Alterya Acquired By Blockchain Giant Chainalysis: Impact On AI And Crypto

Table of Contents

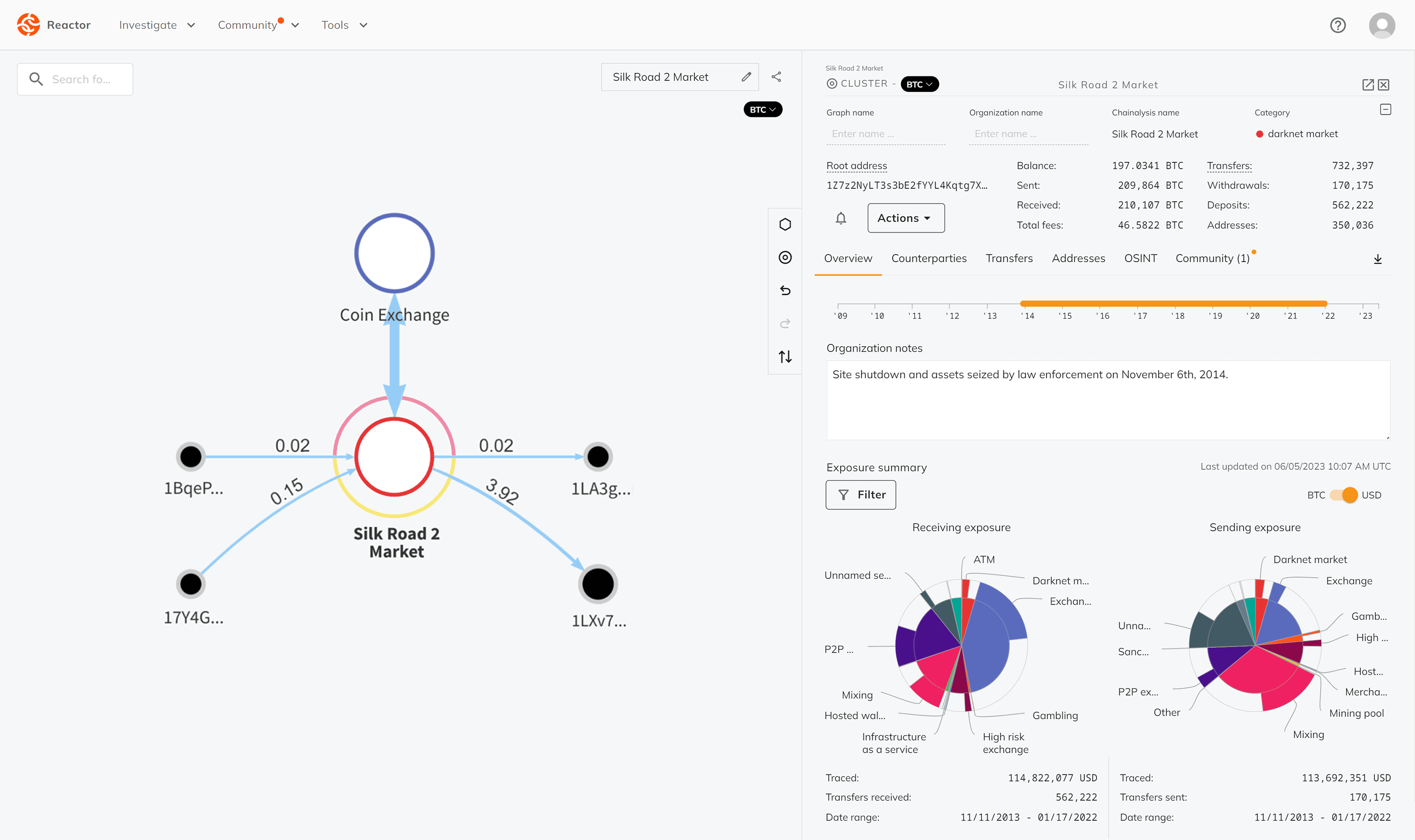

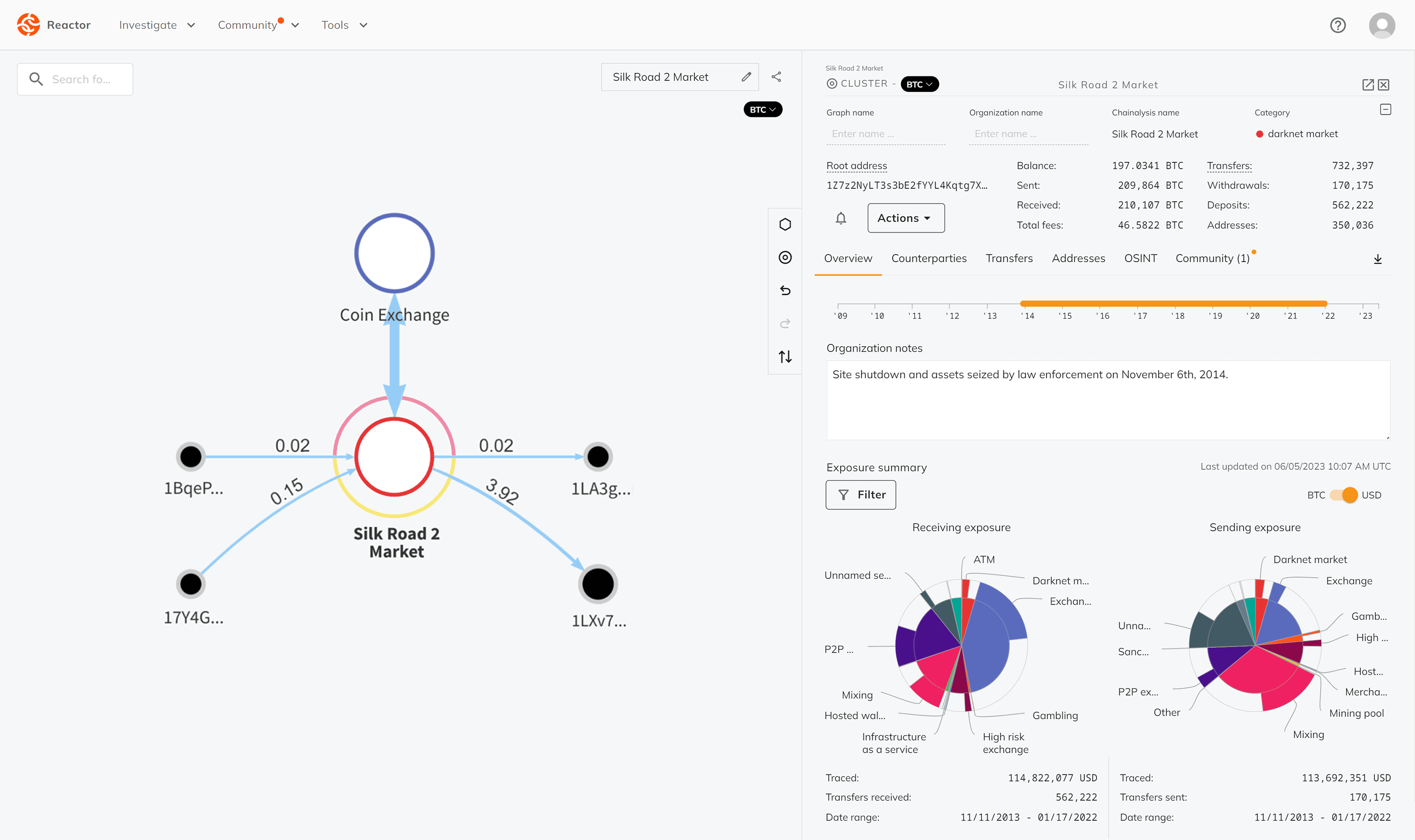

Chainalysis' Enhanced Capabilities in AI-Driven Crypto Analysis

This acquisition dramatically boosts Chainalysis's arsenal in combating illicit cryptocurrency activity.

Leveraging Alterya's Expertise in Data Integration and AI

Alterya’s specialized technology excels in data integration and AI-driven insights. This integration will significantly enhance Chainalysis' ability to analyze the massive and complex datasets generated by blockchain transactions. Specifically, Alterya's technology will power:

- Improved Transaction Tracing: More efficient tracking of cryptocurrency movements across multiple blockchains and exchanges.

- Faster Identification of Illicit Activities: Quicker detection of suspicious patterns and potentially criminal transactions.

- Enhanced Risk Scoring: More accurate assessment of the risk associated with specific transactions and entities.

- More Effective Network Analysis: Improved identification of complex money laundering schemes and criminal networks.

The combined power of Chainalysis and Alterya will also facilitate the development of more sophisticated AI models for fraud detection, leading to a significant increase in accuracy and efficiency.

Strengthening Chainalysis' Market Position

The acquisition of Alterya solidifies Chainalysis' position as the leading provider of blockchain analytics solutions. This strategic move delivers several key advantages:

- Increased Market Share: Expansion into new segments of the market previously inaccessible due to technological limitations.

- Competitive Advantage: A significant leap forward in AI-powered capabilities, differentiating Chainalysis from competitors.

- Attracting More Clients: Enhanced capabilities will attract a wider range of clients, including exchanges, financial institutions, and law enforcement agencies.

This enhanced platform could also enable Chainalysis to expand into new markets or offer new, advanced services to existing clients, further cementing its market leadership.

The Impact on the Cryptocurrency Industry's Regulatory Landscape

The enhanced AI capabilities resulting from this merger will have a substantial impact on the regulatory landscape of the cryptocurrency industry.

Improved AML/KYC Compliance

The integration of Alterya's AI technology will dramatically improve the detection and prevention of money laundering and other financial crimes in the crypto space. This leads to:

- More Efficient Investigations: Faster and more accurate identification of suspicious activity, leading to swifter investigations.

