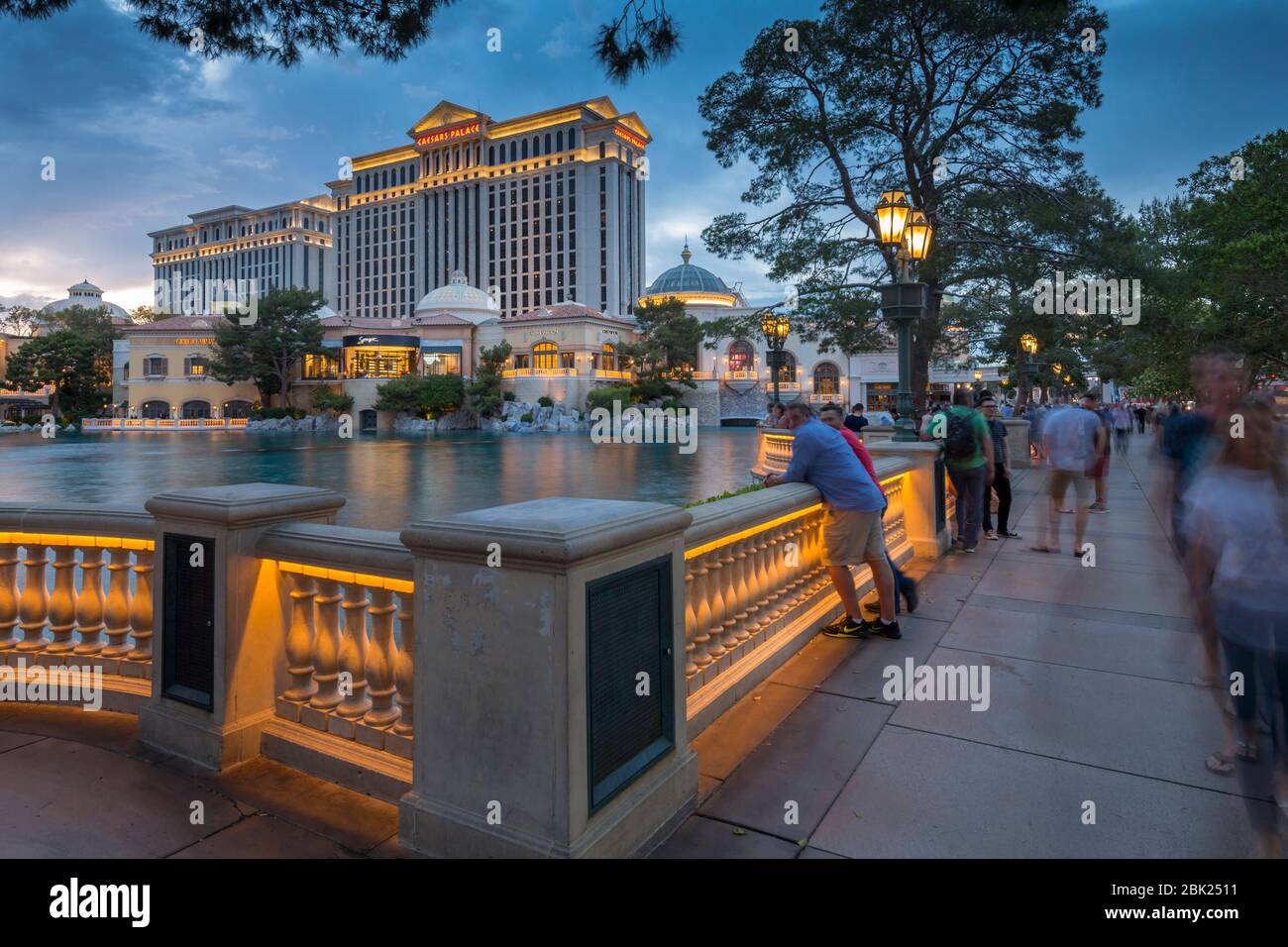

Analysis Of Caesars Las Vegas Strip Properties' Value Drop

Table of Contents

The Impact of the COVID-19 Pandemic on Caesars' Assets

The COVID-19 pandemic delivered a devastating blow to the hospitality and entertainment industries, and Caesars Entertainment was no exception. The dramatic decline in tourism and the subsequent lockdowns had a profound and lasting impact on the valuation of Caesars' Las Vegas Strip properties.

Revenue Loss and Operational Challenges

- Significant Revenue Drop: Lockdowns and travel restrictions led to a catastrophic drop in revenue, with casinos forced to close for extended periods. Occupancy rates plummeted, and non-gaming revenue streams, such as restaurants and entertainment venues, dried up.

- Increased Operational Costs: Even when partially operational, Caesars faced increased costs associated with implementing stringent health and safety measures, including enhanced cleaning protocols, personal protective equipment (PPE) for staff, and social distancing enforcement.

- Workforce Challenges: The pandemic created significant workforce challenges, including staffing shortages, furloughs, and the need for extensive retraining to adapt to new operational procedures.

Debt Accumulation and Financial Strain

- Increased Debt Burden: The sharp decline in revenue forced Caesars to take on additional debt to cover operational expenses and maintain liquidity. This significantly increased the company's debt burden, impacting its financial stability.

