Addressing High Stock Market Valuations: BofA's Insights For Investors

Table of Contents

BofA's Assessment of Current Market Valuations

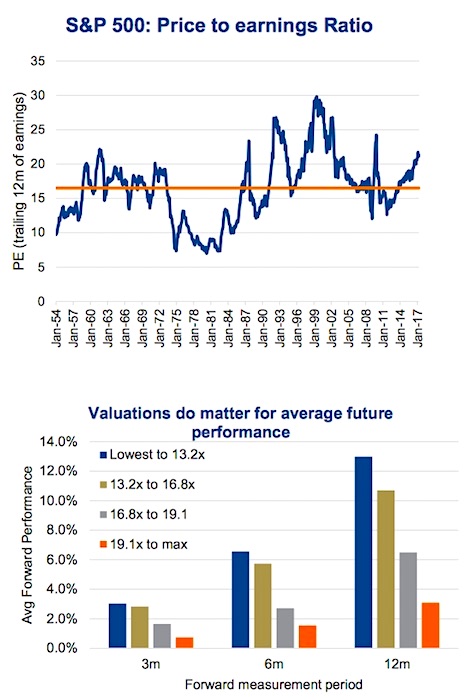

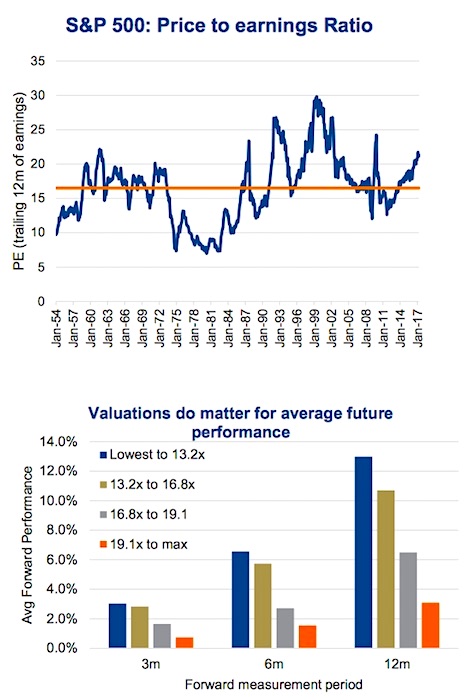

BofA's market outlook incorporates a detailed analysis of various stock market valuation metrics to gauge the current market climate. Their assessment considers both the overall market valuation and sector-specific valuations. Key findings often include an evaluation of traditional metrics like the Price-to-Earnings Ratio (P/E) and the Price-to-Sales Ratio (P/S), alongside a consideration of overall market capitalization.

-

Key Findings: BofA's reports frequently highlight whether current P/E ratios are above or below historical averages, indicating potential overvaluation or undervaluation. They might also analyze the dispersion of valuations across different sectors, highlighting potential discrepancies. For example, they might identify technology stocks as overvalued relative to their historical performance, while certain sectors in the energy or materials industries might appear undervalued.

-

Valuation Metrics: BofA uses a combination of metrics to avoid relying on any single indicator. The P/E ratio, comparing a company's stock price to its earnings per share, is a widely used metric, but BofA also utilizes others such as the P/S ratio (stock price to sales per share) to gain a more comprehensive picture. These metrics are compared against historical data and industry benchmarks.

-

Sector-Specific Analysis: BofA's research often breaks down valuations by sector. This granular approach allows investors to identify pockets of overvaluation and undervaluation within the broader market. This detailed analysis helps investors refine their portfolio allocation strategies. For example, they might identify specific sectors ripe for investment due to undervalued valuations.

-

Comparison to Historical Averages: A critical aspect of BofA's analysis is the comparison of current valuations to historical averages. This context helps determine whether current valuations are unusually high and potentially unsustainable, signaling a possible market correction. Deviations from historical norms are carefully examined for their implications.

Identifying Potential Risks Associated with High Valuations

High stock market valuations inherently carry increased risk. BofA's analysis considers several factors that could trigger a market correction or even a more significant downturn. Understanding these risks is crucial for developing a robust investment strategy.

-

Market Correction Likelihood: BofA's outlook regularly addresses the likelihood of a market correction, considering macroeconomic factors and current market sentiment. Their assessments often incorporate probability ranges, offering a nuanced view rather than definitive predictions.

-

Potential Triggers: Factors like interest rate hikes by central banks (such as the Federal Reserve), rising inflation, geopolitical instability, and unexpected economic slowdowns are all discussed as potential catalysts for a market correction. The analysis often includes scenarios demonstrating the impact of these triggers on various asset classes.

-

Risk Mitigation Strategies: To mitigate risk in a highly valued market, BofA often recommends portfolio diversification. This involves spreading investments across different asset classes (stocks, bonds, real estate) and sectors to reduce the impact of losses in any single area. They may also suggest incorporating defensive investments, which tend to be less volatile during market downturns.

