$800 Million Week 1? Analyzing The Potential Impact Of Approved XRP ETFs

Table of Contents

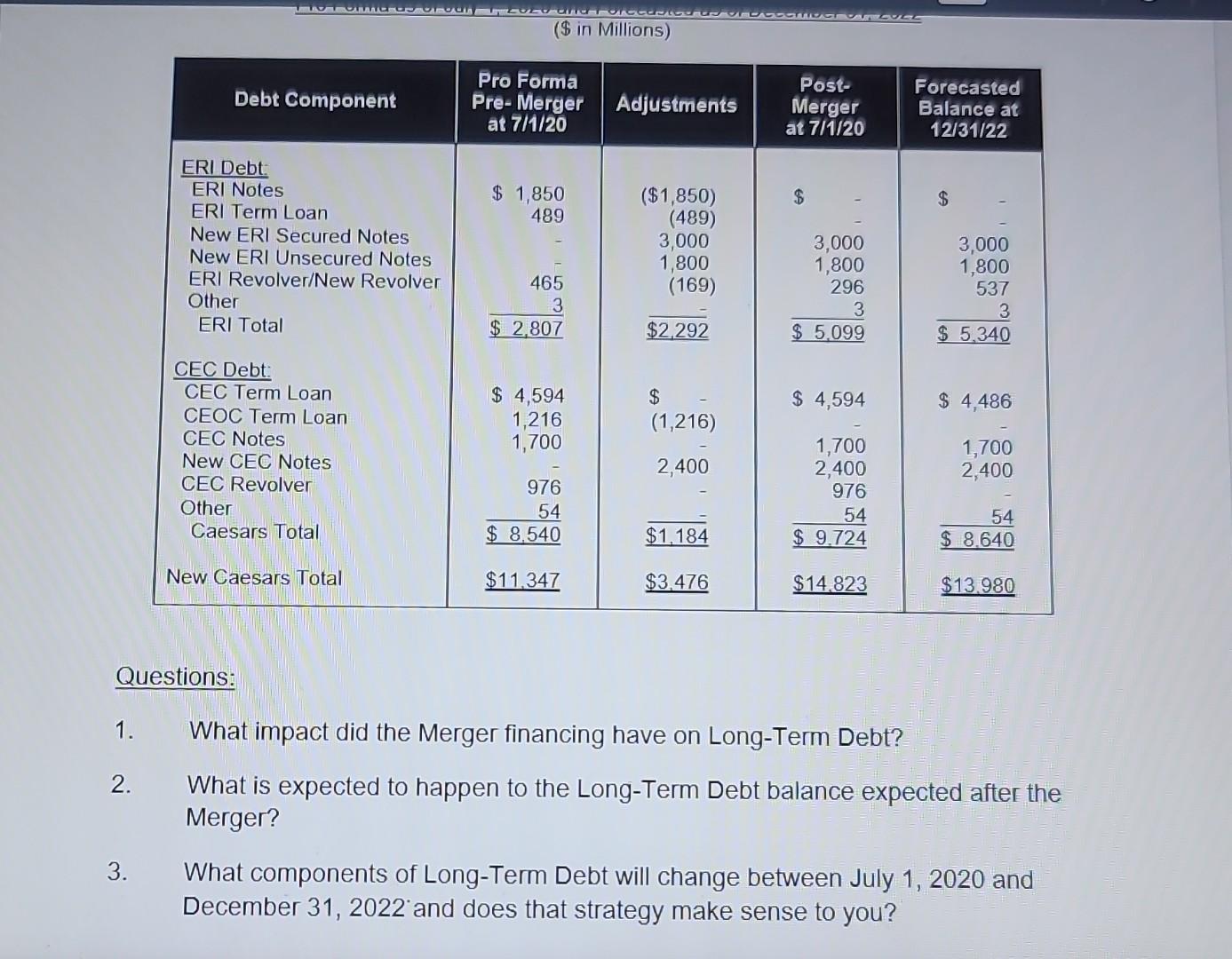

The Potential for Explosive XRP ETF Trading Volume

The launch of approved XRP ETFs could unleash a wave of unprecedented trading activity. The ease of access provided by ETFs is expected to draw in a significant influx of both institutional and retail investors, potentially leading to an explosive increase in trading volume. Imagine a scenario where the first week alone sees a staggering $800 million in XRP ETF trading – a figure that would dramatically overshadow previous trading volumes.

Let's consider some comparable examples. The launch of other successful ETFs in various asset classes often saw initial surges in trading volume. While direct comparisons to crypto are complex due to market volatility, these precedents suggest the potential for significant XRP ETF trading volume.

- Increased institutional investment due to ETF accessibility: Institutional investors, often hesitant to directly engage with cryptocurrencies due to regulatory uncertainty and operational complexities, would find XRP ETFs far more appealing. This injection of institutional capital could substantially boost trading volume.

