Addressing Investor Concerns: BofA On High Stock Market Valuations

Table of Contents

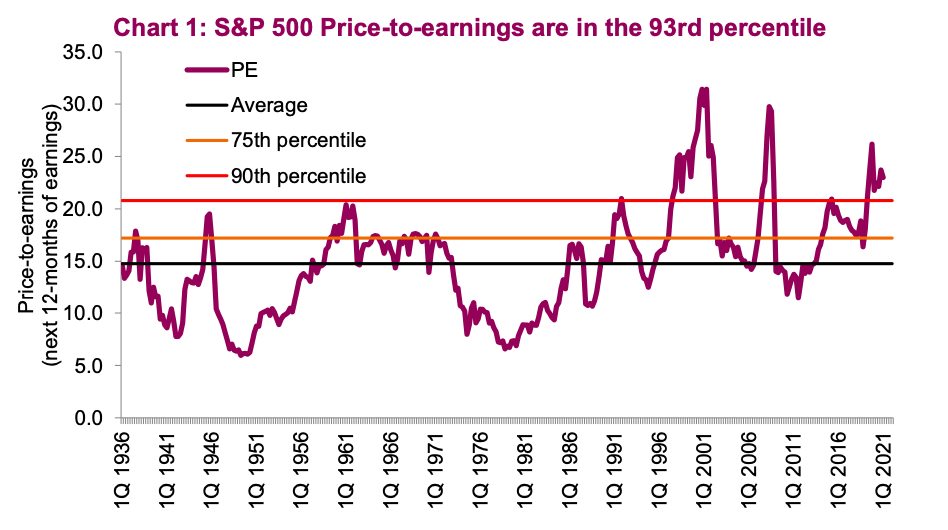

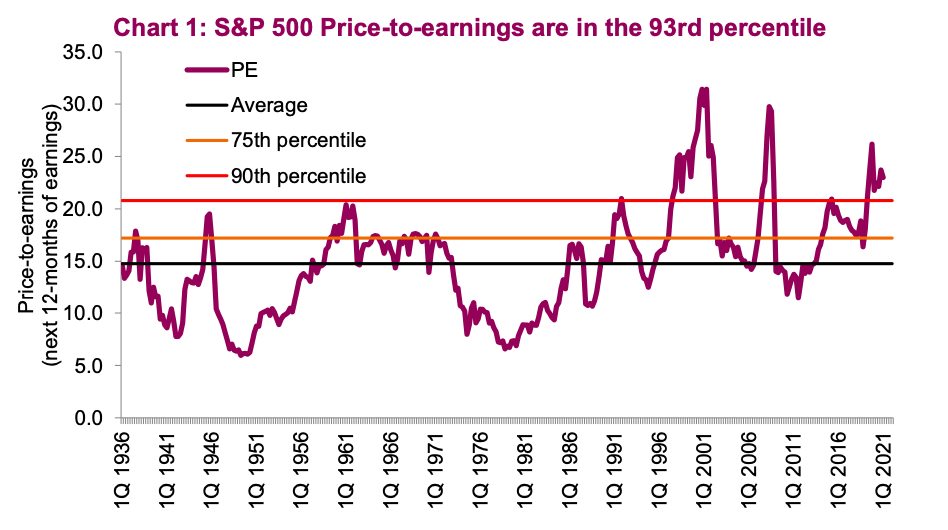

BofA's Assessment of Current Stock Market Valuations

BofA's assessment of current stock market valuations is nuanced. While acknowledging the elevated levels compared to historical averages, their analysis suggests the situation isn't necessarily cause for immediate alarm, but warrants careful consideration. They don't outright declare the market overvalued, but emphasize the need for caution and a strategic approach.

-

Key Arguments: BofA's analysis considers various factors beyond simple price-to-earnings (P/E) ratios. They incorporate factors like interest rate environments, projected earnings growth, and global economic conditions to arrive at a more holistic view of stock market valuation. They acknowledge that certain sectors are more richly valued than others.

-

Metrics Used: BofA's analysis likely incorporates several key metrics, including the standard P/E ratio, the cyclically adjusted price-to-earnings ratio (Shiller PE), and potentially other valuation multiples specific to certain sectors. They also likely consider forward-looking earnings estimates.

-

Source: While the precise report needs to be specified depending on the actual BofA publication being referenced (e.g., a specific research note or press release), it's crucial to cite the source accurately for verification. For example, mention the specific report title and date.

