ABN Amro Facing Dutch Central Bank Scrutiny Over Bonus Payments

Table of Contents

The Dutch Central Bank's Concerns Regarding ABN Amro's Bonus Structure

De Nederlandsche Bank (DNB), the Dutch Central Bank, has expressed serious concerns about aspects of ABN Amro's bonus structure. The DNB's scrutiny centers on several key areas, raising questions about responsible banking practices and the potential for excessive risk-taking. Specifically, the DNB is examining:

- The size of bonuses awarded: Are bonuses excessively high, potentially incentivizing reckless behavior to maximize short-term profits?

- Criteria for awarding bonuses: Are the criteria fair, transparent, and aligned with long-term sustainable growth, or do they inadvertently encourage short-sighted risk-taking?

- Potential conflicts of interest: Does the bonus structure create situations where individual interests conflict with the overall interests of the bank and its stakeholders?

The DNB's concerns stem from a potential breach of responsible banking guidelines. They fear that the bonus system could be inadvertently fueling risk-taking behavior, potentially impacting financial stability, not only for ABN Amro but for the wider Dutch financial system. Comparisons are being drawn with the bonus structures of other major Dutch banks to assess whether ABN Amro's practices deviate significantly from industry norms. While specific data regarding the comparative analysis remains confidential for now, the DNB's public statements clearly indicate a significant level of concern.

ABN Amro's Response to the Scrutiny

ABN Amro has responded to the DNB's scrutiny with a series of official statements and actions. The bank claims it is fully cooperating with the investigation. Key elements of their response include:

- Public statements: ABN Amro has released public statements acknowledging the DNB's concerns and emphasizing their commitment to responsible banking practices. These statements often highlight the bank's ongoing efforts to improve its risk management frameworks.

- Internal reviews and audits: The bank has initiated internal reviews and audits of its bonus structure and risk management processes. The findings of these reviews are expected to inform any necessary changes to its policies.

- Proposed changes to bonus policies: While specifics remain undisclosed pending the completion of the DNB's investigation, ABN Amro has indicated a willingness to revise its bonus policies to align more closely with responsible banking principles. These changes likely aim to mitigate the DNB's concerns about risk-taking incentives.

- Communication strategy: ABN Amro has implemented a communication strategy to engage with stakeholders, including investors, employees, and the public, aiming to reassure them of its commitment to transparency and responsible conduct.

The effectiveness of ABN Amro's response remains to be seen and will largely depend on the outcome of the DNB's investigation and any subsequent regulatory actions.

Potential Consequences for ABN Amro

If found to be in violation of regulations, ABN Amro faces several potential consequences:

- Financial penalties: The DNB could impose significant financial penalties, impacting the bank's profitability and shareholder value.

- Reputational damage: Negative publicity surrounding the bonus scrutiny could severely damage ABN Amro's reputation, impacting its ability to attract and retain clients and talent.

- Changes to management or board structure: The DNB might demand changes in senior management or the board of directors if it finds evidence of negligence or misconduct.

- Impact on future business operations: The investigation and potential penalties could restrict the bank's ability to conduct business, potentially impacting its lending activities and expansion plans.

The legal implications could be substantial, with potential lawsuits from investors or other stakeholders if the bank is found to have misled them about its risk management practices.

Wider Implications for the Dutch Banking Sector

The ABN Amro bonus scrutiny has broader implications for the Dutch banking sector. The DNB's actions could trigger increased scrutiny on bonus structures across the industry, potentially leading to regulatory changes.

- Impact on investor confidence: The situation could erode investor confidence in Dutch banks, potentially affecting their access to capital markets.

- Potential for regulatory changes: The DNB might introduce stricter regulations governing bonus structures across the banking sector, to prevent similar situations from arising in the future.

- Increased scrutiny on bonus structures: Other Dutch banks are likely to face greater scrutiny regarding their own bonus schemes, prompting reviews and potential adjustments.

- Effects on competition: The regulatory changes could impact competition within the Dutch banking market, depending on how the new regulations are designed and implemented.

This situation echoes similar concerns and regulatory responses observed in other countries following the 2008 financial crisis, highlighting the ongoing international focus on responsible banking practices and fair compensation structures.

