AI Quantum Computing Investment: A Strong Reason To Buy The Dip

Table of Contents

The Untapped Potential of AI Quantum Computing

The fusion of AI and quantum computing unlocks unprecedented computational power, paving the way for innovations previously confined to the realm of science fiction. This synergistic relationship is poised to revolutionize industries and create significant investment opportunities.

Exponential Computational Power

Quantum computers leverage the principles of quantum mechanics to perform calculations far beyond the capabilities of classical computers. This exponential speed advantage is particularly impactful when combined with the sophisticated problem-solving abilities of AI algorithms.

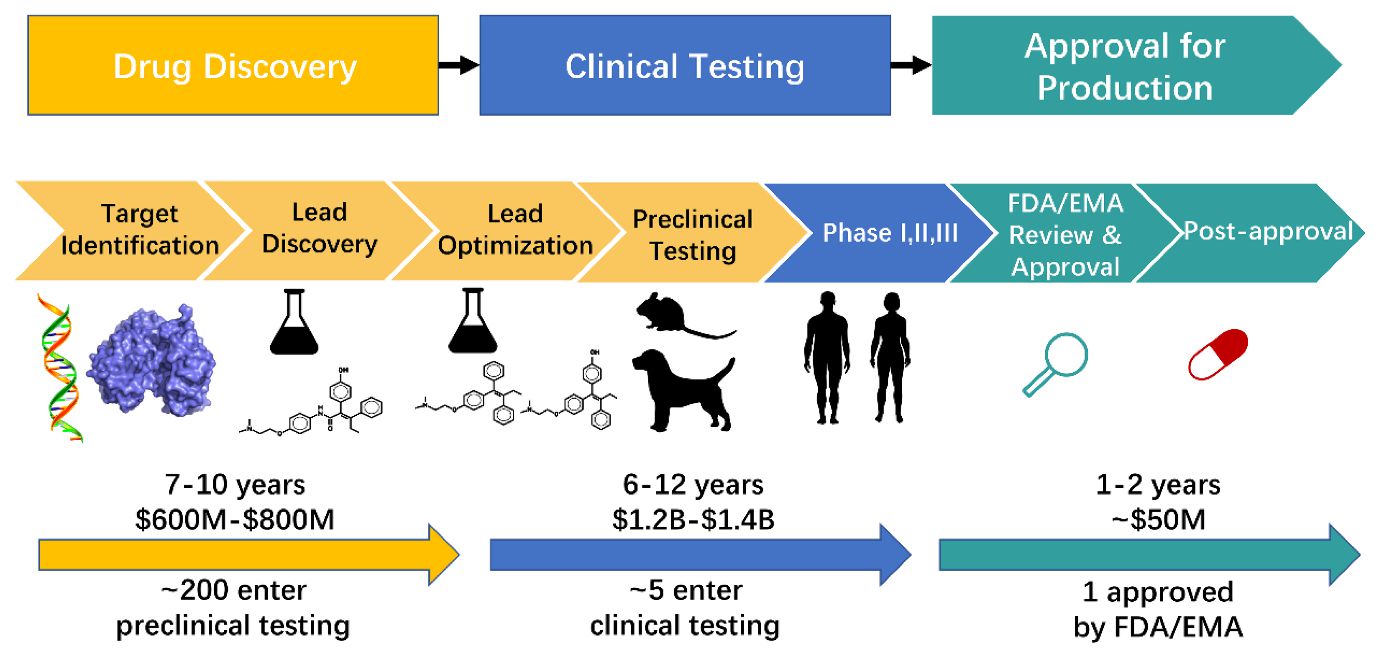

- Solving complex problems currently intractable for classical computers: Areas like drug discovery, materials science, and cryptography will experience transformative advancements. Quantum computers can simulate molecular interactions with unprecedented accuracy, accelerating the development of new medicines and materials.

- Advancements in drug discovery: Identifying drug candidates and predicting their efficacy becomes significantly faster and more precise, leading to quicker development of life-saving medications.

- Materials science breakthroughs: Designing new materials with superior properties for various applications, from aerospace to electronics, will be significantly accelerated.

- Financial modeling improvements: Quantum computing can handle vastly more complex financial models, leading to more accurate risk assessments and improved investment strategies.

Synergistic Relationship Between AI and Quantum Computing

The relationship between AI and quantum computing is deeply symbiotic. AI algorithms are crucial for optimizing and controlling the complex operations of quantum computers, while quantum computing enhances the capabilities of AI itself.

- AI for error correction in quantum computation: Quantum computers are susceptible to errors; AI algorithms are being developed to detect and correct these errors, improving the reliability and accuracy of quantum computations.

- AI-driven algorithm development for quantum applications: AI can help discover and optimize new quantum algorithms, accelerating the development of applications across diverse fields.

- AI for optimizing quantum hardware design: AI can be used to design more efficient and powerful quantum hardware, pushing the boundaries of quantum computing capabilities.

Why Now is the Time to Invest

The current market may present temporary setbacks, but for long-term investors, this dip in the AI quantum computing sector presents a unique buying opportunity.

Current Market Dip Presents Opportunity

Market corrections are a natural part of the investment cycle. The current dip in AI quantum computing stocks shouldn't be viewed as a sign of failure, but rather as a potential entry point for those with a long-term vision.

