ABN Amro Under Investigation: Bonus Practices Scrutinized

Table of Contents

The Nature of the ABN Amro Bonus Investigation

The ABN Amro bonus investigation centers on allegations of irregularities and potential violations within its bonus schemes. Specific details remain confidential due to the ongoing nature of the inquiry, but reports suggest concerns about the transparency and fairness of bonus allocations. The investigation is primarily being conducted by the Dutch Central Bank (De Nederlandsche Bank, or DNB), with potential involvement from other European regulatory bodies depending on the scope of the alleged misconduct.

- Specific examples of alleged misconduct: While precise details are scarce, reports suggest potential misrepresentation of performance metrics used to justify bonus payouts, and possible preferential treatment of certain employees. Further investigation may reveal breaches of internal compliance procedures and ethical guidelines.

- Timeline of events: The investigation was initiated following an internal review that uncovered discrepancies in bonus payments. The exact dates of these discoveries and the subsequent launch of the formal investigation are yet to be publicly disclosed.

- Potential legal frameworks violated: Allegations may involve potential breaches of anti-money laundering regulations, if improperly awarded bonuses are linked to illicit activities. Violations of Dutch financial misconduct laws are also a strong possibility.

Key Players Involved in the ABN Amro Bonus Scandal

Several individuals within ABN Amro's senior management and compensation departments are reportedly under scrutiny. While names haven't been publicly released, it's understood that those involved held significant influence over the design and implementation of the bonus schemes. The investigation may also involve external parties, including potentially whistleblowers who brought the initial concerns to light.

- Roles and responsibilities: The investigation will examine the roles and responsibilities of those implicated to determine the extent of their involvement and accountability in the alleged irregularities.

- Statements released: To date, ABN Amro has issued a general statement acknowledging the investigation and cooperating fully with the authorities, but has refrained from commenting on specific individuals or allegations.

- Potential consequences: Depending on the findings, individuals found culpable could face severe penalties, including fines, dismissal, and even criminal charges.

Potential Impacts of the ABN Amro Bonus Investigation

The ABN Amro bonus scandal carries significant short-term and long-term consequences for the bank and the broader financial landscape.

- Reputational damage: The investigation has already tarnished ABN Amro's reputation, potentially affecting its customer trust and ability to attract and retain talent. This reputational damage is a serious blow, eroding confidence among stakeholders.

- Financial implications: The investigation will incur substantial legal fees. Furthermore, depending on the severity of the findings, substantial fines from the DNB and other regulatory bodies are likely. Investor confidence may also decline, impacting share prices and the bank's ability to raise capital.

- Impact on shareholders, employees and policies:

- Shareholder value: The scandal has already negatively impacted the bank's stock price. Further negative news could cause further losses for shareholders.

- Employee morale and retention: The investigation may cause unrest and uncertainty among employees, potentially leading to decreased morale and higher turnover.

- Changes to bonus structures: The investigation will undoubtedly lead to a complete overhaul of ABN Amro's bonus structures and compensation policies, moving towards greater transparency and accountability.

Similar Cases and Industry Best Practices

The ABN Amro case mirrors several similar bonus-related scandals that have rocked the banking industry in recent years. These incidents underscore the systemic issue of poorly designed and inadequately monitored bonus schemes.

- Examples of similar cases: Several large international banks have faced similar investigations related to bonus payments, highlighting the need for stricter regulatory oversight and improved internal controls.

- Recommendations for preventing future scandals: Implementing clear and transparent bonus criteria, independent audits, and robust oversight mechanisms are crucial steps to prevent future scandals.

- Importance of transparency and accountability: Openness and accountability in compensation practices are vital to building trust with stakeholders and ensuring the long-term stability of the financial system.

Looking Ahead: Future of ABN Amro and Bonus Practices

The outcome of the ABN Amro investigation remains uncertain. However, it is likely to lead to significant changes in the bank's corporate governance, risk management, and compensation policies. The long-term consequences will depend on the extent of the misconduct and the effectiveness of remedial actions taken by the bank. The scandal could also trigger broader regulatory reforms aimed at improving ethical standards and accountability within the financial industry.

