Analysis: House Republicans' Unveiling Of Trump's Tax Plan

Table of Contents

Key Provisions of the Proposed Trump Tax Plan

The proposed Trump's Tax Plan encompasses significant changes to both individual and corporate taxation. Let's examine its core components:

Individual Income Tax Changes

The plan proposes substantial alterations to individual income tax brackets, standard deductions, and various tax credits.

- Proposed Bracket Adjustments: Specific adjustments to tax brackets are expected, potentially leading to lower tax rates for some income levels. The exact changes will depend on the final version of the bill.

- Changes to Child Tax Credits: The plan may modify the existing child tax credit, potentially increasing the amount or expanding eligibility. Details on these alterations are still pending.

- Standard Deduction Modifications: Significant changes to the standard deduction could simplify tax filing for many individuals but could also impact those who currently itemize deductions.

Analysis: The impact of these changes on different income groups remains a subject of considerable debate. While some lower and middle-income families may benefit from increased credits, concerns remain about potential tax cuts disproportionately favoring higher-income individuals.

Corporate Tax Rate Reductions

A cornerstone of Trump's Tax Plan is a substantial reduction in the corporate tax rate.

- Proposed Corporate Tax Rate: The plan aims to significantly lower the current corporate tax rate, potentially boosting business profitability.

- Deductions and Credits: The plan may include specific deductions or tax credits aimed at incentivizing business investment and job creation.

Analysis: Proponents argue that lower corporate taxes will stimulate economic growth, leading to job creation and increased investment. Critics, however, express concerns about potential revenue losses and the possibility that corporations may use these savings for stock buybacks rather than expanding their operations.

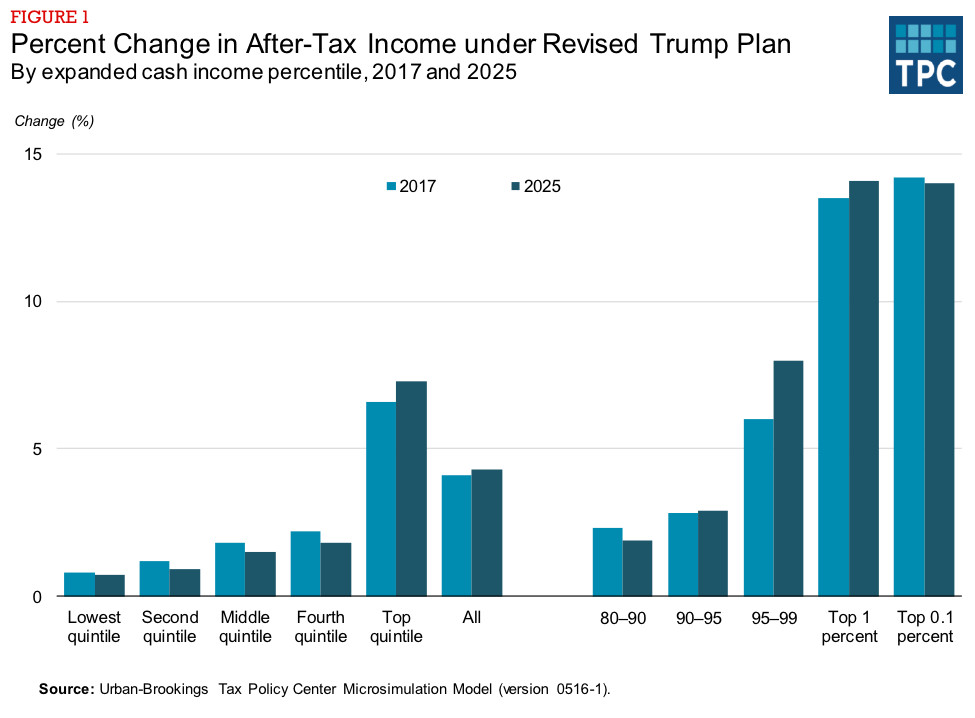

Tax Cuts for the Wealthy

One of the most contentious aspects of Trump's Tax Plan is the perceived disproportionate benefits for high-income earners.

- Statistical Data: Analyses suggest that a significant portion of the tax cuts would go to the wealthiest Americans, potentially exacerbating income inequality.

