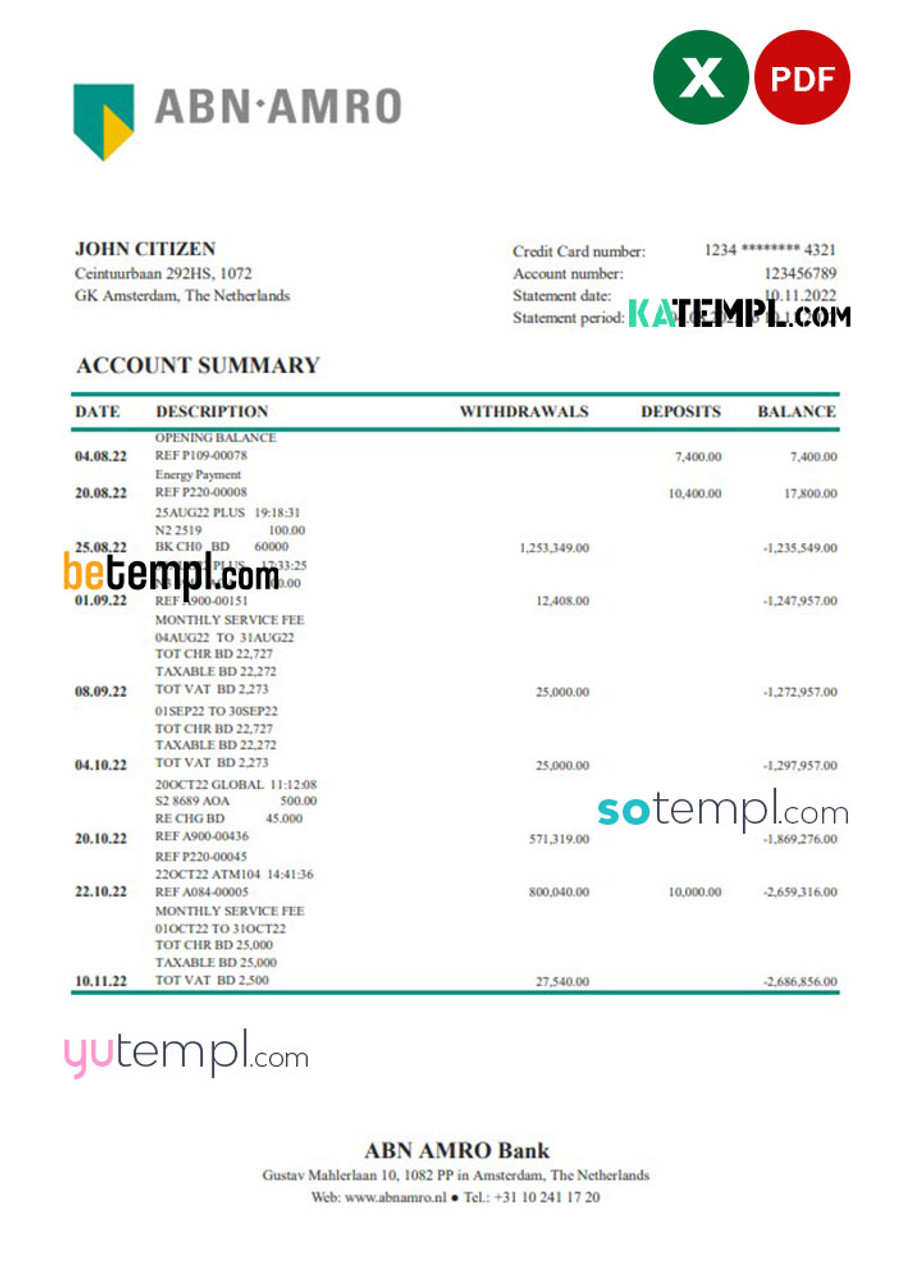

ABN Amro: Potential Fine From Dutch Central Bank Over Bonuses

Table of Contents

De Nederlandsche Bank's Investigation into ABN Amro's Bonus System

De Nederlandsche Bank (DNB) plays a crucial role in supervising and regulating the financial stability of the Netherlands. Its responsibilities include ensuring that banks operate responsibly, adhering to strict guidelines to prevent systemic risk and protect consumers. The DNB's investigation into ABN Amro centers on concerns surrounding the bank's bonus system and potential breaches of regulatory norms. Specific concerns raised by the DNB reportedly include:

- Potential violations of responsible lending guidelines: The DNB may be scrutinizing whether ABN Amro's bonus structures incentivized risky lending practices, potentially leading to increased defaults and financial instability.