- Temporary setbacks in the market often precede significant growth: History shows that periods of market correction are frequently followed by periods of substantial growth.

- Lower entry point for investors: The dip provides a chance to acquire shares at a lower price, potentially maximizing future returns.

- Potential for high returns in the long term: The potential rewards associated with this burgeoning technology are immense, making the current market conditions an attractive entry point.

Government and Private Sector Investment

The substantial investments being poured into AI quantum computing research and development by both governments and private companies significantly de-risks the sector.

- Increased funding leads to accelerated innovation: Massive investments fuel rapid advancements in the field, leading to quicker development of commercially viable applications.

- Creating more opportunities for investors: Increased activity in the sector translates into more investment opportunities and a greater potential for returns.

- Reduction in risk associated with early-stage technology: The significant investment signifies a strong belief in the long-term potential of this technology, reducing the inherent risk associated with investing in emerging technologies.

Mitigating Risks in AI Quantum Computing Investments

While the potential rewards are significant, investing in AI quantum computing does involve inherent risks. A well-informed approach can significantly mitigate these.

Long-Term Investment Strategy

Quantum computing is still in its early stages of development; patience and a long-term perspective are essential for successful investment.

- Focus on companies with strong research and development capabilities: Invest in companies with proven expertise and a strong track record of innovation.

- Diversification of investments across multiple companies: Diversification minimizes risk by spreading investments across different companies in the sector.

- Realistic expectations about timelines for significant returns: Significant returns may take time; avoid short-term speculation and focus on long-term growth.

Due Diligence and Risk Assessment

Thorough research and a comprehensive understanding of the risks involved are crucial for making informed investment decisions.

- Analyzing financial statements of companies: Carefully review financial statements to assess the financial health and stability of potential investments.

- Understanding the competitive landscape: Analyze the competitive landscape to identify companies with a strong competitive advantage.

- Assessing the management team's expertise: Evaluate the expertise and experience of the management team to gauge their ability to navigate the challenges of this emerging field.

Conclusion

The convergence of AI and quantum computing presents an unprecedented investment opportunity. The untapped potential of this technology, coupled with significant government and private sector investment, makes a compelling case for buying the dip in the AI quantum computing market. While risks exist, a long-term investment strategy and thorough due diligence can significantly mitigate these. Don't miss out on the potential of AI quantum computing investment. Research leading companies in the field and consider adding this transformative technology to your portfolio today. Begin your journey into the future of computing by exploring AI quantum computing investment options.

Featured Posts

-

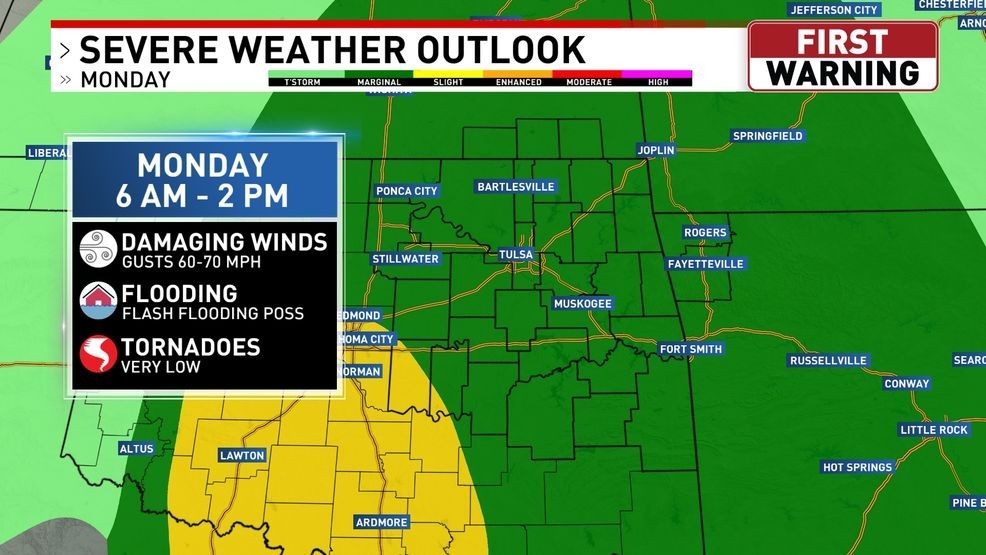

Increased Storm Risk Overnight Severe Weather Possible Monday

May 20, 2025

Increased Storm Risk Overnight Severe Weather Possible Monday

May 20, 2025 -

D Waves Qbts Quantum Leap Ai Driven Drug Discovery And The Future Of Medicine

May 20, 2025

D Waves Qbts Quantum Leap Ai Driven Drug Discovery And The Future Of Medicine

May 20, 2025 -

Big Bear Ai Bbai Plunge In 2025 Investigating The Causes

May 20, 2025

Big Bear Ai Bbai Plunge In 2025 Investigating The Causes

May 20, 2025 -

Fa Cup Rashford Scores Twice As Aston Villa Defeat Preston

May 20, 2025

Fa Cup Rashford Scores Twice As Aston Villa Defeat Preston

May 20, 2025 -

Manchester Uniteds Cunha Pursuit Accelerated Talks And Backup Options

May 20, 2025

Manchester Uniteds Cunha Pursuit Accelerated Talks And Backup Options

May 20, 2025