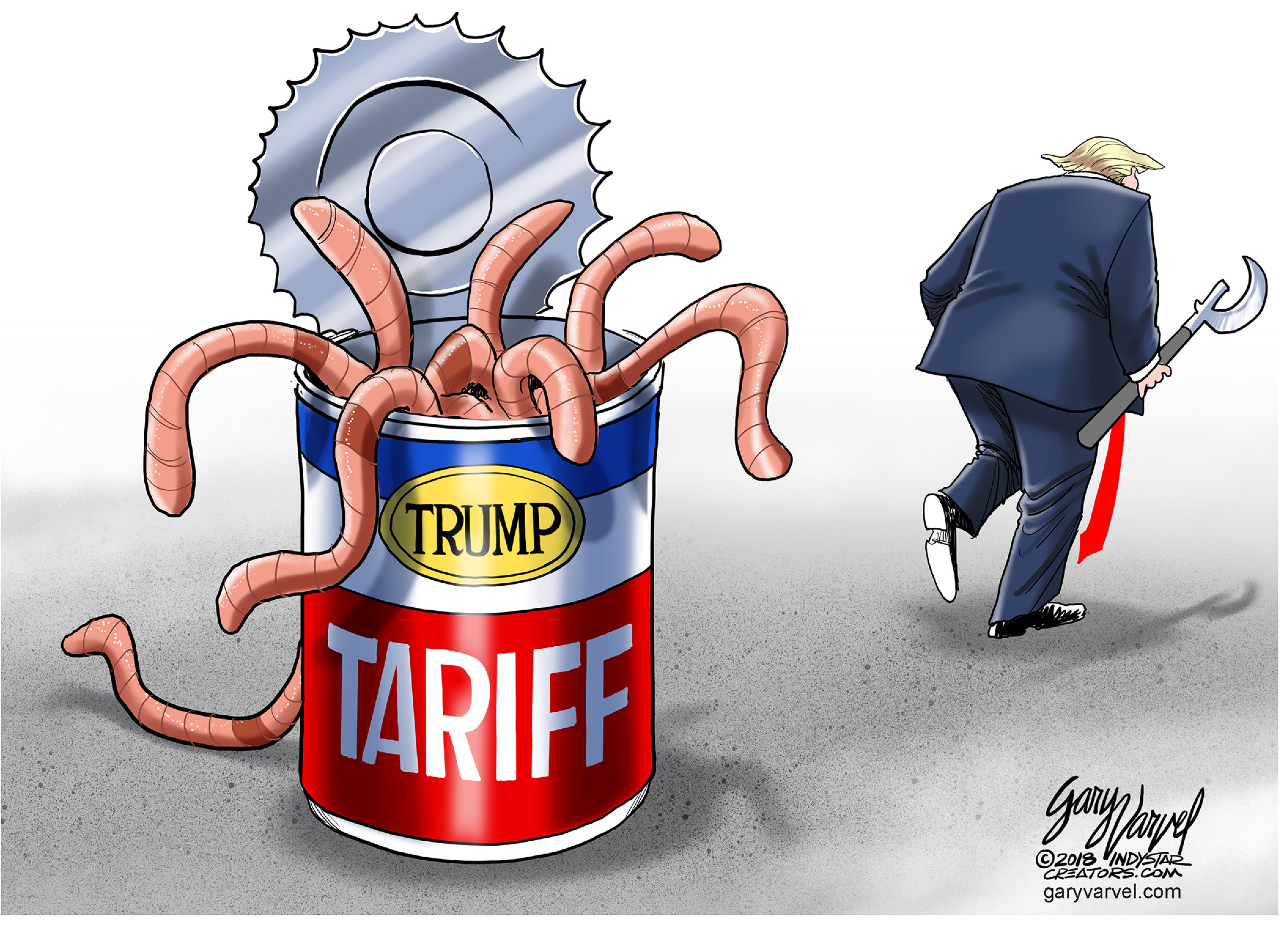

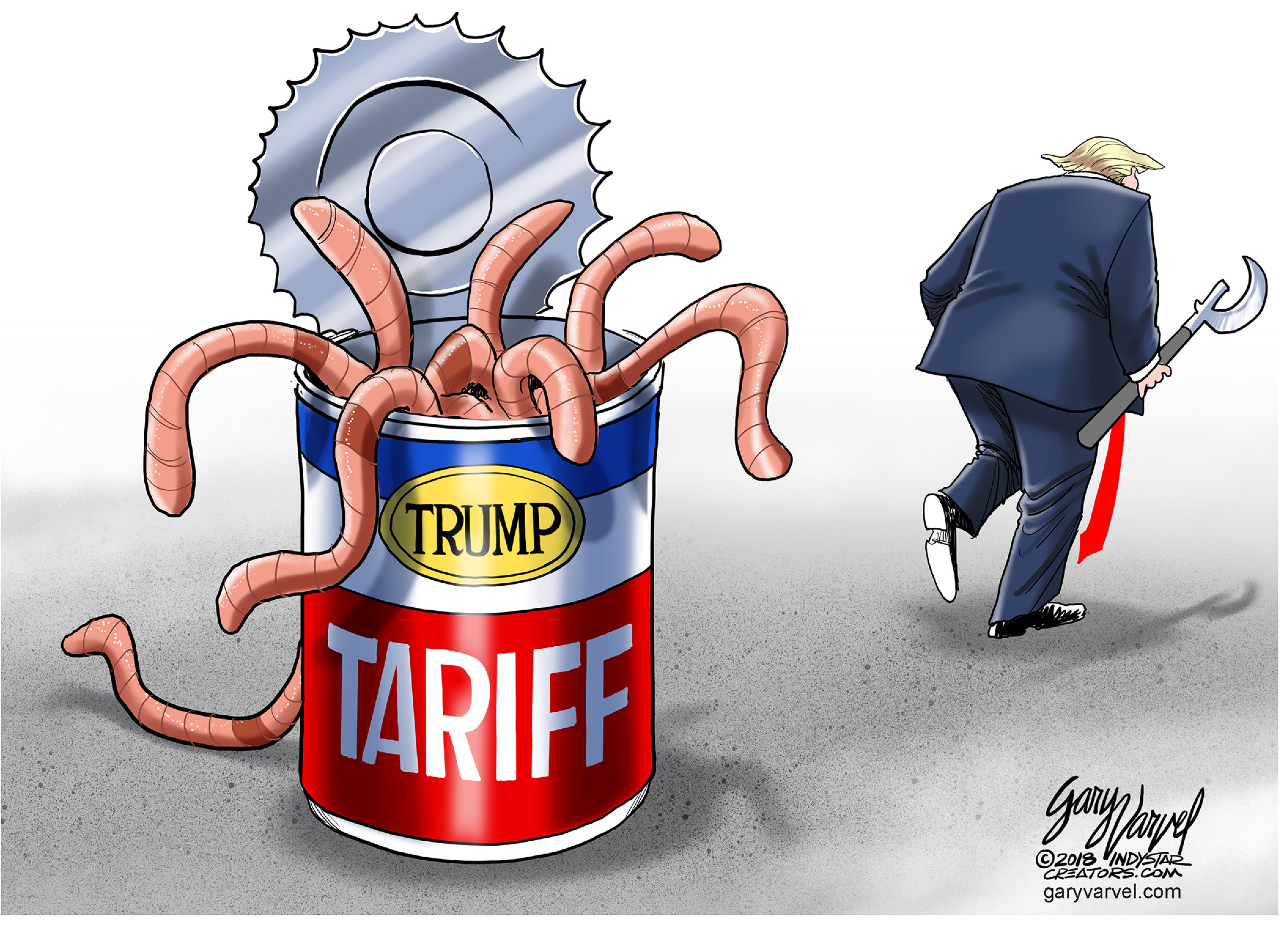

Amsterdam Exchange Down 2%: Impact Of Trump's Latest Tariffs

Table of Contents

Understanding the Impact of Trump's Tariffs on the Amsterdam Exchange

US tariffs significantly impact international trade, creating a ripple effect across global stock markets, including the Amsterdam Exchange. These tariffs fundamentally alter the cost and accessibility of goods and services in international markets. The consequences for the Amsterdam Exchange are multifaceted and far-reaching.

- Increased import costs for Dutch businesses reliant on US goods: Dutch companies importing raw materials or finished goods from the US face substantially higher costs, impacting their profitability and competitiveness. This leads to increased prices for consumers and reduced demand.

- Reduced export opportunities for Dutch companies selling to the US: Higher tariffs on Dutch exports to the US make them less attractive to American consumers, leading to decreased sales and potential job losses in affected Dutch industries.

- Uncertainty in the global market leading to investor hesitation: The unpredictable nature of US trade policy fosters uncertainty in the global market, prompting investors to adopt a more cautious approach and potentially withdraw investments from the Amsterdam Exchange.

- Potential for retaliatory tariffs from the EU impacting US companies trading on the Amsterdam Exchange: The EU may retaliate with its own tariffs on US goods, further destabilizing the market and impacting US companies listed on the Amsterdam Exchange.

- Weakening of the Euro against the US dollar: The economic fallout from the tariffs can lead to a weakening of the Euro, negatively affecting Dutch companies with significant international trade exposure.

