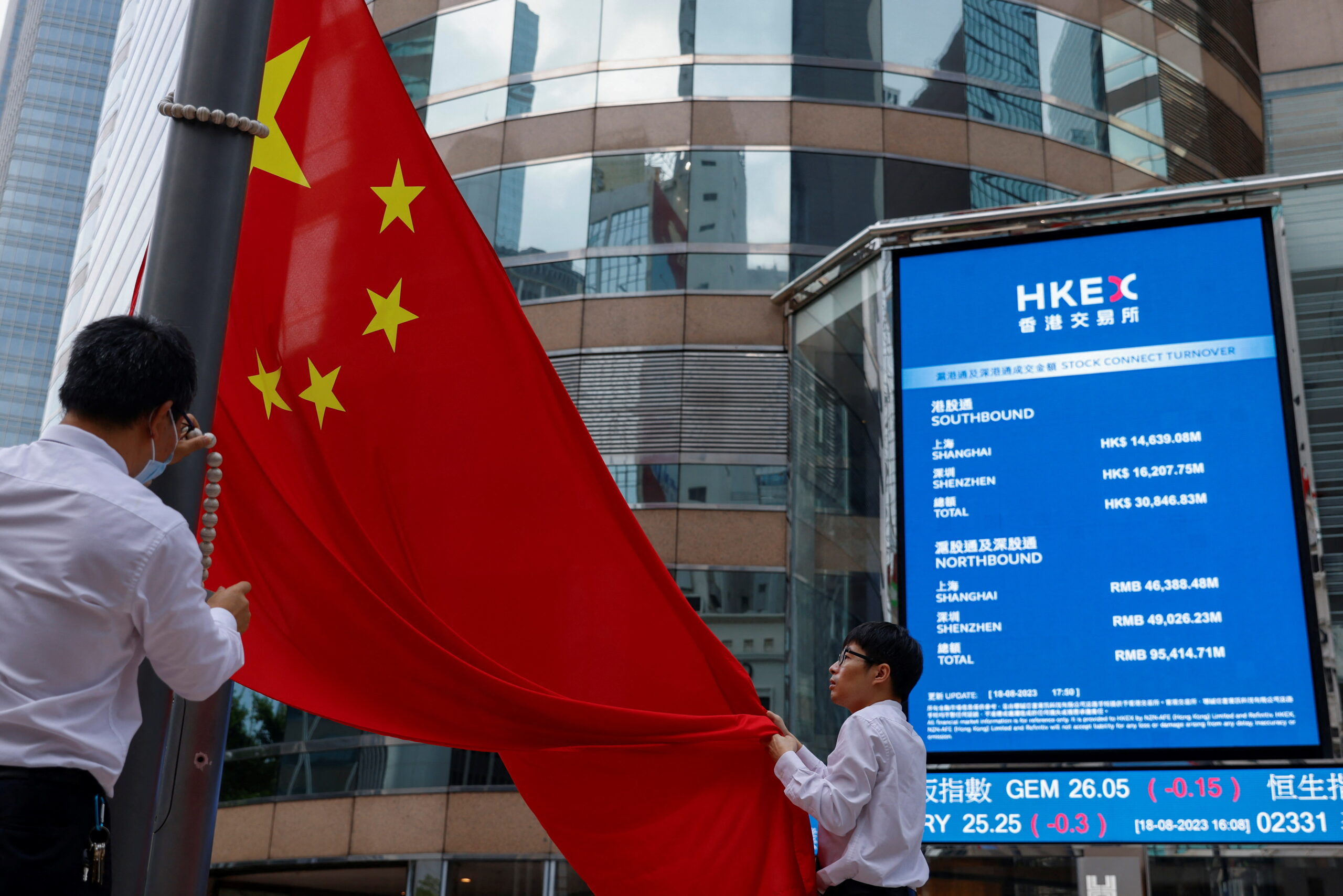

Analysis: Chinese Stock Market's Response To US Negotiations And Data

Table of Contents

Impact of US-China Trade Negotiations

The ongoing trade relationship between the US and China significantly impacts the Chinese stock market. Positive developments lead to increased investor confidence and market rallies, while negative signals trigger downturns and increased volatility.

Positive Negotiation Signals

Positive signals from US-China trade negotiations often translate into a surge in investor confidence, leading to substantial market rallies.

- Increased investor confidence: Agreements or signs of progress reduce uncertainty, encouraging both domestic and foreign investment.