- Difficulty Servicing Debt: The decreased revenue made it challenging for Caesars to service its existing debt obligations, putting pressure on its credit rating and potentially hindering future investment opportunities.

- Government Assistance Limitations: While Caesars, like many businesses, received some government assistance, it proved insufficient to offset the massive financial losses incurred during the pandemic's peak.

Increased Competition on the Las Vegas Strip

The Las Vegas Strip is a fiercely competitive market, and the pandemic only exacerbated existing pressures. New developments and innovative strategies by competitors further impacted the valuation of Caesars' assets.

The Rise of New Resorts and Entertainment Options

- Emergence of New Luxury Resorts: New luxury resorts and entertainment venues have entered the market, offering enhanced amenities and experiences, thereby increasing competition for customers.

- Impact on Market Share and Pricing: This increased competition forced Caesars to adjust its pricing strategies and marketing efforts to retain market share, impacting overall profitability.

- Shifting Tourist Preferences: Tourist preferences are constantly evolving, and Caesars needs to adapt to these changes, such as the growing demand for unique and personalized experiences.

Innovative Marketing and Customer Engagement Strategies by Competitors

- Data-Driven Marketing: Competitors are leveraging data analytics to personalize marketing campaigns and offer tailored experiences to attract and retain customers.

- Enhanced Loyalty Programs: Robust loyalty programs and personalized rewards are being used to foster customer loyalty and encourage repeat visits, which puts pressure on Caesars to innovate.

- Caesars' Response: Caesars has implemented its own strategies to combat increased competition, but the effectiveness of these initiatives remains a key factor impacting its property valuations.

Broader Economic Factors Affecting Caesars' Valuation

Beyond the pandemic and competition, several broader economic factors have contributed to the decline in value of Caesars' Las Vegas Strip properties.

Inflation and Rising Interest Rates

- Impact on Operating Costs: Inflation has significantly increased operating costs for Caesars, affecting everything from labor to supplies, impacting profit margins.

- Higher Borrowing Costs: Rising interest rates have made borrowing more expensive, increasing the cost of debt and hindering investment in renovations and expansion projects.

- Economic Uncertainty: Economic uncertainty affects consumer spending, and as a result, tourism has been impacted, decreasing demand for hotel rooms and casino services.

Changes in the Gambling and Entertainment Landscape

- Shifting Entertainment Preferences: Consumer preferences are shifting towards different forms of entertainment, impacting the demand for traditional casino offerings.

- Rise of Online Gambling: The rise of online gambling has created a new competitive landscape, diverting some customers away from brick-and-mortar casinos.

- Technological Advancements: Technological advancements are constantly reshaping the gaming and entertainment industry, requiring significant investments to stay competitive.

Conclusion: Understanding the Shifting Value of Caesars Las Vegas Strip Properties

The decline in the value of Caesars Las Vegas Strip properties is a complex issue stemming from the combined impact of the COVID-19 pandemic, increased competition, and broader economic headwinds. The pandemic's financial strain, the emergence of new competitors with innovative strategies, and macroeconomic factors like inflation and rising interest rates have all played significant roles. The shifting landscape of the gambling and entertainment industry, including the growth of online gambling, further complicates the situation.

Key Takeaways: Understanding these interconnected factors is crucial for evaluating the future prospects of Caesars and the broader Las Vegas market. The company's ability to adapt to changing consumer preferences, manage its debt, and invest in innovative technologies will be critical to its future success.

To stay updated on the evolving valuation of Caesars Las Vegas Strip properties and the dynamic Las Vegas market, continue to follow our analysis and insights.

Featured Posts

-

Resorts World Las Vegas Hit With 10 5 M Money Laundering Fine

May 18, 2025

Resorts World Las Vegas Hit With 10 5 M Money Laundering Fine

May 18, 2025 -

Brooklyn Bridge Assessment Strengths And Areas For Enhanced Durability

May 18, 2025

Brooklyn Bridge Assessment Strengths And Areas For Enhanced Durability

May 18, 2025 -

How Zuckerbergs Meta Will Adapt To A Trump Presidency

May 18, 2025

How Zuckerbergs Meta Will Adapt To A Trump Presidency

May 18, 2025 -

Analyzing Red Carpet Rule Infractions Causes And Consequences

May 18, 2025

Analyzing Red Carpet Rule Infractions Causes And Consequences

May 18, 2025 -

Miami Acik 2024 Djokovic Finale Cikti

May 18, 2025

Miami Acik 2024 Djokovic Finale Cikti

May 18, 2025

Latest Posts

-

April 30 2025 Daily Lotto Winning Numbers Announced

May 18, 2025

April 30 2025 Daily Lotto Winning Numbers Announced

May 18, 2025 -

Winning Daily Lotto Numbers Friday April 25 2025

May 18, 2025

Winning Daily Lotto Numbers Friday April 25 2025

May 18, 2025 -

25 April 2025 Daily Lotto Winning Numbers

May 18, 2025

25 April 2025 Daily Lotto Winning Numbers

May 18, 2025 -

Check The Daily Lotto Results For Wednesday 30th April 2025

May 18, 2025

Check The Daily Lotto Results For Wednesday 30th April 2025

May 18, 2025 -

Daily Lotto Results Friday 25 04 2025

May 18, 2025

Daily Lotto Results Friday 25 04 2025

May 18, 2025