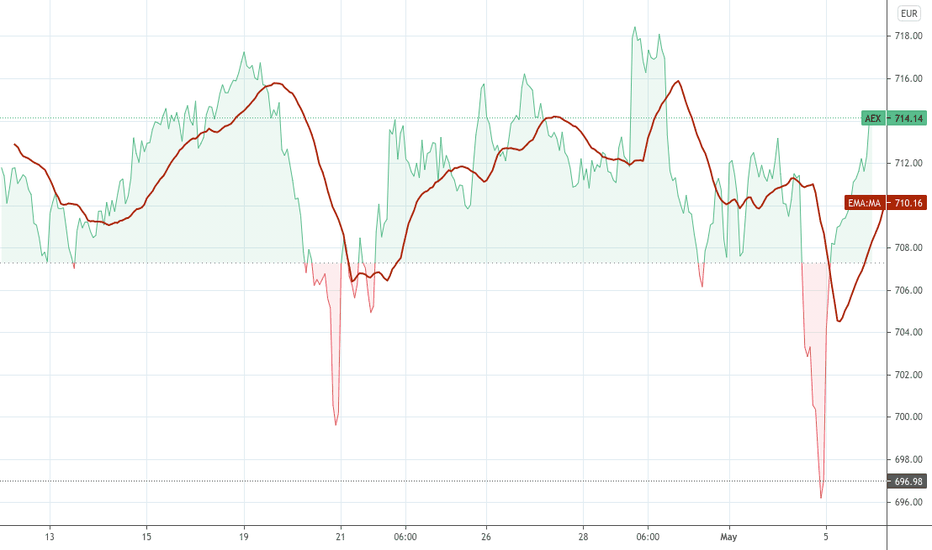

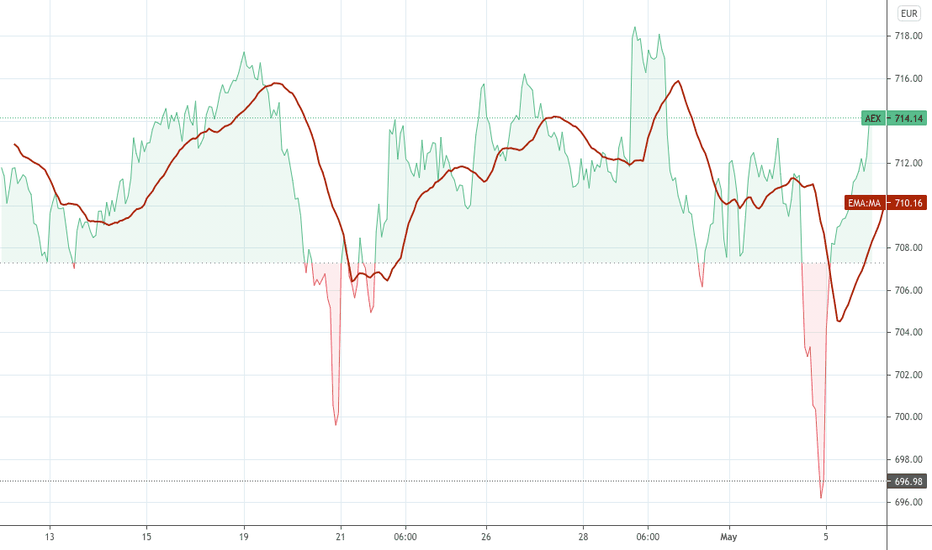

Amsterdam's AEX Index: Significant 4%+ Drop

Table of Contents

Potential Causes of the AEX Index's Significant Drop

Several interconnected factors likely contributed to the substantial drop in the Amsterdam AEX Index. Understanding these contributing elements is crucial for navigating the current market volatility.