Conclusion: ABN Amro Bonus Scrutiny – What's Next?

In summary, the ABN Amro bonus scrutiny highlights the critical role of the Dutch Central Bank in overseeing responsible banking practices. The DNB's concerns about ABN Amro's bonus structure, the bank's response, and the potential consequences underscore the importance of aligning compensation structures with long-term sustainable growth. The broader implications for the Dutch banking sector are significant, with potential regulatory changes and shifts in investor sentiment anticipated.

To stay informed about the evolving situation, follow news reports on the DNB's investigation and ABN Amro's responses. What do you think the long-term implications of this scrutiny will be for ABN Amro and the Dutch banking sector? Share your thoughts in the comments below. Further research into the DNB's guidelines on responsible banking and the European Banking Authority's (EBA) directives on remuneration could offer valuable insights into this ongoing debate on ABN Amro bonus payments and the future of responsible banking.

Featured Posts

-

Watch Looney Tunes And Cartoon Network Stars In A New 2025 Animated Short

May 21, 2025

Watch Looney Tunes And Cartoon Network Stars In A New 2025 Animated Short

May 21, 2025 -

Another Fan Favorite Villain Joins Dexter Resurrection

May 21, 2025

Another Fan Favorite Villain Joins Dexter Resurrection

May 21, 2025 -

Switzerlands Response To Prc Military Activity Near Taiwan

May 21, 2025

Switzerlands Response To Prc Military Activity Near Taiwan

May 21, 2025 -

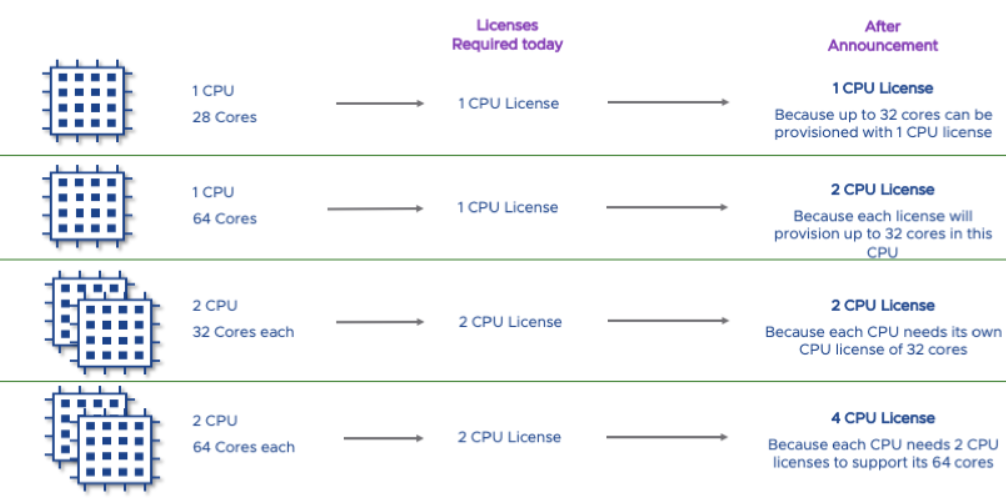

Broadcoms Extreme V Mware Price Increase At And T Details 1 050 Jump

May 21, 2025

Broadcoms Extreme V Mware Price Increase At And T Details 1 050 Jump

May 21, 2025 -

Najbolja Kombinacija Vanja I Sime Odusevili Fanove Gospodina Savrsenog Novim Fotografijama

May 21, 2025

Najbolja Kombinacija Vanja I Sime Odusevili Fanove Gospodina Savrsenog Novim Fotografijama

