Addressing Investor Anxiety: BofA On Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's recent reports indicate a cautiously optimistic stance on current stock market valuations. While acknowledging the elevated levels, they haven't issued a blanket warning of an imminent crash. Instead, their analysis suggests a nuanced approach, urging investors to consider sector-specific valuations rather than making broad market predictions.

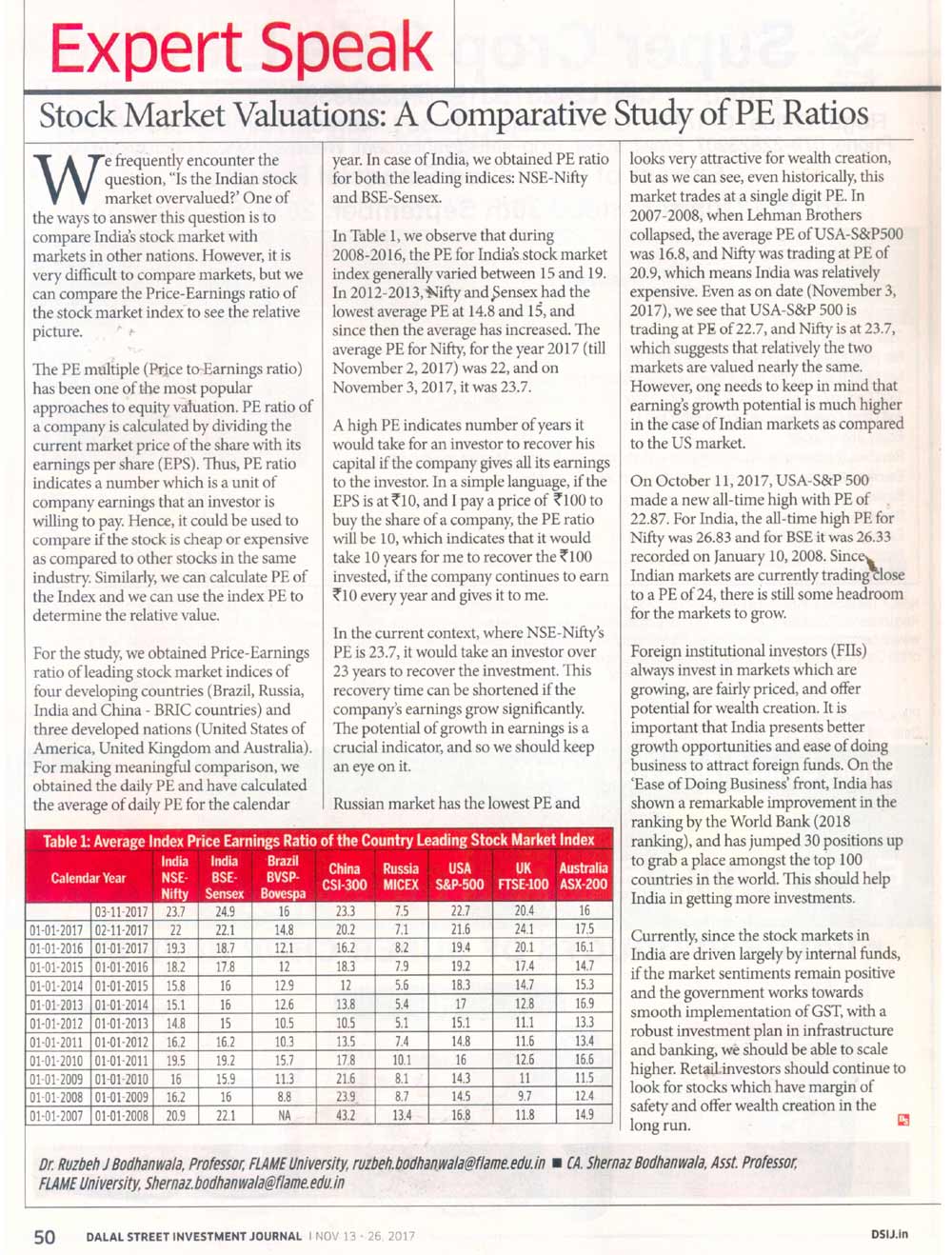

- Key Metrics: BofA employs several key metrics to assess valuations, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and Price-to-Book (P/B) ratios. They analyze these across various sectors to identify potential overvaluations and undervaluations.

- Sector Analysis: BofA's reports often highlight specific sectors. For example, they might identify technology as potentially overvalued based on high P/E ratios compared to historical averages, while pointing towards certain undervalued sectors within the energy or materials space. It's crucial to remember that these assessments are dynamic and change with market conditions.

- Market Prediction: Predicting future market movements with certainty is impossible. However, BofA's commentary often includes forecasts based on macroeconomic indicators and their valuation models. These predictions usually involve probabilities and ranges rather than definitive statements.

Factors Contributing to Elevated Stock Market Valuations

Several economic and market forces contribute to the currently high stock market valuations. Understanding these forces is crucial for making informed investment decisions.

- Low Interest Rates: Historically low interest rates have encouraged investors to seek higher returns in the stock market, driving up demand and consequently, valuations. This is because the returns from traditional low-risk investments are comparatively lower.