Global Factors Influencing the Drop:

- Global Economic Slowdown: Concerns about a looming global recession, fueled by persistent inflation and rising interest rates, significantly impacted investor sentiment. This uncertainty led to a sell-off across global markets, including the AEX. [Link to relevant news article on global economic slowdown]

- Inflationary Pressures: High inflation rates in many countries continue to erode purchasing power and impact corporate profitability. This uncertainty translates into reduced investor confidence and market volatility. [Link to inflation data source]

- Geopolitical Instability: Ongoing geopolitical tensions, particularly the war in Ukraine and its ripple effects on energy prices and global supply chains, further exacerbated market anxieties. [Link to relevant news article on geopolitical instability]

Specific Sector Performance within the AEX:

The decline wasn't uniform across all sectors. Some sectors were hit harder than others:

- Energy Sector: Fluctuations in global energy prices significantly impacted energy companies listed on the AEX. [Mention specific companies and their percentage drops, if available. Consider a chart visualizing sector performance.]

- Technology Sector: The tech sector, already facing headwinds from rising interest rates and reduced consumer spending, experienced a considerable downturn. [Mention specific companies and their percentage drops, if available.]

- Financials Sector: Concerns about rising interest rates and potential loan defaults affected the performance of financial institutions within the AEX. [Mention specific companies and their percentage drops, if available.]

Internal Dutch Economic Factors:

Beyond global events, domestic issues also played a role:

- Energy Crisis Impact: The ongoing energy crisis in Europe significantly impacted Dutch businesses and consumer confidence, leading to reduced economic activity. [Include data on energy prices and their impact on Dutch businesses.]

- Government Policies: Uncertainty surrounding government policies and potential regulatory changes can influence investor sentiment and market stability. [Mention specific policies and their potential impact.]

- Changes in Consumer Spending: Reduced consumer confidence, due to high inflation and economic uncertainty, impacted consumer spending, affecting businesses' bottom lines. [Include data on consumer confidence indices and spending patterns.]

Impact on Dutch Investors and the Economy

The AEX Index's sharp decline has significant implications for both individual investors and the Dutch economy as a whole.

Consequences for Individual Investors:

- Portfolio Losses: Many Dutch investors experienced substantial portfolio losses due to the market downturn. [Mention potential average percentage losses, if available. Be cautious and avoid giving financial advice.]

- Investor Sentiment: The sharp drop negatively impacted investor sentiment, leading to increased market uncertainty and caution.

- Increased Market Uncertainty: The volatility of the AEX Index has created uncertainty for investors, making investment decisions more challenging.

Broader Economic Implications:

- Impact on Business Investment: The decline can discourage business investment and hinder economic growth. [Include data on business investment trends, if available.]

- Consumer Confidence: Reduced consumer confidence can further dampen economic activity and slow down recovery. [Include data on consumer confidence indices.]

- Potential Job Losses: A prolonged economic slowdown could lead to job losses in various sectors. [Include data on unemployment rates, if available.]

Potential Government Responses:

The Dutch government might implement various measures to mitigate the negative consequences of the market decline:

- Fiscal Stimulus Measures: The government might consider fiscal stimulus measures to boost economic activity.

- Monetary Policy Adjustments: The central bank might adjust monetary policy to support economic growth and stabilize the market.

Short-Term and Long-Term Outlook for the AEX Index

The short-term outlook for the AEX Index remains cautious, given the prevailing global and domestic economic uncertainties. However, several factors could contribute to a long-term recovery:

- Resolution of Geopolitical Tensions: Easing of geopolitical tensions could positively impact investor sentiment and market stability.

- Inflation Control: Effective control of inflation could restore consumer and business confidence.

- Government Support Measures: Successful government interventions can support economic growth and market recovery.

Potential catalysts for growth in the Dutch economy include continued innovation in key sectors, such as technology and sustainable energy, as well as increased government investment in infrastructure and human capital.

Conclusion: Navigating the AEX Index Volatility

The 4%+ drop in the Amsterdam AEX Index highlights the interconnectedness of global and domestic economic factors. Understanding these influences is crucial for navigating the volatility of the AEX and making informed investment decisions. The impact extends beyond individual investors, affecting business investment, consumer confidence, and potentially leading to job losses. Staying informed about market trends, diversifying investment portfolios, and seeking professional financial advice are key strategies for mitigating risk. Consult with a financial advisor for personalized guidance on navigating the AEX Index and the broader Dutch stock market. Understanding the complexities of the Amsterdam AEX Index and its potential future movements is key to successful investment strategies.