- Failure to adequately consider risk management in bonus structures: The investigation likely focuses on whether the bank's bonus system appropriately considered and mitigated risks associated with specific financial products or strategies. Did the bonuses incentivize excessive risk-taking?

- Inadequate oversight of employee compensation: The DNB may be examining whether ABN Amro had sufficient internal controls and oversight mechanisms in place to monitor and manage employee compensation, including bonuses, ensuring compliance with regulations.

The timeline of the DNB's investigation remains unclear, but reports suggest that previous warnings or informal actions may have preceded the formal investigation. The DNB's past actions against other financial institutions for similar violations suggest a firm stance on responsible banking practices.

Potential Penalties and Financial Implications for ABN Amro

The potential "ABN Amro fine" resulting from this investigation could range significantly, depending on the severity of the identified violations and the DNB's assessment. Previous DNB sanctions against other financial institutions offer a glimpse into potential outcomes. Fines have varied considerably, reaching millions of euros in some cases, with additional penalties potentially including restrictions on bank operations or specific business activities.

The financial implications for ABN Amro could be substantial. A significant fine would negatively impact the bank's profitability and financial performance, potentially leading to a decrease in its share price. Furthermore, the reputational damage associated with an "ABN Amro bonus scandal" could be far-reaching:

- Loss of investor confidence: Investors may reconsider their investments in the bank following the revelation of regulatory breaches.

- Damage to brand image: The negative publicity associated with the investigation could harm ABN Amro's reputation and trust among its customers.

- Increased scrutiny from regulatory bodies: The DNB and other international regulatory bodies might increase their scrutiny of ABN Amro's operations, increasing compliance costs and operational burdens.

ABN Amro's Response and Future Implications for Bonus Structures in the Dutch Banking Sector

ABN Amro has publicly stated its commitment to cooperating fully with the DNB investigation. While specific details of its response remain limited, the bank is likely reviewing its bonus structures and internal controls to identify areas for improvement and ensure future compliance. This situation may trigger broader changes within the Dutch banking sector:

- Increased regulatory pressure on bank compensation: The outcome of this investigation may lead to increased regulatory oversight and stricter rules governing bank compensation structures across the board.

- Potential for changes in banking legislation: The DNB's findings could influence future legislative changes related to banking regulations and compensation policies in the Netherlands.

- Shift towards performance-based bonuses linked to sustainable practices: This situation might accelerate a shift toward bonus systems that reward performance linked to sustainable and responsible banking practices, aligning incentives with long-term stability and societal benefit.

Conclusion: The ABN Amro Fine and the Future of Responsible Banking

The DNB investigation into ABN Amro's bonus practices highlights the crucial importance of responsible banking and strict adherence to regulatory guidelines. The potential "ABN Amro fine" and its implications serve as a stark reminder of the significant consequences of failing to meet these standards. The outcome of this case will likely have far-reaching implications for the Dutch banking sector and may influence the global conversation about fair and responsible banking practices. To stay updated on the "ABN Amro bonus" case and the evolving landscape of "Dutch banking regulations" and "financial penalties," regularly check reputable news sources and regulatory websites. Understanding these developments is crucial for investors, consumers, and anyone concerned about the future of responsible banking.

