Amsterdam Stock Market: 7% Fall At Opening Reflects Global Trade Tensions

Table of Contents

Global Trade Tensions as the Primary Driver

The current state of global trade wars, particularly the protracted US-China trade conflict, is the primary driver behind the Amsterdam Stock Market's sharp decline. The uncertainty surrounding trade agreements and the imposition of tariffs have created a climate of fear and uncertainty, impacting investor confidence globally. This isn't just an American or Chinese issue; the ripple effect is felt intensely in European markets, including Amsterdam. Recently imposed tariffs on various goods have directly impacted supply chains, causing disruptions and increased costs for businesses across sectors.

- Impact of US tariffs on Dutch exports: Dutch businesses exporting to the US and China face higher costs and reduced competitiveness due to tariffs. This directly impacts their profitability and growth potential.

- Uncertainty surrounding future trade agreements: The lack of clarity regarding future trade agreements adds to the instability, making long-term planning difficult for businesses and causing investors to adopt a more risk-averse approach.

- Decline in investor confidence due to global trade instability: Global trade instability erodes investor confidence, leading to capital flight and a sell-off in stock markets worldwide. The Amsterdam Stock Exchange, being intricately connected to the global economy, is particularly vulnerable.

- Effect on supply chains and global manufacturing: Disruptions in global supply chains due to tariffs and trade restrictions impact manufacturing and production schedules, leading to further economic slowdown.

Impact on Key Sectors of the Amsterdam Stock Market

The 7% drop in the AEX Index wasn't uniform across all sectors. Technology stocks, often sensitive to global economic fluctuations, experienced particularly sharp declines. Financial stocks also suffered significant losses, reflecting investor concern about the broader economic outlook. Energy stocks, while impacted, showed somewhat less dramatic declines.

- Percentage decline in technology, financial, and energy stocks: While precise figures fluctuate, initial reports indicate disproportionately large falls in tech and finance compared to other sectors.

- Specific examples of companies experiencing significant losses: Identifying specific companies with substantial losses requires real-time market data analysis but generally, large-cap companies in the affected sectors would have shown significant decreases.

- Reasons for the varying degrees of impact across different sectors: The varying impact across sectors stems from their varying degrees of exposure to global trade and their sensitivity to economic uncertainty.

Investor Sentiment and Market Volatility

The market crash has significantly impacted investor sentiment, leading to increased market volatility. Risk aversion is high, and many investors are adopting a “wait-and-see” approach. Trading volume has also decreased as investors hesitate before making further transactions.

- Analysis of investor reactions and trading patterns: A detailed analysis of trading patterns would reveal increased short-selling and a flight to safety assets, like government bonds.

- Expert opinions and predictions regarding future market trends: Financial experts offer a range of opinions, with some predicting further short-term volatility while others maintain a more positive long-term outlook.

- The role of fear and uncertainty in driving the market downturn: Fear and uncertainty are powerful forces in financial markets. The current situation amplifies these emotions, leading to a sell-off.

Potential Long-Term Consequences for the Dutch Economy

The 7% drop in the Amsterdam Stock Market has significant implications for the Dutch economy. While the Netherlands boasts a strong and diversified economy, a prolonged period of global trade uncertainty could negatively impact GDP growth, potentially leading to increased unemployment and slower economic expansion.

- Potential impact on Dutch GDP growth: A prolonged downturn could significantly reduce Dutch GDP growth for the current and following fiscal quarters.

- Risk of increased unemployment: Businesses facing reduced exports and heightened uncertainty might resort to layoffs, potentially increasing unemployment.

- Possible government measures to mitigate the economic fallout: The Dutch government is likely to implement fiscal or monetary measures to stimulate the economy and protect businesses and employment.

Strategies for Investors in the Current Climate

Navigating the current market volatility requires a strategic approach. Risk management and portfolio diversification are paramount. Investors should consider their risk tolerance and adjust their investment strategies accordingly. Long-term investing, rather than short-term trading, is generally recommended in volatile markets.

- Strategies for mitigating losses: Diversifying investments, hedging strategies, and considering defensive assets can help mitigate losses.

- Importance of a well-diversified investment portfolio: A diversified portfolio spread across different asset classes and geographical regions helps reduce risk.

- Long-term investment strategies vs. short-term trading: Long-term strategies are more suitable for weathering market volatility than short-term trading.

Conclusion

The 7% drop in the Amsterdam Stock Market represents a significant event, directly linked to escalating global trade tensions. The impact spans various sectors, impacting investor confidence and potentially the Dutch economy's long-term growth trajectory. Understanding these market fluctuations and adapting investment strategies accordingly are crucial for navigating this turbulent period. Stay updated on the latest developments in the Amsterdam Stock Market and the impact of global trade tensions by regularly checking reputable financial news sources. Understanding these market fluctuations is crucial for successful investing in the Amsterdam Stock Market.

Featured Posts

-

Escape To The Country Finding Your Dream Home For Under 1 Million

May 25, 2025

Escape To The Country Finding Your Dream Home For Under 1 Million

May 25, 2025 -

Relx Trotseert Economische Zwakte Met Ai Sterke Resultaten En Vooruitzichten Tot 2025

May 25, 2025

Relx Trotseert Economische Zwakte Met Ai Sterke Resultaten En Vooruitzichten Tot 2025

May 25, 2025 -

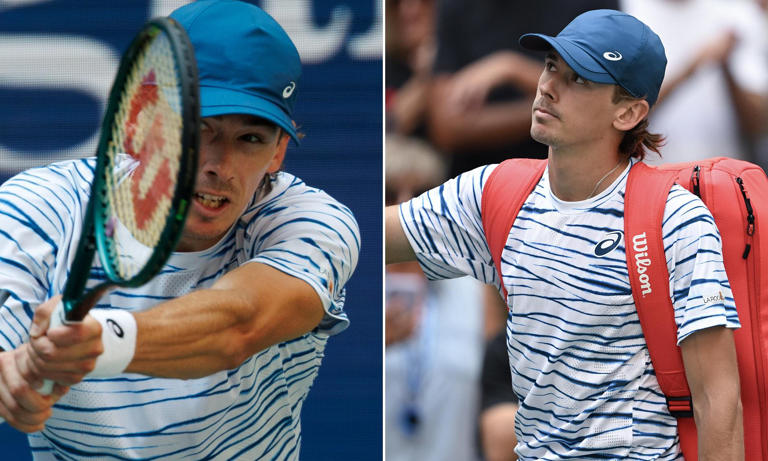

Alex De Minaurs Madrid Open Exit Straight Sets Defeat And Swiateks Victory

May 25, 2025

Alex De Minaurs Madrid Open Exit Straight Sets Defeat And Swiateks Victory

May 25, 2025 -

Sorusturma Real Madrid In Doert Yildiz Oyuncusu

May 25, 2025

Sorusturma Real Madrid In Doert Yildiz Oyuncusu

May 25, 2025 -

Dax Under 24 000 A Report On Frankfurt Market Losses

May 25, 2025

Dax Under 24 000 A Report On Frankfurt Market Losses

May 25, 2025