AIMSCAP Takes On The World Trading Tournament (WTT)

Table of Contents

AIMSCAP's Strategy and Preparations for the WTT

AIMSCAP approached the WTT with a meticulously crafted strategy, focusing on a multifaceted approach to maximize their chances of success. Their preparation was rigorous and involved a combination of advanced market analysis, sophisticated algorithmic trading techniques, and robust risk management protocols.

- Specific Market Focus: AIMSCAP concentrated primarily on the Forex market, leveraging their expertise in currency pair analysis and volatility prediction. They also explored opportunities in the futures market, specifically focusing on indices and commodities.

- Trading Strategies Used: Their arsenal included a blend of technical analysis, utilizing advanced charting techniques and indicators, and fundamental analysis, incorporating macroeconomic data and geopolitical events into their trading decisions. Algorithmic trading played a crucial role, allowing them to execute trades swiftly and efficiently, capitalizing on fleeting market opportunities.

- Risk Management Techniques: A critical component of their strategy was a robust risk management framework. This involved setting strict stop-loss orders to limit potential losses on each trade, diversifying their portfolio across various assets, and carefully managing leverage to avoid excessive risk exposure.

- Team Composition and Roles: AIMSCAP's team comprised expert traders, data scientists, and risk managers. Each member played a crucial role, from analyzing market trends to executing trades and overseeing risk management. This collaborative approach proved invaluable during the tournament's high-pressure environment.

- Pre-tournament Training and Simulations: Months of intensive preparation preceded the WTT. The team engaged in rigorous simulations, replicating the pressures and volatility of the tournament environment. This helped refine their strategies and improve their ability to react swiftly to unexpected market movements.

AIMSCAP's Performance in the WTT

AIMSCAP's journey through the WTT was marked by both triumphs and challenges. Their early performance was characterized by consistent gains, driven by successful trades in the Forex market. However, the tournament's high volatility presented unexpected hurdles, particularly during periods of significant geopolitical uncertainty.

- Early Performance and Initial Challenges: The initial stages saw AIMSCAP secure a comfortable position in the rankings. Their algorithmic trading strategies proved particularly effective in capitalizing on short-term market fluctuations.

- Turning Points and Key Decisions: A pivotal moment came during the second week when a major geopolitical event caused significant market volatility. AIMSCAP’s risk management protocols and ability to swiftly adapt their strategies allowed them to weather the storm, minimizing losses and maintaining their competitive edge.

- Strong Performance Areas: AIMSCAP's strength consistently lay in their ability to accurately predict and capitalize on short-term market trends, especially in the Forex market. Their use of technical analysis and algorithmic trading played a key role in this success.

- Areas for Improvement: Despite their overall strong performance, AIMSCAP identified areas for improvement, particularly in adapting to longer-term market trends and refining their risk management strategies for periods of extreme volatility.

- Final Ranking and Overall Outcome: While the final rankings are still pending official confirmation, AIMSCAP demonstrated exceptional performance throughout the competition, securing a place amongst the top contenders. Their participation was a testament to their strategic planning and the effectiveness of their trading approach.

Analysis of AIMSCAP's WTT Experience: Lessons Learned and Future Implications

AIMSCAP’s participation in the WTT provided invaluable insights and helped shape their future trading strategies. The tournament served as a rigorous testing ground, highlighting both their strengths and areas needing refinement.

- Key Takeaways and Lessons Learned: The team gained critical experience in navigating high-pressure environments and adapting quickly to unexpected market events. The importance of robust risk management, especially during periods of heightened volatility, was further underscored.

- Impact on Future Trading Strategies: AIMSCAP plans to incorporate the lessons learned to refine their algorithmic trading models, improving their ability to adapt to different market conditions. Furthermore, they will continue to enhance their risk management protocols to ensure long-term sustainability.

- Potential Improvements and Adjustments: The team identified the need for improved long-term market forecasting and enhanced diversification of their asset holdings to mitigate risks associated with specific market segments.