- Retail investor influx driven by ease of access: ETFs offer a simplified entry point for retail investors unfamiliar with the complexities of cryptocurrency exchanges. This ease of access could drive a substantial increase in participation and, subsequently, trading volume.

- Potential for short-term volatility due to high demand: The initial rush to acquire XRP ETFs could lead to significant price volatility, amplified by the inherent volatility already present in the cryptocurrency market. This could further contribute to the surge in trading volume.

- Impact on XRP price based on supply and demand dynamics: The increased demand for XRP driven by ETF purchases could put upward pressure on its price, creating a positive feedback loop between price appreciation and increased trading volume.

Several factors contribute to the potential $800 million week 1 volume projection. These include the pent-up demand for XRP exposure, the large number of potential investors waiting for regulated access, and the inherent volatility of the cryptocurrency market. (While specific charts and graphs are beyond the scope of this written article, such visuals would greatly enhance understanding.)

Impact on XRP Price and Market Capitalization

The listing of XRP ETFs is anticipated to cause significant price fluctuations. The initial buying pressure is likely to cause short-term price spikes, potentially exceeding current price predictions. However, this initial surge is likely to be followed by a period of price stabilization as the market absorbs the influx of new capital.

- Short-term price spikes due to initial buying pressure: The immediate demand for XRP driven by ETF investments could cause a considerable increase in price.

- Long-term price stabilization after initial hype subsides: As trading activity normalizes, price volatility is expected to decrease, leading to a more stable XRP price.

- Potential increase in XRP's market capitalization: A surge in XRP's price, combined with increased trading volume, would undoubtedly lead to a substantial increase in its overall market capitalization.

- Comparison with other cryptocurrencies after ETF launches: Analyzing the price performance of other cryptocurrencies after their respective ETF launches provides a useful benchmark, though market conditions and specific circumstances will always differ.

Predicting the precise impact on XRP's price is speculative. While some analysts predict significant price increases, others caution against overestimating the immediate impact, emphasizing the need to consider various market dynamics and potential regulatory hurdles.

Regulatory Implications and Future Outlook for XRP and Other Crypto Assets

The SEC's approval of XRP ETFs would have far-reaching implications, not only for XRP but for the entire cryptocurrency market. This approval sets a precedent, potentially paving the way for other cryptocurrencies to pursue similar ETF listings.

- Increased regulatory scrutiny of the crypto industry: The increased attention from regulators, spurred by the successful listing of XRP ETFs, could lead to more stringent regulatory frameworks within the cryptocurrency space.

- Potential for more crypto ETFs to be approved: The SEC's decision could trigger a domino effect, with other cryptocurrencies seeking similar approvals, leading to increased legitimacy and accessibility within the financial markets.

- Impact on institutional adoption of cryptocurrencies: The availability of XRP ETFs makes cryptocurrencies significantly more appealing to institutional investors, potentially accelerating the broader adoption of digital assets.

- Long-term consequences for the future of the crypto market: The successful launch of XRP ETFs could usher in a new era of mainstream acceptance and integration of cryptocurrencies into the traditional financial system.

However, it's crucial to acknowledge potential risks. Investment in XRP ETFs, like any investment in cryptocurrencies, carries inherent risks, including market volatility, regulatory changes, and potential security breaches.

Conclusion: Investing in the Future with Approved XRP ETFs

The potential impact of approved XRP ETFs on trading volume, XRP price, and the broader crypto market is undeniable. The possibility of an $800 million trading week in the first week alone is a compelling indicator of the transformative power this development could have. Both short-term price spikes and long-term price stabilization are likely, leading to significant growth potential. However, it's crucial to remember that investing in XRP ETFs entails both potential rewards and inherent risks. Thorough research and a clear understanding of these risks are essential before making any investment decisions. With the potential for significant returns, now is the time to research and understand the implications of approved XRP ETFs. Begin your due diligence and explore the exciting world of XRP ETF investing today!

Featured Posts

-

Download Rsmssb Exam Calendar 2025 26 Pdf Plan Your Exam Prep

May 07, 2025

Download Rsmssb Exam Calendar 2025 26 Pdf Plan Your Exam Prep

May 07, 2025 -

Ayesha Howards Pregnancy And Anthony Edwards Response A Look At The Alleged Texts

May 07, 2025

Ayesha Howards Pregnancy And Anthony Edwards Response A Look At The Alleged Texts

May 07, 2025 -

Steelers Face Crucial Decision Retain Pickens Or Risk Losing Him Before 2026

May 07, 2025

Steelers Face Crucial Decision Retain Pickens Or Risk Losing Him Before 2026

May 07, 2025 -

Simone Biles Y La Terapia Como Mantiene Su Enfoque Y Seguridad

May 07, 2025

Simone Biles Y La Terapia Como Mantiene Su Enfoque Y Seguridad

May 07, 2025 -

Los Angeles 2028 Las Dudas De Simone Biles Sobre Su Presencia

May 07, 2025

Los Angeles 2028 Las Dudas De Simone Biles Sobre Su Presencia

May 07, 2025