-

Inflation's Impact: Inflation significantly impacts stock valuations. BofA's analysis considers the relationship between inflation, interest rates, and company earnings. High inflation erodes purchasing power and may lead to higher interest rates, potentially impacting stock prices.

BofA's Recommended Investment Strategies

Based on their valuation assessments and risk analysis, BofA provides recommendations for investors. These strategies often emphasize adapting to the current market environment to balance risk and reward.

-

Investment Strategy Overview: BofA’s strategies may suggest a shift toward more defensive stocks or value investing in a highly valued market. This often involves favoring companies with strong fundamentals and consistent earnings growth.

-

Asset Allocation Strategies: Adjusting asset allocation is crucial. BofA might advise reducing exposure to riskier assets in favor of more stable ones like high-quality bonds or defensive stocks, depending on the overall market outlook.

-

Favored Sectors/Asset Classes: The specific sectors or asset classes recommended by BofA will depend on their current analysis. They might suggest focusing on sectors showing resilience to economic downturns or those demonstrating robust growth prospects despite market valuations. Value investing, which focuses on identifying undervalued companies, is often emphasized.

-

Risk Tolerance and Time Horizon: BofA’s advice always considers individual investor risk tolerance and time horizon. Longer-term investors might tolerate more risk, while those nearing retirement might prioritize capital preservation.

The Role of Interest Rates in Shaping Market Valuations

Interest rates play a significant role in shaping market valuations. Changes in interest rates, particularly those implemented by central banks like the Federal Reserve, directly impact stock prices and investor sentiment.

-

Interest Rate Influence: Higher interest rates generally lead to lower stock valuations because they increase the cost of borrowing for companies, potentially reducing their earnings. Conversely, lower interest rates can boost valuations by making borrowing cheaper and encouraging investment.

-

BofA's Interest Rate Predictions: BofA’s economic forecasts include projections for future interest rate movements. These predictions influence their overall market outlook and investment recommendations.

-

Bond Yields and Stock Market Performance: The relationship between bond yields and stock market performance is often inverse. Rising bond yields can signal higher interest rates, potentially drawing investors away from stocks.

-

Monetary Policy's Impact: BofA analyzes the impact of monetary policy on investor sentiment and market valuations. Central bank actions directly influence market liquidity and expectations for future economic growth, impacting stock prices.

Conclusion

This article summarized BofA's insights into addressing high stock market valuations, highlighting potential risks and recommended investment strategies. BofA's analysis provides a crucial framework for investors to navigate the current market environment and make informed decisions. Understanding the complexities of high stock market valuations and incorporating BofA’s perspectives into your investment approach is essential for long-term success.

Call to Action: Stay informed about market fluctuations and continue to refine your investment strategy by regularly reviewing analyses like BofA’s insights on addressing high stock market valuations. Understanding these valuations is crucial for navigating the market effectively.

Featured Posts

-

Ray Epps Sues Fox News For Defamation Jan 6th Allegations And The Lawsuit

Apr 22, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Allegations And The Lawsuit

Apr 22, 2025 -

The Combined Strength Of Sweden And Finland A Pan Nordic Defense Analysis

Apr 22, 2025

The Combined Strength Of Sweden And Finland A Pan Nordic Defense Analysis

Apr 22, 2025 -

Canadian Bread Price Fixing Case 500 Million Settlement Nears

Apr 22, 2025

Canadian Bread Price Fixing Case 500 Million Settlement Nears

Apr 22, 2025 -

Broadcoms Proposed V Mware Price Hike An Extreme Cost Increase

Apr 22, 2025

Broadcoms Proposed V Mware Price Hike An Extreme Cost Increase

Apr 22, 2025 -

Across America Protests Against The Trump Administration

Apr 22, 2025

Across America Protests Against The Trump Administration

Apr 22, 2025

Latest Posts

-

Solving The Nyt Crossword April 6 2025 Edition A Comprehensive Guide

May 10, 2025

Solving The Nyt Crossword April 6 2025 Edition A Comprehensive Guide

May 10, 2025 -

Strands Nyt Puzzle Solutions Wednesday March 12 Game 374

May 10, 2025

Strands Nyt Puzzle Solutions Wednesday March 12 Game 374

May 10, 2025 -

Complete Guide To Nyt Strands Game 357 February 23 Sunday

May 10, 2025

Complete Guide To Nyt Strands Game 357 February 23 Sunday

May 10, 2025 -

Nyt Strands Game 357 Hints And Answers For February 23rd

May 10, 2025

Nyt Strands Game 357 Hints And Answers For February 23rd

May 10, 2025 -

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 10, 2025

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 10, 2025