Amsterdam Exchange Down 2%: Impact Of Trump's Latest Tariff Increase

Table of Contents

Understanding the Tariff Increase

Trump's latest tariff increase targets a range of goods, primarily focused on [Specify goods and percentages affected, e.g., steel and aluminum imports from the EU, increasing tariffs by 25%]. The stated rationale behind this move is [Explain the official reasons given by the Trump administration, e.g., to protect American industries from unfair competition and bolster domestic production]. However, this action has predictably sparked retaliatory measures from affected countries. The EU, for example, has announced [Mention specific retaliatory tariffs imposed by the EU or other countries]. This escalating trade war creates a complex and volatile global trade environment, marked by increased import duties and significant tariff implications for businesses worldwide.

The Amsterdam Exchange's Vulnerability

The Amsterdam Exchange (Euronext Amsterdam), while a significant European stock market, is particularly vulnerable to the effects of these tariffs due to its strong ties to international trade. Many companies listed on the AEX index, the benchmark index of the Amsterdam stock market, are heavily involved in global supply chains. Sectors such as:

- Technology: Companies reliant on global semiconductor supply chains face disruptions and increased production costs.

- Manufacturing: Dutch manufacturers exporting goods to the US or relying on US components experience decreased competitiveness.

- Retail: Companies importing goods from the US see higher costs and potentially reduced consumer demand.

Specific examples of affected companies include [mention specific companies listed on the Amsterdam Exchange and briefly describe how they are impacted, e.g., "Philips, a major electronics producer, may see increased costs for imported components," or "ASML, a leading semiconductor equipment manufacturer, could face decreased demand from US clients"]. This dependence on international trade makes the Amsterdam stock market acutely sensitive to fluctuations in global trade relations.

Short-Term and Long-Term Impacts

The immediate effect of the tariff increase is evident in the 2% drop on the Amsterdam Exchange. This market volatility underscores the immediate negative reaction to increased trade protectionism. In the short term, we can expect continued uncertainty and potentially further price fluctuations.

Long-term consequences for the Dutch economy and the Amsterdam Exchange are more complex and depend on various factors, including the duration of the trade war and the effectiveness of any countermeasures.

- Best-case scenario: A negotiated settlement leads to a reduction in tariffs, mitigating the negative impact on the Amsterdam Exchange and the Dutch economy.

- Worst-case scenario: The trade war escalates further, leading to prolonged market volatility, reduced economic growth, and potentially significant job losses in affected sectors. This would likely lead to a sustained decline in the AEX index and broader economic hardship. This economic uncertainty necessitates careful consideration of investment strategies.

Investor Sentiment and Market Reactions

Following the tariff announcement, investor sentiment has understandably turned negative. Investor confidence is shaken, with a palpable increase in risk aversion. Trading volume on the Amsterdam Exchange increased significantly, suggesting heightened activity as investors react to the news. We have seen a noticeable flight to safety, with investors shifting their portfolios towards less risky assets like government bonds. This stock market volatility reflects the uncertainty and apprehension surrounding the potential long-term economic consequences of this trade dispute.

Conclusion: Amsterdam Exchange Down 2%: The Continuing Impact of Tariffs

In summary, Trump's latest tariff increase has had a demonstrably negative impact on the Amsterdam Exchange, leading to a 2% decline and highlighting the market's vulnerability to global trade tensions. The short-term effects include increased market volatility and investor uncertainty, while long-term consequences could range from moderate to severe, depending on future developments. The interconnected nature of global trade makes the Amsterdam Exchange, and indeed many other markets, susceptible to these tariff effects.

To navigate this challenging environment, staying informed about global market trends and the impact of tariffs is crucial. Consult with a financial advisor to develop an effective investment strategy that mitigates risk and capitalizes on potential opportunities within the evolving landscape of the Amsterdam Exchange and global markets. Understanding the ongoing implications of these Trump tariffs is critical for successful investment in the long term.

