Amsterdam Stock Exchange Drops 2% After Trump's Tariff Hike

Table of Contents

Trump's Tariff Hike: The Catalyst for the Amsterdam Stock Exchange Decline

President Trump's recent tariff increase acted as a significant catalyst for the downturn in the Amsterdam Stock Exchange. These tariffs, impacting various sectors, directly affected Dutch businesses heavily involved in international trade. The ripple effect was immediate and substantial, leading to a noticeable decrease in investor confidence.

- Specific sectors impacted: The tariffs targeted sectors crucial to the Dutch economy, including technology (particularly semiconductors), agriculture (notably dairy and horticultural products), and manufacturing. These sectors rely heavily on exporting goods to the US and other affected countries.

- Percentage increase in tariffs and affected countries: The percentage increase varied depending on the product, but significant increases were observed, impacting trade with not only the US, but also impacting countries intertwined in global supply chains. This created uncertainty across multiple markets.

- Expert quotes: Leading economists have warned of the potentially devastating effects of these tariffs, citing the interconnectedness of global markets and the risk of escalating trade wars. Professor [Name of Economist] at [University Name], stated, "[Quote about the impact of tariffs on the Dutch economy]."

Impact on Key Dutch Sectors: A Deeper Dive

The impact of Trump's tariffs on specific Dutch industries is far-reaching. The Netherlands' reliance on exports makes it particularly vulnerable to trade wars.

- Semiconductor industry: The Dutch semiconductor industry, a major player in global technology, faced immediate challenges due to increased tariffs on technology components. This led to increased production costs and reduced competitiveness in the international market.

- Agricultural sector: The Dutch agricultural sector, renowned for its exports, experienced significant challenges. Increased tariffs on agricultural products resulted in reduced demand and lower export volumes, impacting farmers and related businesses.

- Potential job losses and economic slowdown: The cumulative effect of these impacts on multiple sectors could lead to job losses and an overall economic slowdown in the Netherlands. The government is facing pressure to implement mitigation strategies.

Investor Sentiment and Market Reaction: A Volatile Landscape

The immediate market reaction to Trump's tariff announcement was characterized by significant volatility. Investor sentiment plummeted, triggering a sharp decline in the AEX index.

- AEX index performance: The AEX index underperformed other major European indices, reflecting the disproportionate impact of the tariffs on the Dutch economy.

- Trading volume and investor behavior: Trading volume spiked as investors reacted to the news, with many opting to sell assets to mitigate potential losses. This heightened volatility further fueled the market downturn.

- Financial analyst quotes: Financial analysts expressed concerns about the potential for further market corrections and emphasized the uncertainty surrounding future trade relations. [Name of Analyst] from [Financial Institution] noted, "[Quote about market predictions and future outlook]."

Long-Term Implications for the Amsterdam Stock Exchange and Dutch Economy

The long-term consequences of Trump's tariff hikes for the Amsterdam Stock Exchange and the Dutch economy remain uncertain. Further tariff escalations could exacerbate the situation, leading to prolonged economic uncertainty.

- Potential for further market corrections: The possibility of further market corrections and sustained economic instability cannot be discounted.

- Government responses and mitigation strategies: The Dutch government is likely to implement various strategies to mitigate the negative impacts, but the effectiveness of these measures remains to be seen.

- Long-term economic outlook: The long-term economic outlook for the Netherlands hinges on the resolution of trade disputes and the ability of the Dutch economy to adapt to the changing global landscape.

Conclusion

The 2% drop in the Amsterdam Stock Exchange following Trump's tariff hike underscores the vulnerability of the Dutch economy to global trade policies. The impact on key sectors like technology and agriculture is significant, and the potential for long-term economic consequences is a serious concern. The market volatility highlights the need for careful monitoring of the situation. Stay updated on the Amsterdam Stock Exchange’s response to trade wars and learn more about how Trump's tariffs impact the Amsterdam Stock Exchange and the Dutch economy to better understand the evolving economic landscape.

