Amsterdam Exchange Plunges: 2% Drop After Trump Tariff Announcement

Table of Contents

The Immediate Impact of the Tariff Announcement on the AEX

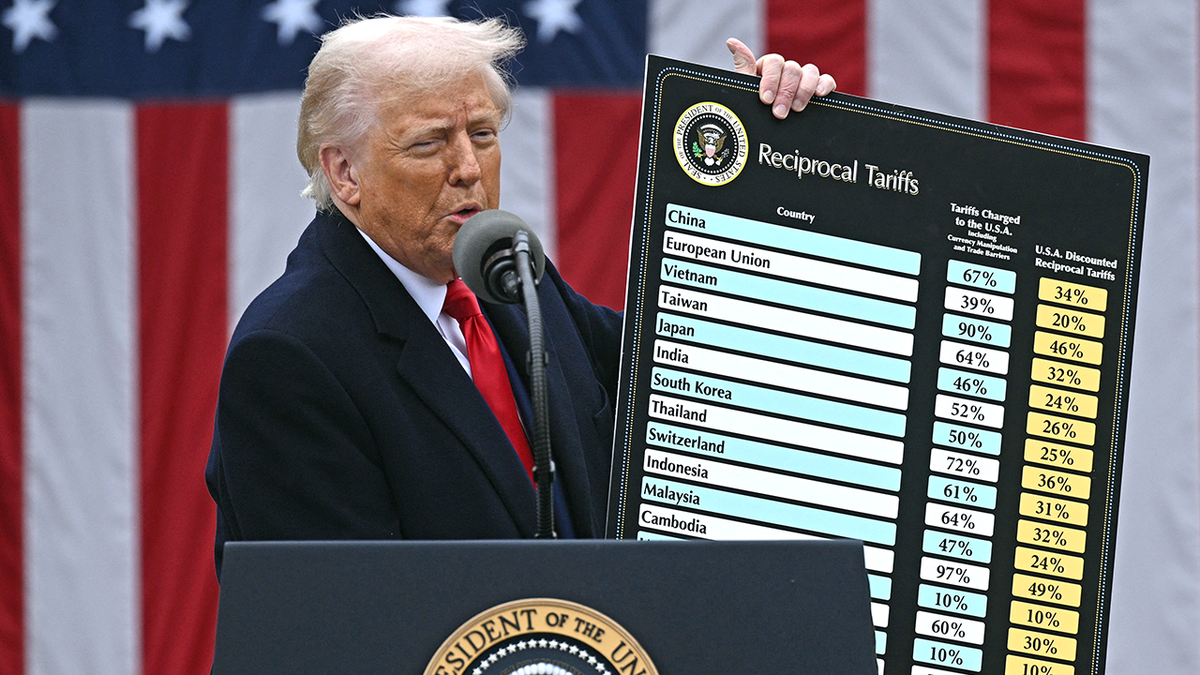

The announcement of the new tariffs broke just before midday, triggering an immediate and sharp decline in the AEX index. Within minutes, the index plummeted, showcasing the market's immediate sensitivity to trade policy uncertainty. [Insert chart or graph visually representing the AEX's plunge]. Financial news sources like the Financial Times and Reuters reported widespread concern amongst investors.

- Percentage drop in key sectors: The technology sector experienced a 2.5% drop, while the financial sector fell by 2%.

- Volume of trading activity: Trading volume spiked significantly immediately following the announcement, indicating heightened investor activity and anxiety.

- Specific companies significantly affected: Companies heavily reliant on exports, such as [Company A] and [Company B], saw percentage losses exceeding the overall market decline.

Sectors Most Affected by the Trump Tariff Announcement

The sectors most vulnerable to the new tariffs are primarily export-oriented industries. These businesses rely heavily on international trade and are directly impacted by increased import costs and potential retaliatory measures from other countries.

- Detailed analysis of the impact on specific sectors: The automotive and agricultural sectors are particularly susceptible, given their heavy reliance on global supply chains.

- Comparison to previous tariff announcements: This decline is more pronounced than the market reactions to previous tariff announcements, suggesting a growing concern about the escalating trade war.

- Expert opinions on the long-term consequences: Experts warn of potential job losses and reduced economic growth if the trade tensions persist.

Investor Sentiment and Future Market Predictions for the Amsterdam Exchange

Following the AEX plunge, investor sentiment is understandably cautious. Many analysts express concern about the long-term implications of the new tariffs and the potential for further escalation. However, some experts point to potential mitigating factors, such as increased domestic demand and government stimulus packages.

- Summary of analyst predictions: Short-term predictions are largely negative, with many anticipating further volatility. Long-term predictions are more varied, depending on the future trajectory of trade negotiations.

- Discussion of investor strategies: Investors are adopting diverse strategies, from hedging against further losses to seeking out opportunities in less exposed sectors.

- Potential government intervention: The Dutch government may announce measures to support affected businesses and mitigate the economic impact of the tariffs.

Global Market Reaction and the Ripple Effect of the Trump Tariffs

The impact of the Trump tariffs extends far beyond the Amsterdam Exchange. Major stock exchanges across Europe and globally experienced declines, reflecting the interconnectedness of international markets and the widespread concern about the escalating trade war.

- Comparison of the AEX's performance to other major indices: The AEX's performance mirrors the declines seen in other major European indices, indicating a broader European concern.

- Analysis of the interconnectedness of global financial markets: This event underlines the interconnectedness of global markets and how a localized event can have significant ripple effects.

