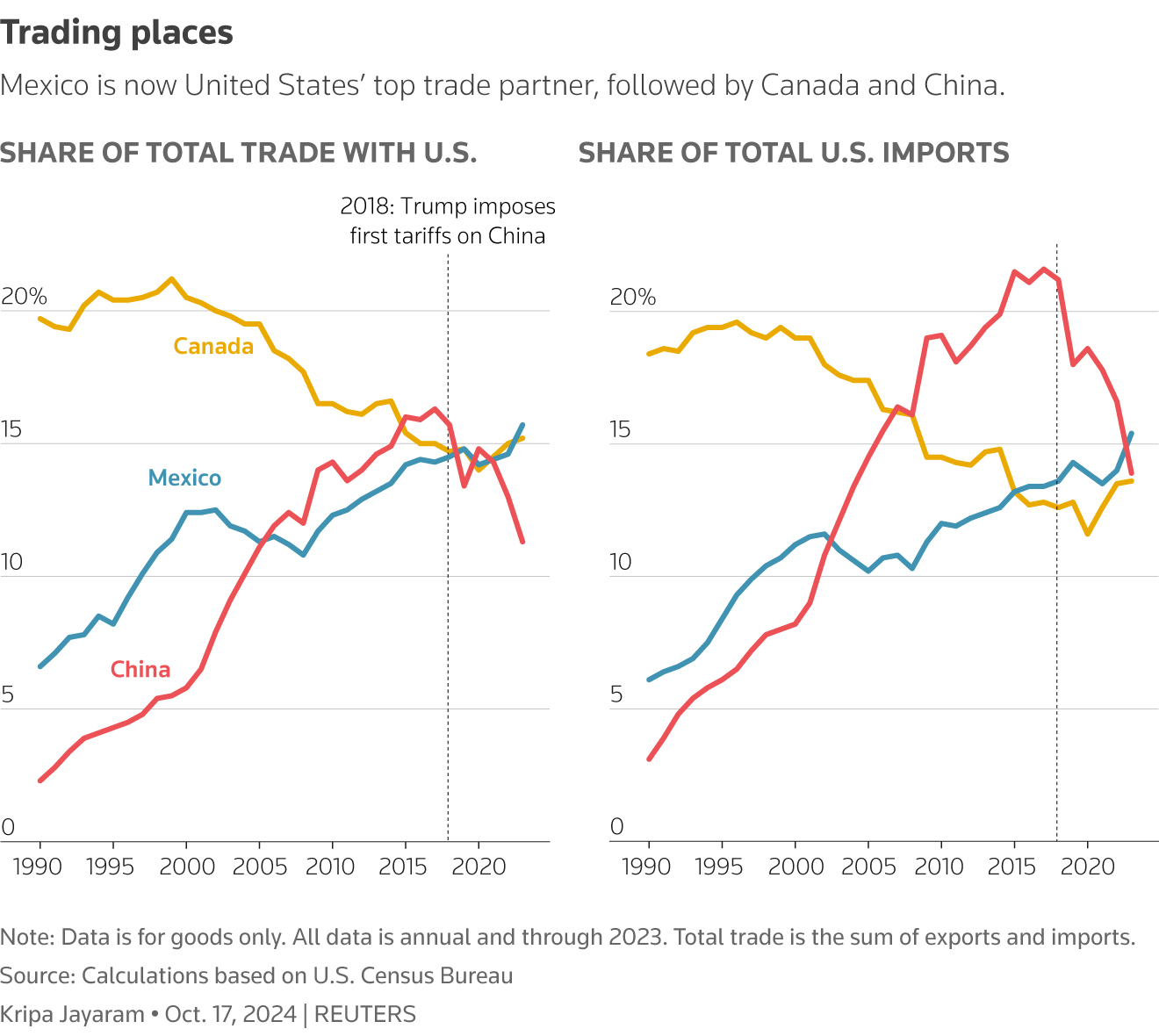

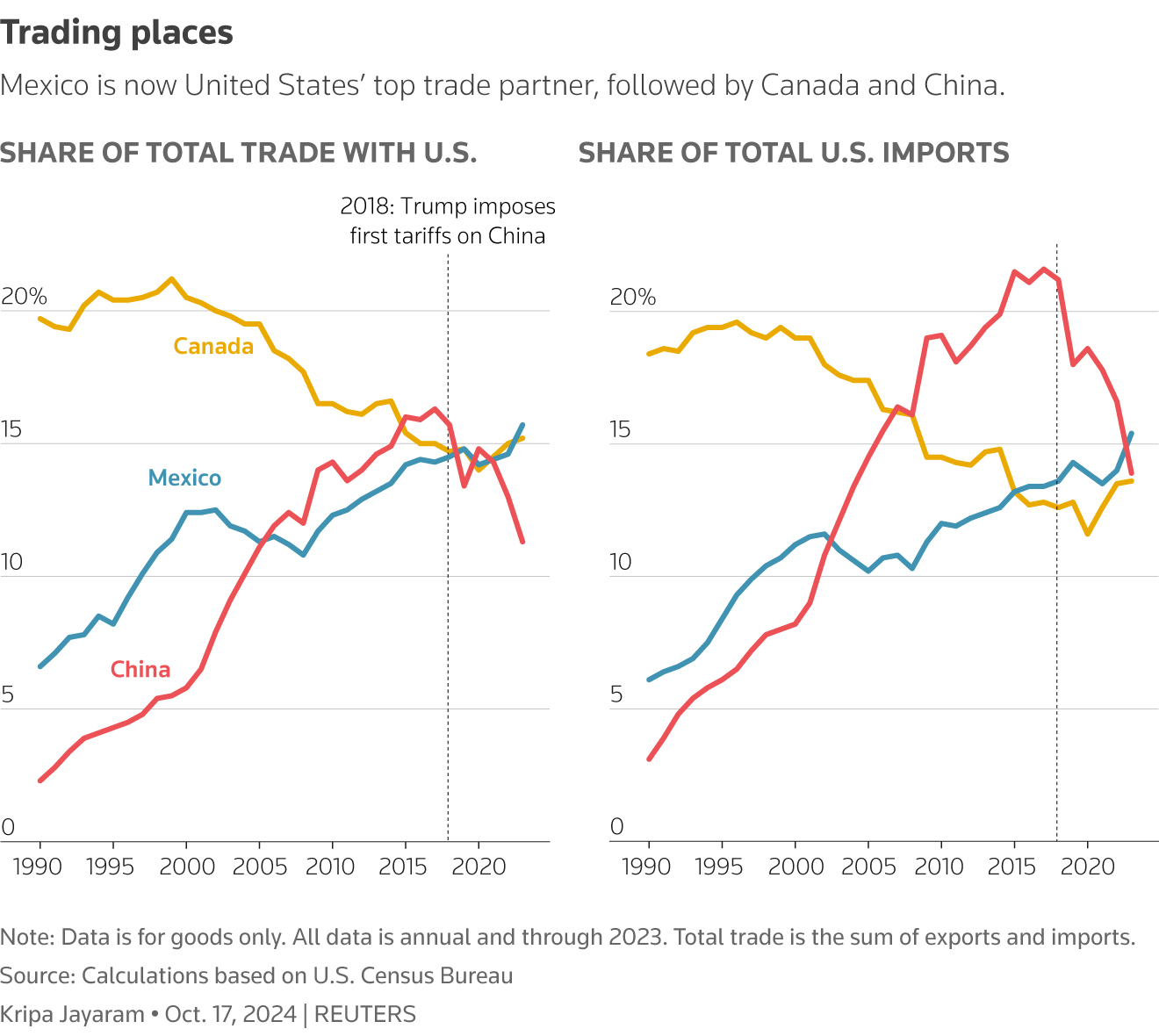

Trump's Tariff Policies and Global Market Reactions

The Trump administration implemented several significant tariff policies during this period, including [list specific examples of tariffs imposed, e.g., tariffs on steel and aluminum imports, tariffs on goods from China]. These policies triggered varied global reactions. While some sectors benefited from protectionist measures, others suffered due to increased import costs and trade tensions. Tariffs can significantly influence stock markets through various channels, including:

-

Increased Inflation: Tariffs can raise prices for imported goods, potentially leading to higher inflation and impacting consumer spending.

-

Trade Wars: Retaliatory tariffs from other countries can escalate trade disputes, disrupting global supply chains and negatively affecting business confidence.

-

Investor Sentiment: Uncertainty surrounding tariff policies can negatively impact investor sentiment, leading to market volatility and potentially causing stock prices to fall.

-

Global Market Index Reactions: [Example: The Dow Jones Industrial Average showed a [percentage]% decrease following the announcement of new tariffs.]

-

Expert Opinions: [Include quotes or summaries of expert opinions on the impact of tariffs on global trade, citing sources.]