- Counterarguments: Supporters argue that lower taxes incentivize investment and job creation, ultimately benefitting everyone through economic growth. They also highlight the potential for increased tax revenue from a more robust economy.

Analysis: The debate over the distribution of tax benefits remains highly polarized. Critics argue that these tax cuts will further concentrate wealth in the hands of the already affluent, while supporters emphasize the broader economic benefits.

Economic and Fiscal Impacts of Trump's Tax Plan

The proposed tax plan carries significant economic and fiscal implications:

Projected Revenue Losses

The Congressional Budget Office and other independent organizations have projected substantial decreases in government revenue as a result of the proposed tax cuts.

- CBO Projections: The CBO's estimates indicate potentially trillions of dollars in lost revenue over the coming decade.

- Impact on National Debt: These revenue losses could significantly increase the national debt and potentially lead to cuts in government spending programs.

Analysis: The magnitude of projected revenue losses raises concerns about the long-term fiscal sustainability of the plan. The potential impact on crucial government services and programs is a significant point of contention.

Potential Stimulative Effects

Supporters argue that the tax cuts will stimulate economic growth, offsetting the revenue losses.

- GDP Growth Projections: Proponents suggest that the tax cuts will lead to increased investment, job creation, and overall GDP growth.

- Supply-Side Economics: This argument relies on the principles of supply-side economics, which posits that lower taxes incentivize production and investment.

Analysis: While the stimulative effects are possible, their magnitude and timing remain uncertain. Economic forecasts vary widely, and the actual impact will depend on numerous factors.

Political Ramifications and Public Opinion

The Trump's Tax Plan has profound political implications and has ignited a vigorous public debate.

Congressional Support and Opposition

The plan has faced varying levels of support and opposition within Congress, largely along party lines.

- Party Divisions: Republican support is generally high, but some moderate Republicans have voiced concerns. Democratic opposition is widespread.

- Legislative Challenges: Passing the plan through Congress will require significant negotiation and compromise.

Analysis: The political landscape surrounding the plan is highly dynamic, with potential for amendments and compromises throughout the legislative process.

Public Reaction and Debate

Public opinion polls and media coverage reveal a mixed public reaction to Trump's Tax Plan.

- Poll Results: Surveys show a diversity of opinions, with some Americans supporting the tax cuts and others expressing concerns about their potential consequences.

- Media Narratives: Media coverage reflects the diverse viewpoints and ongoing debate surrounding the plan.

Analysis: Public perception will likely play a significant role in shaping the political debate and influencing the final outcome of the legislation.

Conclusion: Analyzing House Republicans' Unveiling of Trump's Tax Plan

Trump's Tax Plan, as unveiled by House Republicans, presents a complex picture with significant implications for the American economy and its citizens. The plan's core provisions – individual and corporate tax cuts – aim to stimulate economic growth but also risk substantial revenue losses and increased national debt. The political ramifications are equally significant, with the plan facing fierce opposition and triggering a heated public debate. The long-term consequences of Trump's Tax Plan remain uncertain and warrant careful consideration.

To stay informed and engaged on this crucial issue, we encourage you to research the plan independently, using resources like the Congressional Budget Office website and reputable news sources. Contact your elected representatives to express your views and participate in informed public discussions about Trump's Tax Plan and its potential impact on your community and the nation.

Featured Posts

-

Vont Weekend At 107 1 Kiss Fm Picture Highlights April 4 6 2025

May 16, 2025

Vont Weekend At 107 1 Kiss Fm Picture Highlights April 4 6 2025

May 16, 2025 -

Padres 7 Game Win Streak A Prediction Against The Yankees

May 16, 2025

Padres 7 Game Win Streak A Prediction Against The Yankees

May 16, 2025 -

The Amber Heard Elon Musk Twin Controversy Examining The Evidence

May 16, 2025

The Amber Heard Elon Musk Twin Controversy Examining The Evidence

May 16, 2025 -

Analisis Del Partido Belgica 0 1 Portugal Goles Y Resumen

May 16, 2025

Analisis Del Partido Belgica 0 1 Portugal Goles Y Resumen

May 16, 2025 -

Jaylen Wells Injury Details Of Scary Fall And Stretcher Evacuation

May 16, 2025

Jaylen Wells Injury Details Of Scary Fall And Stretcher Evacuation

May 16, 2025