- Potential international trade disputes: This tariff announcement could further escalate trade tensions between the US and other countries, leading to further market volatility.

Understanding the Amsterdam Exchange Plunge and its Implications

In conclusion, the 2% drop in the AEX index represents a significant market reaction to President Trump's latest tariff announcement. The export-oriented sectors have been particularly hard hit, and investor sentiment remains cautious. This event highlights the interconnectedness of global markets and underscores the broader economic implications of escalating trade tensions. The long-term consequences for the Amsterdam Exchange and the global economy remain uncertain, depending heavily on the future trajectory of trade relations. Stay updated on the latest developments affecting the Amsterdam Exchange and global markets by subscribing to our newsletter/following our social media/visiting our website regularly for in-depth analysis of AEX index performance and future Trump Tariff impacts.

Featured Posts

-

M6 Drivers Face Significant Delays Following Van Crash

May 24, 2025

M6 Drivers Face Significant Delays Following Van Crash

May 24, 2025 -

Sergey Yurskiy 90 Let Geniyu Paradoksov

May 24, 2025

Sergey Yurskiy 90 Let Geniyu Paradoksov

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Nav Analysis And Implications

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc Nav Analysis And Implications

May 24, 2025 -

Nightcliff Robbery Teenager Arrested Following Fatal Stabbing Of Shop Owner In Darwin

May 24, 2025

Nightcliff Robbery Teenager Arrested Following Fatal Stabbing Of Shop Owner In Darwin

May 24, 2025 -

Escape To The Country Top Locations For A Tranquil Life

May 24, 2025

Escape To The Country Top Locations For A Tranquil Life

May 24, 2025

Latest Posts

-

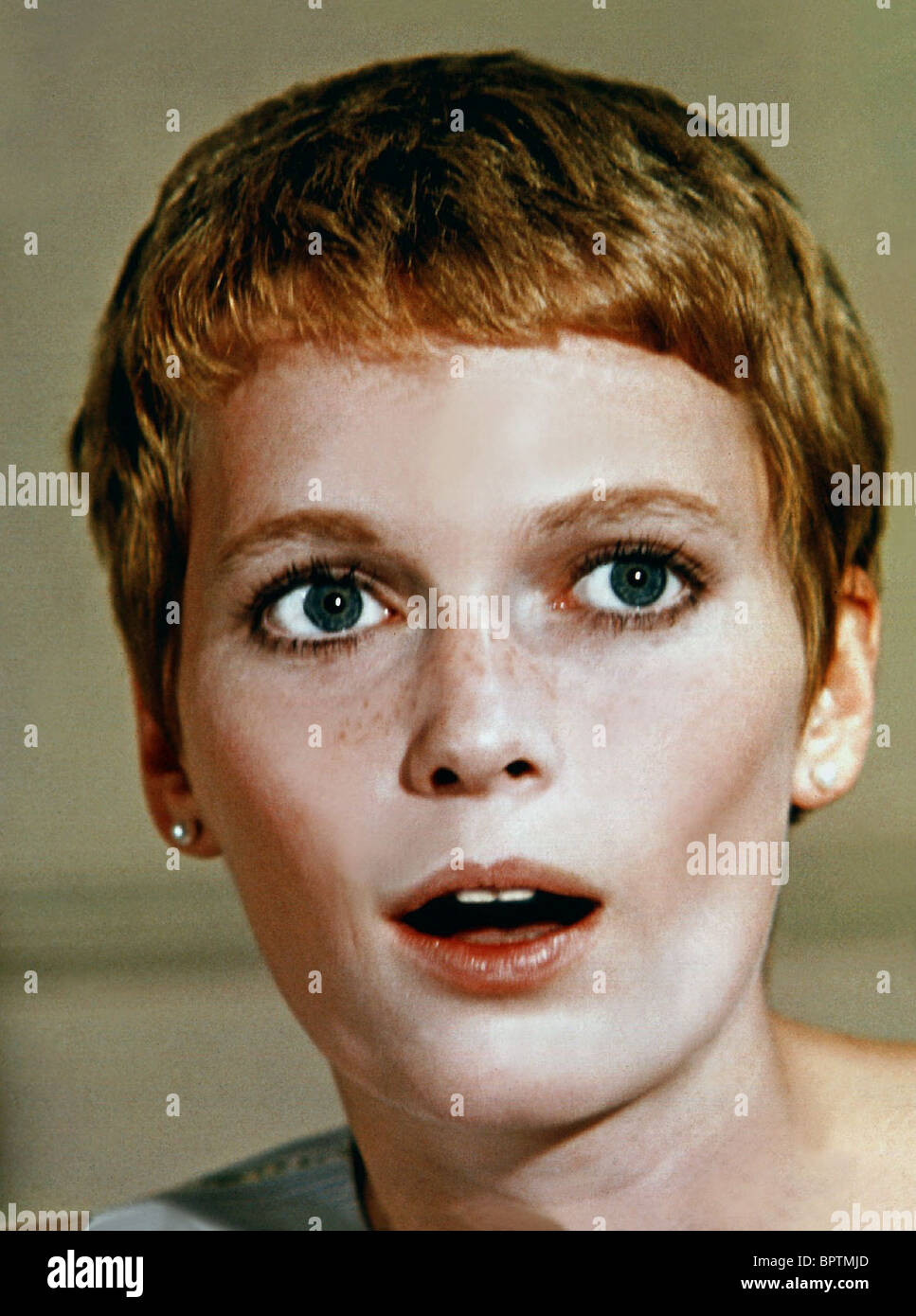

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025 -

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025