Amundi MSCI All Country World UCITS ETF USD Acc: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI All Country World UCITS ETF USD Acc, this means calculating the total value of all the global stocks it holds, subtracting any debts or expenses, and then dividing that figure by the total number of ETF shares currently in circulation. This provides a per-share valuation of the ETF.

The calculation is straightforward:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV per Share

Let's illustrate with a simple example:

- Total Assets: $100 million

- Total Liabilities: $1 million

- Number of Outstanding Shares: 10 million

NAV per Share: ($100 million - $1 million) / 10 million = $9.90

Understanding this Net Asset Value Calculation is fundamental to assessing the ETF Valuation and your investment's true worth. Key elements in this calculation include accurate Asset Valuation, proper accounting for Liability, and a precise count of Outstanding Shares.

Factors Affecting the Net Asset Value (NAV) of Amundi MSCI All Country World UCITS ETF USD Acc

Several factors influence the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc. Understanding these elements is vital for interpreting NAV changes and predicting potential movements.

Market Fluctuations

The primary driver of NAV changes is market volatility. The value of the underlying assets—global stocks in this case—constantly fluctuates due to various factors.

- Stock Price Changes: Individual stock price movements directly impact the overall portfolio value and therefore the NAV. A strong market typically leads to NAV increases, while a bear market results in decreases.

- Currency Fluctuations: As the ETF holds assets in various currencies, exchange rate changes can significantly affect the NAV when translated back to USD.

- Interest Rate Movements: Interest rate changes impact the value of bonds and other fixed-income securities held within the ETF, consequently influencing the overall NAV.

Expenses and Fees

The Amundi MSCI All Country World UCITS ETF USD Acc, like all ETFs, incurs expenses. These ETF Costs, including the expense ratio and management fees, are deducted from the portfolio's value and thus directly affect the NAV. These Investment Expenses reduce the investor's overall return.

Dividend Distributions

Dividend Yield from the underlying holdings impacts the NAV. When the ETF distributes dividends, the NAV decreases on the ex-dividend date because the assets held within the fund have reduced in value by the amount distributed. However, reinvesting dividends can mitigate this reduction in NAV over the long term. Understanding the Dividend Reinvestment policy is crucial.

Using NAV to Make Informed Investment Decisions with Amundi MSCI All Country World UCITS ETF USD Acc

Monitoring and interpreting NAV is crucial for successful investment management.

Monitoring NAV Changes

Tracking NAV Performance over time allows you to assess the ETF's performance. Using charts and graphs to visualize NAV Performance trends helps identify long-term growth and potential short-term fluctuations. This Investment Monitoring is essential for evaluating your portfolio's progress.

Comparing NAV to ETF Price

The ETF's market price might sometimes deviate slightly from its NAV, creating a premium to NAV or a discount to NAV. These discrepancies present potential arbitrage opportunities for sophisticated investors.

NAV and Buy/Sell Decisions

While NAV is a valuable indicator, it shouldn't be the sole factor influencing your buy signals or sell signals. Other considerations include:

- Your overall investment strategy and risk tolerance.

- Market outlook and predictions.

- Your personal financial goals.

Using NAV in conjunction with these factors helps you implement an effective Investment Strategy and optimize your Investment Timing.

Conclusion: Mastering Net Asset Value for Successful Investing with the Amundi MSCI All Country World UCITS ETF USD Acc

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for making informed investment decisions. By understanding its calculation, the factors influencing it, and how to interpret its relationship with the market price, investors can better assess performance, manage risk, and make timely buy and sell decisions. Regularly monitoring the NAV of your holdings is a key component of successful long-term investing with this ETF. Learn more about the Amundi MSCI All Country World UCITS ETF USD Acc and its NAV to optimize your investment strategy!

Featured Posts

-

Porsche 956 Muezede Tavan Sergisi Neden

May 24, 2025

Porsche 956 Muezede Tavan Sergisi Neden

May 24, 2025 -

Memorial Day 2025 Flights When To Fly And When To Avoid Crowds

May 24, 2025

Memorial Day 2025 Flights When To Fly And When To Avoid Crowds

May 24, 2025 -

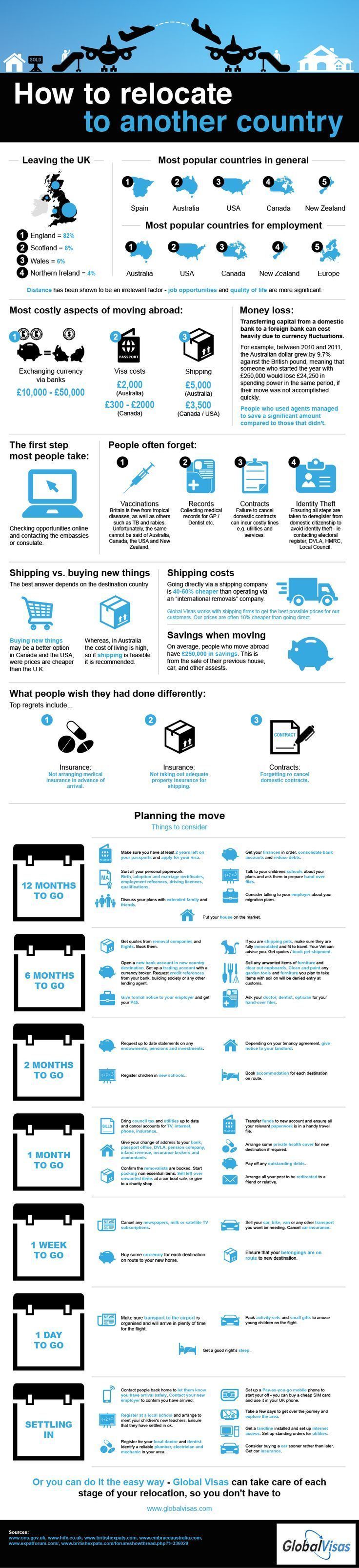

A Successful Escape To The Country Tips And Advice For Relocating

May 24, 2025

A Successful Escape To The Country Tips And Advice For Relocating

May 24, 2025 -

The Best Gear For Maintaining And Enjoying Your Ferrari

May 24, 2025

The Best Gear For Maintaining And Enjoying Your Ferrari

May 24, 2025 -

Joy Crookes New Track I Know You D Kill A Deeper Dive

May 24, 2025

Joy Crookes New Track I Know You D Kill A Deeper Dive

May 24, 2025

Latest Posts

-

Annie Kilner Seen Without Wedding Ring After Kyle Walkers Night Out

May 24, 2025

Annie Kilner Seen Without Wedding Ring After Kyle Walkers Night Out

May 24, 2025 -

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025 -

Kyle Walkers Night Out Annie Kilner Spotted Running Errands

May 24, 2025

Kyle Walkers Night Out Annie Kilner Spotted Running Errands

May 24, 2025 -

Leeds United And Kyle Walker Peters Transfer Update

May 24, 2025

Leeds United And Kyle Walker Peters Transfer Update

May 24, 2025 -

Latest On Kyle Walker Peters Potential Transfer To Leeds

May 24, 2025

Latest On Kyle Walker Peters Potential Transfer To Leeds

May 24, 2025