Amundi Dow Jones Industrial Average UCITS ETF: NAV Calculation And Implications

Table of Contents

Understanding the Amundi Dow Jones Industrial Average UCITS ETF

The Amundi Dow Jones Industrial Average UCITS ETF offers investors a cost-effective way to gain diversified exposure to the 30 largest and most influential companies in the United States, as represented by the prestigious Dow Jones Industrial Average (DJIA) index. Its structure as a UCITS (Undertakings for Collective Investment in Transferable Securities) ETF provides several key benefits:

- Tracks the Dow Jones Industrial Average (DJIA) index: This ensures close tracking of the performance of these blue-chip companies.

- Offers exposure to 30 leading US blue-chip companies: Provides broad diversification within the US equity market, mitigating risk associated with investing in individual stocks.

- UCITS compliant: Allows for seamless cross-border investment, making it accessible to a global investor base.

- Low expense ratio: Compared to actively managed funds, ETFs like this one generally have significantly lower fees, enhancing returns.

NAV Calculation Methodology

The Amundi Dow Jones Industrial Average UCITS ETF NAV is calculated daily, reflecting the net asset value of the fund per share. This calculation involves a straightforward process:

- Daily calculation based on closing prices of underlying assets: The market value of each holding in the ETF's portfolio is determined using the closing prices of those assets on the relevant exchange.

- Sum of market values of all holdings less liabilities: The total market value of all holdings is calculated, and any fund liabilities (expenses, etc.) are subtracted.

- Divided by the total number of outstanding shares: This results in the NAV per share, representing the theoretical value of one share of the ETF.

- Published daily: The calculated NAV is typically published daily on the Amundi website and disseminated through major financial data providers like Bloomberg and Refinitiv. This transparency allows investors to monitor their investment's performance closely.

Factors Influencing Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors contribute to the daily fluctuations in the Amundi Dow Jones Industrial Average UCITS ETF NAV. Understanding these is key to interpreting NAV changes:

- Performance of the Dow Jones Industrial Average: The ETF's NAV is highly correlated with the performance of the DJIA. A rise in the DJIA generally leads to a rise in the ETF's NAV, and vice-versa.

- Currency exchange rate fluctuations (if applicable): For investors holding the ETF in a currency different from the base currency of the fund (typically USD), currency fluctuations can impact the NAV expressed in their local currency.

- Dividend distributions from underlying companies: When underlying companies pay dividends, the ETF receives these payments, which can positively impact the NAV (though this is usually immediately reflected in the price and then the next day's NAV calculation).

- Market sentiment and investor behavior: Broader market trends and investor sentiment toward US equities significantly influence the DJIA and, consequently, the ETF's NAV.

- Changes in the composition of the DJIA: While infrequent, changes to the DJIA's constituent companies will affect the ETF's holdings and, therefore, its NAV.

Impact of Dividend Reinvestment on NAV

Dividend reinvestment is a common feature of many ETFs, including this one. Understanding its impact on the NAV is crucial:

- Dividends typically reinvested to purchase additional shares: Instead of receiving cash dividends, investors typically see their dividends reinvested automatically, increasing the number of shares they own.

- Impacts NAV per share, although overall value increases: While the NAV per share might slightly decrease due to the increased number of shares, the overall value of the investment increases due to the acquisition of additional shares.

- Beneficial for long-term growth and compounding returns: Dividend reinvestment contributes significantly to long-term capital appreciation through the power of compounding.

Interpreting NAV and Investment Implications

The Amundi Dow Jones Industrial Average UCITS ETF NAV is a critical metric for making informed investment decisions:

- Track performance relative to the DJIA: Compare the ETF's NAV performance to the DJIA's performance to assess how effectively the ETF tracks the index.

- Evaluate investment returns: Monitor changes in the NAV over time to calculate your investment's return.

- Compare to other similar ETFs: Benchmark the ETF's performance against other Dow Jones Industrial Average tracking ETFs to evaluate its cost-effectiveness and efficiency.

- Identify potential buying or selling opportunities (though arbitrage is typically limited in well-functioning markets): While significant deviations between the ETF's share price and NAV are rare, monitoring the difference can offer insights into potential trading opportunities.

Conclusion

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV calculation is crucial for informed investment decisions. By analyzing the factors that influence the NAV and its daily fluctuations, investors can better assess the ETF's performance and manage their exposure to the leading US companies. Regularly monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV, alongside the DJIA itself, allows investors to make well-informed choices aligned with their investment goals. Start monitoring your Amundi Dow Jones Industrial Average UCITS ETF NAV today for a clearer understanding of your investment's performance.

Featured Posts

-

Seattle Green Space A Womans Sanctuary During The Early Pandemic

May 24, 2025

Seattle Green Space A Womans Sanctuary During The Early Pandemic

May 24, 2025 -

Get Your Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Guide

May 24, 2025

Get Your Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Guide

May 24, 2025 -

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Entertainment

May 24, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Entertainment

May 24, 2025 -

Aex Stijgt Na Uitstel Trump Positief Herstel Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Uitstel Trump Positief Herstel Voor Alle Fondsen

May 24, 2025 -

Glastonbury Festival 2025 Full Lineup Announcement Featuring Olivia Rodrigo And The 1975

May 24, 2025

Glastonbury Festival 2025 Full Lineup Announcement Featuring Olivia Rodrigo And The 1975

May 24, 2025

Latest Posts

-

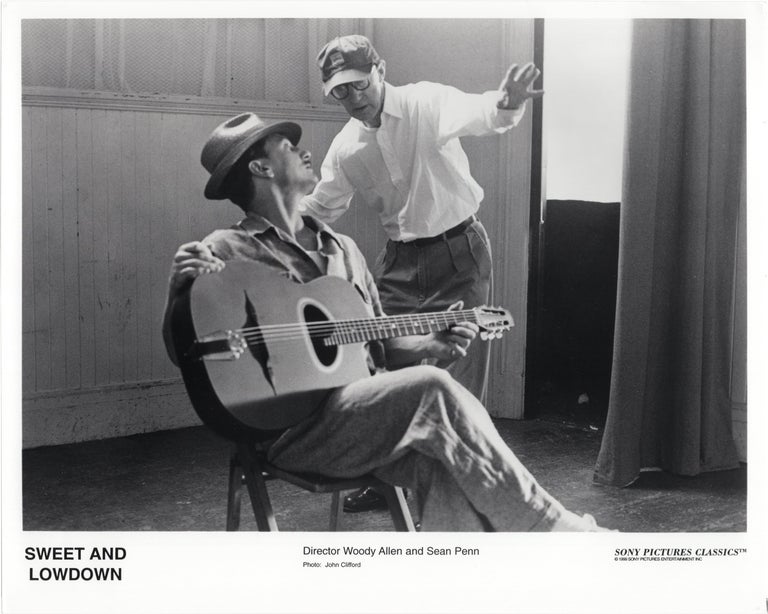

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Perspective On The Allegations

May 24, 2025

The Woody Allen Dylan Farrow Case Sean Penns Perspective On The Allegations

May 24, 2025 -

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025 -

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025 -

Actor Sean Penn Expresses Doubts About Dylan Farrows Account

May 24, 2025

Actor Sean Penn Expresses Doubts About Dylan Farrows Account

May 24, 2025