- Examples: The "Phase One" trade deal signed in 2020, for instance, resulted in a noticeable short-term boost to the Shanghai Composite Index. Easing of tariffs on specific goods also had a positive, albeit often sector-specific, impact.

- Market Sentiment Indices: Analyzing market sentiment indices like the China VIX (volatility index) during periods of positive negotiation progress reveals a clear decrease in volatility, reflecting investor optimism.

- Specific Instances:

- Reduced tariffs on agricultural products led to a rise in related stock prices.

- Announcements of increased cooperation in specific technological sectors boosted the relevant indices.

Negative Negotiation Signals

Conversely, negative developments in US-China trade negotiations often result in market downturns and heightened volatility.

- Market Downturns: Increased trade tensions, new tariffs, or threats of sanctions create uncertainty and prompt investors to withdraw funds.

- Examples: Escalation of trade disputes, like the imposition of tariffs on Chinese goods in 2018 and 2019, led to significant declines in major Chinese stock market indices.

- Investor Flight to Safety: During trade disputes, investors often move their capital to safer assets like US Treasury bonds, further depressing the Chinese stock market.

- Specific Instances:

- Imposition of tariffs on Chinese technology companies triggered sharp declines in their stock prices.

- Threats of further sanctions led to a general sell-off across various sectors.

- Sectoral Impact: Sectors heavily reliant on exports to the US, such as manufacturing and technology, are particularly vulnerable to negative negotiation signals.

Response to US Economic Data

The performance of the US economy significantly influences the Chinese stock market, impacting investor sentiment and capital flows.

Impact of US GDP Growth

A strong US economy generally benefits China through increased demand for Chinese exports and foreign investment.

- Correlation: Historically, there's a positive correlation between US GDP growth and the performance of Chinese stock market indices.

- Influence on Exports: Robust US GDP growth fuels demand for Chinese goods, benefiting Chinese exporters and their stock prices.

- Data Illustration: Analyzing historical data reveals a clear link between periods of strong US GDP growth and positive returns in the Chinese stock market.

Influence of US Interest Rate Changes

Changes in US interest rates affect capital flows and the value of the Chinese Yuan.

- Capital Flows: US interest rate hikes can attract capital away from China, potentially depressing the Chinese stock market. Conversely, rate cuts can stimulate capital inflows.

- Chinese Yuan: US monetary policy impacts the value of the US dollar relative to the Chinese Yuan, influencing the competitiveness of Chinese exports and investment flows.

- Company Valuations: Changes in interest rates affect borrowing costs for Chinese companies, influencing their profitability and valuations.

Reaction to US Inflation Data

US inflation data affects Chinese export competitiveness and commodity prices.

- Export Competitiveness: High US inflation can make Chinese exports less competitive, potentially negatively impacting Chinese companies reliant on exports.

- Commodity Prices: US inflation impacts global commodity prices, affecting the profitability of Chinese companies involved in commodity production and trade.

- Market Volatility: Unexpected changes in US inflation can introduce volatility into the Chinese stock market.

Analyzing Key Market Indices

Understanding the performance of major Chinese stock market indices is crucial for effective analysis.

- Key Indices: The Shanghai Composite Index, Shenzhen Component Index, and CSI 300 are key indicators of the Chinese stock market's health.

- Comparative Analysis: Comparing the performance of these indices during periods of US-China negotiations and economic data releases reveals valuable insights.

- Trends and Patterns: Identifying trends and patterns in the market's response helps anticipate future reactions.

- Visual Representation: Utilizing charts and graphs provides a clear visual representation of the data and findings, aiding in better understanding the market dynamics.

Conclusion

The Chinese stock market's performance is undeniably intertwined with US negotiations and economic data. Understanding the nuanced relationship between these factors is crucial for investors seeking to navigate this dynamic market. While positive negotiation signals and robust US economic data generally boost investor confidence, negative news can lead to significant market volatility. Careful monitoring of both US-China relations and key US economic indicators, combined with analysis of major Chinese stock market indices, is essential for informed investment decisions in the Chinese stock market. Further research into specific sectors and companies within the Chinese market will further refine your understanding of this complex landscape. Begin your in-depth analysis of the Chinese stock market today to make informed investment choices.

