Action Required: Understanding The Latest HMRC Letters Sent To UK Households

Table of Contents

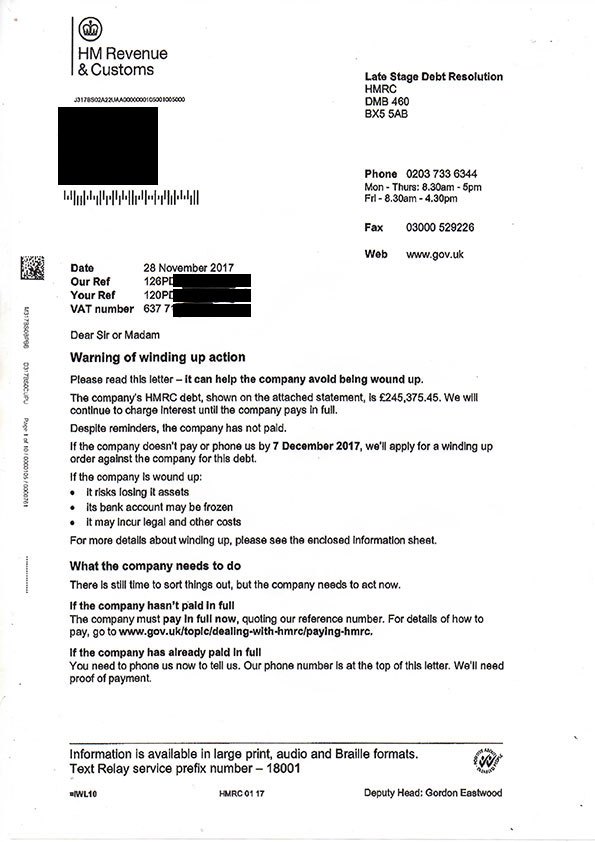

Identifying the Type of HMRC Letter

Receiving an HMRC letter can be daunting, but identifying its type is the first step. Different HMRC letter types require different actions. Knowing what kind of HMRC correspondence you've received is vital for a prompt and appropriate response. Key identifiers include reference numbers, deadlines, and specific amounts owed or refunded.

- Self-Assessment Reminders: These letters remind you to file your self-assessment tax return by the deadline (typically 31 January). Look for phrases like "Self Assessment Tax Return," "Reminder," and your Unique Taxpayer Reference (UTR).

- Tax Bill Notifications: These letters inform you of the tax you owe and the payment deadline. They clearly state the amount due and the payment reference number. Expect subject lines like "Your Tax Bill," or "Notice of Tax Due."

- Payment Reminders: If you haven't paid your tax bill on time, you'll receive a payment reminder. This letter will emphasize the outstanding amount and the potential for penalties if payment isn't made promptly. Look for phrases like "Overdue Payment," "Tax Arrears," and "Penalty Notice."

- Investigation Letters: These letters indicate that HMRC is investigating your tax affairs. They may request further information or documentation. These letters usually have formal language and may refer to specific tax years or transactions.

- Penalty Notices: These are issued if you fail to meet your tax obligations, such as missing a filing deadline or failing to pay on time. The letter will clearly state the penalty amount and the reasons for the penalty.

Always check the sender's details to verify the letter's authenticity. HMRC letters will have official letterhead and contact information. If in doubt, contact HMRC directly to verify.

Understanding Your Tax Obligations Based on the Letter

Once you've identified the type of HMRC letter, you need to understand your tax obligations. This may involve reviewing your tax code, understanding your self-assessment liability, or checking your PAYE (Pay As You Earn) contributions.

- Interpreting the Information: Carefully read the letter to understand the specifics of your tax liability. Note any deadlines, payment amounts, and reference numbers.

- Accessing Your Online Tax Account: Verify the information in the letter by logging into your online tax account at GOV.UK. This allows you to view your tax details, payment history, and correspondence.

- Understanding the Differences: A tax bill is a notification of tax owed; a payment reminder indicates an overdue payment; a penalty notice is issued for non-compliance.

- Consequences of Ignoring Correspondence: Ignoring HMRC correspondence can lead to further penalties, interest charges, and potentially legal action.

Responding to Your HMRC Letter: The Necessary Actions

Responding promptly and correctly to your HMRC letter is crucial. You can respond in several ways:

- Online via the HMRC website: This is often the quickest and most convenient method. You can make payments, update your details, and view correspondence.

- By post: You may need to send documentation by post, as indicated in the letter. Always retain proof of postage.

- By phone: HMRC provides a helpline for queries and assistance.

Making online tax payments is secure and efficient, offering various payment options. If you disagree with a penalty notice or a disputed tax bill, you can follow the instructions in the letter to appeal. Seeking professional help from a tax advisor is advisable if the situation is complex or you need guidance.

Dealing with Tax Debt

Facing tax debt can be stressful. However, HMRC offers options to manage this:

- Payment Plans: HMRC can arrange payment plans to help you manage your tax debt over time.

