Analysis: Bank Of Canada And The Potential April Interest Rate Reduction Following Trump Tariffs

Table of Contents

The Lingering Impact of Trump Tariffs on the Canadian Economy

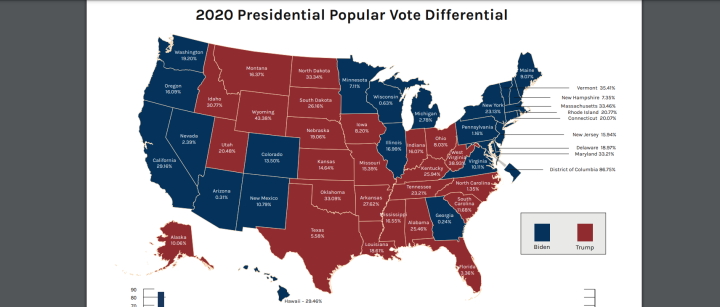

Trump's tariffs, implemented between 2018 and 2020, targeted several key Canadian industries, most notably lumber and agriculture. These trade barriers led to significant disruptions, impacting businesses and consumers alike. The resulting economic slowdown wasn't immediate but manifested gradually, affecting various economic indicators. For example, Canadian GDP growth experienced a noticeable deceleration during this period, with exports to the US – a vital market for Canada – significantly declining.

- Decreased exports to the US: Tariffs increased the cost of Canadian goods in the US market, reducing demand and impacting export volumes across multiple sectors.

- Increased input costs for businesses: Canadian businesses reliant on US-sourced materials faced higher costs, squeezing profit margins and potentially impacting investment decisions.

- Reduced consumer confidence: Uncertainty surrounding trade relations and the potential for further tariff increases dampened consumer spending, a crucial driver of economic growth.

- Impact on specific sectors: The automotive and manufacturing sectors, heavily integrated with the US economy, were particularly vulnerable, experiencing job losses and reduced production.

- Relevant economic indicators: A decline in the Canadian dollar's value against the US dollar, coupled with reduced business investment, further underscored the negative economic consequences.

Inflation and the Bank of Canada's Mandate

The Bank of Canada's primary mandate is to maintain price stability and promote full employment. Currently, inflation rates in Canada are [insert current inflation data and source], although the trajectory is [insert analysis of inflation trends and source]. The lingering impact of Trump's tariffs might be contributing to disinflationary or even deflationary pressures. Higher input costs, reduced demand, and a weakened Canadian dollar all contribute to a complex inflationary landscape.

- Current inflation rate data: [Insert specific data points and source – e.g., Statistics Canada].

- Analysis of inflation expectations: [Discuss what economists and analysts predict for future inflation].

- Discussion of potential deflationary risks: [Explain the scenarios where deflation might become a concern].

- How the Bank of Canada typically responds to inflation pressures: [Explain the Bank's typical monetary policy tools, such as interest rate adjustments].

Employment and Economic Growth: Key Indicators for a Rate Cut

The Canadian employment picture is currently showing [insert current unemployment rate and source], with job creation numbers at [insert data and source]. The relationship between economic growth and employment is inextricably linked; slower growth typically translates to lower job creation. The lingering impact of the tariffs continues to hinder economic growth and hence job creation.

- Current unemployment rate: [Insert specific data and source].

- Job creation numbers: [Insert specific data and source].

- GDP growth projections: [Insert projections and source, highlighting any downward revisions attributed to tariff impacts].

- Analysis of consumer spending and business investment: [Discuss how these key economic drivers are currently performing].

Global Economic Conditions and Their Influence

The global economic climate significantly influences the Bank of Canada's monetary policy decisions. Currently, [insert overview of the current global economic conditions and outlook – e.g., global recessionary fears, geopolitical instability]. The interconnectedness of the Canadian and US economies means that developments in the US, including its interest rate policies, heavily impact Canada.

- Overview of global economic outlook: [Provide a concise summary of the global economic situation].