Featured Posts

-

Met Gala 2024 A List Celebrities Shine On The Red Carpet

May 07, 2025

Met Gala 2024 A List Celebrities Shine On The Red Carpet

May 07, 2025 -

Jenna Ortega And Glen Powell Team Up For Fantasy Film Shoot In London This Summer

May 07, 2025

Jenna Ortega And Glen Powell Team Up For Fantasy Film Shoot In London This Summer

May 07, 2025 -

Cavs Rookie Car Prank Donovan Mitchells Pre Game Prediction Comes True

May 07, 2025

Cavs Rookie Car Prank Donovan Mitchells Pre Game Prediction Comes True

May 07, 2025 -

Game 4 Thriller Warriors Defeat Rockets Lead Series 3 1

May 07, 2025

Game 4 Thriller Warriors Defeat Rockets Lead Series 3 1

May 07, 2025 -

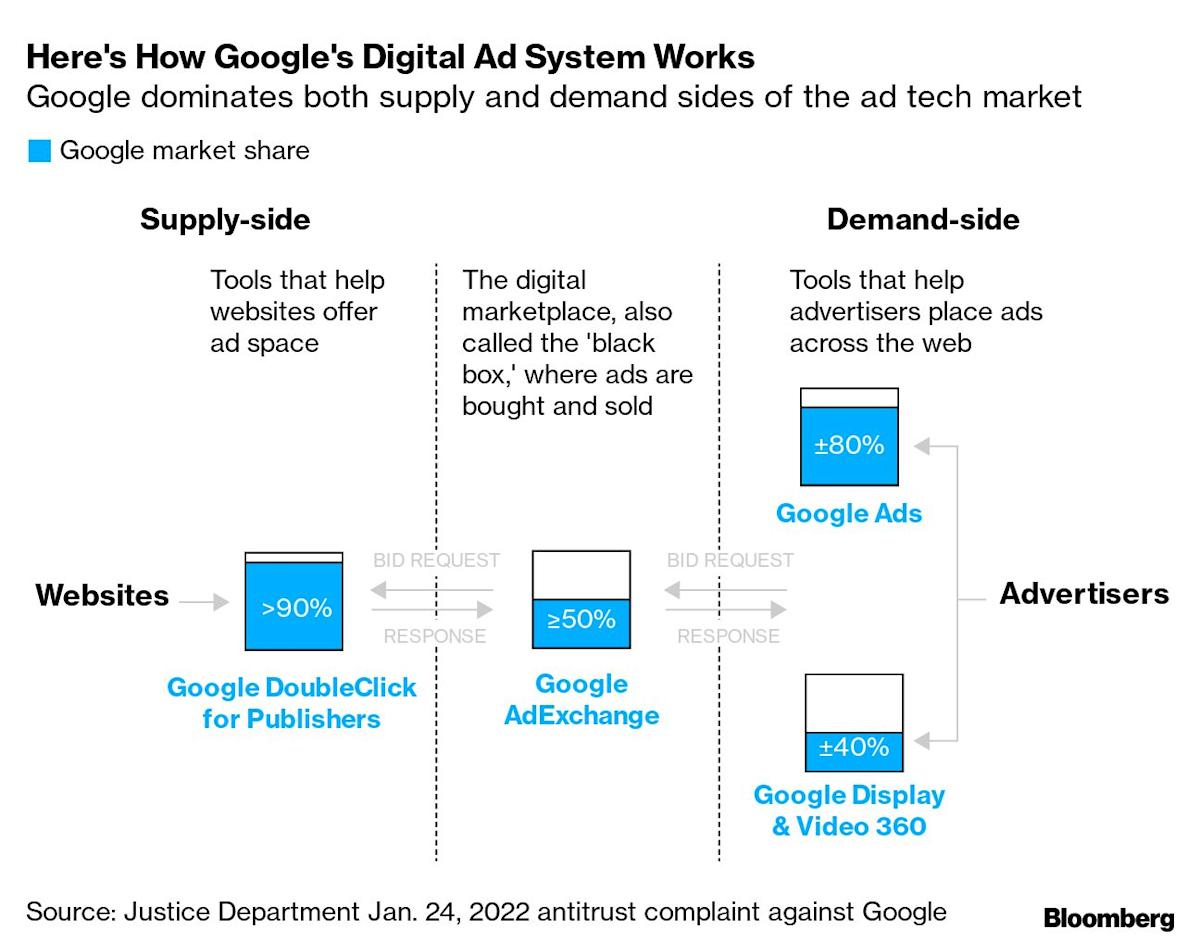

Us Antitrust Action Googles Ad Tech Empire Under Threat Of Forced Sale

May 07, 2025

Us Antitrust Action Googles Ad Tech Empire Under Threat Of Forced Sale

May 07, 2025