Sectors Most Affected by the Downturn on the Amsterdam Exchange

The impact of the tariffs is not uniform across all sectors. Some industries within the Amsterdam Exchange are disproportionately affected, experiencing more significant drops than others.

- Automotive industry: This sector is heavily reliant on US-sourced parts and exports vehicles to the US. Tariffs on both imports and exports severely impact profitability and competitiveness. Companies like VDL Groep, a major player in the Dutch automotive industry, may experience considerable losses.

- Agricultural sector: The agricultural sector, a significant part of the Dutch economy, faces substantial challenges due to tariffs on agricultural products. This directly impacts export revenues and farm incomes.

- Technology sector: Supply chain disruptions and reduced demand from the US negatively impact the Dutch technology sector, leading to slower growth and potentially layoffs.

- Financial services: Market volatility and reduced investor confidence negatively affect the financial services sector, impacting banks and investment firms listed on the Amsterdam Exchange.

- Specific examples: We need to monitor specific companies within these sectors for significant drops in their stock prices to gain a clearer picture of the full impact. Further analysis of individual company performance will paint a more complete picture.

Investor Sentiment and Future Predictions for the Amsterdam Exchange

Investor sentiment towards the Amsterdam Exchange has shifted significantly, reflecting a growing risk aversion. The market shows signs of increased volatility, and further corrections are possible.

- Increased risk aversion among investors: Investors are becoming more cautious, reducing their exposure to riskier assets, leading to lower trading volumes on the Amsterdam Exchange.

- Potential for further market corrections: The uncertainty surrounding future US trade policy suggests that further market corrections may occur in the coming weeks and months.

- Analysis of current trading volumes: A detailed analysis of current trading volumes on the Amsterdam Exchange is crucial to understanding the depth and extent of the impact of Trump's tariffs.

- Expert opinions on the long-term impact of the tariffs: Economists and market analysts are closely watching the situation and offering varying opinions on the long-term impact of these trade measures on the Amsterdam Exchange.

- Potential strategies for investors to mitigate risks: Investors may consider diversification, hedging strategies, and reassessing their investment portfolios to minimize risks.

Government Response and Potential Mitigation Strategies

The Dutch government is likely to implement various measures to mitigate the negative effects of these tariffs on the Amsterdam Exchange and the national economy.

- Government support packages for affected industries: Financial aid and tax breaks may be offered to companies struggling due to increased import costs and reduced export opportunities.

- Negotiations with the US administration to alleviate tariffs: The Dutch government may engage in diplomatic efforts to negotiate with the US to reduce or eliminate tariffs impacting Dutch businesses.

- Diversification of trade partners to reduce reliance on the US market: The Netherlands may actively pursue trade agreements with other countries to reduce its dependence on the US market.

- Investment in domestic industries to boost economic resilience: Government investments in domestic industries aim to strengthen the Dutch economy’s resilience to external shocks.

- Potential policy changes to support businesses impacted by the tariffs: New policies may be introduced to ease the burden on affected businesses and stimulate economic growth.

Conclusion

Trump's latest tariffs have had a significant and demonstrably negative impact on the Amsterdam Exchange, causing a 2% decline and affecting numerous sectors, including automotive, agriculture, technology, and financial services. The uncertainty and volatility in the market are substantial, and further corrections are possible. Understanding the impact of Trump’s tariffs on the Amsterdam Exchange is crucial for navigating the current market volatility. Regularly check for updates on the Amsterdam Exchange and the effects of Trump's tariffs to make informed investment decisions. Stay informed about developments in the Amsterdam Exchange and the ongoing trade negotiations to make sound financial choices. Seek further reading and resources to better understand the broader impact of Trump's tariffs on global markets.

Featured Posts

-

England Airpark And Alexandria International Airport Ae Xplore Campaign Promises Enhanced Connectivity

May 25, 2025

England Airpark And Alexandria International Airport Ae Xplore Campaign Promises Enhanced Connectivity

May 25, 2025 -

Los Angeles Wildfires The Ethics And Economics Of Disaster Gambling

May 25, 2025

Los Angeles Wildfires The Ethics And Economics Of Disaster Gambling

May 25, 2025 -

Kyle Walker Partying With Mystery Women After Annie Kilners Departure

May 25, 2025

Kyle Walker Partying With Mystery Women After Annie Kilners Departure

May 25, 2025 -

Atletico Madrid In Geri Doenuesue Taktiksel Degisimler Ve Oyuncular

May 25, 2025

Atletico Madrid In Geri Doenuesue Taktiksel Degisimler Ve Oyuncular

May 25, 2025 -

Is Naomi Campbell Banned From The Met Gala A Look At The Alleged Anna Wintour Dispute

May 25, 2025

Is Naomi Campbell Banned From The Met Gala A Look At The Alleged Anna Wintour Dispute

May 25, 2025