A Crypto Trader's White House Dinner: The Tale Of The $TRUMP Short

Table of Contents

The Genesis of the $TRUMP Short

The $TRUMP token emerged in the volatile landscape of meme coins, capitalizing on the name recognition of a prominent political figure. Its initial market performance was characterized by extreme volatility, mirroring the often unpredictable nature of the political climate it was associated with.

- Initial market cap and price: Launched with a relatively small market cap, $TRUMP saw a dramatic initial surge fueled by speculation and social media hype. The price fluctuated wildly in its first few weeks.

- Reasons behind the token's creation: The token's creators aimed to capitalize on the existing interest in the namesake figure, creating a speculative asset designed to attract investors driven by political sentiment and meme culture.

- Target audience and investor sentiment: The primary target audience was comprised of individuals interested in speculative investments and cryptocurrency meme coins, with investor sentiment ranging from highly optimistic to deeply skeptical.

Our trader, let's call him Alex, saw an opportunity. His rationale for initiating a short position rested on a combination of technical and fundamental analysis, coupled with a keen observation of the prevailing political climate.

- Technical analysis indicators suggesting a potential price drop: Alex identified several key technical indicators, such as overbought conditions on the Relative Strength Index (RSI) and bearish candlestick patterns, suggesting an impending price correction.

- Fundamental analysis pointing to risks or vulnerabilities: Alex's fundamental analysis highlighted the inherent risks associated with a meme coin tied to a political figure. The lack of underlying utility and the potential for regulatory scrutiny raised significant concerns.

- News events or political climate that might affect the token's value: Negative news cycles surrounding the namesake figure, coupled with an anticipated regulatory crackdown on unregulated cryptocurrencies, further solidified Alex's belief in a potential price drop.

The White House Dinner – A High-Stakes Setting

The White House dinner was a black-tie affair, a gathering of influential figures from various sectors. The atmosphere was one of both excitement and apprehension, a stark contrast to the high-stakes trading Alex was simultaneously managing. This unique setting presented an unprecedented challenge.

- The psychological pressure of being surrounded by influential figures while managing a risky trade: The pressure of potentially losing significant capital while surrounded by powerful individuals added an extra layer of complexity.

- Potential for leaked information or insider trading concerns: The ethical implications and potential legal ramifications weighed heavily on Alex's mind.

- The challenge of maintaining composure and making rational decisions: Balancing social graces with the constant monitoring of a volatile trade proved to be a significant test of Alex's emotional intelligence and trading discipline.

Executing the $TRUMP Short: Strategy and Risk Management

Alex employed a sophisticated shorting strategy, carefully considering risk mitigation at every step.

- Leverage levels used: Alex used a moderate leverage level to amplify potential gains without excessively increasing risk.

- Stop-loss and take-profit levels: Stop-loss orders were implemented to limit potential losses, while take-profit orders were set to secure profits at predetermined price levels.

- Hedging strategies (if any): To further manage risk, Alex considered hedging strategies, although they were ultimately deemed unnecessary given his existing risk management protocols.

- Diversification of portfolio to reduce exposure: Alex ensured that his $TRUMP short position represented only a fraction of his overall portfolio, mitigating overall risk.

Unforeseen Events and Market Volatility

The market, as always, presented unexpected twists.

- Impact of news events (positive or negative) on the token's price: A surprise positive news event briefly sent the $TRUMP price soaring, testing Alex's resolve and his stop-loss orders.

- Unexpected market trends or price fluctuations: Sudden surges and dips unrelated to specific news events added further volatility to the already unpredictable market.

- The trader's response to sudden price movements: Alex's calm demeanor and pre-planned risk management strategies allowed him to weather these storms without panic selling or deviating from his strategy.

The Outcome of the $TRUMP Short: Success or Failure?

Ultimately, Alex's $TRUMP short proved successful.

- Final profit or loss amount: He secured a substantial profit, capitalizing on the eventual price drop.

- Lessons learned from the experience: The experience underscored the importance of thorough market analysis, risk management, and maintaining emotional control amidst high-pressure situations.

- Long-term impact on the trader's strategy: The $TRUMP short reinforced Alex's approach to shorting cryptocurrencies, fine-tuning his strategy based on this invaluable real-world experience.