- Strong Corporate Earnings (in select sectors): Strong earnings reports from some companies, especially within certain technology and consumer goods sectors, contribute to increased investor confidence and higher stock prices, boosting overall market valuations. However, this isn't universally true across all sectors.

- Inflationary Pressures: Inflationary pressures create uncertainty and can impact investor sentiment. While inflation might initially push valuations higher, sustained inflation often leads to a more cautious approach by investors and central banks, potentially impacting future market performance.

- Geopolitical Events: Geopolitical events, such as trade wars or international conflicts, introduce significant volatility to the market. These events can impact investor confidence and lead to unpredictable fluctuations in valuations.

- Quantitative Easing (QE) and Monetary Policy: Central bank policies like quantitative easing (QE) inject liquidity into the market, influencing stock prices and overall valuations. The impact of these policies is a subject of ongoing debate among economists and investors.

Strategies for Investors Amidst High Stock Market Valuations

Navigating high stock market valuations requires a strategic approach. BofA's analysis, along with sound investment principles, guides the following strategies:

- Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors minimizes risk. Don't put all your eggs in one basket.

- Long-Term Investment Approach: A long-term investment horizon is crucial. Short-term market fluctuations are normal, and focusing on long-term growth minimizes the impact of short-term volatility.

- Value Investing: Identify potentially undervalued sectors or companies using fundamental analysis. Value investing involves buying assets when their price is below their intrinsic value.

- Risk Management: Establish a clear risk management strategy that aligns with your risk tolerance. This includes setting stop-loss orders and understanding potential downsides.

- Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This mitigates the risk of investing a lump sum at a market peak.

Managing Investor Anxiety

High market volatility can trigger anxiety. Here's how to manage it:

- Stick to Your Plan: Adhering to a well-defined investment plan reduces emotional decision-making. Avoid impulsive trades based on short-term market fluctuations.

- Regular Reviews (without overreaction): Regular portfolio reviews are important, but avoid overreacting to daily market news. Focus on long-term trends rather than daily movements.

- Financial Advisor: Consult a qualified financial advisor for personalized advice and support. A professional can offer guidance tailored to your individual circumstances.

- Understand Your Risk Tolerance: Know your risk tolerance before making investment decisions. This will help you avoid emotional decisions and make informed choices.

Conclusion

BofA's analysis provides valuable context for understanding the current elevated stock market valuations. By considering the factors influencing these valuations and adopting a strategic approach to investment, investors can better navigate the current market environment and manage their anxiety. Remember that diversification, long-term planning, and a well-defined risk management strategy are crucial for success. Don't let anxiety dictate your investment decisions; instead, make informed choices based on a thorough understanding of current stock market valuations and their underlying drivers. Stay informed about market trends and consult with a financial advisor to develop a personalized strategy for managing your investments in light of these high stock market valuations.

Featured Posts

-

Analyzing The Big Rig Rock Report 3 12 96 1 The Rocket A Detailed Guide

May 23, 2025

Analyzing The Big Rig Rock Report 3 12 96 1 The Rocket A Detailed Guide

May 23, 2025 -

Grand Ole Opry Royal Albert Hall Broadcast Marks International Expansion

May 23, 2025

Grand Ole Opry Royal Albert Hall Broadcast Marks International Expansion

May 23, 2025 -

Emissary Alleges Hamas Duplicity The Witkoff Story

May 23, 2025

Emissary Alleges Hamas Duplicity The Witkoff Story

May 23, 2025 -

Arsenal Defender Earns Ten Hags Respect After Real Madrid Triumph

May 23, 2025

Arsenal Defender Earns Ten Hags Respect After Real Madrid Triumph

May 23, 2025 -

French Cinemas 2025 Rendez Vous A Look At Upcoming Films And Festivals

May 23, 2025

French Cinemas 2025 Rendez Vous A Look At Upcoming Films And Festivals

May 23, 2025

Latest Posts

-

Jonathan Groff Reflecting On His Asexual Past

May 23, 2025

Jonathan Groff Reflecting On His Asexual Past

May 23, 2025 -

Gideon Glick And Jonathan Groffs Hilarious Etoile Reunion A Spring Awakening Throwback

May 23, 2025

Gideon Glick And Jonathan Groffs Hilarious Etoile Reunion A Spring Awakening Throwback

May 23, 2025 -

Etoile Gideon Glick And Jonathan Groff Reunite In Hilarious Spring Awakening Scene

May 23, 2025

Etoile Gideon Glick And Jonathan Groff Reunite In Hilarious Spring Awakening Scene

May 23, 2025 -

Broadways Just In Time Jonathan Groff Celebrates Opening Night With Star Studded Cast

May 23, 2025

Broadways Just In Time Jonathan Groff Celebrates Opening Night With Star Studded Cast

May 23, 2025 -

Lea Michele Daniel Radcliffe And More Support Jonathan Groffs Broadway Debut

May 23, 2025

Lea Michele Daniel Radcliffe And More Support Jonathan Groffs Broadway Debut

May 23, 2025