Conclusion: ABN Amro Under Investigation: A Call for Reform

The ABN Amro bonus investigation highlights the critical need for ethical and compliant bonus structures within the banking sector. The potential financial and reputational consequences for ABN Amro are severe, serving as a cautionary tale for other financial institutions. It is crucial that lessons are learned, resulting in industry-wide reforms to prevent similar scandals from occurring in the future. Follow our updates for the latest on the ABN Amro under investigation situation and the ongoing implications for the financial industry, including further "ABN Amro investigation updates" and analysis of the "ABN Amro bonus scandal." Stay informed about the "ABN Amro regulatory scrutiny" and its impact on the future of banking practices.

Featured Posts

-

Les Cordistes Nantais Et Le Defi Des Tours Modernes

May 22, 2025

Les Cordistes Nantais Et Le Defi Des Tours Modernes

May 22, 2025 -

Musique Du Hellfest Concert Exceptionnel Au Noumatrouff

May 22, 2025

Musique Du Hellfest Concert Exceptionnel Au Noumatrouff

May 22, 2025 -

Jd Vances Socks And Other Hilarious White House Moments With Trump And The Irish Pm

May 22, 2025

Jd Vances Socks And Other Hilarious White House Moments With Trump And The Irish Pm

May 22, 2025 -

How Aimscap Is Changing The World Trading Tournament Wtt

May 22, 2025

How Aimscap Is Changing The World Trading Tournament Wtt

May 22, 2025 -

The Goldbergs Behind The Scenes And Fun Facts

May 22, 2025

The Goldbergs Behind The Scenes And Fun Facts

May 22, 2025

Latest Posts

-

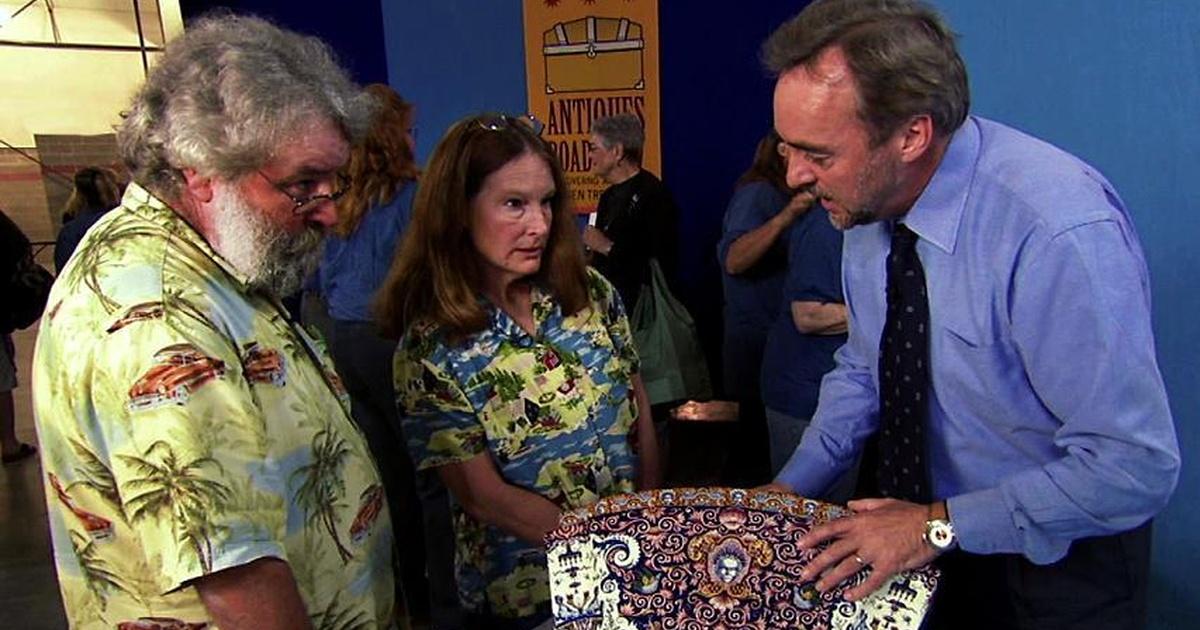

Antiques Roadshow National Treasure Appraisal Leads To Arrest Of Couple For Trafficking

May 22, 2025

Antiques Roadshow National Treasure Appraisal Leads To Arrest Of Couple For Trafficking

May 22, 2025 -

Antiques Roadshow Stolen Artifacts Result In Couples Arrest

May 22, 2025

Antiques Roadshow Stolen Artifacts Result In Couples Arrest

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025 -

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025 -

Us Couple Facing Charges After Bbc Antiques Roadshow Episode

May 22, 2025

Us Couple Facing Charges After Bbc Antiques Roadshow Episode

May 22, 2025