Conclusion

The tale of the $TRUMP short serves as a compelling case study in the high-stakes world of cryptocurrency trading. This daring venture highlighted the immense potential for profits, but also the critical importance of rigorous risk management and a deep understanding of market dynamics. While the $TRUMP short yielded positive results for Alex, it underscores that shorting, particularly in volatile markets, requires careful planning and discipline.

Call to Action: Are you ready to explore the world of crypto trading and learn from real-world examples like the $TRUMP short? Learn more about effective strategies for shorting cryptocurrencies and managing risk to maximize your potential gains. Remember to research thoroughly before engaging in any $TRUMP short or similar high-risk trades. Successful cryptocurrency trading, especially when employing strategies like shorting $TRUMP, demands meticulous planning and a deep understanding of market volatility.

Featured Posts

-

Wie Moet Ajax Aanstellen Van Hanegem Geeft Advies

May 29, 2025

Wie Moet Ajax Aanstellen Van Hanegem Geeft Advies

May 29, 2025 -

Mum Convicted Kidnapping And Trafficking Of 6 Year Old Daughter For Organs

May 29, 2025

Mum Convicted Kidnapping And Trafficking Of 6 Year Old Daughter For Organs

May 29, 2025 -

Prakiraan Cuaca Besok 24 April Jawa Tengah Waspada Hujan Sore

May 29, 2025

Prakiraan Cuaca Besok 24 April Jawa Tengah Waspada Hujan Sore

May 29, 2025 -

The Leading Music Lawyers Of 2025 A Billboard Perspective

May 29, 2025

The Leading Music Lawyers Of 2025 A Billboard Perspective

May 29, 2025 -

Brisbane Mayor Withdraws Q Music Support After Musician Award Controversy

May 29, 2025

Brisbane Mayor Withdraws Q Music Support After Musician Award Controversy

May 29, 2025

Latest Posts

-

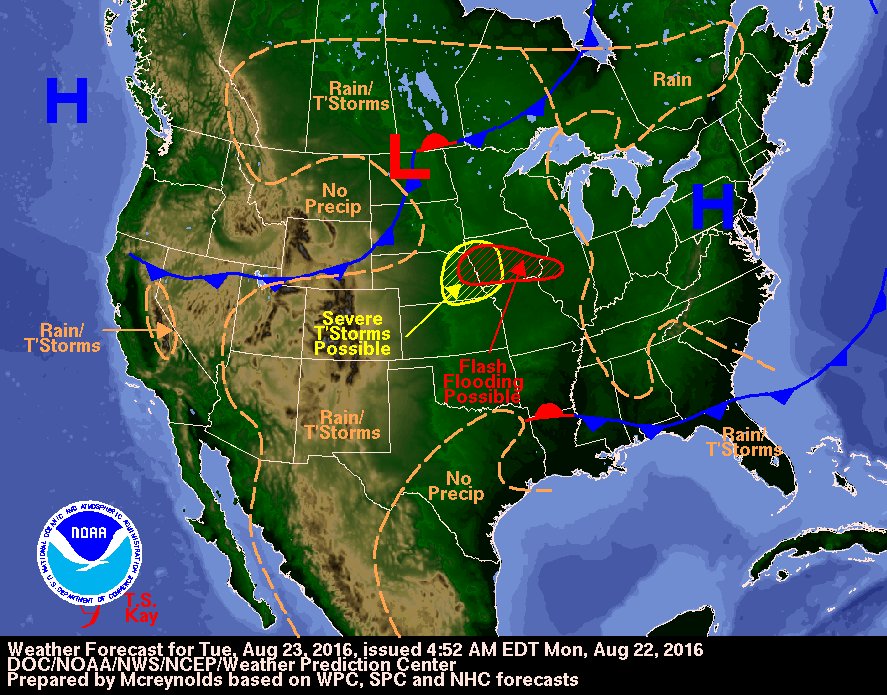

Northeast Ohio Weather Tuesday Brings Sunshine And Dry Conditions

May 31, 2025

Northeast Ohio Weather Tuesday Brings Sunshine And Dry Conditions

May 31, 2025 -

Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025 -

Saturday May 3rd Nyt Mini Crossword Solutions

May 31, 2025

Saturday May 3rd Nyt Mini Crossword Solutions

May 31, 2025 -

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025 -

Find The Answers Nyt Mini Crossword Saturday April 19th

May 31, 2025

Find The Answers Nyt Mini Crossword Saturday April 19th

May 31, 2025