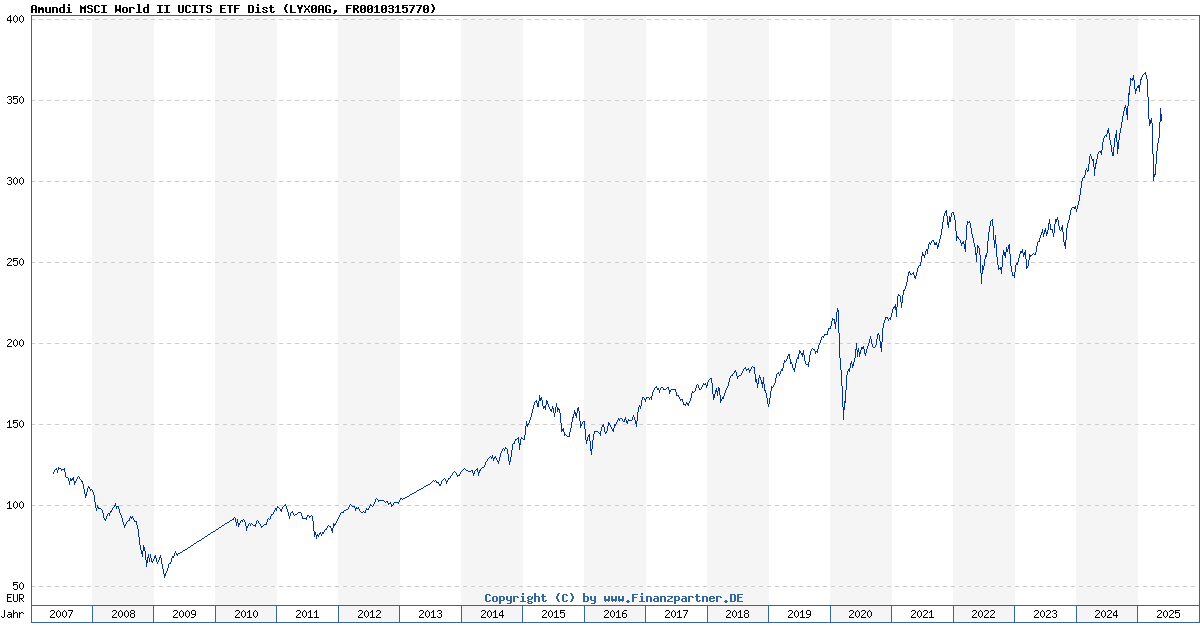

Amundi MSCI World II UCITS ETF Dist: NAV Explained Simply

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the per-share value of an exchange-traded fund (ETF)'s underlying assets. Think of it like this: if you were to liquidate all the stocks, bonds, or other assets held within the Amundi MSCI World II UCITS ETF Dist today, and then divide the total value by the number of outstanding shares, the result would be the NAV. This figure reflects the intrinsic value of your investment.

- NAV is calculated daily: This ensures your investment's value is updated regularly to reflect market changes.

- It reflects the market value of all holdings: The NAV calculation considers the current market price of each asset within the ETF.

- NAV fluctuates based on market performance: If the underlying assets perform well, the NAV rises; if they decline, the NAV falls.

- Understanding NAV helps investors track performance: It provides a clear picture of your investment's growth or loss over time.

How is the NAV of the Amundi MSCI World II UCITS ETF Dist Calculated?

The NAV of the Amundi MSCI World II UCITS ETF Dist is calculated daily, reflecting the value of its underlying assets, which mirror the MSCI World Index. This index tracks the performance of large and mid-cap equities across developed markets globally, giving investors broad diversification.

- The ETF tracks the MSCI World Index: The ETF aims to replicate the index's performance, making it a passively managed investment.

- Daily closing prices are used: The calculation uses the closing market prices of all the companies in the MSCI World Index.

- Dividends received are included (Distributing ETF): As this is a distributing ETF, the dividends received from the underlying companies are added to the total value before calculating the NAV per share. This is a key difference from accumulating ETFs.

- Expenses are deducted: The ETF's operating expenses are deducted from the total asset value before the NAV per share is calculated. This ensures the NAV reflects the net value available to investors.

Why is Understanding NAV Important for Amundi MSCI World II UCITS ETF Dist Investors?

Understanding the NAV of your Amundi MSCI World II UCITS ETF Dist investment is crucial for several reasons:

- Track your investment's growth or decline: Regularly monitoring the NAV allows you to see how your investment is performing over time.

- Compare performance against benchmarks: You can compare the NAV against the MSCI World Index itself to gauge the ETF's tracking efficiency.

- Make informed buy/sell decisions: While not the sole factor, NAV movements can help inform your investment decisions, especially when considered alongside other market indicators.

- Understand the impact of market fluctuations: NAV changes directly reflect the impact of market fluctuations on your investment, providing valuable insights into its risk profile.

NAV vs. Market Price of the Amundi MSCI World II UCITS ETF Dist

While the NAV represents the intrinsic value of the ETF, the market price is the price at which the ETF is actually trading on the exchange. These two figures can differ slightly.

- Market price can differ from NAV due to supply and demand: Like any traded asset, the market price fluctuates based on buying and selling pressure.

- A large discrepancy may signal opportunities: A significant difference between NAV and market price might indicate potential buying or selling opportunities, though careful analysis is needed.

- Understanding the difference is crucial for trading decisions: Investors should be aware of this difference when making active trading decisions related to the Amundi MSCI World II UCITS ETF Dist. The bid-ask spread also contributes to this difference.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist is fundamental for any investor. NAV provides a clear picture of your investment's underlying value, allowing you to monitor performance, compare it to benchmarks, and make informed decisions. Remember that the NAV differs slightly from the market price due to supply and demand. Ready to confidently monitor your investment in the Amundi MSCI World II UCITS ETF Dist? Learn more about understanding its NAV and make informed investment decisions today!

Featured Posts

-

Top 10 British Pop Films A Must Watch List

May 25, 2025

Top 10 British Pop Films A Must Watch List

May 25, 2025 -

H Nonline Sk Nemecke Firmy A Masivne Prepustanie Dosledky Hospodarskej Recesie

May 25, 2025

H Nonline Sk Nemecke Firmy A Masivne Prepustanie Dosledky Hospodarskej Recesie

May 25, 2025 -

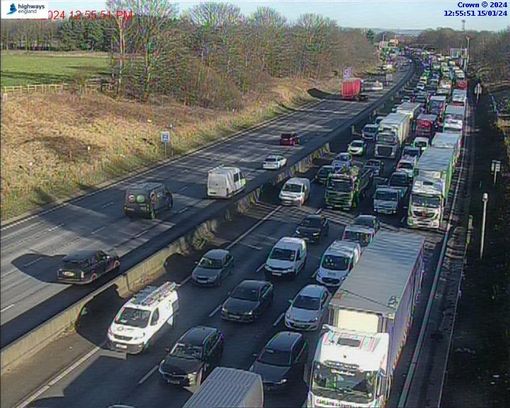

Traffic Alert M62 Westbound Resurfacing Works Manchester To Warrington

May 25, 2025

Traffic Alert M62 Westbound Resurfacing Works Manchester To Warrington

May 25, 2025 -

West Hams Kyle Walker Peters Bid Transfer News And Analysis

May 25, 2025

West Hams Kyle Walker Peters Bid Transfer News And Analysis

May 25, 2025 -

Amsterdam Stock Exchange Opens Down 7 On Intensifying Trade War Concerns

May 25, 2025

Amsterdam Stock Exchange Opens Down 7 On Intensifying Trade War Concerns

May 25, 2025