Featured Posts

-

Sejarah Dan Perkembangan Porsche 356 Di Zuffenhausen

May 25, 2025

Sejarah Dan Perkembangan Porsche 356 Di Zuffenhausen

May 25, 2025 -

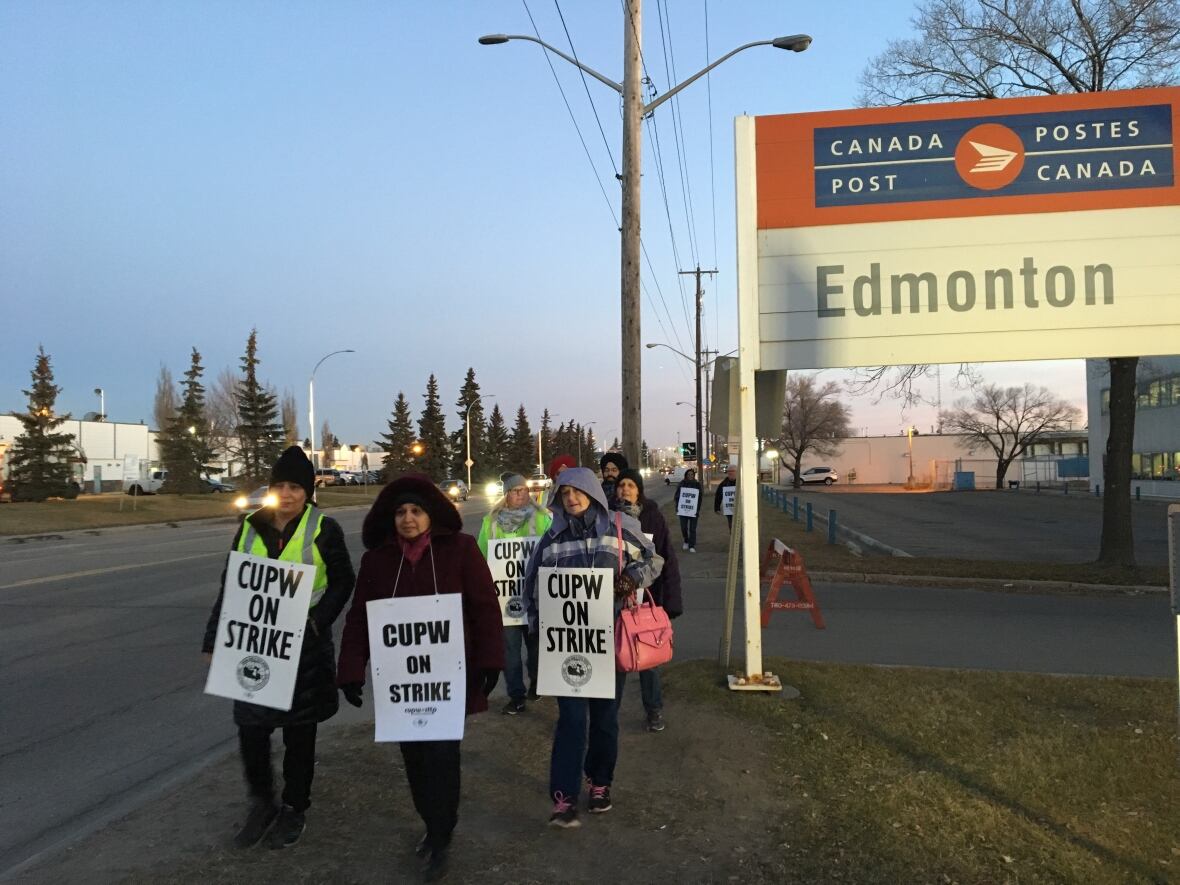

Will A Canada Post Strike Result In Lost Customers

May 25, 2025

Will A Canada Post Strike Result In Lost Customers

May 25, 2025 -

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 25, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 25, 2025 -

Sabalenka And Gauff Both Progress To Italian Open Third Round

May 25, 2025

Sabalenka And Gauff Both Progress To Italian Open Third Round

May 25, 2025 -

Michael Schumacher And His Rivals A Look At The Tensions In F1

May 25, 2025

Michael Schumacher And His Rivals A Look At The Tensions In F1

May 25, 2025