ABN Amro Bonus Scandal: Potential Fine Imminent?

Table of Contents

Details of the ABN Amro Bonus Scandal

The core of the ABN Amro bonus scandal revolves around allegations of excessive bonuses paid to executives, despite the bank's poor performance and potential violations of internal regulations and possibly even Dutch law. These payouts are alleged to have been disproportionate to the bank's overall financial results and the individual contributions of the recipients. The scandal has sparked intense scrutiny of the bank's internal controls and corporate governance practices.

- Specific examples of alleged misconduct: Reports suggest that bonuses were awarded despite significant losses in certain divisions and a failure to meet pre-defined performance targets. Further details, if made public, would likely provide a clearer picture of the alleged discrepancies.

- Key figures involved in the scandal: While specific names haven't been publicly released in full due to the ongoing investigation, it's understood that senior management and potentially members of the remuneration committee are under scrutiny.

- Timeline of events leading to the investigation: The timeline likely starts with specific bonus payments, followed by internal reviews, whistleblower reports (if any), and finally the initiation of the formal regulatory investigation.

- Source of the allegations: The exact source of the allegations remains partially unclear, though it is likely a combination of internal audits, whistleblower testimony, and possibly external media reports which led to the scrutiny.

The Regulatory Response and Ongoing Investigation

The Dutch Central Bank (DNB) and potentially other European regulatory bodies are actively involved in investigating the ABN Amro bonus scandal. This investigation represents a significant regulatory response to the alleged misconduct. The severity of the potential penalties is directly linked to the findings of this ongoing investigation.

- Status of the investigation: At the time of writing, the investigation is ongoing, and its duration remains uncertain. The detailed findings are yet to be officially released.

- Types of evidence being gathered: The investigation is likely gathering evidence from various sources, including internal documents, employee interviews, financial records, and communications related to bonus decisions.

- Potential legal avenues being explored: Depending on the findings, the DNB may explore various legal avenues, potentially including civil penalties, criminal investigations, and enforcement actions against individuals and the bank itself.

- Previous similar cases and their outcomes: Examination of similar cases involving executive compensation irregularities and regulatory breaches in other financial institutions will likely inform the DNB's approach and the eventual penalties imposed.

Potential Financial Penalties for ABN Amro

The potential financial penalties ABN Amro faces are substantial and could significantly impact the bank's financial performance and reputation. The size of any fine will depend on several key factors.

- Factors influencing the size of the fine: The severity of the alleged misconduct, the level of cooperation from ABN Amro during the investigation, and the presence of any aggravating circumstances will all play a role in determining the size of the penalty.

- Potential impact on ABN Amro's financial performance: A substantial fine could negatively affect ABN Amro's profitability, potentially impacting shareholder value and investor confidence.

- Legal precedents for similar cases: Precedents from similar cases in the Netherlands and the EU will provide a framework for determining the appropriate level of penalties.

- Possible reputational damage: Regardless of the financial penalty, the reputational damage associated with the scandal could be long-lasting, impacting the bank's ability to attract and retain customers and talent.

Wider Implications for the Financial Industry

The ABN Amro bonus scandal has significant implications for the broader financial industry, highlighting the ongoing need for stronger regulatory oversight and ethical conduct.

- Increased scrutiny of executive compensation practices: The scandal is likely to lead to increased scrutiny of executive compensation practices across the financial sector, potentially triggering stricter regulations and increased transparency.

- Potential changes in regulations surrounding bonuses: Regulatory bodies might consider changes to regulations governing executive compensation, potentially limiting the size and structure of bonuses to reduce incentives for risky behavior.

- Impact on investor confidence: The scandal could erode investor confidence in the Dutch banking sector and broader financial markets, leading to increased volatility and uncertainty.

- Lessons learned from the scandal: The scandal serves as a stark reminder of the importance of robust corporate governance, ethical decision-making, and effective regulatory oversight in the financial industry.

Conclusion

The ABN Amro bonus scandal highlights the ongoing challenges in regulating executive compensation and ensuring ethical conduct within the financial industry. The potential for a substantial fine underscores the serious consequences of misconduct. The outcome of this investigation will undoubtedly shape future regulatory practices and corporate governance. The scandal serves as a cautionary tale for other financial institutions, emphasizing the importance of transparency, accountability, and adherence to ethical standards in all aspects of business operations.

Call to Action: Stay informed about the latest developments in the ABN Amro bonus scandal and the potential fine. Follow reputable news sources and financial publications for continuous coverage on this significant event impacting the Dutch banking sector and the global financial landscape. Search "ABN Amro bonus scandal" for more information.