- Time-to-Pay Arrangements: These allow you to pay your tax debt in installments.

- Consequences of Unpaid Tax Debt: Failure to address tax debt can result in further penalties, legal action, and potential damage to your credit rating.

- Professional Help: Consider seeking help from a debt advisor or insolvency practitioner if you're struggling to manage your tax debt.

Preventing Future HMRC Letters

Proactive tax planning and record keeping are vital to avoiding future correspondence:

- Accurate Record-Keeping: Maintain detailed records of income, expenses, and tax-relevant transactions.

- On-Time Filing: File your self-assessment tax returns by the deadline to avoid penalties.

- Effective Tax Planning: Seek advice from a tax professional to ensure you are taking advantage of available tax reliefs and allowances.

Conclusion

Receiving an HMRC letter can be stressful, but understanding its contents and acting promptly is key. This guide helped you identify different letter types, understand your tax obligations, and respond effectively. Always verify the letter's authenticity and meet all deadlines. Don't ignore your HMRC letter! Take action today to maintain compliance and avoid penalties. For further assistance, contact HMRC directly or seek professional advice. Understanding your HMRC correspondence is vital for managing your finances and preventing future tax issues.

Featured Posts

-

Todays Nyt Mini Crossword Solutions March 31

May 20, 2025

Todays Nyt Mini Crossword Solutions March 31

May 20, 2025 -

Walliams Slams Cowell Alleged Britains Got Talent Rift Explodes

May 20, 2025

Walliams Slams Cowell Alleged Britains Got Talent Rift Explodes

May 20, 2025 -

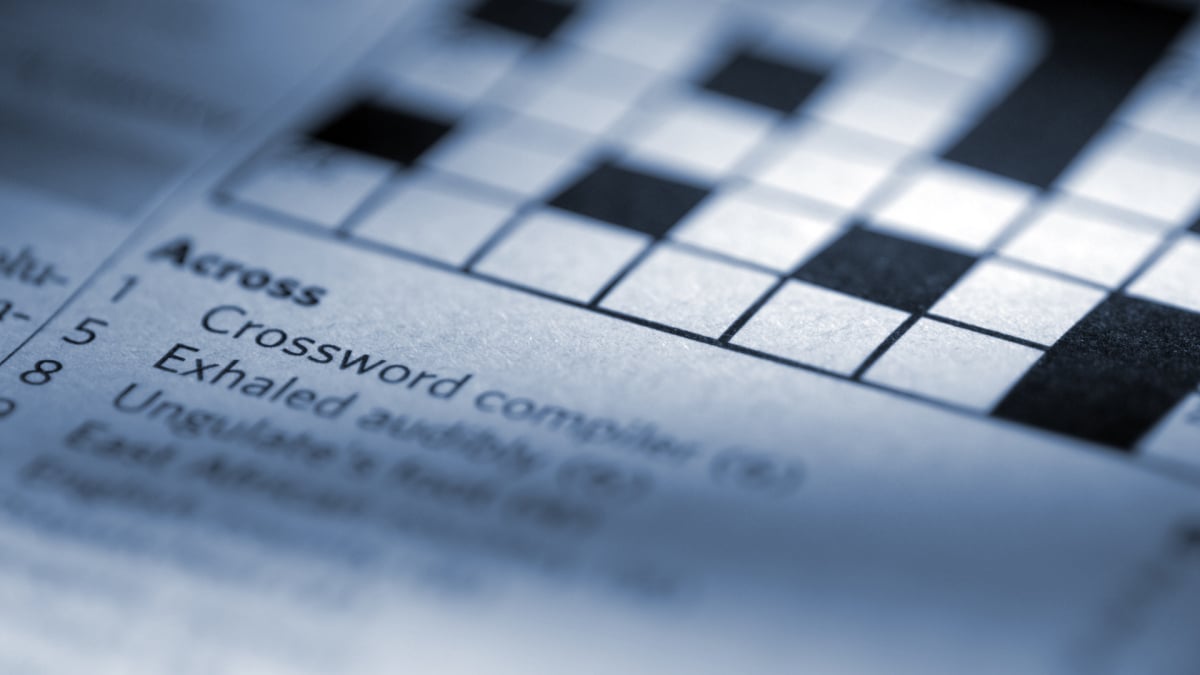

Chat Gpt Plus Enhanced Coding Capabilities With Ai Agent

May 20, 2025

Chat Gpt Plus Enhanced Coding Capabilities With Ai Agent

May 20, 2025 -

Bribery Scandal Rocks The Navy Retired Admirals Fall From Grace

May 20, 2025

Bribery Scandal Rocks The Navy Retired Admirals Fall From Grace

May 20, 2025 -

Protomagia Sto Oropedio Evdomos Idanikes Drastiriotites Kai Protaseis

May 20, 2025

Protomagia Sto Oropedio Evdomos Idanikes Drastiriotites Kai Protaseis

May 20, 2025