Identifying Potential Risks Associated with High Stock Market Valuations

Even if not definitively "overvalued," high stock market valuations inherently present risks that investors must acknowledge. BofA, along with other market experts, highlight several key concerns:

-

Increased Market Volatility: High valuations often precede periods of increased market volatility. Sharp corrections or even a bear market become more likely when valuations are stretched.

-

Impact of Rising Interest Rates: Rising interest rates directly impact stock valuations by increasing the cost of borrowing for companies and making bonds a more attractive alternative investment. This can lead to lower stock prices.

-

Potential for a Market Bubble: Sustained high valuations without a corresponding increase in underlying economic fundamentals raise concerns about a potential market bubble. A burst bubble can cause significant and rapid price declines.

-

Geopolitical Risks: Global political instability and unforeseen events (wars, pandemics, etc.) can dramatically impact market sentiment and valuations, regardless of underlying fundamentals.

Opportunities Within a High Valuation Market

Despite the risks, a market with high valuations doesn't automatically mean investors should stay on the sidelines. Strategic approaches can still yield positive results:

-

Focus on Undervalued Sectors or Stocks: Not all sectors or individual companies are equally valued. Careful analysis can uncover undervalued opportunities within a generally overvalued market. This is where in-depth fundamental research is crucial.

-

Importance of Diversification: Diversification across asset classes (stocks, bonds, real estate, etc.) and sectors helps mitigate the risk associated with high valuations in any single area.

-

Strategies for Managing Risk: Value investing, focusing on companies trading below their intrinsic value, and employing defensive strategies by investing in less volatile sectors (e.g., consumer staples) can help navigate a high-valuation environment.

-

Long-Term Investing: The impact of short-term market fluctuations is less significant for long-term investors. A long-term perspective helps weather the volatility associated with high valuations.

BofA's Recommendations for Investors

While specific recommendations vary depending on the BofA report, some general investor strategies often suggested include:

-

Specific Investment Strategies: BofA may recommend sector rotation, moving investments from overvalued to undervalued sectors, or focusing on companies with strong fundamentals and sustainable growth prospects.

-

Sectors or Asset Classes to Consider: Depending on the market outlook, BofA might highlight specific sectors expected to perform better in a high-valuation environment, or suggest allocating a portion of the portfolio to less correlated assets.

-

Importance of Due Diligence: BofA always emphasizes the critical need for individual investors to conduct their own thorough research and due diligence before making investment decisions. This includes understanding the company’s financials, industry trends, and overall market conditions.

-

Professional Financial Advice: Seeking guidance from a qualified financial advisor is often recommended, especially in navigating complex market conditions like high stock market valuations.

Conclusion

BofA's analysis of high stock market valuations provides valuable insights, highlighting both the inherent risks and the potential opportunities present. While the market's overall valuation may be elevated, a strategic approach that incorporates diversification, risk management, and thorough due diligence is key. Remember that understanding and carefully managing the risks associated with high stock market valuations is paramount to long-term investment success. While BofA's analysis offers valuable guidance, it's crucial to conduct your own thorough research and possibly consult with a financial advisor before making any investment decisions. Stay informed about market trends and continue your research on managing your portfolio effectively in this environment.

Featured Posts

-

Oltre Il Danno La Beffa Becciu Condannato A Risarcire Gli Accusatori

Apr 30, 2025

Oltre Il Danno La Beffa Becciu Condannato A Risarcire Gli Accusatori

Apr 30, 2025 -

Retro Sarm Dzilijan Anderson U Predivnoj Haljini

Apr 30, 2025

Retro Sarm Dzilijan Anderson U Predivnoj Haljini

Apr 30, 2025 -

Rodon Yankees Shut Out Guardians 5 1 Series Finale Win

Apr 30, 2025

Rodon Yankees Shut Out Guardians 5 1 Series Finale Win

Apr 30, 2025 -

Gillian Anderson Eyed For Doctor Who Villain Role By Ncuti Gatwa

Apr 30, 2025

Gillian Anderson Eyed For Doctor Who Villain Role By Ncuti Gatwa

Apr 30, 2025 -

Did Chris Paul Harrison Barnes And Julian Champagnie Play Every Spurs Game This Season

Apr 30, 2025

Did Chris Paul Harrison Barnes And Julian Champagnie Play Every Spurs Game This Season

Apr 30, 2025