Featured Posts

-

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025 -

Refleksiya Fedora Lavrova Pavel I Trillery I Tyaga K Adrenalinu

May 24, 2025

Refleksiya Fedora Lavrova Pavel I Trillery I Tyaga K Adrenalinu

May 24, 2025 -

Is This Us Band Playing Glastonbury Social Media Clues Suggest Yes

May 24, 2025

Is This Us Band Playing Glastonbury Social Media Clues Suggest Yes

May 24, 2025 -

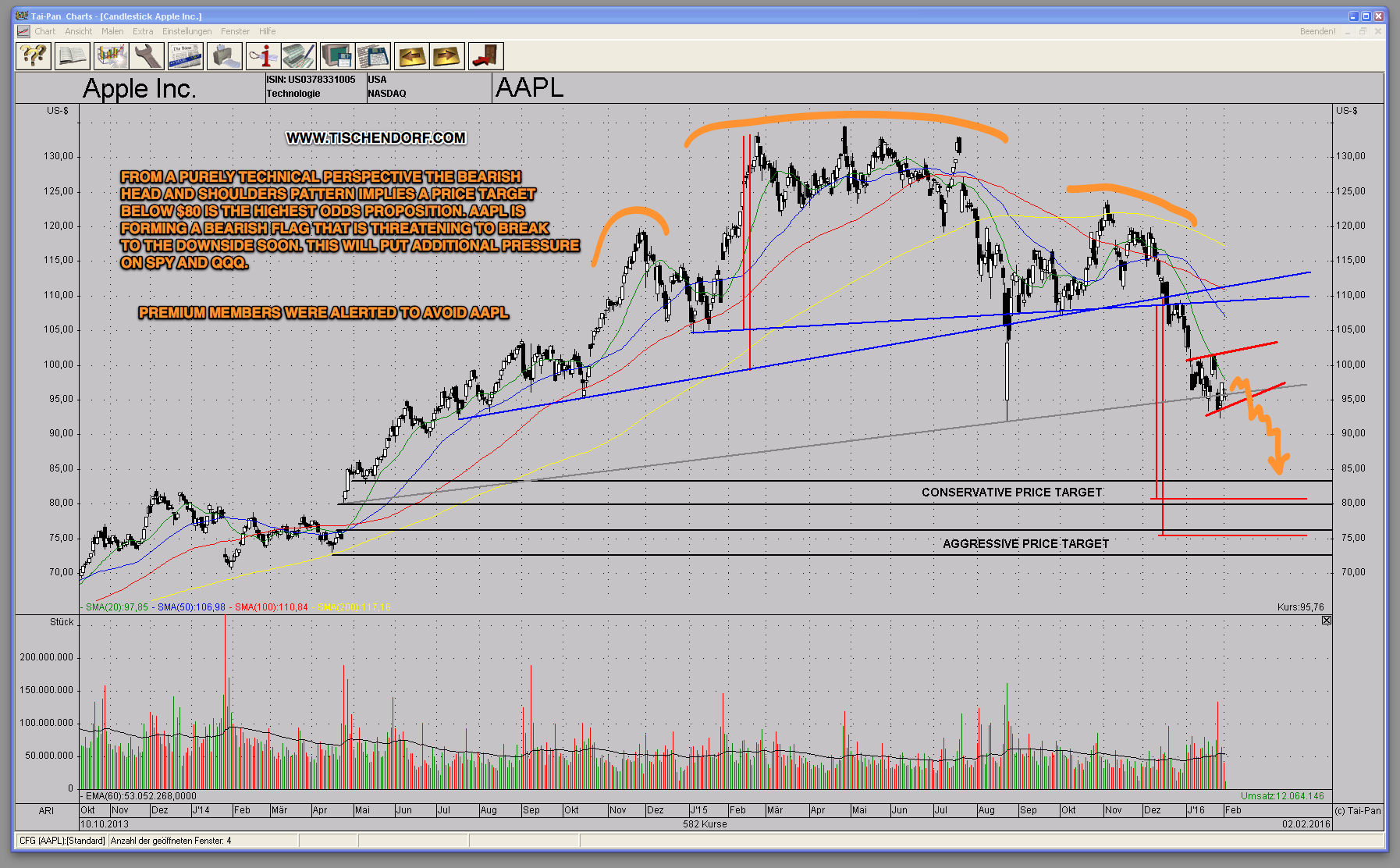

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025 -

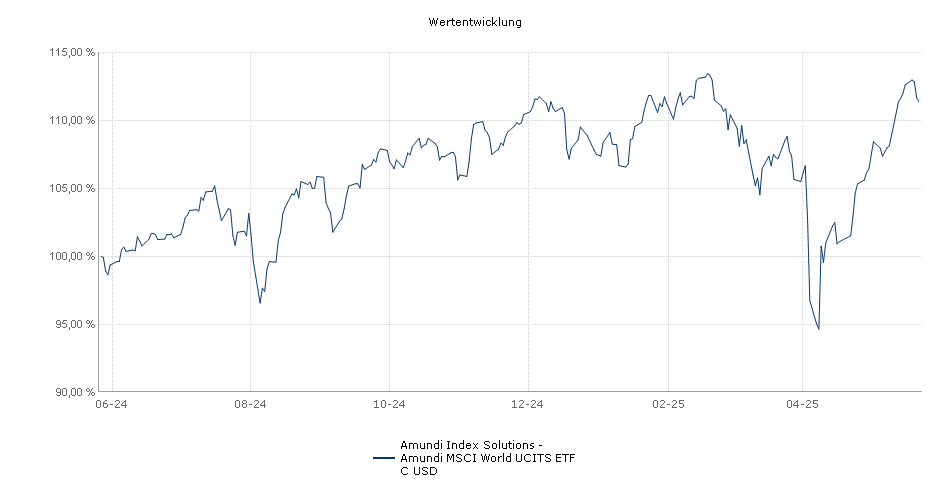

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Latest Posts

-

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow Trump Should Be Jailed Over Venezuelan Deportation Controversy

May 24, 2025 -

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025

Mia Farrows Outrage Trumps Actions On Venezuelan Deportations Demand Accountability

May 24, 2025 -

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Prosecute Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025