Featured Posts

-

Will Jordan Bardellas Leadership Revitalize The National Rally In France

May 25, 2025

Will Jordan Bardellas Leadership Revitalize The National Rally In France

May 25, 2025 -

Los Hijos De Alberto De Monaco Hacen Su Primera Comunion

May 25, 2025

Los Hijos De Alberto De Monaco Hacen Su Primera Comunion

May 25, 2025 -

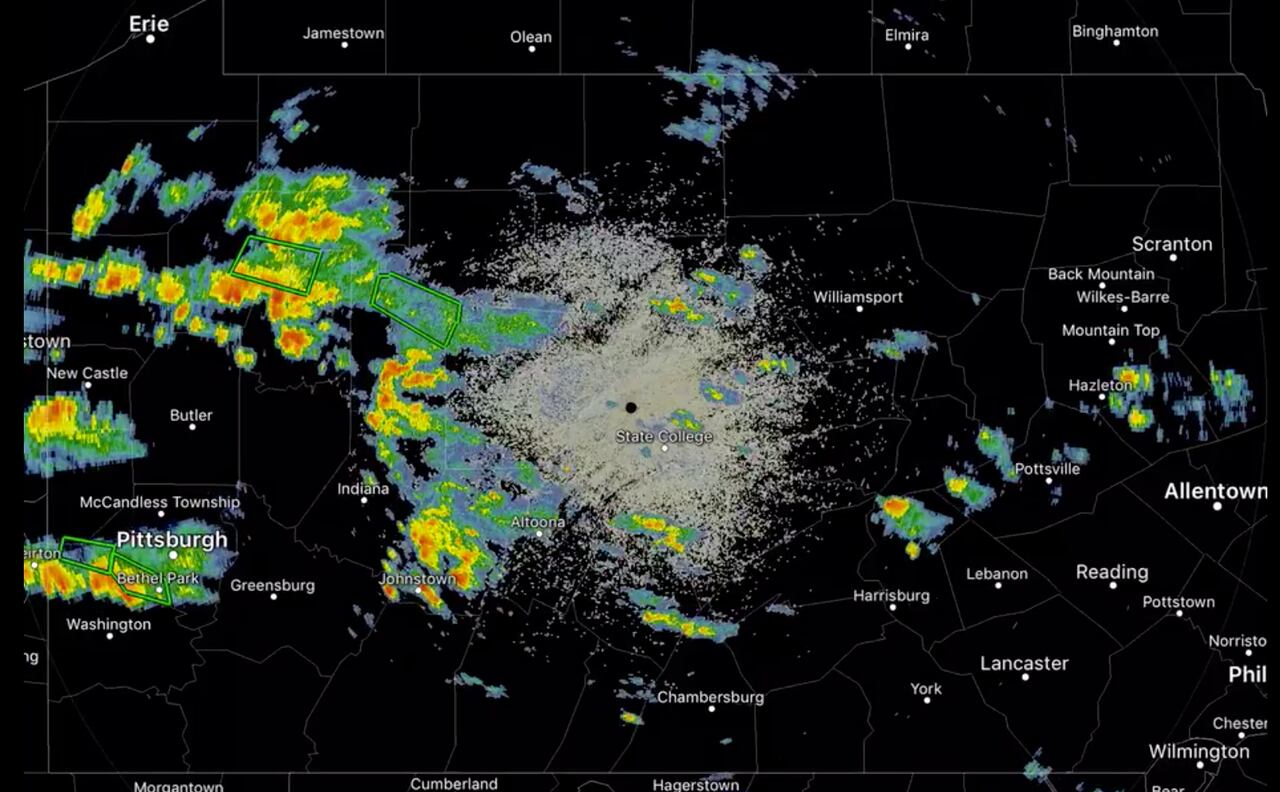

Southeast Pennsylvania Coastal Flood Advisory Wednesday Update

May 25, 2025

Southeast Pennsylvania Coastal Flood Advisory Wednesday Update

May 25, 2025 -

Fabrication De Chaussures La Charentaise A Saint Brieuc Un Heritage Preserve

May 25, 2025

Fabrication De Chaussures La Charentaise A Saint Brieuc Un Heritage Preserve

May 25, 2025 -

Can We Make Housing More Affordable Without Crashing Home Prices The Gregor Robertson Approach

May 25, 2025

Can We Make Housing More Affordable Without Crashing Home Prices The Gregor Robertson Approach

May 25, 2025