- Stricter Compliance Measures: More robust AML/KYC protocols and compliance measures enforced by both exchanges and regulators.

- Increased Transparency and Trust: A more transparent and trustworthy cryptocurrency market, encouraging wider adoption and investment.

This will likely lead to increased cooperation between regulatory bodies and blockchain analytics firms like Chainalysis, improving their oversight of cryptocurrency transactions and the enforcement of relevant regulations.

Implications for Crypto Exchanges and Businesses

Cryptocurrency exchanges and businesses will face both challenges and opportunities as a result of this acquisition.

- Increased Scrutiny of Transactions: Expect a higher level of scrutiny on transactions, particularly those deemed high-risk.

- Higher Compliance Costs: Businesses will likely incur increased costs to maintain compliance with evolving regulations and leverage updated technologies.

- Need for Updated Risk Management Strategies: Exchanges and businesses will need to update their risk management strategies to adapt to the enhanced capabilities of Chainalysis.

- Potential Benefits of Using Chainalysis' Upgraded Platform: Access to superior AML/KYC tools and increased security.

Ultimately, this improved compliance infrastructure will likely foster a more stable and mature cryptocurrency ecosystem.

Future Implications for AI and Blockchain Technology

The synergy between Chainalysis and Alterya’s technologies has the potential to drive significant advancements in AI and blockchain technology.

Synergies and Innovation

The combined engineering teams will undoubtedly foster innovation. We can expect:

- Development of New AI Algorithms: More advanced algorithms for analyzing blockchain data and detecting anomalies.

- Improved Blockchain Analysis Techniques: More effective methods for tracking cryptocurrency transactions and identifying illicit activities.

- New Applications for AI in Crypto: Expansion of AI applications into areas such as DeFi security and risk management.

This collaborative environment will likely lead to breakthroughs in AI-powered fraud detection and risk assessment tools.

Broader Adoption of AI in Fintech

The Alterya acquisition could act as a catalyst for wider adoption of AI and machine learning across the fintech sector. This could result in:

- Increased Investment in AI-Powered Solutions: More investment in developing AI-driven solutions for financial services.

- Development of New Industry Standards: The establishment of new industry standards for AI-powered AML/KYC compliance.

- Improved Overall Security and Efficiency: Increased security and efficiency in financial transactions across various sectors.

This acquisition could spur further similar collaborations and acquisitions, accelerating the integration of AI into the fintech industry as a whole.

Conclusion

The acquisition of Alterya by Chainalysis represents a powerful combination of blockchain expertise and advanced AI capabilities. This merger will significantly improve AML/KYC compliance within the cryptocurrency industry, enhance the fight against financial crime, and drive innovation in both AI and blockchain technologies. The impact on the regulatory landscape and the broader fintech sector is expected to be substantial. To learn more about Chainalysis's enhanced offerings and how their AI-powered solutions can improve your crypto security and compliance, visit the Chainalysis website today. Discover how Alterya's integration is shaping the future of AI in crypto.

Featured Posts

-

Could Kyle Walker Peters Join Crystal Palace On A Free

May 24, 2025

Could Kyle Walker Peters Join Crystal Palace On A Free

May 24, 2025 -

Maryland Softball Rallies Past Delaware 5 4

May 24, 2025

Maryland Softball Rallies Past Delaware 5 4

May 24, 2025 -

En Tutkulu Erkek Burclari Ask Ve Baglantilarda Sicaklik Ve Ates

May 24, 2025

En Tutkulu Erkek Burclari Ask Ve Baglantilarda Sicaklik Ve Ates

May 24, 2025 -

Accessibility In Games Feeling The Pinch Of Industry Cutbacks

May 24, 2025

Accessibility In Games Feeling The Pinch Of Industry Cutbacks

May 24, 2025 -

Leeds United Target Kyle Walker Peters Transfer News

May 24, 2025

Leeds United Target Kyle Walker Peters Transfer News

May 24, 2025

Latest Posts

-

Today Show Shakeup Savannah Guthries Temporary Co Host

May 24, 2025

Today Show Shakeup Savannah Guthries Temporary Co Host

May 24, 2025 -

Savannah Guthries Mid Week Co Host Swap Who Filled In

May 24, 2025

Savannah Guthries Mid Week Co Host Swap Who Filled In

May 24, 2025 -

Today Show Walt Frazier And Dylan Dreyers Championship Ring Moment

May 24, 2025

Today Show Walt Frazier And Dylan Dreyers Championship Ring Moment

May 24, 2025 -

Al Roker And Co Host Clash Details Of Off The Record Conversation Revealed

May 24, 2025

Al Roker And Co Host Clash Details Of Off The Record Conversation Revealed

May 24, 2025 -

Behind The Scenes Today Show Drama Al Rokers Comments Cause Tension

May 24, 2025

Behind The Scenes Today Show Drama Al Rokers Comments Cause Tension

May 24, 2025