Analyzing Euronext Amsterdam's Specific Vulnerability/Resilience to Tariffs

Euronext Amsterdam's composition significantly influences its vulnerability or resilience to tariffs. The exchange lists companies across various sectors, including [list key sectors, e.g., finance, technology, energy, consumer goods]. The international trade connections of these sectors determine their sensitivity to tariffs.

- Key Sectors and International Trade: [Example: The energy sector, heavily reliant on international trade, might be particularly sensitive to tariffs on energy resources.]

- Company-Specific Examples: [Example: Discuss a specific company listed on Euronext Amsterdam and its experience with tariffs, referencing its financial reports or news articles.]

Alternative Explanations for the Stock Market Jump

Attributing the 8% jump solely to Trump's tariffs would be an oversimplification. Other factors likely contributed to this market surge. These could include:

-

Positive Economic News: [Example: The release of unexpectedly strong economic data for the Eurozone could have boosted investor confidence.]

-

Investor Speculation: Market sentiment can be influenced by speculation, causing price fluctuations irrespective of underlying economic fundamentals.

-

Currency Fluctuations: Changes in exchange rates can impact the value of stocks listed on Euronext Amsterdam.

-

Weighing the Explanations: [Analyze the relative importance of each contributing factor, supporting your analysis with data and evidence.]

Long-Term Implications and Future Predictions

Trump's tariff policies could have long-term consequences for Euronext Amsterdam and the European economy. Predicting the future is inherently challenging, but based on the current situation, several scenarios are possible:

-

Scenario 1: [Describe a potential scenario and its implications for Euronext Amsterdam.]

-

Scenario 2: [Describe another potential scenario and its implications.]

-

Investor Considerations: Investors should carefully consider these scenarios when making investment decisions. Diversification and a thorough understanding of market risks are crucial.

Conclusion: Understanding the 8% Stock Market Jump on Euronext Amsterdam – Key Takeaways and Future Outlook

The 8% stock market jump on Euronext Amsterdam was a complex event, likely influenced by a combination of factors, including but not limited to Trump's tariff policies. While tariffs played a role in the broader global market reaction, attributing the entire surge solely to them would be an oversimplification. Understanding market fluctuations requires considering multiple interacting forces. Stay updated on Euronext Amsterdam's response to trade policies and learn more about the interplay between tariffs and stock market performance to make informed investment decisions. Continue researching the impact of Trump's tariffs and Euronext Amsterdam's performance for a comprehensive understanding of market dynamics.

Featured Posts

-

Full Soundtrack For The Prime Video Film Picture This

May 24, 2025

Full Soundtrack For The Prime Video Film Picture This

May 24, 2025 -

M56 Motorway Closure Live Traffic And Travel Updates Following Serious Crash

May 24, 2025

M56 Motorway Closure Live Traffic And Travel Updates Following Serious Crash

May 24, 2025 -

Glastonbury Festival 2025 Full Lineup Announcement Featuring Olivia Rodrigo And The 1975

May 24, 2025

Glastonbury Festival 2025 Full Lineup Announcement Featuring Olivia Rodrigo And The 1975

May 24, 2025 -

Hamiltons Controversial Comments Draw Scathing Criticism From Ferrari

May 24, 2025

Hamiltons Controversial Comments Draw Scathing Criticism From Ferrari

May 24, 2025 -

Jordan Bardella Leading The French Election Opposition

May 24, 2025

Jordan Bardella Leading The French Election Opposition

May 24, 2025

Latest Posts

-

Extreme Price Increase Broadcoms V Mware Deal Sparks Outrage From At And T

May 24, 2025

Extreme Price Increase Broadcoms V Mware Deal Sparks Outrage From At And T

May 24, 2025 -

Strengthening Ties Bipartisan Senate Resolution Celebrates Canada U S Partnership

May 24, 2025

Strengthening Ties Bipartisan Senate Resolution Celebrates Canada U S Partnership

May 24, 2025 -

1050 Price Hike At And Ts Concerns Over Broadcoms V Mware Deal

May 24, 2025

1050 Price Hike At And Ts Concerns Over Broadcoms V Mware Deal

May 24, 2025 -

U S Senate Recognizes Vital Canada U S Relationship With New Resolution

May 24, 2025

U S Senate Recognizes Vital Canada U S Relationship With New Resolution

May 24, 2025 -

Legal Ruling Impacts E Bays Liability For Banned Chemical Listings

May 24, 2025

Legal Ruling Impacts E Bays Liability For Banned Chemical Listings

May 24, 2025