- Long-Term Implications for AIMSCAP: The WTT participation will significantly boost AIMSCAP’s credibility and visibility within the competitive trading community. Their experience will be instrumental in attracting new talent and securing future partnerships.

- Impact on the Wider Trading Community: AIMSCAP's innovative trading strategies and data-driven approach offer valuable lessons to the wider trading community, highlighting the importance of technology and risk management in navigating today's dynamic financial markets.

Conclusion: AIMSCAP's WTT Journey – A Look Ahead

AIMSCAP's journey in the World Trading Tournament (WTT) was a remarkable display of skill, strategy, and adaptability. Their performance highlighted the effectiveness of a well-defined trading strategy combined with robust risk management. The insights gained will undoubtedly shape their future endeavors. Learn more about AIMSCAP's innovative approach to competitive trading and stay updated on their future participation in the World Trading Tournament (WTT). Follow AIMSCAP's journey as they continue to compete in the challenging world of the WTT and push the boundaries of what's possible in algorithmic and competitive trading.

Featured Posts

-

Racial Hatred Tweet Appeal Update On Ex Tory Councillors Wifes Case

May 21, 2025

Racial Hatred Tweet Appeal Update On Ex Tory Councillors Wifes Case

May 21, 2025 -

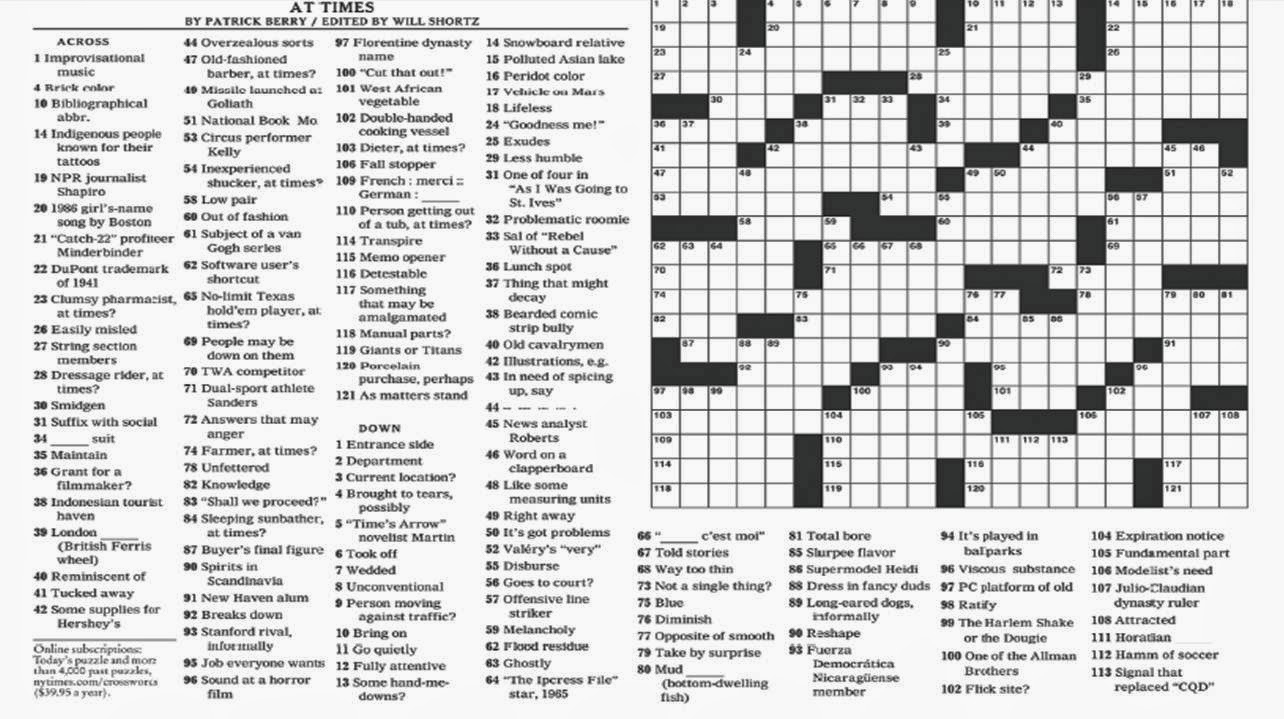

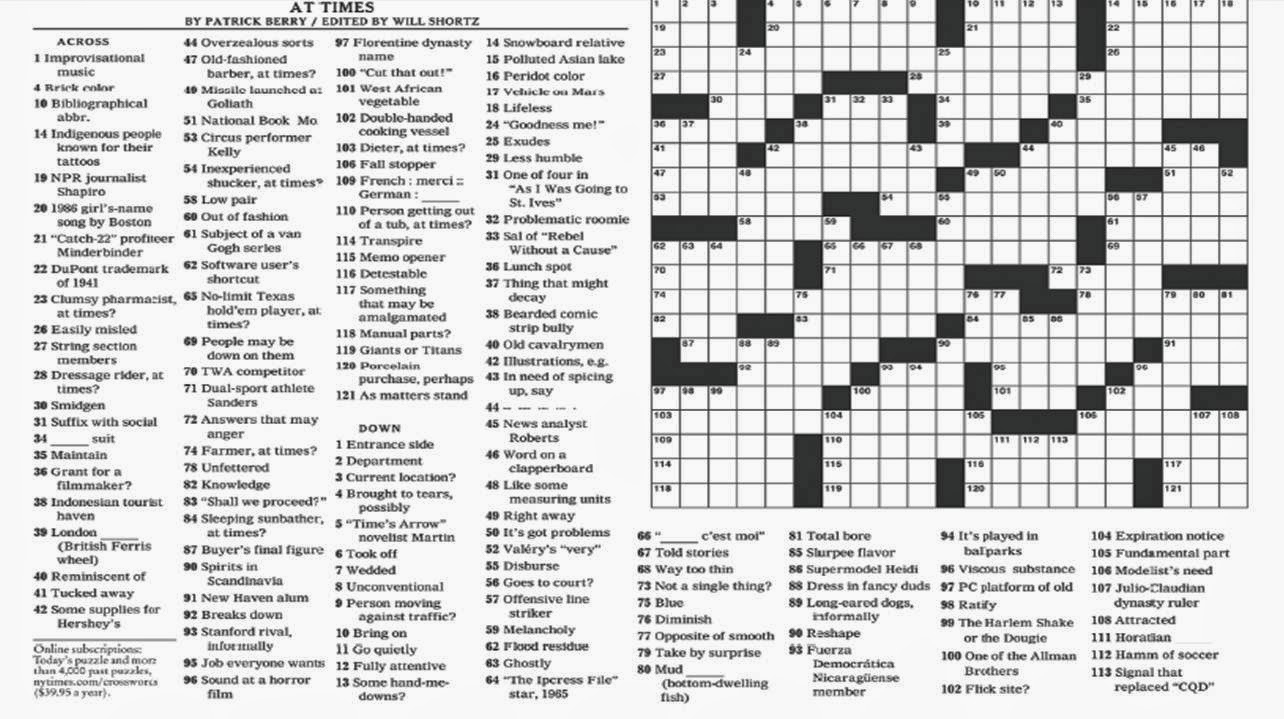

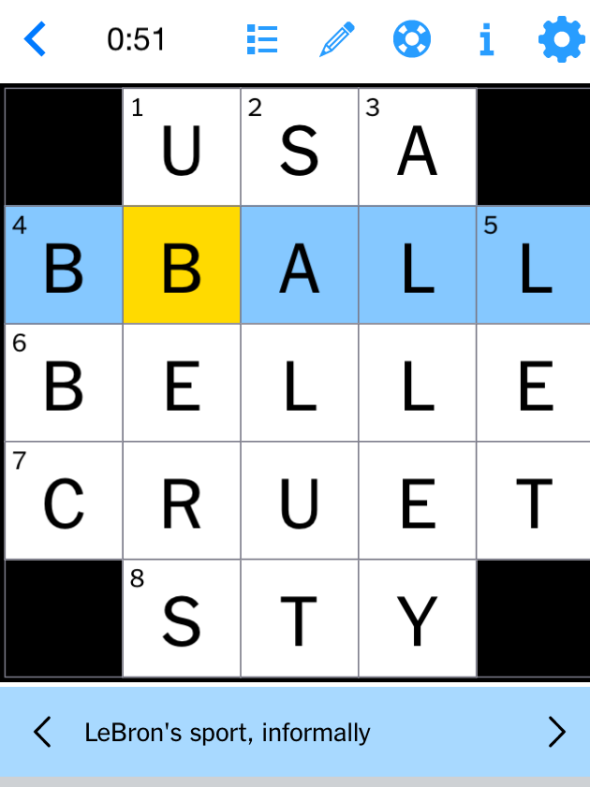

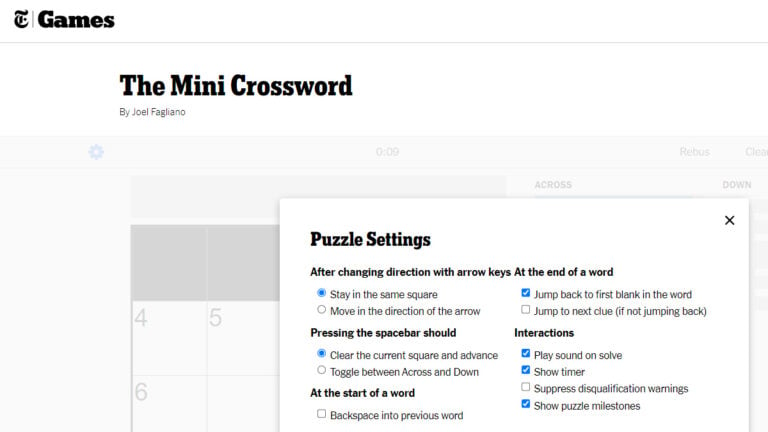

Nyt Mini Crossword Solution April 8 2025 Tuesday

May 21, 2025

Nyt Mini Crossword Solution April 8 2025 Tuesday

May 21, 2025 -

Cassis Blackcurrant Health Benefits And Nutritional Information

May 21, 2025

Cassis Blackcurrant Health Benefits And Nutritional Information

May 21, 2025 -

Switzerland Condemns Chinas Military Drills Near Taiwan

May 21, 2025

Switzerland Condemns Chinas Military Drills Near Taiwan

May 21, 2025 -

Stijgende Huizenprijzen Ondanks Rente Abn Amros Prognose

May 21, 2025

Stijgende Huizenprijzen Ondanks Rente Abn Amros Prognose

May 21, 2025

Latest Posts

-

Nyt Mini Crossword Solution April 8 2025 Tuesday

May 21, 2025

Nyt Mini Crossword Solution April 8 2025 Tuesday

May 21, 2025 -

Nyt Mini Crossword Answers Today March 18 2025 Clues And Solutions

May 21, 2025

Nyt Mini Crossword Answers Today March 18 2025 Clues And Solutions

May 21, 2025 -

March 13 2025 Nyt Mini Crossword Complete Answers And Clues

May 21, 2025

March 13 2025 Nyt Mini Crossword Complete Answers And Clues

May 21, 2025 -

Nyt Mini Crossword Solutions For March 13 2025

May 21, 2025

Nyt Mini Crossword Solutions For March 13 2025

May 21, 2025 -

Trump Administration Aerospace Deals A Deep Dive Into Numbers And Lack Of Detail

May 21, 2025

Trump Administration Aerospace Deals A Deep Dive Into Numbers And Lack Of Detail

May 21, 2025