Featured Posts

-

Post Nuclear Taiwan Lng Imports And Energy Security

May 21, 2025

Post Nuclear Taiwan Lng Imports And Energy Security

May 21, 2025 -

Trans Australia Run Record A New Challenger Emerges

May 21, 2025

Trans Australia Run Record A New Challenger Emerges

May 21, 2025 -

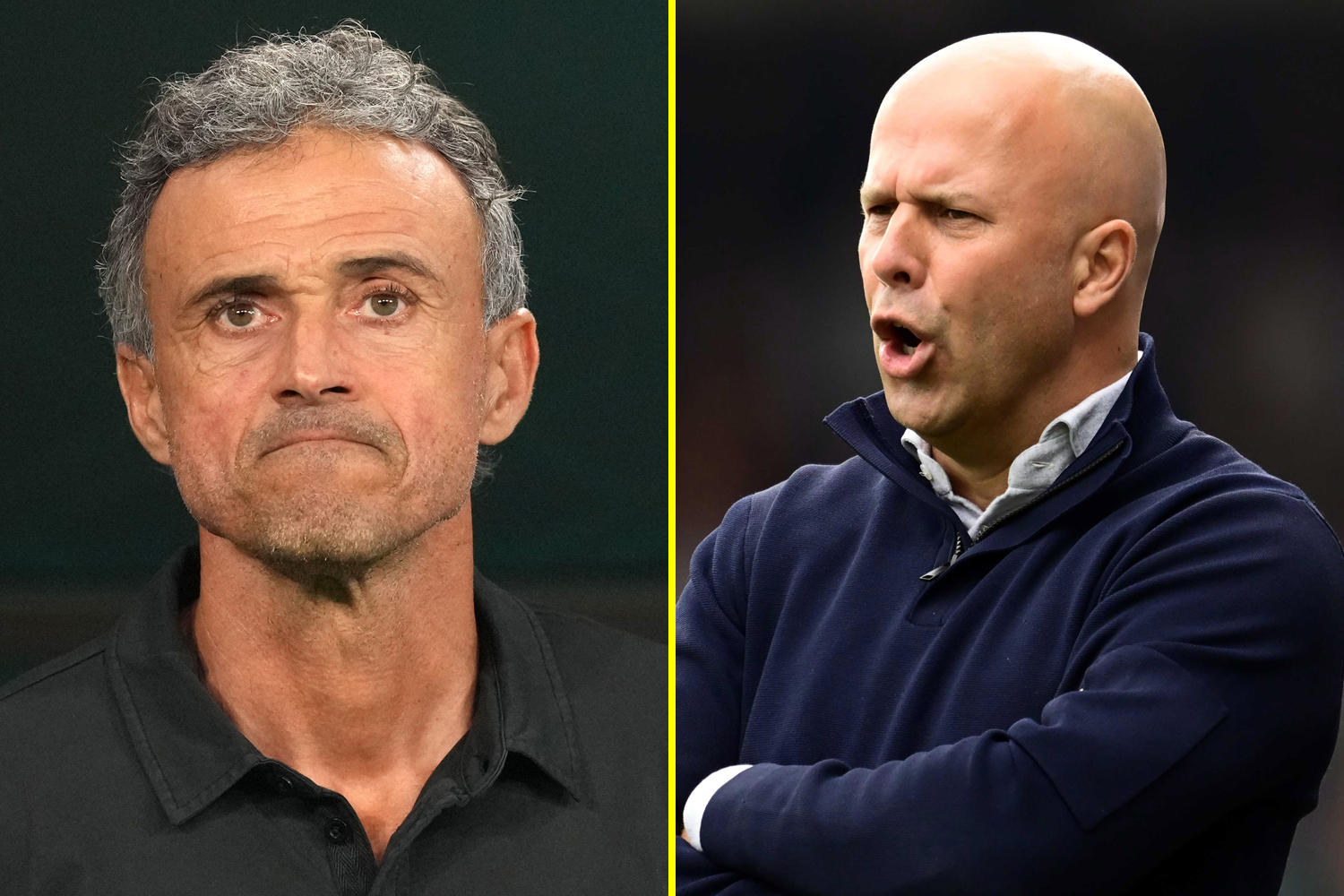

Analysis Arne Slot And Luis Enrique On Liverpools Win And Alissons Role

May 21, 2025

Analysis Arne Slot And Luis Enrique On Liverpools Win And Alissons Role

May 21, 2025 -

Analysis Of Sasol Sol S New Strategic Direction Investor Implications

May 21, 2025

Analysis Of Sasol Sol S New Strategic Direction Investor Implications

May 21, 2025 -

Eu Trade Shift Macrons Plea For European Procurement

May 21, 2025

Eu Trade Shift Macrons Plea For European Procurement

May 21, 2025

Latest Posts

-

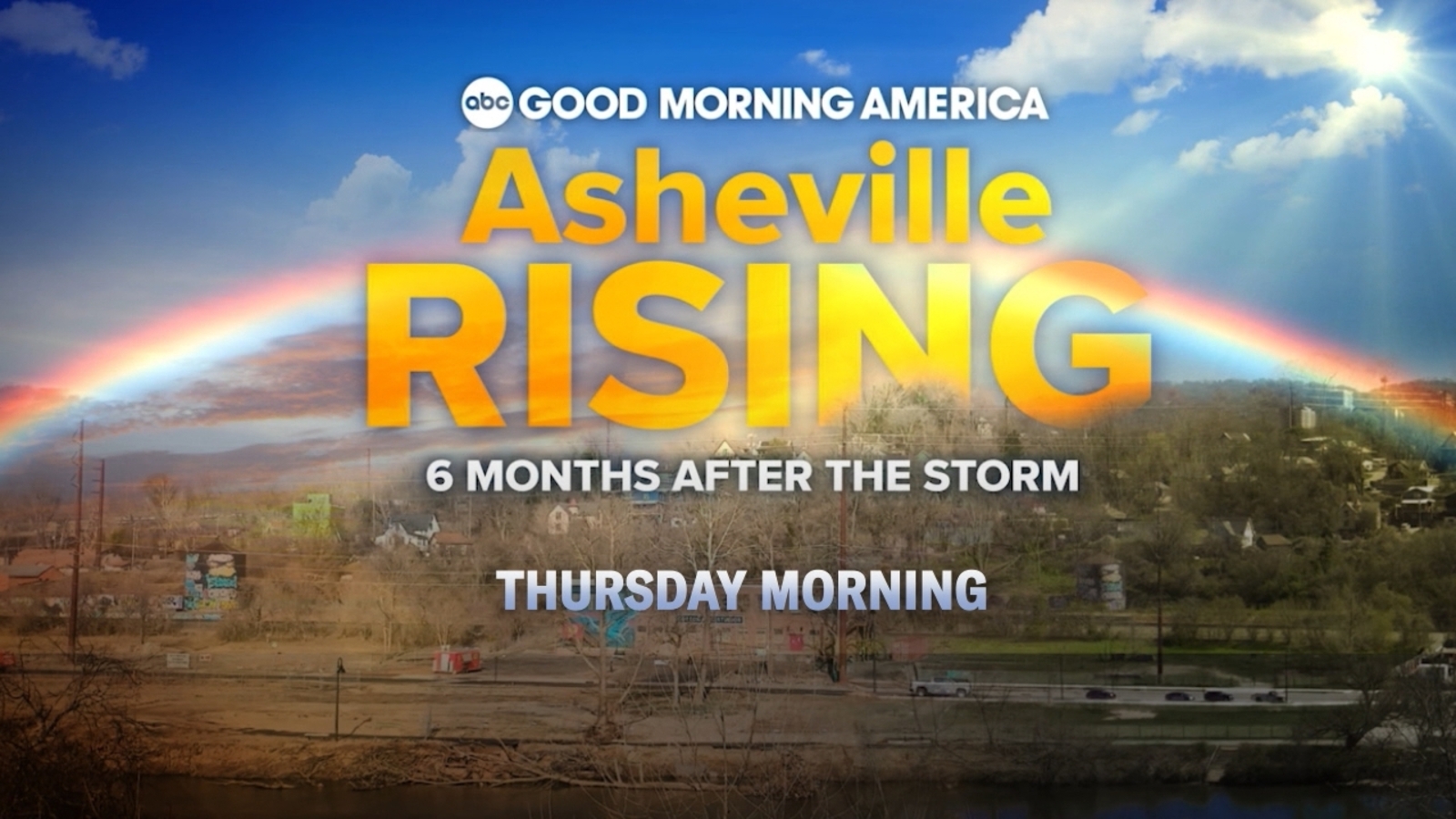

Preview Ginger Zee Gma At Wlos For Asheville Rising Helene Special

May 21, 2025

Preview Ginger Zee Gma At Wlos For Asheville Rising Helene Special

May 21, 2025 -

Understanding Michael Strahans Approach To Securing High Profile Interviews

May 21, 2025

Understanding Michael Strahans Approach To Securing High Profile Interviews

May 21, 2025 -

Asheville Rising Gmas Ginger Zee At Wlos For Special Report

May 21, 2025

Asheville Rising Gmas Ginger Zee At Wlos For Special Report

May 21, 2025 -

Decoding Michael Strahans Interview Strategy Winning In The Ratings Game

May 21, 2025

Decoding Michael Strahans Interview Strategy Winning In The Ratings Game

May 21, 2025 -

Good Morning America Behind The Scenes Chaos And Potential Job Losses

May 21, 2025

Good Morning America Behind The Scenes Chaos And Potential Job Losses

May 21, 2025