Amundi MSCI World II UCITS ETF Dist: A Guide To Net Asset Value (NAV)

Table of Contents

What is the NAV of the Amundi MSCI World II UCITS ETF Dist and How is it Calculated?

The Net Asset Value (NAV) represents the value of a single share in the Amundi MSCI World II UCITS ETF Dist. It's calculated daily by subtracting the fund's liabilities from its assets. Let's break this down:

-

Assets: This represents the total market value of all the securities held within the ETF's portfolio. For the Amundi MSCI World II UCITS ETF Dist, this includes a diverse range of global equities mirroring the MSCI World Index. The value fluctuates constantly based on the market performance of these individual holdings.

-

Liabilities: These are the fund's outstanding obligations, such as administrative expenses, management fees, and any payable dividends not yet distributed.

Therefore, the basic formula is: Assets (market value of holdings) – Liabilities = NAV.

-

Impact of Currency Fluctuations: Since the Amundi MSCI World II UCITS ETF Dist invests globally, currency exchange rates significantly impact its NAV. A strengthening Euro against other currencies will generally increase the NAV (assuming the underlying assets remain constant), while a weakening Euro will have the opposite effect.

-

NAV vs. Market Price: While the NAV represents the intrinsic value of the ETF's holdings, the market price is the actual price at which you can buy or sell shares on the exchange. These prices might differ due to supply and demand fluctuations in the market. The difference, however small, is generally insignificant in the long term.

-

Bullet Points:

- Definition of assets: The market value of all stocks, bonds, and other securities owned by the Amundi MSCI World II UCITS ETF Dist.

- Types of liabilities: Management fees, administrative expenses, outstanding dividend payments.

- Role of the fund manager: The fund manager is responsible for overseeing the portfolio and ensuring the accurate calculation of the NAV.

- Frequency of NAV calculation: The NAV is usually calculated daily, reflecting the closing market prices of the underlying assets.

Factors Affecting the Amundi MSCI World II UCITS ETF Dist's NAV

Several factors influence the NAV of the Amundi MSCI World II UCITS ETF Dist:

-

Market Performance of Underlying Assets: The primary driver of NAV changes is the performance of the underlying assets tracking the MSCI World Index. Positive market movements generally lead to NAV increases, while negative movements result in decreases.

-

Impact of Dividends and Distributions: When the ETF distributes dividends, the NAV is reduced by the amount distributed. However, reinvesting these dividends can contribute to long-term NAV growth.

-

Influence of Currency Exchange Rates: Fluctuations in exchange rates between the Euro (or the investor's currency) and other currencies represented in the portfolio directly affect the NAV.

-

Bullet Points:

- Specific examples: A 10% increase in the MSCI World Index will likely result in a similar increase in the ETF's NAV (excluding fees and other factors).

- Impact of dividend reinvestment: Reinvesting dividends effectively buys more shares, potentially increasing your overall stake and future NAV growth.

- Interpreting currency changes: A weakening Euro against the US dollar could decrease the NAV, even if the underlying US-based assets performed well.

How to Use NAV Information for Investment Decisions in Amundi MSCI World II UCITS ETF Dist

Understanding the NAV is vital for informed investment choices:

-

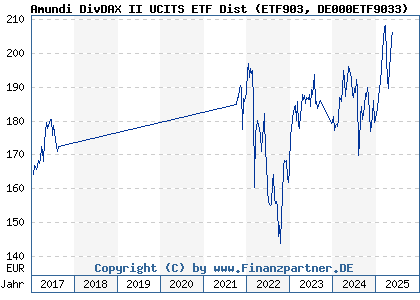

Assessing Investment Performance: Tracking NAV changes over time helps assess the performance of your investment in the Amundi MSCI World II UCITS ETF Dist. You can calculate your returns by comparing the initial NAV to the current NAV.

-

Comparing with Other Options: The NAV facilitates comparisons with other investment options, enabling you to evaluate the relative performance and suitability of the Amundi MSCI World II UCITS ETF Dist for your portfolio.

-

Buy/Sell Decisions and Portfolio Rebalancing: While the market price is used for transactions, monitoring the NAV provides insights into the underlying value of your investment and can inform rebalancing decisions within your broader portfolio.

-

Bullet Points:

- Calculating returns: [(Current NAV – Initial NAV) / Initial NAV] * 100% = Percentage Return

- Comparing to benchmarks: Compare the NAV performance of the Amundi MSCI World II UCITS ETF Dist against the MSCI World Index to gauge its tracking efficiency.

- Long-term growth monitoring: Consistent NAV increases over the long term indicate a healthy investment.

Where to Find the Amundi MSCI World II UCITS ETF Dist's NAV

Reliable sources for accessing real-time and historical NAV data include:

-

Amundi Website: The official Amundi website usually provides up-to-date NAV information for all its ETFs.

-

Financial News Sources: Many reputable financial news websites and data providers (like Bloomberg or Yahoo Finance) offer real-time and historical NAV data for various ETFs.

-

Brokerage Platforms: Your brokerage account will also display the current NAV and usually provide historical data for your holdings.

-

Bullet Points:

- Links to relevant websites: [Insert links to relevant Amundi pages and financial data providers here].

- Interpreting data: Pay close attention to the currency used for the NAV and the date/time of the data.

- Setting up alerts: Most brokerage platforms and financial websites allow you to set up price alerts, including NAV updates.

Conclusion: Mastering the Amundi MSCI World II UCITS ETF Dist NAV

Understanding the Net Asset Value is fundamental to successful investing in the Amundi MSCI World II UCITS ETF Dist. By actively monitoring the NAV and understanding the factors influencing it, you can make more informed investment decisions, assess your portfolio's performance, and effectively track the long-term growth of your global equity exposure. Regularly review your Amundi MSCI World II UCITS ETF Dist's NAV and consider exploring additional resources to deepen your knowledge of ETFs and global investment strategies. Mastering the Amundi MSCI World II UCITS ETF Dist NAV is key to maximizing your investment potential.

Featured Posts

-

Is Kyle Walker Peters Joining West Ham Latest Transfer News

May 24, 2025

Is Kyle Walker Peters Joining West Ham Latest Transfer News

May 24, 2025 -

German Stock Market Update Dax Under 24 000

May 24, 2025

German Stock Market Update Dax Under 24 000

May 24, 2025 -

Net Asset Value Nav For Amundi Msci World Ii Ucits Etf Usd Hedged Dist What Investors Need To Know

May 24, 2025

Net Asset Value Nav For Amundi Msci World Ii Ucits Etf Usd Hedged Dist What Investors Need To Know

May 24, 2025 -

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Escape To The Country The Costs And Benefits Of Rural Living

May 24, 2025

Escape To The Country The Costs And Benefits Of Rural Living

May 24, 2025

Latest Posts

-

Leeds Interest In Kyle Walker Peters A Closer Look

May 24, 2025

Leeds Interest In Kyle Walker Peters A Closer Look

May 24, 2025 -

Is Kyle Walker Peters Heading To Leeds Transfer Rumours

May 24, 2025

Is Kyle Walker Peters Heading To Leeds Transfer Rumours

May 24, 2025 -

Walker Peters Transfer Speculation Leeds In The Frame

May 24, 2025

Walker Peters Transfer Speculation Leeds In The Frame

May 24, 2025 -

Leeds United Target Kyle Walker Peters Transfer News

May 24, 2025

Leeds United Target Kyle Walker Peters Transfer News

May 24, 2025 -

Kyle Walker Peters To Leeds Transfer Links Intensify

May 24, 2025

Kyle Walker Peters To Leeds Transfer Links Intensify

May 24, 2025