A Financial Planner's Guide To Student Loan Repayment

Table of Contents

Understanding Your Student Loan Debt

Before strategizing your repayment plan, a thorough understanding of your student loan debt is crucial. This involves identifying the types of loans, consolidating if beneficial, and accurately calculating your total debt and interest.

Types of Student Loans

Understanding the nuances between federal and private student loans is the first step. Federal loans, backed by the U.S. government, offer various repayment options and potential forgiveness programs. Private loans, on the other hand, typically have higher interest rates and fewer protections.

- Federal loans:

- Subsidized loans: The government pays the interest while you're in school (under certain conditions).

- Unsubsidized loans: Interest accrues while you're in school.

- Stafford Loans: Common undergraduate and graduate loans.

- Perkins Loans: Low-interest loans for undergraduate students with exceptional financial need.

- PLUS Loans: Loans for graduate students and parents of undergraduate students.

- Private loans: Offered by banks and credit unions; often come with higher interest rates, variable or fixed interest rates, and fewer repayment options compared to federal loans. They may lack the government protections afforded to federal student loans.

Consolidating Your Loans

Student loan consolidation combines multiple loans into a single loan with a new interest rate and monthly payment.

- Benefits: Simplifies repayment with one monthly payment; potentially lower monthly payments (though this might increase the total interest paid over the life of the loan).

- Drawbacks: May result in a higher overall interest paid over the life of the loan; you might lose some benefits associated with individual loans (such as specific repayment plans or forgiveness programs).

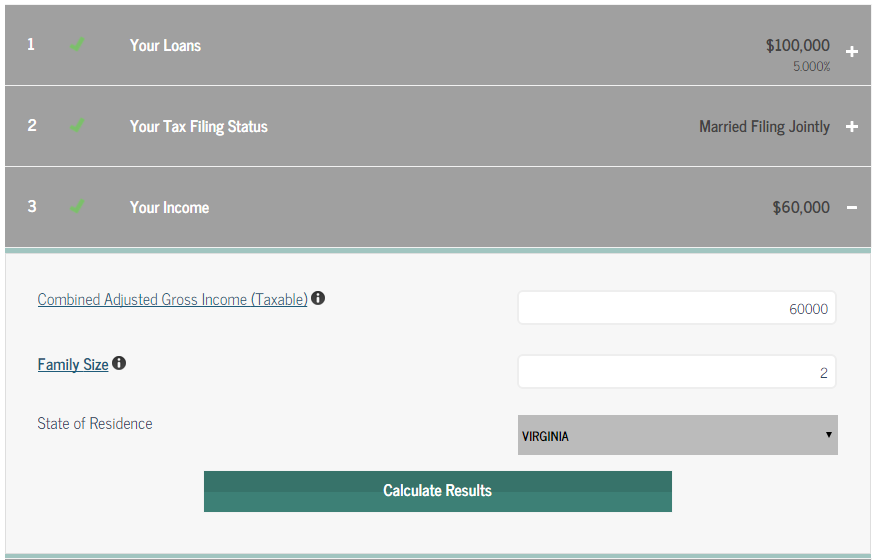

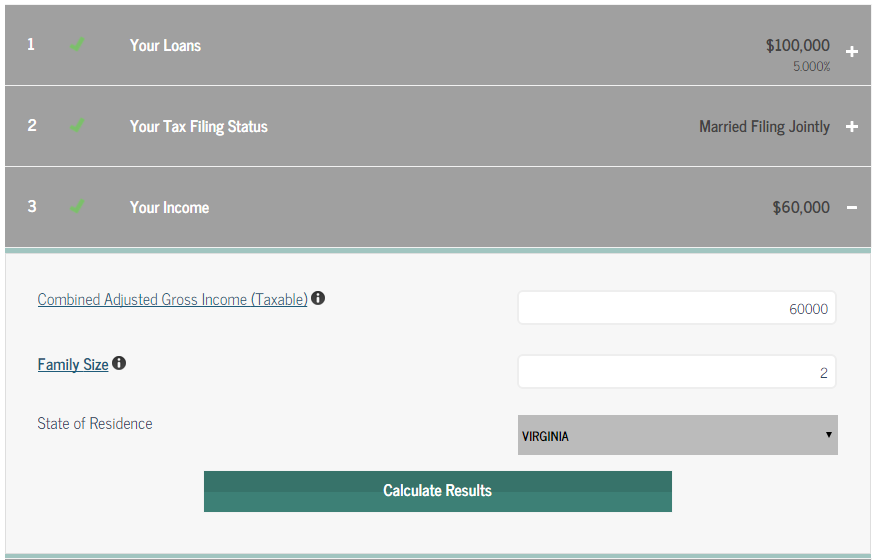

Calculating Your Total Debt and Interest

Accurately calculating your total debt and the impact of interest is vital for effective planning. Many online student loan calculators can help.