May 21, 2025

Latest Posts

-

Robin Roberts Gma Family Announcement A New Addition

May 21, 2025

Robin Roberts Gma Family Announcement A New Addition

May 21, 2025 -

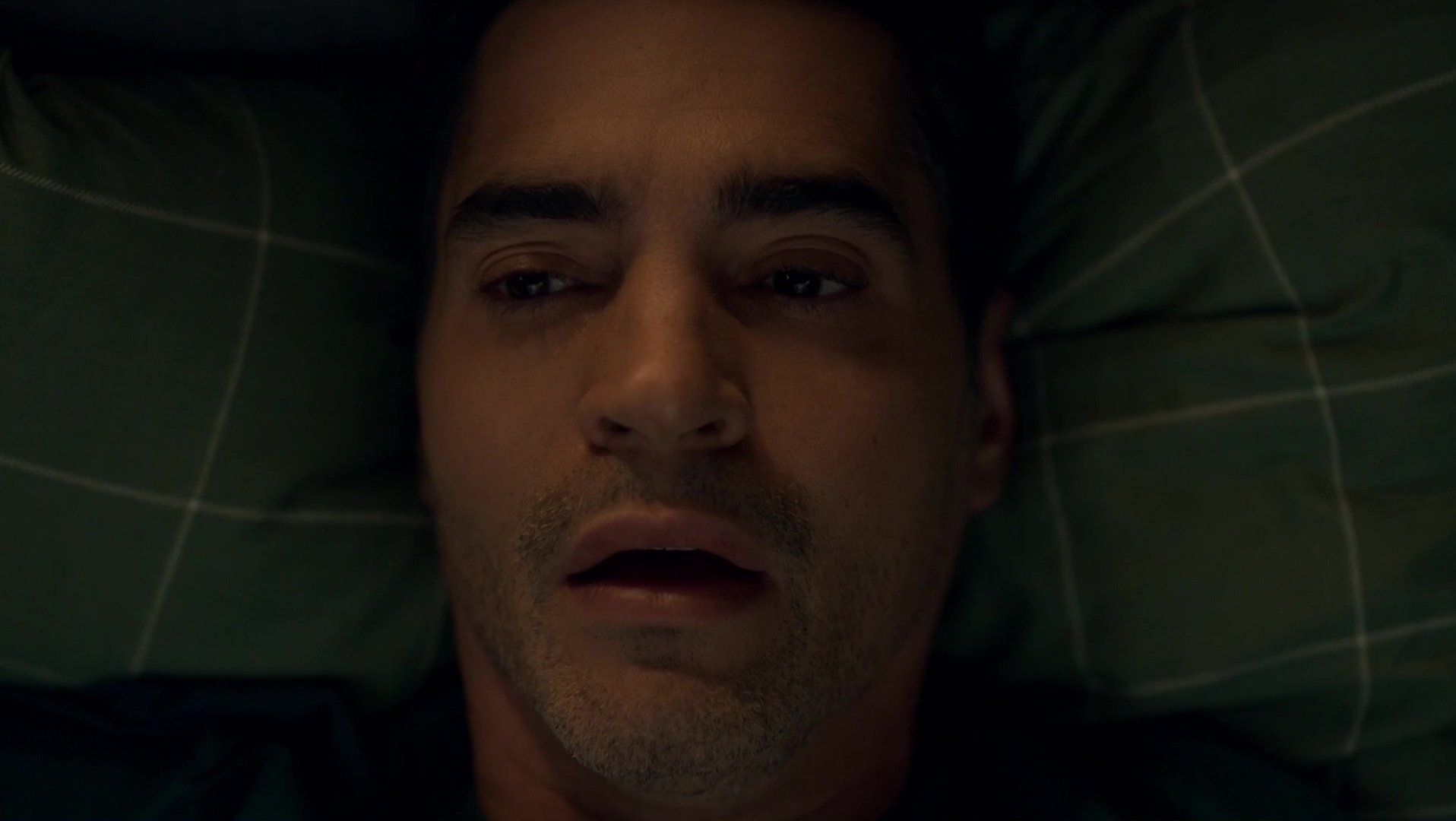

Actor Ramon Rodriguez Details Unexpected Scorpion Encounter On Will Trent Set

May 21, 2025

Actor Ramon Rodriguez Details Unexpected Scorpion Encounter On Will Trent Set

May 21, 2025 -

Ramon Rodriguez Will Trent Slept Through Three Scorpion Stings