- Impact of US monetary policy: [Explain how US interest rate decisions can affect the Canadian economy].

- Influence of other global events on the Canadian economy: [Discuss other factors, such as geopolitical tensions or commodity price fluctuations].

- Potential spillover effects from other regions: [Analyze any potential risks originating from other parts of the world].

Market Expectations and Analyst Predictions Regarding a Bank of Canada Rate Reduction

Market analysts and economists offer differing perspectives on the likelihood of a Bank of Canada interest rate reduction in April. [Insert quotes from relevant experts and their predictions]. The range of predicted interest rate changes varies, with some suggesting [insert range of predictions]. Market reactions to previous Bank of Canada announcements provide clues about the potential response to a rate cut.

- Summary of analyst predictions: [Summarize the different views and their rationale].

- Range of expected rate changes: [Quantify the range of potential interest rate adjustments].

- Market reaction to previous Bank of Canada announcements: [Discuss the market's historical response to interest rate changes].

Conclusion: Assessing the Likelihood of a Bank of Canada Interest Rate Reduction

Considering the lingering effects of Trump's tariffs, subdued inflation, modest economic growth, and the uncertain global outlook, the arguments for a Bank of Canada interest rate reduction in April are [summarize the key arguments for a rate cut]. However, factors such as [summarize the counterarguments against a rate cut] may temper the central bank's inclination to cut rates.

Ultimately, the decision will depend on the Bank of Canada's assessment of the overall economic situation. While a rate cut isn't certain, the lingering economic consequences of the tariffs increase the probability. To stay informed about future Bank of Canada interest rate decisions and the Canadian interest rate outlook, regularly consult the Bank of Canada website [insert link].

Featured Posts

-

Van Mesdagkliniek Groningen Onderzoek Naar Steekincident Met Patient

May 02, 2025

Van Mesdagkliniek Groningen Onderzoek Naar Steekincident Met Patient

May 02, 2025 -

When Will Trust Care Health Offer Mental Health Treatment A Comprehensive Overview

May 02, 2025

When Will Trust Care Health Offer Mental Health Treatment A Comprehensive Overview

May 02, 2025 -

Indias Rail Network Expands To Kashmir First Train Inauguration Details

May 02, 2025

Indias Rail Network Expands To Kashmir First Train Inauguration Details

May 02, 2025 -

Ukraine And The United States Strengthen Economic Ties With Rare Earth Mineral Agreement

May 02, 2025

Ukraine And The United States Strengthen Economic Ties With Rare Earth Mineral Agreement

May 02, 2025 -

The 2024 Elections Key Insights From Florida And Wisconsin Voter Turnout Data

May 02, 2025

The 2024 Elections Key Insights From Florida And Wisconsin Voter Turnout Data

May 02, 2025

Latest Posts

-

Ukrainskie Bezhentsy I S Sh A Prognozy Dlya Germanii

May 10, 2025

Ukrainskie Bezhentsy I S Sh A Prognozy Dlya Germanii

May 10, 2025 -

India Pakistan Tensions Cast Shadow On Imfs 1 3 Billion Loan To Pakistan

May 10, 2025

India Pakistan Tensions Cast Shadow On Imfs 1 3 Billion Loan To Pakistan

May 10, 2025 -

Pakistan Economic Crisis Imfs 1 3 Billion Package Under Review

May 10, 2025

Pakistan Economic Crisis Imfs 1 3 Billion Package Under Review

May 10, 2025 -

Izolyatsiya Zelenskogo Otsutstvie Gostey Na 9 Maya

May 10, 2025

Izolyatsiya Zelenskogo Otsutstvie Gostey Na 9 Maya

May 10, 2025 -

S Sh A I Noviy Potok Bezhentsev Iz Ukrainy Vzglyad Iz Germanii

May 10, 2025

S Sh A I Noviy Potok Bezhentsev Iz Ukrainy Vzglyad Iz Germanii

May 10, 2025