- Importance of accurate calculation: Provides a clear picture of your total debt burden and allows for informed decision-making regarding repayment strategies.

- Impact of interest: High interest can significantly increase the total repayment amount over time. Understanding the compounding effect of interest is crucial for long-term financial planning.

Exploring Repayment Options

Several repayment options exist, each with its advantages and disadvantages. Choosing the right option depends on your individual financial situation.

Standard Repayment Plan

This plan typically involves fixed monthly payments over 10 years. While straightforward, it might result in higher monthly payments than other options for borrowers with lower incomes or high debt loads.

Income-Driven Repayment (IDR) Plans

IDR plans link your monthly payment to your income and family size. They offer lower monthly payments but often extend the repayment period, leading to potentially higher total interest paid.

- IBR (Income-Based Repayment): Monthly payments are based on your discretionary income and family size.

- PAYE (Pay As You Earn): Similar to IBR, but generally features lower monthly payments.

- REPAYE (Revised Pay As You Earn): Considers both income and loan amount to calculate monthly payments.

- ICR (Income-Contingent Repayment): Based on your income and the amount of your loan.

Extended Repayment Plans

These plans stretch your repayment period beyond the standard 10 years, reducing monthly payments but increasing the total interest paid.

Forbearance and Deferment

These are temporary pauses in your payments. While offering short-term relief, they typically lead to increased interest accrual, potentially increasing your overall debt.

Strategies for Effective Student Loan Repayment

Effective repayment requires careful planning, budgeting, and strategic decision-making.

Budgeting and Prioritization

Creating a realistic budget that prioritizes student loan payments is paramount. Track your expenses and allocate funds accordingly.

Debt Avalanche vs. Debt Snowball Method

- Debt Avalanche: Prioritize paying off the loan with the highest interest rate first.

- Debt Snowball: Prioritize paying off the smallest loan first for motivational purposes. The best method depends on your personal preferences and financial situation.

Negotiating with Lenders

Explore the possibility of negotiating lower interest rates or more favorable repayment terms with your loan servicers.

Seeking Professional Help

Consulting a financial advisor for personalized guidance can be invaluable in navigating the complexities of student loan repayment.

Conclusion

Effectively managing student loan repayment requires careful planning and a strategic approach. By understanding your loan types, exploring available repayment options, and implementing sound financial strategies, you can navigate the complexities of student loan debt and achieve financial freedom. Don't let student loan debt define your future—take control today. Contact a financial planner to discuss a customized plan for your student loan repayment needs. Learn more about effective student loan repayment strategies and find the best plan for your situation.

Featured Posts

-

Knicks Vs Trail Blazers Game Live Score Updates 77 77 March 13 2025

May 17, 2025

Knicks Vs Trail Blazers Game Live Score Updates 77 77 March 13 2025

May 17, 2025 -

Thibodeaus Papal Prank A Deeper Look At The Knicks Humor

May 17, 2025

Thibodeaus Papal Prank A Deeper Look At The Knicks Humor

May 17, 2025 -

Rossiyane V Dubae Legko Li Nayti Rabotu V 2025 Godu

May 17, 2025

Rossiyane V Dubae Legko Li Nayti Rabotu V 2025 Godu

May 17, 2025 -

Record Breaking Performance Josh Harts Triple Double Dominance For The Knicks

May 17, 2025

Record Breaking Performance Josh Harts Triple Double Dominance For The Knicks

May 17, 2025 -

Mlb Game Today Tigers Vs Mariners Prediction And Betting Odds

May 17, 2025

Mlb Game Today Tigers Vs Mariners Prediction And Betting Odds

May 17, 2025