May 21, 2025

Ramon Rodriguez Will Trent Slept Through Three Scorpion Stings

May 21, 2025 -

Good Morning America Without Michael Strahan The Story Behind His Exit

May 21, 2025

Good Morning America Without Michael Strahan The Story Behind His Exit

May 21, 2025 -

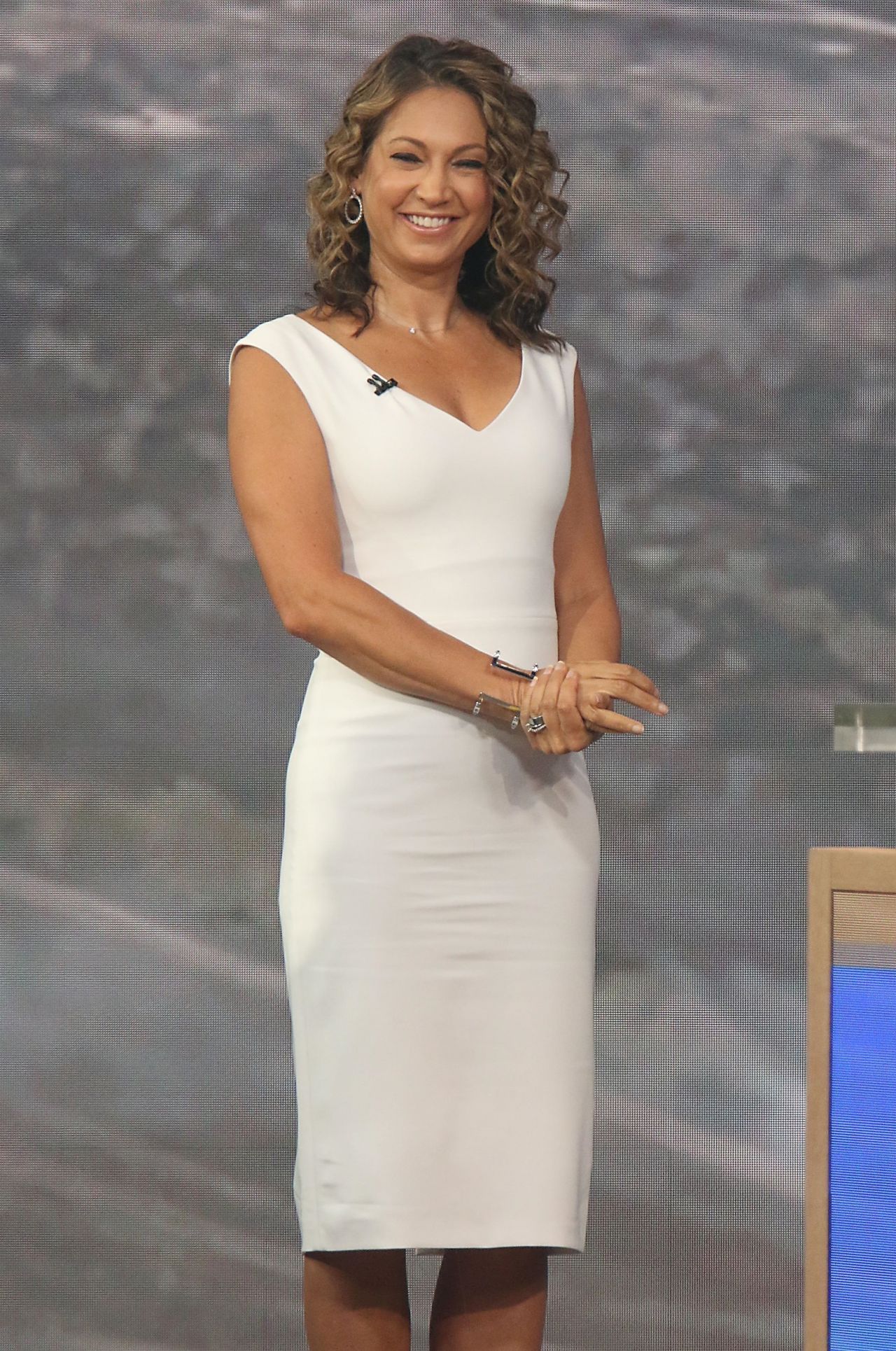

Preview Ginger Zee Gma At Wlos For Asheville Rising Helene Special

May 21, 2025

Preview Ginger Zee Gma At Wlos For Asheville Rising Helene Special

May 21, 2025