Featured Posts

-

11 6 Billion Investment Fuels Open Ais Texas Data Center Expansion

May 22, 2025

11 6 Billion Investment Fuels Open Ais Texas Data Center Expansion

May 22, 2025 -

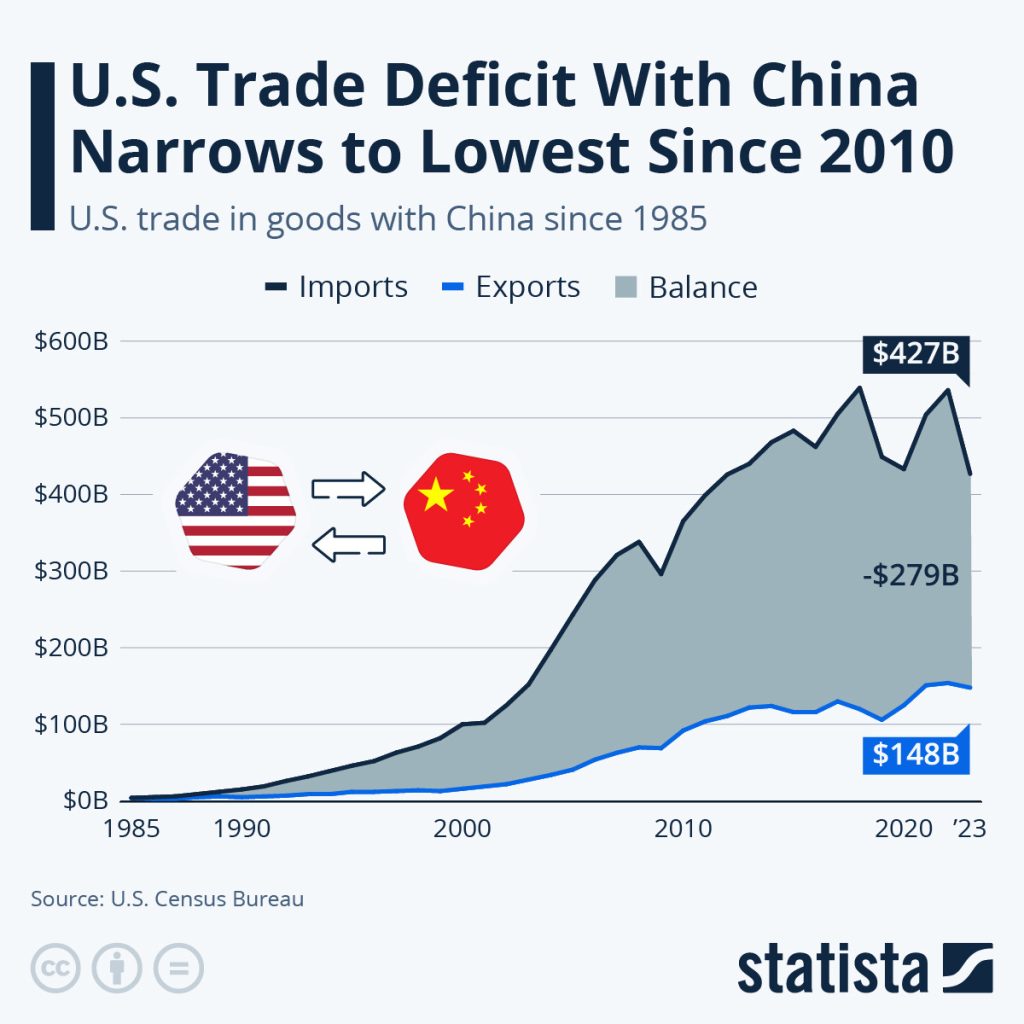

G 7 Nations Debate Lowering Tariffs On Chinese Imports A Closer Look

May 22, 2025

G 7 Nations Debate Lowering Tariffs On Chinese Imports A Closer Look

May 22, 2025 -

Cassis Blackcurrant Uses In Cocktails And Cuisine

May 22, 2025

Cassis Blackcurrant Uses In Cocktails And Cuisine

May 22, 2025 -

Forrests Pilbara Criticism Rio Tintos Response And Environmental Stewardship

May 22, 2025

Forrests Pilbara Criticism Rio Tintos Response And Environmental Stewardship

May 22, 2025 -

Testez Vos Connaissances Sur La Loire Atlantique Histoire Gastronomie Culture

May 22, 2025

Testez Vos Connaissances Sur La Loire Atlantique Histoire Gastronomie Culture

May 22, 2025

Latest Posts

-

The Rise Of Succession Planning Among The Super Rich A Comprehensive Guide

May 22, 2025

The Rise Of Succession Planning Among The Super Rich A Comprehensive Guide

May 22, 2025 -

How Two Ceos Romance Led To A Business Scandal

May 22, 2025

How Two Ceos Romance Led To A Business Scandal

May 22, 2025 -

Succession Planning The Growing Trend Among High Net Worth Individuals

May 22, 2025

Succession Planning The Growing Trend Among High Net Worth Individuals

May 22, 2025 -

Streaming Revenue Growth Increased Complexity For The Average Viewer

May 22, 2025

Streaming Revenue Growth Increased Complexity For The Average Viewer

May 22, 2025 -

11 6 Billion Investment Fuels Open Ais Texas Data Center Expansion

May 22, 2025

11 6 Billion Investment Fuels Open Ais Texas Data Center Expansion

May 22, 2025